Pound Lower Against Majors

February 28 2024 - 4:41AM

RTTF2

The pound traded lower on Wednesday, amid a resurgence in the

U.S. dollar ahead of key inflation data.

Personal consumption expenditures price index, scheduled for

release on Thursday, may influence investor expectations about the

Fed's potential moves on interest rates.

On Tuesday, Fed Governor Michelle Bowman said inflation will

continue to decline further but it's too soon to begin cutting

interest rates.

Weak economic data released overnight stirred expectations of an

earlier-than-anticipated rate cut by the Fed.

Orders for long-lasting U.S. manufactured goods fell by the most

in nearly four years in January while there was an unexpected

deterioration in consumer confidence in February, separate data

revealed.

The pound fell to 6-day lows of 190.27 against the yen, 1.1121

against the franc and 1.2621 against the greenback, off its early

highs of 190.97, 1.1152 and 1.2686, respectively. The currency is

poised to challenge support around 180.00 against the yen, 1.10

against the franc and and 1.24 against the greenback.

The pound pulled back against the euro and was trading at

0.8563. If the currency falls further, it is likely to test support

around the 0.88 region.

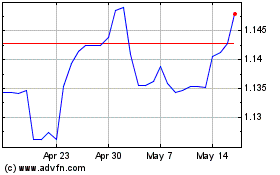

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2024 to May 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From May 2023 to May 2024