Intermediate declaration by the Board of Directors

Regulatory News:

X-FAB (BOURSE:XFAB):

Highlights Q1 2024:

- Revenue was USD 216.2 million, up 4% year-on-year (YoY) and

down 9% quarter-on-quarter (QoQ), within the guidance of USD

215-225 million

- Revenue in X-FAB’s key end markets – automotive, industrial,

and medical – was up 9% YoY*

- All-time high silicon carbide (SiC) revenue at USD 26.3

million*, up 100% YoY

- All-time high bookings at USD 271.5 million, up 20% YoY

- EBITDA at USD 51.0 million, down 12% YoY

- EBITDA margin of 23.6%; excluding IFRS 15 impact, EBITDA margin

was 24.0%, compared to the guidance of 24-27%

- EBIT was USD 27.2 million, down 27% YoY

Outlook:

- Q2 2024 revenue is expected to come in within a range of USD

200-210 million with an EBITDA margin in the range of 20-23%.

- This guidance is based on an average exchange rate of 1.08

USD/Euro.

- Full-year 2024 guidance gets reiterated with revenue in a range

of USD 900-970 million and an EBITDA margin in the range of

25-29%

Revenue breakdown per quarter:

in millions of USD

Q2 2022

Q3 2022

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q1 y-o-y growth

Automotive

98.3

96.9

104.4

120.9

131.1

135.3

151.8

135.6

12%

Industrial

42.5

46.7

42.3

46.9

51.3

53.7

54.3

52.6

12%

Medical

13.9

13.5

14.6

17.6

16.2

17.0

16.4

14.5

-18%

Subtotal core business

154.7

157.0

161.3

185.4

198.7

206.1

222.5

202.6

9%

81.9%

83.4%

87.9%

89.1%

90.8%

92.2%

92.8%

92.6%

CCC1

33.6

30.7

21.6

22.5

20.0

17.2

17.2

16.0

-29%

Others

0.6

0.6

0.7

0.2

0.2

0.2

0.1

0.1

Revenue*

188.8

188.3

183.6

208.1

218.9

223.5

239.8

218.7

5%

Impact from revenue recognized over

time

0

0

0

0

8.3

10.4

-2.0

-2.6

Total revenue

188.8

188.3

183.6

208.1

227.1

233.8

237.7

216.2

4%

1Consumer, Communications &

Computer

in millions of USD

Q2 2022

Q3 2022

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q1 y-o-y growth

CMOS

156.3

152.6

151.9

172.8

180.7

180.5

188.4

168.3

-3%

Microsystems

19.8

18.4

19.5

22.2

20.8

24.4

27.9

24.1

9%

Silicon carbide

12.8

17.4

12.2

13.2

17.3

18.6

23.5

26.3

100%

Revenue*

188.8

188.3

183.6

208.1

218.9

223.5

239.8

218.7

5%

Impact from revenue recognized over

time

0

0

0

0

8.3

10.4

-2.0

-2.6

Total revenue

188.8

188.3

183.6

208.1

227.1

233.8

237.7

216.2

4%

Business development

In the first quarter of 2024, X‑FAB recorded revenues of USD

216.2 million, up 4% year-on-year and down 9% quarter-on-quarter.

Excluding the impact from revenue recognized over time of USD -2.6

million, first quarter revenue totaled USD 218.7 million. This is

in line with the guidance of USD 215-225 million.

Revenues in X‑FAB’s core markets – automotive, industrial, and

medical – amounted to USD 202.6 million*, up 9% year-on-year and

representing a 93% share of total revenues*.

The first quarter was characterized by continued strong demand

for X-FAB's 200mm CMOS technologies, in particular the 180nm

process, and microsystems technologies, resulting in record

quarterly bookings of USD 271.5 million, up 20% year-on-year. This

is also reflected in the backlog, which amounted to USD 520.9

million, up from USD 475.8 million at the end of the previous

quarter.

In the first quarter, automotive revenue came in at USD 135.6

million*, up 12% year-on-year and down 11% compared to a strong

previous quarter. Industrial revenues were USD 52.6 million*, which

is an increase of 12% year-on-year. The industrial end market

benefited from record silicon carbide (SiC) revenues in the first

quarter. SiC revenues totaled USD 26.3 million*, up 100%

year-on-year. On the other side, customer actions to reduce high

inventory levels resulted in low quarterly SiC bookings with a

book-to-bill of 0.38 in the first quarter. Despite this temporary

weakness in silicon carbide, the outlook remains positive. X-FAB's

SiC customers continue to be upbeat about the long-term prospects

and X-FAB signed another long-term agreement with one of its

silicon carbide customers.

The long-term fundamentals for the automotive and industrial end

markets remain strong. The megatrend of "electrification of

everything" to mitigate climate change drives the structural demand

for X-FAB's specialty technologies that enable energy-efficient and

climate-friendly solutions for a wide range of applications. Apart

from silicon carbide, X‑FAB's 180nm HV CMOS technology is in high

demand and one of the key technologies used. Its growth will be

supported by the ongoing capacity conversion and debottlenecking at

X-FAB France. In the first quarter, the French site’s revenues

based on X-FAB technologies recorded a year-on-year growth of 42%

and accounted for 93% of the site’s total revenue.

In the first quarter of 2024, medical revenues were USD 14.5

million*, down 18% year-on-year, mainly due to normal fluctuations.

A key driver for innovative medical solutions is X-FAB’s

microsystems expertise to combine MEMS and CMOS and to enable the

integration of different systems at wafer level. Microsystems

revenue in the first quarter amounted to USD 24.1 million*, up 9%

year-on-year. The main contributors to X-FAB's medical business in

the first quarter were a next-generation DNA sequencing application

and an ultrasound probe head IC.

In the first quarter, X-FAB’s CCC (Consumer, Communication &

Computer) business came in at USD 16.0 million*, down 29%

year-on-year.

Quarterly prototyping revenues totaled at USD 23.2 million*,

down 12% year-on-year. Apart from normal fluctuations, the decline

is mainly related to industrial customers and the current temporary

weakness in silicon carbide.

Prototyping and production revenue* per quarter and end

market:

in millions

of USD

Revenue

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Automotive

Prototyping

3.5

3.9

6.2

10.0

6.7

Production

117.3

127.2

129.1

141.8

128.9

Industrial

Prototyping

14.2

16.6

14.3

10.5

10.7

Production

32.7

34.8

39.4

43.8

41.9

Medical

Prototyping

2.9

2.5

3.3

3.3

2.7

Production

14.7

13.7

13.7

13.1

11.8

CCC

Prototyping

5.7

4.5

3.3

3.5

3.1

Production

16.8

15.4

13.9

13.7

12.9

The lower revenue guidance for the second quarter reflects the

anticipated decline in demand for X-FAB's 150mm CMOS technologies,

primarily from industrial customers, as well as a decline in SiC

revenues following the reduction of SiC bookings in the first

quarter. The second quarter is considered to mark the bottom of the

current slowdown with X-FAB’s SiC business expected to gradually

recover in the second half of the year. The positive long-term

outlook for X-FAB’s business remains unchanged due to the Group’s

positioning in high-growth end markets and its future-oriented

technology portfolio, which enables sustainable solutions for

today's key societal challenges.

Operations update

In the first quarter, X-FAB’s 200mm CMOS lines and the

MEMS/microsystems fabs were running at full load and capacity still

had to be allocated.

The sites that produce the 150mm CMOS technologies, i.e. in

Erfurt, Germany, and Lubbock, Texas, recorded lower utilization

rates in line with the lower demand for these technologies. Both

sites are focused on the transition to their respective new areas

of business, i.e. MEMS/microsystems in Erfurt and silicon carbide

in Lubbock.

In the first quarter, X-FAB's capacity expansion program

continued as planned. Key projects include the expansion of

capacity for X-FAB's popular 200mm CMOS technology at X-FAB France

and X-FAB Sarawak, Malaysia, as well as X-FAB's SiC business at

X-FAB Texas. The building construction at the Malaysian site to

create additional clean room space is on schedule, and it is

planned to start moving in equipment in the fourth quarter of

2024.

Total capital expenditures in the first quarter came in at USD

105.0 million, up 5% against the previous quarter.

Financial update

First quarter EBITDA was USD 51.0 million with an EBITDA margin

of 23.6%. Excluding the impact from revenues recognized over time,

the EBITDA margin of the first quarter would have been 24.0%, at

the lower end of the guided 24-27%. The quarterly guidance does not

take the impact related to IFRS 15 into account, as this cannot be

reliably predicted.

First quarter profitability was negatively impacted by a

combination of lower 150mm CMOS production and lower SiC wafer

starts. A reversal is expected in the second half of 2024, driven

by the recovery of the SiC business and the positive effects of

increased economies of scale as additional 200mm CMOS capacity

becomes available. In addition, X-FAB has initiated a number of

measures to adjust the cost structure of the sites producing 150mm

CMOS wafers while accelerating the transition to silicon carbide in

Lubbock and microsystems in Erfurt to replace the 150mm CMOS

business.

Thanks to the natural hedging of X-FAB's business in terms of

currency exposure, profitability is not affected by exchange rate

fluctuations. At a constant USD/Euro exchange rate of 1,07 as

experienced in the previous year’s quarter, the EBITDA margin would

have been 0,1 percentage points lower.

Cash and cash equivalents at the end of the first quarter

amounted to USD 351.5 million.

Management comments

Rudi De Winter, CEO of X-FAB Group, said: “In the first quarter,

we continued to see very strong demand for our popular 200mm CMOS

and microsystems technologies, resulting in an all-time high

quarterly order intake. On the other hand, our silicon carbide

business was impacted by the general weakness in the SiC market,

reflected by a decline in SiC order intake. Supported by our SiC

customers' confidence in their future business development, we see

this is as a temporary dip. We are confident in X-FAB's positioning

in the semiconductor market, and the overall high level of bookings

underscores the importance of our ongoing capacity expansion

program to ensure reliable supply to our customers in line with

their business needs. With more capacity coming online and the

recovery of the SiC business, we expect strong growth in the second

half of the year versus the first half.”

X-FAB Quarterly Conference Call

X-FAB’s first quarter results will be discussed in a live

conference call/webcast on Thursday, April 25, 2024, at 6.30 p.m.

CEST. The conference call will be in English.

Please register here for the webcast (listen only).

Please register here for the conference call (listen and ask

questions).

The second quarter 2024 results will be communicated on July 25,

2024.

About X-FAB

X-FAB is the leading analog/mixed-signal and MEMS foundry group

manufacturing silicon wafers for automotive, industrial, consumer,

medical and other applications. Its customers worldwide benefit

from the highest quality standards, manufacturing excellence and

innovative solutions by using X-FAB’s modular CMOS processes in

geometries ranging from 1.0 µm to 110 nm, and its special silicon

carbide and MEMS long-lifetime processes. X-FAB’s analog-digital

integrated circuits (mixed-signal ICs), sensors and

micro-electro-mechanical systems (MEMS) are manufactured at six

production facilities in Germany, France, Malaysia and the U.S.

X-FAB employs approx. 4,500 people worldwide. For more information,

please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness, or

completeness of the information contained herein and no reliance

should be placed on it.

Condensed Consolidated Statement of Profit and Loss

in thousands of USD

Quarter

ended

31 Mar 2024

unaudited

Quarter

ended

31 Mar 2023

unaudited

Quarter

ended

31 Dec 2023

unaudited

Year

ended

31 Dec 2023

audited

Revenue*

218,712

208,109

239,750

890,181

Impact from revenue recognized over

time

-2,559

0

-2,017

16,605

Total revenue

216,152

208,109

237,733

906,786

Revenues in USD in %

62

55

57

56

Revenues in EUR in %

38

45

43

44

Cost of sales

-165,786

-150,912

-174,183

-648,734

Gross Profit

50,367

57,197

63,551

258,052

Gross Profit margin in %

23.3

27.5

26.7

28.5

Research and development expenses

-11,106

-10,922

-12,581

-47,191

Selling expenses

-2,537

-2,196

-2,157

-8,463

General and administrative expenses

-12,811

-10,501

-13,113

-47,157

Rental income and expenses from investment

properties

1,434

2,071

-532

2,906

Other income and other expenses

1,847

1,743

392

-472

Operating profit

27,193

37,393

35,559

157,675

Finance income

5,778

8,538

10,451

34,658

Finance costs

-7,653

-10,255

-10,172

-37,149

Net financial result

-1,875

-1,717

280

-2,491

Profit before tax

25,318

35,676

35,839

155,184

Income tax

-2,260

7,042

2,964

6,711

Profit for the period

23,059

42,717

38,803

161,895

Operating profit (EBIT)

27,193

37,393

35,559

157,674

Depreciation

23,765

20,618

24,048

87,939

EBITDA

50,958

58,011

59,607

245,614

EBITDA margin in %

23.6

27.9

25.1

27.1

Earnings per share at the end of

period

0.18

0.33

0.30

1.24

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.08605

1.07165

1.07570

1.08138

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

Condensed Consolidated Statement of Financial

Position

in thousands of USD

Quarter ended

31 Mar 2024

unaudited

Quarter ended

31 Mar 2023

unaudited

Year ended

31 Dec 2023

audited

ASSETS

Non-current assets

Property, plant, and equipment

800,843

486,499

734,488

Investment properties

7,108

7,539

7,171

Intangible assets

5,985

6,184

5,627

Other non-current assets

54

73

58

Deferred tax assets

83,692

77,577

83,772

Total non-current assets

897,682

577,872

831,116

Current assets

Inventories

276,983

233,322

269,227

Contract assets

21,451

0

24,010

Trade and other receivables

119,271

93,896

123,101

Other assets

48,786

53,231

50,659

Cash and cash equivalents

351,468

350,276

405,701

Total current assets

817,959

730,725

872,698

TOTAL ASSETS

1,715,640

1,308,597

1,703,814

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

203,218

59,227

180,159

Cumulative translation adjustment

-1,052

-297

-301

Treasury shares

-770

-770

-770

Total equity attributable to equity

holders of the parent

982,850

839,614

960,542

Non-controlling interests

0

0

0

Total equity

982,850

839,614

960,542

Non-current liabilities

Non-current loans and borrowings

58,778

59,143

42,661

Other non-current liabilities and

provisions

4,696

4,023

4,024

Total non-current liabilities

63,474

63,165

46,685

Current liabilities

Trade payables

102,660

78,119

90,681

Current loans and borrowings

185,400

211,542

218,316

Other current liabilities and

provisions

381,258

116,157

387,590

Total current liabilities

669,317

405,818

696,587

TOTAL EQUITY AND LIABILITIES

1,715,640

1,308,597

1,703,814

Condensed Consolidated Statement of Cash Flow

in thousands of USD

Quarter

ended

31 Mar 2024

unaudited

Quarter

ended

31 Mar 2023

unaudited

Quarter

ended

31 Dec 2023

unaudited

Year

ended

31 Dec 2023

audited

Income before taxes

25,318

35,676

35,839

155,184

Reconciliation of net income to cash

flow arising from operating activities:

23,732

22,981

16,227

88,948

Depreciation and amortization, before

effect of grants and subsidies

23,765

20,618

24,048

87,939

Recognized investment grants and subsidies

netted with depreciation and amortization

-673

-737

-730

-2,972

Interest income and expenses (net)

-306

1,445

607

2,600

Loss/(gain) on the sale of plant,

property, and equipment (net)

-1,751

-1,483

-199

-3,373

Other non-cash transactions (net)

2,698

3,138

-7,498

4,754

Changes in working capital:

-799

-1,210

70,615

172,490

Decrease/(increase) of trade

receivables

8,252

-21,001

-496

-39,774

Decrease/(increase) of other receivables

& prepaid expenses

6,587

3,073

5,371

4,855

Decrease/(increase) of inventories

-4,951

-18,886

-8,266

-52,504

Decrease/(increase) of contract assets

2,559

0

2,017

-24,010

(Decrease)/increase of trade payables

-206

27,240

16,823

16,634

(Decrease)/increase of other

liabilities

-13,040

8,364

55,166

267,289

Income taxes (paid)/received

-1,441

-109

-3,275

-6,658

Cash Flow from operating

activities

46,810

57,339

119,405

409,964

Cash Flow from investing

activities:

Payments for property, plant, equipment

& intangible assets

-104,980

-48,895

-100,432

-337,789

Acquisition of subsidiary, net of cash

acquired

23,229

0

0

0

Payments for loan investments to related

parties

0

-135

-39

-276

Proceeds from loan investments related

parties

0

120

47

252

Proceeds from sale of property, plant, and

equipment

1,791

1,486

235

3,733

Interest received

3,433

1,014

3,748

10,457

Cash Flow used in investing

activities

-76,527

-46,411

-96,442

-323,623

Condensed Consolidated Statement of Cash Flow – con’t

in thousands of USD

Quarter

ended

31 Mar 2024

unaudited

Quarter

ended

31 Mar 2023

unaudited

Quarter

ended

31 Dec 2023

unaudited

Year

ended

31 Dec 2023

audited

Cash Flow from (used in) financing

activities:

Proceeds from loans and borrowings

50,300

9,213

105,640

205,784

Repayment of loans and borrowings

-94,113

-35,931

-112,939

-241,806

Receipts of sale & leaseback

arrangements

31,616

0

0

0

Payments of lease installments

-1,169

-1,513

-1,197

-5,512

Interest paid

-4,058

-3,258

-7,170

-11,630

Cash Flow from (used in) financing

activities

-17,423

-31,488

-15,666

-53,164

Effect of changes in foreign currency

exchange rates on cash

-7,093

1,411

7,129

3,099

Increase/(decrease) of cash and cash

equivalents

-47,140

-20,560

7,298

33,177

Cash and cash equivalents at the beginning

of the period

405,701

369,425

391,274

369,425

Cash and cash equivalents at the end

of

the period

351,468

350,276

405,701

405,701

*excluding impact from revenue recognized over time according to

IFRS 15

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424965508/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

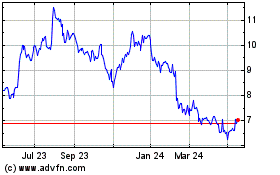

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

From Oct 2024 to Nov 2024

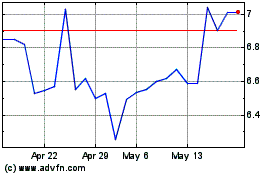

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

From Nov 2023 to Nov 2024