Press release

First half 2018 results

-

Portfolio[1]

value: €162.6m after sale of the Nova office

building marking the end of refocusing on retail

properties

-

Increase in net operating cash

flow to €1.1m

-

Annualised net

rents[2]: €8.3m, up 12%

-

Launch of 2 shopping centre

extension projects

-

Confirmation of

target[3] of annualised net rents over €10m post completion of the

value-enhancement plan, scheduled for late 2019

Paris,

27 July 2018: MRM (Euronext code ISIN FR0000060196), a

real estate company specialising in retail property, today

announced its half-year results as of June 30, 2018. This

publication follows the review and approval of the half-year

financial statements[4] by MRM's

Board of Directors at its meeting of 26 July 2018.

Asset management and letting

activity in the 1st half of the year

Sale of the Nova

office building

On 15 May 2018, MRM sold the Nova

office building in La Garenne-Colombes on the outskirts of La

Défense for €38 million (excluding transfer taxes). Representing a

total floor area of 10,600 sqm, this multi-tenant building was sold

with an occupancy rate of 81%.

This sale of MRM's last office

building in operation marks the end of the process initiated in

2013 of gradually refocusing its real estate investment business on

the ownership and management of retail properties. This brings the

total proceeds of office property sales carried out by MRM since

this date to €126 million (excluding transfer taxes).

Following this asset sale, the

Office category within MRM's property portfolio now comprises only

Urban, a vacant building due to be sold as it stands.

Solid progress in

letting operations during the 1st half of the

year

Regarding letting activity during

the first half of the year, nine leases (new leases or renewals)

were signed, representing an annual rent of €0.8 million.

Ten leases came into effect during

the same period, corresponding in particular to the reletting of a

several mid-size units: Le Grand Bazar took over the 2,800 sqm

high-street unit in Reims, Basic-Fit opened a 1,275 sqm store at

Les Halles du Beffroi in Amiens, and retailers V&B and MaxiZoo

now occupy 1,400 sqm within Aria Parc in Allonnes. These leases

took effect on a staggered basis between February and the end of

June 2018.

Good progress of letting activity

in the first half of the year resulted in a sharp increase in the

occupancy rate to 83% at 1 July 2018 compared with 76% at 1 January

2018. As a result, annualised net rents2 rose by 12%

to €8.3 million at 1 July 2018 compared with €7.4 million at 1

January 2018.

Asset portfolio of

€162.6 million at end-June 2018

The value of MRM's portfolio was €162.6 million at 30 June 2018,

down 18.5% compared with €199.6 million at 31 December 2017. This

fall is due to the sale of the Nova building in May 2018. On a

like-for-like basis[5], the value

of the portfolio rose by 0.2%, reflecting the slight increase in

value of retail properties.

The value of retail properties, which was €159.5 million at 30 June

2018, rose by 0.4% compared with €159.0 million at end-December

2017. On a like-for-like basis, i.e. adjusted for the sale of the

freehold of a garden centre during the period, this represents an

increase of 0.5%.

Investments over the first half of

the year totalled €5.5 million, corresponding to the launch of the

two largest projects still to be committed. This concerns:

-

The partial redevelopment and 2,600 sqm

extension of the Valentin shopping centre near Besançon, due to be

completed at the end of 2019;

-

The 2,300 sqm extension programme at Aria Parc

in Allonnes to create a mid-size store to be taken up by Maison

Dépôt at the end of 2018.

Rental income and net

income

Consolidated revenues

€m |

H1 2018 |

H1 2017 |

Change (reported) |

Change

like-for-like[6] |

| €m |

€m |

| Retail |

4.3 |

4.5 |

-5.9% |

-6.9% |

|

Offices |

0.8 |

1.1 |

-30.4% |

+2.5% |

| Gross rental income |

5.1 |

5.7 |

-10.8% |

-5.6% |

|

Non-recovered property expenses |

(1.8) |

(2.1) |

-12.7% |

|

| Net rental income |

3.2 |

3.6 |

-9.7% |

|

Gross rental income for the first

half of the year totalled €5.1 million, down 10.8% relative to the

first half of 2017, mainly due to the sale of the Nova building

during the period (15 May 2018) and the temporary drop in the

retail occupancy rate. On a like-for-like basis, gross rental

income fell by 5.6%.

Gross rental income from retail

properties came to €4.3 million in the first half of 2018. This

5.9% fall relative to the year-earlier period was due to:

. The negative

effect of the vacating of three mid-size units representing a total

of 6,000 sqm (termination notices received in 2017 for the Reims

property, Aria Parc in Allonnes and Les Halles du Beffroi in

Amiens). Leases were signed during the first half of the year for

two of these units , but because of the date they take effect, the

impact on rental income for the period was only partial;

. The positive impact

of leases corresponding in particular to the 1,050 sqm of retail

space created within Carré Vélizy (taking effect in the second half

of 2017) and the 1,000 sqm units let to Freeness since end-2017 by

Freeness at Le Passage de la Réunion in Mulhouse;

. Rent paid by

the tenant of the 1,500 sqm unit acquired in June 2017 within Aria

Parc. Not taking account of this acquisition, revenues for the

retail property portfolio fell by 6.9% like-for-like compared with

the first half of 2017.

Office rental income reflects

rents received from tenants of the Nova building until 15 May 2018,

when the property was sold.

Non-recovered property expenses

decreased further in the first half of 2018, benefiting from the

lower vacancy rate for retail properties, cost-cutting efforts and

the higher occupancy rate for Nova.

Net rental income came to €3.2

million compared with €3.6 million in the first half of 2017.

Operating expenses fell sharply,

mainly thanks to the end of the CBRE Global Investors contract in

the third quarter of 2017, down 18.6% at €1.4 million. While MRM

benefited from net reversals of provisions of €0.5 million in the

first half of 2017, provisions net of reversals totalled €0.4

million in the first half of 2018.

Meanwhile, other operating income

and expense increased from -€1.1 million[7] to +€0.2

million. As a result, operating income before asset sales and

change in fair value increased to €1.6 million compared with €1.2

million a year earlier.

Including investments for the

period and taking account of the higher yield applied by expert

appraisers at the end of the first half of the year, MRM recorded a

negative change in the fair value of its portfolio of €5.2

million.

Consequently, despite an 11.9%

reduction in cost of net debt, MRM posted a consolidated net loss

of €4.9 million for the first half of 2018, compared with a loss of

€2.6 million in the first half of 2017.

The simplified income statement is

attached in an appendix.

Increase in net operating cash

flow

Net operating cash flow [8]

€m

|

H1 2018 |

H1

2017 |

| Net rental income |

3.2 |

3.6 |

| Operating

expenses |

(1.4) |

(1.8) |

| Other

operating income and expense |

0.2 |

(1.1) |

| EBITDA |

2.0 |

0.7 |

| Net cost

of debt |

(0.8) |

(1.0) |

| Net operating cash flow |

1.1 |

(0.3) |

EBITDA rose from €0.7 million in

the first half of 2017 to €2.0 million in the first half of 2018

despite the decline in net rental income. This improvement was

thanks to lower operating expenses and the recognition of a net

amount of €0.2 million in other operating income, compared with a

net amount of €1.1 million in other operating expenses7

that affected the financial statements for the first half of

2017.

Net cost of debt decreased to €0.8

million from €1.0 million in the first half of 2017.

Consequently, net operating cash

flow was €1.1 million compared with -€0.3 million in the first half

of 2017. Adjusted for non-recurring items, net operating cash flow

was also up at €1.0 million in the first half of 2018 compared

with €0.8 million in the first half of 2017.

Solid financial position

Gross financial debt decreased

from €95.3 million at 31 December 2017 to €72.3 million at 30 June

2018. This significant reduction was due to the repayment of the

€22.0 million loan from SCOR following the sale of the Nova

building.

Consequently, and taking account

of the refinancing operations carried out by MRM in the fourth

quarter of 2017, no significant loan repayments are due before the

end of 2021.

At the end of June 2018, MRM had

cash and cash equivalents of €18.5 million compared with €13.3

million at 31 December 2017.

Net debt therefore stood at €53.8

million at 30 June 2018 compared with €81.9 million at

31 December 2017. The net LTV ratio was 33.1% compared with

41.0% six months earlier.

As a result in particular of the

dividend[9] paid in

respect of 2017 (€4.8 million), net operating cash flow generated

during the year (€1.1 million) and the change in the fair value of

properties (-€5.2 million), EPRA NNNAV was €108.2 million, down

8.3% relative to 31 December 2017 (€118.0 million). Adjusted

for the dividend payout in respect of 2017, EPRA NNNAV fell by

4.4%

Net asset value |

30.06.2018 |

31.12.2017 |

Total

€m |

Per share

€ |

Total

€m |

Per share

€ |

| EPRA NNNAV |

108.2 |

2.48 |

118.0 |

2.70 |

| Replacement NAV |

119.4 |

2.74 |

133.2 |

3.05 |

Number of shares

(adjusted for treasury stock) |

43,617,801 |

43,632,801 |

Outlook

MRM is continuing to carry on the

investment plan dedicated to its retail portfolio. This plan, which

concerns seven of the nine retail properties in the portfolio,

includes a total of 6,900 sqm of additional space, of which

2,000 sqm has already been completed.

Three programmes have already been

completed: the refurbishment of Les Halles du Beffroi in Amiens,

the partial redevelopment and renovation of the Sud Canal shopping

centre in Saint-Quentin-en-Yvelines, and the extension of retail

space at the Carré Vélizy mixed-use complex in

Vélizy-Villacoublay.

During the first half of the year,

MRM committed a total of €20.4 million in investment corresponding

primarily to extension projects at the Valentin shopping centre and

Aria Parc in Allonnes, which will result in the creation of a total

of 4,900 sqm of additional space, representing a 6% increase in the

total space at end-June 2018 of the retail property portfolio

(84,000 sqm). MRM also launched the more modest renovation

project at La Galerie du Palais in Tours. At end-June 2018, a total

of €34 million was committed in respect of the value-enhancement

plan, while the total investment budget is still estimated at €35

million over the 2016-2019 period.

Taking account rents on additional

space and assuming a retail portfolio occupancy rate of 95%, MRM

confirms its target of total annualised net rents2 of over

€10 million at the end of the value-enhancement plan, scheduled for

late 2019 (excluding acquisitions or asset sales).

Calendar

Revenues for the third quarter of

2018 are due out on 9 November 2018 before market opening.

About MRM

MRM is a listed real estate

investment company that owns and manages a portfolio in France

consisting primarily of retail properties across several regions of

France. Its majority shareholder is SCOR SE, which owns 59.9% of

share capital. MRM is listed in Compartment C of Euronext Paris

(ISIN: FR0000060196 - Bloomberg code: MRM:FP - Reuters code:

MRM.PA). MRM opted for SIIC status on 1 January 2008.

For more information:

MRM

5, avenue Kléber

75795 Paris Cedex 16

France

T +33 (0)1 58 44 70 00

relation_finances@mrminvest.com |

Isabelle

Laurent, DDB Financial

T +33 (0)1 53 32 61 51

M +33 (0)6 42 37 54 17

isabelle.laurent@ddbfinancial.fr

|

Website: www.mrminvest.com

Appendix 1: Income

statement

Simplified IFRS income statement

€m |

H1 2018 |

H1 2017 |

| Net rental income |

3.2 |

3.6 |

| Operating

expenses |

(1.4) |

(1.8) |

| Provisions

net of reversals |

(0.4) |

0.5 |

| Other

operating income and expense |

0.2 |

(1.1) |

Operating income before disposals and

change in fair value of properties |

1.6 |

1.2 |

| Net

gains/(losses) on disposals of assets |

(0.1) |

0.0 |

| Change in

fair value of properties |

(5.2) |

(2.7) |

| Operating income |

(3.8) |

(1.5) |

| Net cost of

debt |

(0.8) |

(1.0) |

| Other

financial income and expense |

(0.3) |

(0.2) |

| Net income before tax |

(4.9) |

(2.6) |

| Income

tax |

0.0 |

0.0 |

| Consolidated net income |

(4.9) |

(2.6) |

Appendix 2: 2018

second-quarter revenues

Consolidated

€m |

Q2 2018 |

Q2

2017 |

Change |

Like-for-like change8 |

| Retail |

2.14 |

2.25 |

-5.1% |

-6.1% |

| Offices |

0.26 |

0.53 |

-51.6% |

0.0% |

| Total gross rental income |

2.40 |

2.79 |

-14.0% |

-5.5% |

Appendix 3: Balance sheet

Simplified IFRS balance sheet

€m |

30.06.2018 |

31.12.2017 |

| Investment

properties |

159.3 |

158.5 |

| Assets held

for sale |

3.3 |

41.1 |

| Current

receivables/assets |

7.5 |

7.0 |

| Cash and

cash equivalents |

18.5 |

13.3 |

| Total Assets |

188.6 |

219.9 |

|

Equity |

108.2 |

118.0 |

| Financial

debt |

72.3 |

95.3 |

| Other debt

and liabilities |

8.1 |

6.6 |

| Total Equity and liabilities |

188.6 |

219.9 |

[1] Value

excluding transfer taxes based on valuations issued on 30 June 2018

by JLL, including assets held for sale, which are recognised in

accordance with IFRS 5.

[2] 12-month

projection of guaranteed minimum rent in place, excluding taxes,

rent-free periods and support measures for lessees.

[3] Taking

account of space currently being created and assuming a retail

portfolio occupancy rate of 95%.

[4] The

financial statements have been subject to a limited review by the

statutory auditors. The statutory auditors' report on financial

information for the first half of 2018 has been issued without any

observations or reservations.

[5] Change in

portfolio adjusted for asset sales carried out since 1 January

2018.

[6] Revenues

are calculated on a like-for-like basis by deducting the rental

income generated by acquired assets from the revenues reported for

the current year and deducting the rental income generated from

assets sold from the revenues reported for the previous year.

[7] Including

the payment of deferred registration fees relating to the

acquisition of Urban in 2007 and eviction compensation paid to a

tenant.

[8] Net

operating cash flow = consolidated net income before tax adjusted

for non-cash items.

[9]

Distribution of premiums.

Download the press release in

PDF

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: MRM via Globenewswire

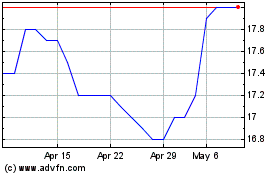

MRM (EU:MRM)

Historical Stock Chart

From Jun 2024 to Jul 2024

MRM (EU:MRM)

Historical Stock Chart

From Jul 2023 to Jul 2024