EARNINGS PREVIEW: European Drinks Makers To Show Worst Is Over

April 20 2010 - 7:33AM

Dow Jones News

TAKING THE PULSE: Europe's drinks producers will update on

recent trading in the coming month and are expected to demonstrate

that the worst of the recession is over, at least when it comes to

sales volumes.

Sales figures from Europe's brewers and distillers are expected

to benefit from extremely weak comparatives last year, when a

combination of customer destocking of inventories and weak consumer

confidence hit demand.

Analysts will look for evidence that consumer spending trends

have started to improve in the developed world. The resilience of

emerging markets compared with Europe and the U.S. will benefit

those with exposure there.

The weak comparative figures may disguise what has been a poor

quarter for beer producers, with some volume growth in emerging

markets offsetting further drops in Europe.

The world's largest spirits makers Diageo and Pernod Ricard

meanwhile are expected to post some encouraging figures showing

volume growth for the first time in more than a year.

Recent industry data has pointed to stagnant growth in Europe,

but signs of recovery in the U.S.

COMPANIES TO WATCH

Heineken Holdings NV (HEIO.AE) - Apr. 21 0500GMT

MARKET EXPECTATIONS: Heineken is expected to report a 2.3%

decline in organic revenue in its first quarter trading update.

Beer volumes are expect to decline 4% organically to 24.5 million

hectoliters according to a Dow Jones Newswires survey of four

analysts. Analysts expect lower volumes in the Americas due to

consumers shifting to non premium brands, and lower volumes in

Central and Eastern Europe due to duty increases.

MAIN FOCUS: Analysts will be focusing on the impact of raw

material and energy prices and looking for news on cost cutting.

They don't expect Heineken to give full year earnings guidance.

Pernod Ricard SA (RI.FR) - Apr. 29 0500GMT

MARKET EXPECTATIONS: The French spirits and wine group updates

on its third quarter sales and is expected to post a strong rebound

from last year. Underlying sales are seen about 10% higher for the

latest quarter against easy comparative numbers last year, when

sales dropped 12% due to customers destocking their

inventories.

MAIN FOCUS: Pernod has already indicated that January was a very

good month for sales and analysts expect this to be true of the

quarter as a whole, as trading returns to normal following last

year's disruptions. A strong performance may be considered a

turning point in Pernod's fortunes. Recent industry data suggests

U.S. sales are improving, while Europe should show some recovery

despite some tough markets. Asia meanwhile will benefit from a

later Chinese new year this year. The sales growth will be driven

by volumes but analysts will look for comments on the pricing

environment to see whether the recovery can be sustained. Analysts

will also look to see if marketing spend will continue to rise in

support of brands.

Anheuser Busch InBev (ABI.BT) - May 5 0500GMT

MARKET EXPECTATIONS: Anheuser-Busch InBev (ABI.BT) is expected

to report weak first-quarter results. Sales in the U.S., its

biggest market, are expected to be sluggish, weighed down by the

country's high unemployment rate and struggling economy. Higher

costs, including options expenses for executive compensation, may

also eat into profits during the quarter, analysts say. Sales in

Latin America are expected to be strong, as a minimum wage boost

earlier this year should help buoy beer consumption. But heavy

rainfall in March will also dampen sales, analysts say, as people

stayed inside and drank less.

MAIN FOCUS: The company said in March that Ebitda growth in 2010

would start out at a "low single digit" rate and increase

progressively throughout the year. Investors will want to know

whether that projection is on track, or whether weakness in the

U.S. will subdue expectations for improvement later in the

year.

Diageo PLC (DEO) - May 6 0600 GMT

MARKET EXPECTATIONS: The world's largest spirits company posts

its third quarter trading update on May 6. Like its smaller rival

Pernod Ricard, Diageo is expected to return to more normal trading.

Third quarter sales are expected to rise by 4%-8%, after falling by

7% in the same period last year.

MAIN FOCUS: Analysts will look closely at the figures to make

sure there is a genuine improvement in trading rather than just a

recovery from last year's figures, which were hit by the one-off

impact of industry destocking. Analysts will also look for any

change to the company's guidance for low single digit organic

operating profit growth for the full year. The company has already

started talking about "green shoots" of recovery, particularly in

the U.S., but has a much lower exposure than Pernod to growth

markets like China. With the pricing environment still tough,

analysts will look to the brief statement for indications growth

can be maintained. A recent analyst presentation suggests the trend

for customers to trade up to more expensive brands will return in

time.

Carlsberg (CARL-A.KO) - May 11 0500 GMT

MARKET EXPECTATIONS: Carlsberg is expected to post a net loss of

DKK190 million in the first quarter according to an early Dow Jones

Newswires and Factset survey of four analysts, compared to a loss

of DKK212 million last year. Sales are seen coming in at DKK10.96

billion.

MAIN FOCUS: Carlsberg's first quarters are traditionally small

and loss-making and do not provide significant read-across for the

full year. Eyes will be on the troubled Russian and Eastern

European beer markets and on whether Carlsberg has managed to pass

on a tax increase to consumers. Analysts say the company's

estimates appear low and remain confident that full year guidance

will be reiterated. In February, Carlsberg said it expects net

profit growth of more than 20% this year.

SABMiller PLC (SAB.LN) - May 20 0600 GMT

MARKET EXPECTATIONS: The world's second largest brewer reports

its full-year results and is expected to post earnings per share of

164 cents, up from 137 cents the previous year.

MAIN FOCUS: The company has already said that full-year lager

volumes were flat, so all eyes will be on the group's margin

figures and outlook for the coming year. It is suffering from a

sluggish consumer environment in its mature markets like South

Africa and the U.S. and the effect of large tax hikes in emerging

markets like Colombia. It is however benefiting from falling input

costs as commodity prices ease. Analysts will look closely at SAB's

performance in South Africa where it is facing increasing

competition from a Heineken/Diageo joint venture.

-By Michael Carolan, Dow Jones Newswires; +44 20 7842 9278;

michael.carolan@dowjones.com (Matthew Dalton, Johan Anderberg and

Bart Koster contributed to this report.)

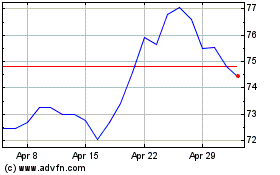

Heineken (EU:HEIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Heineken (EU:HEIO)

Historical Stock Chart

From Jul 2023 to Jul 2024