Antipodean Currencies Rise Amid Risk Appetite

May 15 2024 - 10:54PM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars strengthened against their major currencies in the

Asian session on Thursday amid risl appetite, as traders reacted

positively to a closely watched report on U.S. consumer price

inflation that showed a smaller-than-expected increase in the month

of April to reinforce expectations the U.S. Fed will begin cutting

interest rates in September.

Gains across most sectors led by gold miners and technology

stocks, also led to the upturn of investor sentiment.

Crude oil prices traded higher, buoyed by soft inflation data

and a report showing a bigger than expected drop in U.S. crude

inventories last week. West Texas Intermediate Crude oil futures

for June ended up by $0.61 or 0.78 percent at $78.63 a barrel.

In economic news, data from Australian Bureau of Statistics

showed that the Australian economy had created 38,500 jobs in

April, against a 23,700 forecast.

In the Asian trading now, the Australian dollar rose to a 9-day

high of 1.6223 against the euro, from yesterday's closing value of

1.6254. The aussie may test resistance around the 1.61 region.

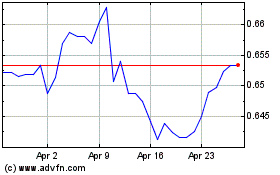

Against the Canada and the U.S. dollars, the aussie advanced to

more than a 1-year high of 0.9126 and more than a 4-month high of

0.6715 from Wednesday's closing quotes of 0.9111 and 0.6700,

respectively. If the aussie extends its uptrend, it is likely to

find resistance around 0.92 against the loonie and 0.68 against the

greenback.

The NZ dollar rose to more than 2-month highs of 0.6141 against

the U.S. dollar and 1.7738 against the euro, from yesterday's

closing quotes of 0.6129 and 1.7766, respectively. The kiwi is

likely to find resistance around 0.63 against the greenback and

1.74 against the euro.

Against the Australian dollar, the kiwi advanced to more than a

3-week high of 1.0915 from Wednesday's closing value of 1.0931. If

the kiwi extends its uptrend, it is likely to find resistance

around the 1.08 area. Also, the Canadian dollar rose to more than a

1-month high of 1.3590 against the U.S. dollar, from yesterday's

closing value of 1.3598. The loonie may test resistance around the

1.33 region.

Looking ahead, U.S. building permits for April, weekly jobless

claims data, housing starts for April, U.S. Philadelphia Fed

manufacturing index for May, U.S. export and import prices for

April and industrial production for April are slated for release in

the New York session.

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Oct 2024 to Oct 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Oct 2023 to Oct 2024