MRM : Third quarter 2018 financial information

November 09 2018 - 1:30AM

Press release

Third quarter 2018 financial

information

Paris, 9 November

2018: MRM (Euronext code ISIN FR0000060196), a real estate

investment company specialising in retail property, today announced

its consolidated revenues for the third quarter of 2018,

corresponding to gross rental income recorded over the period.

It should be reminded that, during

the second quarter of 2018, MRM sold the Nova building in La

Garenne-Colombes, the last office property in operation in the

company's portfolio. This disposal marked the completion of the

strategy initiated in mid-2013 of refocusing MRM's operations on

retail properties. Consequently, revenues for the third quarter of

2018 correspond entirely to gross rental income from retail

properties.

Gross rental income for the first

nine months of 2018 totalled €7.24 million, down 14.2% compared

with the same period last year, primarily due to the sale of the

Nova building. On a like-for-like basis[1], gross

rental income fell by 4.7%.

Retail

Retail properties generated gross

rental income of €2.18 million during the third quarter of 2018.

This represents a slight drop of €0.06 million relative to the

third quarter of 2017 (-2.8%).

Overall, over the first nine

months of 2018, gross rental income from retail properties totalled

€6.46 million. This 4.9% fall relative to the first nine months of

2017 is mainly due to the vacating at the end of 2017 of three

medium-sized units representing a total of 6,000 sqm. Two of these

medium-sized units have since been relet under more favourable

financial terms. However, in view of the effective dates of the

corresponding leases (March 2018 at Les Halles du Beffroi in Amiens

and June 2018 in Reims), their contribution to rental income for

the first nine months of 2018 is only partial.

Offices

Office rental income for the first

nine months of 2018 totalled €0.78 million, corresponding to rental

income generated by the Nova building until 15 May 2018, when the

property was sold.

Consolidated revenues

| (€m) |

Q3 2018 |

% of

total |

Q3

2017 |

Change |

Like for like change1 |

|

9 months 2018 |

% of

total |

9 months

2017 |

Change |

Like for like change1 |

| Retail |

2.18 |

100% |

2.24 |

-2.8% |

-2.8% |

|

6.46 |

89% |

6.79 |

-4.9% |

-5.6% |

|

Office |

- |

0% |

0.53 |

-100.0% |

0.0% |

|

0.78 |

11% |

1.66 |

-52.6% |

+2.5% |

| Total gross rental income |

2.18 |

100% |

2.77 |

-21.3% |

-2.8% |

|

7.24 |

100% |

8.44 |

-14.2% |

-4.7% |

| (Unaudited figures) |

Outlook

MRM is continuing to roll out its

investment plan dedicated to seven of the nine retail properties in

its portfolio. The projects concerning Les Halles du Beffroi in

Amiens, the Sud Canal shopping centre in Saint-Quentin-en-Yvelines

and the Carré Vélizy mixed-use complex in Vélizy-Villacoublay have

been completed.

At the start of the fourth

quarter, the extension works at Aria Parc in Allonnes were

completed and retail chain Maison Dépôt's lease for a 3,300 sqm

unit came into effect.

MRM is continuing with works to

enhance the value of the Valentin shopping centre near Besançon,

the largest project in its investment plan. Following the

renovation of the existing site in 2017, works on the 2,600 sqm

shopping gallery extension began in the second quarter of this

year, bringing the total floor area to 6,700 sqm. The Valentin

shopping centre is due to open its doors to the public in its new

configuration in early 2020.

Assuming a retail portfolio

occupancy rate of 95%, MRM confirms its target of total annualised

net rental income[2] of over €10

million on completion of the value-enhancement plan, scheduled for

early 2020 (excluding acquisitions or asset sales).

Calendar

Revenues for the fourth quarter

and 2018 full-year results are due out on 22 February 2019 before

market opening and will be presented during an information meeting

to be held on the same day.

About MRM

MRM is a listed real estate

investment company that owns and manages a portfolio consisting

primarily of retail properties across several regions of France.

Its majority shareholder is SCOR SE, which owns 59.9% of share

capital. MRM is listed in Compartment C of Euronext Paris (ISIN:

FR0000060196 - Bloomberg code: MRM:FP - Reuters code: MRM.PA).

MRM opted for SIIC status on 1 January 2008.

For more information

MRM

5, avenue Kléber

75795 Paris Cedex 16

France

T +33 (0)1 58 44 70 00

relation_finances@mrminvest.com |

Isabelle

Laurent, DDB Financial

T +33 (0)1 53 32 61 51

M +33 (0)6 42 37 54 17

isabelle.laurent@ddbfinancial.fr

|

| Website: www.mrminvest.com |

|

Appendix: Quarterly

revenues

Consolidated revenues

(€m) |

Q1

2018 |

Q1

2017 |

Change |

Like-for-like change1 |

|

Retail |

2.13 |

2.29 |

-6.7% |

-7.7% |

|

Offices |

0.53 |

0.59 |

-11.3% |

+3.8% |

| Total gross rental income |

2.66 |

2.88 |

-7.7% |

-5.6% |

Consolidated revenues

(€m) |

Q2

2018 |

Q2

2017 |

Change |

Like-for-like change1 |

|

Retail |

2.14 |

2.25 |

-5.1% |

-6.1% |

|

Offices |

0.26 |

0.53 |

-51.6% |

0.0% |

| Total gross rental income |

2.40 |

2.79 |

-14.0% |

-5.5% |

Consolidated revenues

(€m) |

Q3

2018 |

Q3

2017 |

Change |

Like-for-like change1 |

|

Retail |

2.18 |

2.24 |

-2.8% |

-2.8% |

|

Offices |

- |

0.53 |

-100.0% |

0.0% |

| Total gross rental income |

2.18 |

2.77 |

-21.3% |

-2.8% |

[1] Revenues

are calculated on a like-for-like basis by deducting the rental

income generated by acquired assets from the revenues reported for

the current year and deducting the rental income generated from

assets sold from the revenues reported for the previous year.

[2] 12-month

projection of guaranteed minimum rent in place, excluding taxes,

rent-free periods and support measures for lessees.

Download the press release in

PDF

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: MRM via Globenewswire

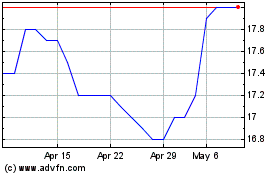

MRM (EU:MRM)

Historical Stock Chart

From Jun 2024 to Jul 2024

MRM (EU:MRM)

Historical Stock Chart

From Jul 2023 to Jul 2024