Information for MBWS shareholders in advance of the AGM on 31st

January 2019

Paris, 25th January 2019

Information for MBWS shareholders in

advance of

the Annual General Meeting to be held

on 31st January 2019

Marie Brizard Wine & Spirits (Euronext:

MBWS) has decided to publish today additional detailed information

in advance of its General Meeting to be held on 31st January 2019,

regarding the operations and proposals submitted for the approval

of its shareholders.

Context of the agreement signed by COFEPP and Marie

Brizard Wine & Spirits

The Group has faced significant operating and

financial difficulties during the past several months which have

led to the involvement of a conciliator and of an Inter-Ministerial

Industrial Restructuring Committee, two independent bodies under

whose guidance all solutions in the Company’s best interest have

been explored (refinancing, disposal of brands and assets,

involvement of a financial or industrial partner, capital increase,

etc.).

Thus, since March 2018, the Company’s management

has sought solutions to address the Group’s liquidity

problems. Under the guidance of the conciliator, several

loans were obtained from the syndicate of banks for a total

principal amount of €7.5m, as well as a current account advance

granted by COFEPP for a principal amount of €7.5m. These

loans were expected to enable the Group to finalize the discussions

with its banking partners before the end-of-summer in 2018.

Faced with the deterioration of market

conditions in France and the United States, and the delay in

executing the plan of corrective measures in Poland, the estimate

for 2018 EBITDA was revised downward significantly. This

rendered it impossible for the Group to conclude the discussions

with its banking partners before the end-of-summer 2018.

On 4th September 2018, the Group announced a

project to sell some of its brands in order to cover all or part of

the FY 2018 losses. This project was announced after a

budgeting exercise carried out in the summer of 2018 led to a

decrease in the estimated 2018 EBITDA, and highlighted the Group’s

weakened cash position, which – based on the assumptions made by

the Group – pointed to a funding need in a range of €40m to €50m by

January 2020, particularly in light of the termination of coverage

by some credit insurers.

Consequently, a process (which lasted three

months) to sell some brands was carried out by an investment bank.

In total, approximately 40 investors were contacted formally.

Some of these investors made indicative offers, but no binding

offer was received as of the Board of Directors meeting on 21st

December 2018, which met to close the 2017 accounts. Given

this state of affairs, the Board of Directors made the decision to

end the asset disposal process.

Given this situation and in light of the

impossibility of finding additional debt

finance ng, as well as facing the

difficulty of identifying buyers for the assets that were for sale,

the investment bank was also mandated to find an industrial or

financial partner capable of providing the Group with the required

capitalization, in the event that the asset disposal project

failed.

During this period, roughly 20 investors were

contacted and two firm offers were received during the week of the

17th December, after three months of analysis and advanced

discussions.

After assessing the two proposals, COFEPP’s

offer -- after negotiation -- was chosen unanimously by the Board

of Directors (excluding the Board members representing COFEPP, who

abstained from participating in the deliberation and the vote) over

the offer made by a foreign first-tier financial investor.

The offer submitted by COFEPP was also preferred over the

possibility of opening an insolvency procedure which would have

significantly worsened the situation (specifically leading to the

loss of credit provided by suppliers, client contracts, as well as

the risk that the Group’s key employees might resign or be hired

away) and would have permanently damaged the Company.

The offer submitted by COFEPP was chosen based

on objective criteria: a higher amount invested (€37.7m in COFEPP’s

Principal Option, compared to €25m in the financial investor’s

proposal) and a higher subscription price for the reserved capital

increase (€4.00 per share offered by COFEPP, compared to €3.52 per

share offered by the financial investor).

The Board of Directors also considered that an

industrial partner offered the Group significant strategic

advantages.

Moreover the offer made by COFEPP, which is

structured in the form of a Principal Option subject to certain

conditions, and – if the Principal Option is not able to be

executed – an Alternative Option (under the sole condition of the

approval of shareholders at the General Meeting) would secure the

required recapitalization of the Group. A summarized

description of the Principal and Alternative Options are included

in the annexes of this press release.

The conclusion of that agreement enabled the

Board of Directors to close the FY 2017 accounts on 21st December

2018, with the Company as a going concern, and to summon

shareholders to an Annual General Meeting. The execution,

without delays, of the binding agreement with COFEPP is a condition

for the Group’s status as a going concern. However, the

assumptions regarding the Company’s liquidity estimates relies on

the disposal of assets (excluding brands). The Group has

received several expressions of interest, but no firm offer has

been received at present. Any disposal of significant assets

will first be evaluated by an ad hoc committee.

In applying the agreement reached between the

Company and COFEPP on 21st December 2018, the parties agreed to

place in escrow, to be received by a conciliator as Escrow, the

amount of €25m as a guarantee of COFEPP’s proper execution of all

of its voting, deposit, subscription and payment commitments

(including a receivable offset) of said agreement. In the

event that it does not respect these commitments, COFEPP has agreed

to pay an indemnity of €5m, without prejudice to any enforcement of

rights.

The Group’s Board of Advisors and Chief

Executive Officer have clearly affirmed their preference for the

Principal Option of the agreement signed with COFEPP (the COFEPP

Reserved Capital Increase, outlined in Resolution 28 to be proposed

at the General Meeting). This is the only option which will

provide the Group with sufficient funds to cover its financial

requirements and to enable its turnaround.

Given the Group’s liquidity challenges, and the

urgency of obtaining funding as quickly as possible to enable the

Group to face its financial obligations, the decision has been made

to submit this operation to the shareholders at the General Meeting

of 31st January 2019, without waiting for the publication of the

Company’s FY 2018 results or the new strategic plan. The

agreement with COFEPP includes a bridge loan of €25m to be granted

to the Company by COFEPP within two days following the General

Meeting, in the event of a favorable vote on either of the

Options. Therefore, in order to receive these funds it has

become necessary to hold a General Meeting without delay. As

a reminder, the agreement with COFEPP will become automatically

void if a General Meeting is not held to vote on the Operation by

31st January 2019 at the latest.

Update on the strategic plan and preliminary

estimates on FY 2018 EBITDA and Net Loss

Andrew Highcock, Chief Executive Officer of

Marie Brizard Wine & Spirits, joined the Group at the end of

October 2018. He spent the first weeks of his tenure meeting

with company staff and with the largest clients across the Group’s

various geographies. He is currently working with the Group’s

employees to prepare a new strategic plan which should be presented

and communicated before the end of Q1 2019.

No member of the Board of Directors, including

those representing COFEPP, has yet had access to any part of the

strategic plan or the future business plan.

Given the constraints as regards regulatory

controls on mergers, COFEPP cannot contribute to MBWS’ strategic

plan before obtaining the required authorizations. Once the

authorizations are secured, COFEPP will work with MBWS management

to identify and to seize the possible synergies, within the

confines of the best interests for each of the companies, and an

equitable distribution between the two companies within the context

specifically of MBWS’ recovery and development.

In order to provide the best information

possible to its shareholders, the Group has decided to publish its

latest estimates for FY 2018. These are preliminary numbers

as the auditors have not yet begun their review of the FY 2018

accounts.

Thus, for the year ended 31st December 2018, the

Group expects an EBITDA of approximately -€28m and a net loss,

based on the work carried out so far on the annual accounts, in a

range of -€60m and

-€6

5m, also including impairments.

A standstill granted by the

banks

On 23rd January 2019, the creditors of the

medium term loan received on 26th July 2017 and of the bridge loan

received on 29th May 2018 accepted to waive the right to

request the immediate repayment of the medium-term loan, with a

principal amount of €45m. This waiver is valid until 28th

February 2020 at the latest. During the same period, they

have also agreed to waive the half-yearly payments on said mid-term

loan, and -- until the realization of the capital increases

outlined in the Operation (such as the term is defined hereafter)

-- to the repayment of the bridge loan in the amount of €7.5m in

principal, granted on 29th May 2018.

The waivers will be rescinded immediately and in

advance if one of the following events takes place:

- No approval is given by shareholders at the General Meeting for

one or the other of the operations outlined in the 21st December

2018 agreement with COFEPP (“the Operation”);

- Lack of repayment of the bridge loan with a principal amount of

€7.5m granted on 29th May 2018, following the planned capital

increases outlined in the framework of the Operation, and no later

than 19th April 2019;

- Lack of payment of interests, fees and commissions due under

the terms of the covenants on the syndicated loan of 26th July 2017

and the bridge loan of 29th May 2018;

- No extension granted by the Commission of Heads of the

Financial Services of the Île-de-France

(CCSF) on the plan for the clearance of

current public liabilities (currently in process), under certain

conditions;

- Reduction of the usable amount of the overdraft granted by a

banking partner in Poland, whose effect was not compensated, within

four weeks of said reduction;

- Receipt by COFEPP of all repayments (other than in shares)

related to the advance granted on 29th May 2018 before the total

repayment of the bridge loan of 29th May 2018;

- Lack of a finalized agreement with financial partners reached

by 20th May 2019 at the latest, or delivery of a judgement

officially ratifying said agreement no later than 30th June 2019.

Discussions continue with the Group’s financial partners and public

creditors in order to reach a definitive agreement, within the

framework of an open conciliation process which began on 20th

December 2018 for the benefit of the Company and its affiliates

MBWS France, Moncigale and Cognac Gautier. For information

purposes, the Group’s negotiations with its financial partners, its

largest shareholders and its public creditors, underway since early

2018, have been carried out -- since 20th April 2018 -- within the

framework of an open conciliation process by the President of the

Business Court of Paris (Tribunal de commerce de Paris), and then

from 20th September 2018, within the framework of the process of an

ad hoc mandate, and under the guidance of the Inter-Ministerial

Industrial Restructuring Committee. As is the case with all

companies facing financial difficulties, it was in the legitimate

best interest of the Group to maintain the confidentiality of these

processes and related information, in order to improve the chances

of fruitful negotiations. Plan to clear tax and social

benefit liabilities The cash shortfall faced by the

Company and its affiliates (MBWS France, Moncigale and Cognac

Gautier) have generated tax and social benefit liabilities which

are the object of a plan of transitory clearance that was closed by

the CCSF on 27th June 2018 and extended until February 2019 by a

decision handed down on 20th December 2018. The CCSF is

expected to meet before the end of March to rule on a new extension

of the liability clearance plan. A delay in the plan’s

monthly payment schedule or of current tax or social benefit

liabilities will lead to the termination of the plan. In

accordance with the rescheduling called by the CCSF, the tax and

social benefit liabilities of the companies mentioned hereafter are

guaranteed by:

- A pledge by MBWS France of the brands San José and Old Lady’s

to the benefit of the DGE (General Direction of Enterprises) and

the brand William Pitterson to the benefit of the URSSAF (the

French government’s Union of Receipts of Social Security and Family

Allocation);

- First and second tier pledges by Moncigale of the brand Fruits

and Wine to the benefit of the DGE (the second tier pledge is being

finalized);

- A pledge of Cognac stocks without dispossession to the benefit

of the DGE;

- Mortgage registrations on MBWS’ Lormont site to the benefit of

the DGE and the URSAFF. These security pledges will remain in force

until the repayment is received of all of the amounts due in

relation to the liability clearance by the companies

involved. At 23rd January 2019, the total amount of tax and

social benefit liabilities taken into account by the plan is

approximately €9.6m. Assignment of the firm

Ledouble As a reminder, on 10th January 2019 the

Company announced the voluntary hiring, based on the foundation of

article 261-3 of the AMF’s general regulations, of the firm

Ledouble in its role as an independent expert, tasked with

providing an expert opinion on the reserved capital increase

outlined in the Operation. Given the deadline, Ledouble will

not be in a position to provide an expert opinion at the General

Meeting. It will address a status report of its progress to

the Company’s Board of Directors prior to the General

Meeting. This report will be published on the Company’s

website for full disclosure to shareholders.

Guarantees On 7th June 2018, the Group

announced the subscription of a bridge loan granted by the banks

for a principal amount of €7.5m and a current account advance for a

principal amount of €7.5m granted by COFEPP while the Group was

facing a cash shortfall. The Operation with COFEPP should

enable the following repayments:

- Repayment in shares of the advance granted by COFEPP;

- Repayment in cash of the bridge loan granted by the banks.

These reimbursements will enable the Company to obtain the release

of the assurances in place to guarantee the repayment of these

loans, as follows:

- The pledge of the Sobieski brand (however, in the event of the

execution of the Operation’s Alternative Option, this brand will

serve as a pledge in guarantee for the repayment of the bonds

issued by the Company for an amount of €14.5m);

- The pledge to a custody account on 35% of the capital of MBWS

France;

- The pledge of the Marie Brizard brand. In the event of the

execution of the Operation’s Principal Option, no new guarantee

shall be granted on the Group’s assets to the benefit of COFEPP.In

the event of the execution of the Alternative Option, the following

guarantees will be granted for the benefit of COFEPP:

- A pledge on the Sobieski brand as a guarantee of the

repayment of the bonds issued by MBWS for a total amount of

€14.5m;

- A pledge to a custody account on all of the shares of Cognac

Gautier as a guarantee of repayment of the bonds issued by MBWS

France for a total amount of €15m, reduced by the amount of the

capital increase subscribed by COFEPP above and beyond €10.5m.

The execution of the Operation will not have a direct effect

on the other existing guarantees on the Group’s assets (e.g. pledge

of the William Peel brand, guarantees on the public liabilities,

etc.). It is further specified that a request will be made,

without this constituting a condition, that the bridge loans (to be

subscribed by COFEPP if either the Principal or Alternative Options

receive a favorable vote by shareholders at the General Meeting) as

well as in the Operation’s Alternative Option, the bonds issued

could benefit from the privilege of the article L. 611-11 of the

Commercial Code under the assumption that an agreement is ratified

within the framework of the conciliations that are underway.

Amendments to the 2017 Registration

Document The information regarding tax loss carry

forwards, in note 5.5 (Impact of exceptional tax assessments) in

chapter 5 (Annual financial statements) of the 2017 Registration

Document (French version), is not precise and should be worded as

follows: “At 31st December 2017, the amount of tax loss carry

forwards under the tax consolidation totaled €188.4m, virtually

flat compared to 31st December 2016.” However, the use

of these tax losses assumes the realization of profit in the

countries in which these tax losses exist, and their use is

regulated by fiscal tax provisions. Additionally, the table

in Note 6.3 of the 2017 consolidated accounts on page 94 (French

version of the Registration Document) contains an error. A

correction can be found in the annex of this press release.

Finally, regarding what is indicated in paragraph 2.3.1 on page 24

and in paragraph 4.6.11 on page 99 of the French version of the

2017 Registration Document, please note that the credit contract

signed on 26th July 2017 is not the object of any request for early

repayment.

Governance

Within the framework of recent organizational

changes at Marie Brizard Wine & Spirits, the General Managers

of the international affiliates now report directly to the Group’s

Chief Executive Officer. Andrew Highcock provides the benefit

of his knowledge of the international beverage and spirits markets,

as he has held senior management positions in several of those

countries. Consequently, Stanislas Ronteix, Deputy CEO of the

Group responsible for distribution and sales development in the

clusters, left the Group on 18th January 2019.

As announced in the press release of 24th

December 2018, the Company has agreed to submit to its shareholders

a list of nominees of members representing COFEPP with the aim of

having a majority of members of the Board of Directors representing

COFEPP in the event of the execution of the Principal Option of

that agreement. This is valid assuming that the Capital

Increase Reserved for COFEPP is realized.

Given the intention of Christine Mondollot and

Constance Benqué to resign from their positions as Board members

with effect on the date of the execution of the Operation (and

considering Benoît Hérault’s resignation with effect at the same

date), COFEPP will propose to the shareholders at the next General

Meeting the following representatives[1]:

- Pascale Anquetil, responsible for Finance and Administration at

COFEPP;

- Anna Luc, Director of Marketing - France at La

Martiniquaise;

- Cyril Cahart, General Manager of Operations – France, and

CEO of Benelux COFEPP;

- Georges Graux, Chief Financial Officer at COFEPP.

Biographical details for these candidates are

available on the Company’s website (in French) on the “Assemblée

Générale 2019” page.

The objective of the financial and industrial

investment by COFEPP in MBWS is the turnaround of the latter via

the preservation and development of MBWS’ business activities,

particularly in light of potential synergies. Within this

context, COFEPP confirms that it does not have any intention, in

the short or medium term, of pursuing a merger or a contribution

between MBWS and COFEPP. If such a transaction were to be

proposed to shareholders at a later date, the parity to be retained

would take into account the recovery of MBWS and it business

potential, for the benefit of all MBWS shareholders.

Discussions regarding sales and distribution underway

between MBWS and COFEPP

As announced when COFEPP became a shareholder of

Marie Brizard Wine & Spirits, opportunities for joint sales and

distribution in international markets have been explored. In

Spain, Marie Brizard Wine & Spirits’ affiliate does not have

the critical size necessary to enable it to achieve sustainable

profitability.

The Company is currently assessing a number of

measures to reduce operating losses tied to distribution of the

Company’s products in Spain. One of the options under

evaluation would be to outsource the distribution of its products

to a third party. In this regard, Bardinet Spain, a COFEPP

affiliate, could take on such distribution. The Company’s

Board of Directors will consider a preliminary approval of such an

arrangement. The possible distribution of MBWS products by

Bardinet Spain is not in any way tied to the binding agreement

signed by MBWS and COFEPP.

Marie Brizard Wine &

Spirits produces and sells a range of wine and spirits

across four geographic clusters: Western Europe, Middle East &

Africa, Central and Eastern Europe, the Americas, and Asia-Pacific.

MBWS has distinguished itself for its know-how, the range of its

brands, and a long tradition and history of innovation. From the

inception of Maison Marie Brizard in Bordeaux, France in 1755, to

the launch of Fruits and Wine in 2010, MBWS has successfully

developed and adapted its brands to make them contemporary while

respecting their origins. MBWS is committed to providing value by

offering its customers bold, trustworthy, flavorful and

experiential brands. The company has a broad portfolio of leading

brands in their respective market segments, most notably William

Peel scotch whisky, Sobieski vodka, Krupnik vodka, Fruits and Wine

flavored wine, Marie Brizard liqueurs and Cognac Gautier. MBWS is

listed on the regulated market of Euronext Paris, Compartment B

(ISIN code FR0000060873, ticker MBWS) and is included in the

EnterNext© PEA-PME 150 index, among others.

|

Investor Contact Raquel

Lizarraga raquel.lizarraga@mbws.com Tél :

+33 1 43 91 50 |

Press Contact Simon Zaks, Image

Sept szaks@image7.fr Tél : +33 1 53 70 74 63

|

Annexes

Correction to Note 6.3 of the FY 2017 consolidated

accounts: Financial Assets

|

(in thousands of euros) |

31.12.2016 |

Acquisitions/ Increases |

Disposals/ Decreases |

Net charges |

Other changes |

Change in consolidation |

Translation differences |

31.12.2017 |

| Equity

investmetns |

17,361 |

|

(3,910) |

|

|

|

16 |

13,468 |

| Other long-term

securities |

21 |

|

|

|

|

|

|

21 |

| Other financial

assets |

35,995 |

807 |

(3,959) |

|

|

|

(20) |

32,823 |

|

Other receivables |

11,161 |

|

|

|

|

|

|

11,161 |

|

Gross Value |

64,538 |

807 |

(7,868) |

|

|

|

(4) |

57,473 |

| |

|

|

|

|

|

|

|

|

| Equity

investments |

(17,344) |

|

3,912 |

|

|

|

(10) |

(13,442) |

| Other financial

assets |

(31,430) |

|

3,098 |

11,751 |

|

|

(2) |

(16,583) |

|

Other receivables |

(11,161) |

|

|

|

|

|

|

(11,161) |

|

Impairment charges |

(59,935) |

|

7,010 |

11,751 |

|

|

(12) |

(41,187) |

|

NET VALUE |

4,602 |

807 |

(858) |

11,751 |

|

|

(16) |

16,285 |

Summary Description of the Principal

Option and the Alternative Option

If the resolutions regarding the Principal

Option -- Resolutions 28 and 29 -- do not receive a favorable vote

by shareholders at the General Meeting, or if the conditions to

which this Option are subject are not met, the Alternative Option

will be executed by the Board of Directors. The only specific

conditions on the Alternative Option are those described below.

Whichever of the two options is executed, with

the only condition being the favorable vote by the shareholders at

the General Meeting on one of the two options, the agreement with

COFEPP calls for COFEPP to grant the Company a bridge loan in the

amount of €25m (at an annual interest rate of 4.56%), maturing on

30th April 2020. This loan is to be paid within two days

following the date of the General Meeting. The bridge loan

will be repaid in advance at the date of the realization of one of

the two options described hereunder, by inclusion in the

capital.

- Principal Option -

Conditions:

- Favorable vote on Resolutions 28 and 29 at the General

Meeting

- Obtaining an exemption form the AMF, excluding any recourse, no

later than 28th February 2019[2]

- Obtaining the authorization of the anti-trust authorities in

France and in Poland no later than 28th February 2019

- Obtaining the formal approval of the AMF on the prospectus

relative to the Operation -

Structure:

- Capital increase reserved for COFEPP for a total amount (issue

premium included) of €37.712m, at a subscription price of €4 per

share (issue premium included)

- Allocation to all shareholders of two types of free stock

warrants, following the payment delivery of the reserved capital

increase (one short-term stock warrant, and one long-term stock

warrant granted for each ordinary share) at an exercise price of €3

per share:

-

- Stock warrants exercisable for one month

(“Short-term stock warrants”), enabling the

Company to quickly raise additional funds, 23 Short-term stock

warrants enabling the subscription to 10 new ordinary shares for a

total amount of €49.3m (issue premium included)

- Stock warrants exercisable for 27 months (“Long-term

stock warrants”), enabling shareholders to benefit

from the Group’s medium-term recovery, 23 Long-term stock warrants

enabling the subscription to 10 new ordinary shares for a total

amount of €49.3m (issue premium included)

- On an indicative basis, assuming that the effective realization

of the reserved capital increase takes place on 28th February 2019,

the stock warrants would be exercisable beginning on 5th March

2019

- Commitment by COFEPP to exercise stock warrants in the amount

of at least €15m (Short or Long term stock warrants, at COFEPP’s

option)

- Appointment of new members to the Board of Directors, in

representation of COFEPP, enabling COFEPP to have a majority of

Board members as of the effective execution of the reserved capital

increase

- Dilution resulting from the Principal Option

|

Shareholder participation

(in %) |

Non-diluted basis |

Diluted basis (2) |

|

Before issuing new shares and allocation of stock

warrants(1) |

1.00% |

0.98% |

|

After issuing 9,428,000 new shares |

0.75% |

0.74% |

|

After issuing 9,428,000 new shares and exercising all of the

Short-term and Long-term stock warrants – Shareholder exercising

the Short-term stock warrants but not exercising the Long-term

stock warrants(3) |

0.58% |

0.57% |

|

After issuing 9,428,000 new shares and exercising all of the

Short-term and Long-term stock warrants – Shareholder not

exercising the Short-term stock warrants, but exercising the

Long-term stock warrants (3) |

0.58% |

0.57% |

|

After issuing 9,428,000 new shares and exercising all of the

Short-term and Long-term stock warrants – Shareholder exercising

the Long-term stock warrants and the Short-term stock warrants |

0.75% |

0.74% |

|

After issuing 9,428,000 new shares and exercising all of the

Short-term and Long-term stock warrants – Shareholder not

exercising his Long-term stock warrants nor his Short-term stock

warrants (3) |

0.40% |

0.40% |

(1)

Preference shares (as described in Note 2 hereunder) do not grant

the right to stock warrants.

(2)

Calculations carried out under the assumption of the issue of the

maximum number of shares to be issued within the framework of the

conversion of 4,732 free preference shares granted in application

of the LTIP 2 plan on 1st July 2016 (at a rate of 100 ordinary

shares per one preference share in the event of a change of

control, equivalent to 473,200 ordinary shares). The 2023

stock warrants are not dilutive because the strike price is higher

than the average share price in 2018, and the same is the case for

the 349,000 stock options; these instruments are thus not taken

into account in the analysis of potential dilution.

(3) Assumption in the

event that a shareholder sells his stock warrants, and that they

are later exercised

- Alternative Option -

Conditions:

- Favorable vote on Resolution 18 at the General Meeting

- Obtaining the formal approval of the AMF on the prospectus

relative to the Operation -

Structure:

- Capital increase with shareholders’ preferential subscription

rights for a total maximum amount (issue premium included) of €35m,

at a subscription price per share equal to the volume-weighted

average price (VWAP) of the last five trading days preceding the

decision to realize the operation, reduced by a 40% discount, not

to exceed €2.50 nor to be less than €2.00 (the ”Capital

Increase with PSR”)

- Binding commitment by COFEPP to subscribe to the Capital

Increase with PSR up to its share of MBWS’ capital, or

approximately €10.5m

- Binding commitment by COFEPP to guarantee the realization of

the Capital Increase with PSR to reach 75% of total in the event

that there is not a high enough level of subscription by other

shareholders (COFEPP will be able to place the shares exceeding 30%

of capital in a Trust, and the Trustee will be able to sell the

shares received at its complete discretion)

- Binding commitment by COFEPP to subscribe, on 3rd March 2019,

to a bond issue for MBWS and MBWS France, in the amount of €29.5m,

at an annual interest rate of 4.56%, maturing on 30th April

2024. It is further specified that in the event that a

recourse is filed against the exemption granted by the AMF but the

Paris Appeals Court confirms the exemption (or overturns that

decision but a new exemption void of all recourse is obtained),

these bonds will be repaid in advance in exchange of 7,375,000 of

the Company’s shares, subject to the favorable vote on Resolution

28 at the General Meeting (in the event that Resolution 28 is

rejected, the bonds will become simple bonds, and not convertible

into shares). Furthermore, it is specified that the total

nominal amount of the bonds shall be reduced proportionally to the

amount subscribed as collateral by COFEPP within the framework of

the Capital Increase with PSR.

- Dilution resulting from the Alternative Option

Scenario 1 – Subscription by all

shareholders to all of the shares issued within the framework of

the capital increase (subscription price of €2.50 per

share)

|

Shareholder participation

(in %) |

Non-diluted basis |

Diluted basis (1) |

|

Before issuing 14,000,000 new shares |

1.00% |

0.98% |

|

After issuing 14,000,000 new shares, for one shareholder not

participating in the capital increase with PSR |

0.67% |

0.66% |

|

After issuing 14,000,000 new shares, and after repayment of bonds

with 7,375,000 new shares (2) |

0.57% |

0.56% |

- ) Calculations carried out assuming the

maximum number of shares to be issued within the framework of the

conversion of 4,732 free preference shares issued in application of

the LTIP 2 plan on 1st July 2016 (equivalent to 100 ordinary shares

per each preference share in the event of a change of control, or

473,200 ordinary shares) and insofar as a change in the control of

the Company as defined in said plan would take place following the

execution of the Alternative Option. The 2023 stock warrants

are not dilutive because the exercise prices is higher than the

average share price in FY 2018, as is the case for the 349,000

stock options, which are therefore not taken into account in the

potential dilution analysis.

- ) Hereunder, the scenario in which the

bonds are repayable in shares.

Scenario 2 – Subscription by COFEPP

to 75% of ordinary shares issued within the framework of the

capital increase (subscription price of €2.50 per

share)

|

Shareholder participation

(in %) |

Non-diluted basis |

Diluted basis (1) |

|

Before issuing 10,500,000 new shares |

1.00% |

0.98% |

|

After issuing 10,500,000 new shares, for a shareholder not

participating in the capital increase with PSR |

0.73% |

0.72% |

|

After issuing 10,500,000 new shares, and after repayment of bonds

with 3,391,695 new shares(2) |

0.67% |

0.66% |

- ) Calculation carried out assuming the

issue of the maximum number of shares to be issued within the

framework of the conversion of the 4,732 free preference shares

granted in application of the LTIP 2 plan on 1st July 2016 (100

ordinary shares for one preference share in the event of a change

of control, or 473,200 ordinary shares) and insofar as a change of

control of the Company in the sense of said plan takes place

following the execution of the Alternative Option. The 2023

stock warrants are not dilutive because the strike price is higher

than the average share price in FY2018, as is the case for the

349,000 stock options which are therefore not considered in the

dilution analysis. .

(2) Hereunder, the scenario in which the

bonds are repayable in shares.

Scenario 3 – Subscription by all

shareholders to all of the shares issued within the framework of

the capital increase (subscription price of €2)

|

Shareholder participation

(in %) |

Non-diluted basis |

Diluted basis (1) |

|

Before issuing 17,500,000 new shares |

1.00% |

0.98% |

|

After issuing 17,500,000 new shares, for a shareholder not

participating in the capital increase with PSR |

0.62% |

0.61% |

|

After issuing 17,500,000 new shares and after repayment of bonds

with 7,375,000 new shares(2) |

0.53% |

0.53% |

- Calculation carried out

assuming the issue of the maximum number of shares to be issued

within the framework of the conversion of the 4,732 free preference

shares granted in application of the LTIP 2 plan on 1st July 2016

(100 ordinary shares for one preference share in the event of a

change of control, or 473,200 ordinary shares) and insofar as a

change of control of the Company in the sense of said plan takes

place following the execution of the Alternative Option. The

2023 stock warrants are not dilutive because the strike price is

higher than the average share price in FY2018, as is the case for

the 349,000 stock options which are therefore not considered in the

dilution analysis.

- ) Hereunder, the scenario in which the bonds

are repayable in shares.

Scenario 4 – Subscription by COFEPP

to 75% of the ordinary shares issued within the framework of the

capital increase (subscription price of €2)

|

Shareholder participation

(in %) |

Non-diluted basis |

Diluted basis (1) |

|

Before issuing 13,125,000 new shares |

1.00% |

0.98% |

|

After issuing 13,125,000 new shares, for a shareholder not

participating in the capital increase with PSR |

0,68% |

0.68% |

|

After issuing 13,125,000 new shares and after repayment of the

bonds with 3,391,695 new shares(2) |

0.63% |

0.63% |

- Calculation carried out

assuming the issue of the maximum number of shares to be issued

within the framework of the conversion of the 4,732 free preference

shares granted in application of the LTIP 2 plan on 1st July 2016

(100 ordinary shares for one preference share in the event of a

change of control, or 473,200 ordinary shares) and insofar as a

change of control of the Company in the sense of said plan takes

place following the execution of the Alternative Option. The

2023 stock warrants are not dilutive because the strike price is

higher than the average share price in FY2018, as is the case for

the 349,000 stock options which are therefore not considered in the

dilution analysis.

- ) Hereunder, the scenario in which the bonds

are repayable in shares.

[1] Given the resignation intentions received, only four

candidates will be nominated (and not five as listed in the Meeting

Notice for the General Meeting.

[2] Condition at COFEPP’s option

- MBWS_CP_25_janv 19 - VF ENG

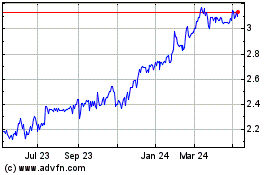

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From Jun 2024 to Jul 2024

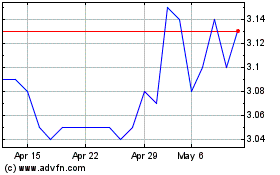

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From Jul 2023 to Jul 2024