Tencent's Biggest Shareholder Looks to Fix Valuation Snag

May 12 2021 - 9:30AM

Dow Jones News

By Alexandra Wexler

JOHANNESBURG -- Naspers Ltd., Africa's most-valuable listed

company, is taking another swipe at bridging a $100 billion

valuation gap between its market capitalization and the value of

its stake in Tencent Holdings Ltd., long a headache for its

investors.

Naspers is offering holders of ordinary shares the opportunity

to swap their stock for newly issued shares of its Amsterdam-listed

subsidiary, Prosus NV, which is the largest shareholder in Tencent.

The Chinese internet giant has a market value of about $739

billion.

Naspers and Prosus Chief Executive Bob van Dijk estimates that

the move could create immediate value of about $11 billion for

shareholders.

Naspers has been trying to narrow the gap since 2019, when it

created Prosus to hold its international assets -- the stake in

Tencent, along with investments in tech companies such as Russian

social-media operator Mail.ru Group Ltd., German food-delivery

business Delivery Hero and U.S. online marketplace Letgo.

Prosus's 29% stake in Tencent is worth about $214 billion, over

$100 billion more than the market value of Naspers, despite the

company's other profitable businesses in areas like online

classifieds, payments and retail. That has presented Naspers

executives with the riddle of determining how to unlock value for

shareholders without cashing out on one of the world's most

successful tech companies.

"At the core of it, it isn't complicated: As a Naspers

shareholder, you can now exchange Naspers shares for Prosus

shares," Basil Sgourdos, chief financial officer of Naspers and

Prosus, said in an interview. "As a result, you increase value

because Prosus trades at a lower discount to Naspers."

The major reason that the valuation gap is wider for Naspers

than for Prosus is the size of Naspers on the Johannesburg Stock

Exchange, Mr. Sgourdos said. Naspers, which now comprises more than

23% of the benchmark JSE SWIX Index, has become a constraint for

local index-tracking funds, which can't hold too much of a single

stock.

The problem had become more acute as the gap widened during the

past year, when the coronavirus-induced rally in tech stocks pumped

up valuations of Tencent. While many of the companies listed on the

exchange shrunk during the pandemic, Naspers shares were boosted by

Tencent's gains. That means that when Naspers stock goes up, many

South African investors need to sell, which can widen the discount

of Naspers relative to Tencent.

Analysts say this latest move is progress, but not a

panacea.

"Management are taking steps in the right direction to address

the discount by reducing the size and weighting of Naspers in the

South African indices," said Neelash Hansjee, portfolio manager at

Old Mutual Equities in Cape Town. "This is a big deal despite the

remaining complexity of the structure."

According to Mr. Sgourdos, the share swap should reduce the size

of Naspers on the JSE to about 14%, relieving some of the pressure

to sell the company's shares when they rise closer toward the value

of Prosus.

"This is a very significant and sustainable move that we're

making," Mr. Sgourdos said, adding that it frees up executives'

time to focus on growing the businesses rather than solving the

structural issue of the valuation gap.

Executives say the proposed transaction, which is expected to

more than double the Prosus free float to 60%, is also good news

for Prosus shareholders: The inflow of cash from index-tracking

funds is expected to propel the company to a top 20 spot on the

Euro Stoxx 50 Index.

Prosus will acquire up to a maximum of 45.4% of the issued

Naspers ordinary shares, which, together with shares already held,

will give it an economic interest of no more than 49.5%, the

companies said. If the offer is taken up in full by Naspers

shareholders, Naspers's holding in Prosus will be reduced to 57.2%

from 73.2%. The offer is expected to be implemented in the third

quarter of 2021.

Naspers originally paid $34 million for a third of Tencent in

2001, years before the operator of the WeChat messaging app became

China's most-valuable publicly listed company and the world's

largest videogame company by revenue.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

May 12, 2021 09:15 ET (13:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

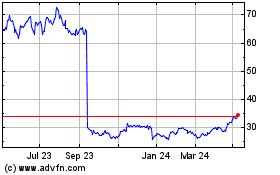

Prosus NV (EU:PRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

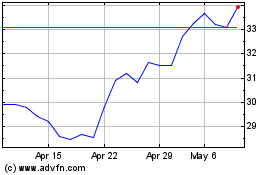

Prosus NV (EU:PRX)

Historical Stock Chart

From Jan 2024 to Jan 2025