- Gross rental income up +6.2% like-for-like thanks to indexation

(+5.2%) and rental reversion (+1.2%)

- Strong year-on-year rental growth (+4.3%) despite the high

volume of sales in 2023 (€1.3bn)

- Significant rental reversion (+16% overall for offices, nearly

+30% in Paris)

- Gecina ramping up the rollout of its “managed” offers for

offices and residential

- Payment of a cash dividend of €5.3 per share for 2023

- 2024 recurrent net income per share target confirmed at €6.35

to €6.40, up +5.5% to +6.5%

Regulatory News:

Gecina (Paris:GFC):

Strong rental income

growth over the first three months of the year

Gross rental income

Mar 31, 2023

Mar 31, 2024

Change (%)

In million euros

Current basis

Like-for-like

Offices

133.2

141.2

+6.0%

+6.3%

Residential

33.5

32.6

-2.8%

+5.8%

Total gross rental income

166.7

173.8

+4.3%

+6.2%

- Contribution by rent indexation following on from 2023

(+5.2%)

- Significant rental reversion captured during the first

quarter (+16% overall for offices), particularly at the heart of

Paris

- Occupancy rate stable overall at 94.3%

- Pipeline’s positive net rental contribution benefiting

from the impact of the deliveries of the Boétie building (Paris

CBD) in 2023 and a residential building in Ville d’Avray

- Growth on a current basis still high despite the historically

significant volume of sales completed in 2023 (€1.3bn)

2024 guidance

confirmed

- Group outlook supported by a solid balance sheet, further

strengthened through the sales in 2023 and the renewal of €0.7bn of

undrawn credit lines since the start of the year, as well as

positive rental market trends

- Recurrent net income (Group share) is expected to reach

€6.35 to €6.40 per share in 2024, up +5.5% to

+6.5%

Start of the year confirming the performance of Gecina’s

strategy

- Rental markets still polarized during

the first quarter, benefiting Gecina’s preferred

sectors

For the first quarter, the rental market shows an outperformance

by the Paris Region’s most central sectors. The volume of rental

transactions on the Paris Region market for the first quarter of

2024 is consistent overall year-on-year (+1%), but this stability

masks significant contrasts in trends between the areas.

In the most central sectors (Paris City and

Neuilly/Levallois), take-up shows an increase of nearly

+50%, thanks in particular to the upturn in transactions over

5,000 sq.m, with this performance particularly marked as the

vacancy rate in Paris is historically low (2.3% in Paris’ Central

Business District, showing a further year-on-year decrease).

- Gecina: limited available supply in

central sectors and significant rental reversion

In this context, the volume of transactions signed by Gecina

during the first quarter is linked to the scarcity of spaces

available for letting within its portfolio.

Since the start of the year, 11,500 sq.m have been let, relet or

renegotiated.

Gecina continued to capture a still very significant level of

rental reversion potential in the first quarter (+16% on

average, close to +30% in Paris City).

The contribution from the rental reversion captured during

previous half-year periods had a positive impact on like-for-like

income growth, with +1.2% for the first quarter.

- Indexation supporting the Group’s

rental income growth

Rental income also benefited from the still high level of

indexation, mechanically reflected in the current rents on an

annual basis, and on a sustainable basis in the central sectors

where market rents are higher than index-linked rents. The latest

ILAT index published in March was +5.6%.

During the first quarter, indexation contributed +5.2% to

like-for-like growth.

- Occupancy rate stable overall across

the portfolio

At end-March 2024, the average financial occupancy rate for

Gecina’s portfolio was stable overall at 94.3%, slightly below the

level from end-March 2023, but slightly higher than the end-2023

rate.

- Strong rental income growth at

end-March 2024 both like-for-like and on a current

basis

As a result, the Group’s rental income is up +6.2%

like-for-like and +4.3% on a current basis, linked to the

impact of the sales completed since the start of 2023 (€1.3bn with

an average premium of +8% versus the appraisals and a loss of

rental income of 2.5%).

- Gecina is committed to optimizing its

potential for growth over the medium term

With a robust financial structure, significantly

strengthened in 2023, Gecina is moving forward with confidence over

the medium and long term (LTV of 34%, ICR of 5.9x, €4.1bn of

surplus liquidity, 92% fixed-rate hedging for the cost of debt on

average for the next five years, A- rating confirmed).

During the first quarter, Gecina further strengthened its

liquidity profile with €0.7bn of new bank credit lines renewed,

with an average maturity of seven years.

The Group’s ambition is to be able to launch three major

redevelopment projects at the heart of the most central sectors

(Paris and Neuilly) over the next 12 months, which will increase

its potential for cash flow growth and will capitalize on its value

creation potential. These projects represent nearly €500m of

investments to be made, with €35m to €40m of additional net rental

potential over time.

Alongside this, since the end of 2023, Gecina has been

developing serviced real estate solutions, for both residential

and office properties, with their deployment expected to help

capture additional potential for growth. At this stage, the new

solutions have already been rolled out for 3,900 sq.m of offices,

and Gecina has identified around 13,000 sq.m for their deployment

in the short term. In the residential sector, around 450 apartments

are covered to date.

About Gecina

As a specialist for centrality and uses, Gecina operates

innovative and sustainable living spaces. A real estate investment

company, Gecina owns, manages and develops a unique portfolio at

the heart of the Paris Region’s central areas, with more than 1.2

million sq.m of offices and more than 9,000 housing units, almost

three-quarters of which are located in Paris City or

Neuilly-sur-Seine. This portfolio is valued at 17.1 billion euros

at end-2023.

Gecina has firmly established its focus on innovation and its

human approach at the heart of its strategy to create value and

deliver on its purpose: “Empowering shared human experiences at

the heart of our sustainable spaces”. For our 100,000 clients,

this ambition is supported by our client-centric brand YouFirst. It

is also positioned at the heart of UtilesEnsemble, our program

setting out our solidarity-based commitments to the environment, to

people and to the quality of life in cities.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60 and CAC 40 ESG indices. Gecina is also recognized as one of the

top-performing companies in its industry by leading sustainability

benchmarks and rankings (GRESB, Sustainalytics, MSCI, ISS-ESG and

CDP).

www.gecina.fr

Appendices

Gross rental income up +6.2% like-for-like

Strong organic trend and contribution from the pipeline

Gross rental income

Mar 31, 2023

Mar 31, 2024

Change (%)

In million euros

Current basis

Like-for-like

Offices

133.2

141.2

+6.0%

+6.3%

Residential

33.5

32.6

-2.8%

+5.8%

Total gross rental income

166.7

173.8

+4.3%

+6.2%

Like-for-like, the acceleration in performance slightly

exceeded the levels reported at end-2023, with rental income growth

of +6.2% overall and +6.3% for offices.

This trend follows on from the previous quarters.

- Impacts of indexation contributing +5.2%

- Rental reversion captured, for both offices and

residential, with a +1.2% impact on organic rental income

growth.

- Contribution by the change in the occupancy rate, stable

overall for the quarter (-0.2%)

On a current basis, rental income is up +4.3% (+6.0% for

offices), benefiting from not only the robust like-for-like rental

performance, but also the pipeline’s strong net rental

contribution, with the deliveries of the “Boétie” building in

Paris’ Central Business District and the “Ville d’Avray”

residential building in 2023. The change in rental income on a

current basis also reflects the significant sales completed during

2023 for nearly €1.3bn, with an average loss of rental income of

around 2.5%.

Offices: rental trends still positive

Gross rental income- Offices

Mar 31, 2023

Mar 31, 2024

Change (%)

In million euros

Current basis

Like-for-like

Offices

133.2

141.2

+6.0%

+6.3%

Central areas (Paris, Neuilly,

Southern Loop)

97.1

101.5

+4.5%

+6.5%

Paris City

77.6

79.1

+2.0%

+5.0%

Core Western Crescent

19.5

22.3

+14.3%

+12.4%

La Défense

17.5

18.9

+8.1%

+8.1%

Other locations (Peri-Défense,

Inner / Outer Rims and Other regions)

18.5

20.8

+12.5%

+3.9%

Like-for-like office rental income growth came to +6.3%

year-on-year benefiting from the positive indexation effect

which is continuing to ramp up (+5.8%), passing on - with a delayed

impact - the return of an inflationary context, as well as the

impact of the positive reversion captured (+1.0%).

- In the most central sectors (86% of Gecina’s office

portfolio), like-for-like rental income growth came to

+6.5%, linked mainly to the combined impact of the

indexation of rents and the positive reversion captured at the end

of leases.

- On the La Défense market (7% of the Group’s office

portfolio), Gecina’s rental income is up by nearly +8.1%

like-for-like, primarily reflecting the benefit of indexation and

the increase in financial occupancy levels, with the letting of the

portfolio’s final unoccupied platforms in this sector.

Rental income growth on a current basis came to

+6% for offices, supported by the solid like-for-like trend,

while also reflecting the impact of the pipeline’s positive net

contribution (with the Boétie-Paris CBD and Ville d’Avray

buildings delivered in 2023), offsetting the impact of the sales

completed in 2023 (for €1.3bn).

Residential: robust trends supported by occupancy,

reversion and indexation

Gross rental income

Mar 31, 2023

Mar 31, 2024

Change (%)

In million euros

Current basis

Like-for-like

Residential

33.5

32.6

-2.8%

+5.8%

Traditional residential

27.7

26.0

-6.3%

+4.8%

Student residences

5.8

6.6

+13.8%

+9.5%

For the residential portfolio, all the components of

like-for-like growth show positive trends. The like-for-like

rental income growth rate came to +5.8%, benefiting from positive

indexation (+2.7%), the impact of significant rental reversion

(+1.9%) and the reduction in the financial vacancy rate

(+1.3%).

On a current basis, rental income is down -2.8%, linked

mainly to the impact of sales completed since the start of 2023 in

Courbevoie and Paris.

Occupancy rate: stable, at a high level

Average financial occupancy rate

Mar 31, 2023

Jun 30, 2023

Sep 30, 2023

Dec 31, 2023

Mar 31, 2024

Offices

94.5%

93.8%

93.6%

93.7%

93.9%

Residential

96.4%

94.4%

93.6%

94.7%

96.7%

Group total

94.9%

93.9%

93.6%

93.9%

94.3%

The average financial occupancy rate came to 94.3%, a

slight improvement compared with end-2023.

Sales: €44m of additional sales under preliminary

agreements

Since the start of the year, Gecina has secured or completed

€44m of additional sales, resulting in an average loss of

rental income strictly below 3% and exceeding the latest

appraisals. These disposals are linked primarily to the sale of a

residential building in Paris’ 11th arrondissement, sold to a

French institutional investor.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425852013/en/

GECINA CONTACTS Financial communications Samuel

Henry-Diesbach Tel: +33 (0)1 40 40 52 22

samuelhenry-diesbach@gecina.fr

Attalia Nzouzi Tel: +33 (0)1 40 40 18 44

attalianzouzi@gecina.fr

Press relations Glenn Domingues Tel: +33 (0)1 40 40 63 86

glenndomingues@gecina.fr

Armelle Miclo Tel: +33 (0)1 40 40 51 98

armellemiclo@gecina.fr

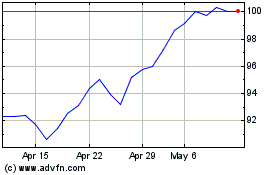

Gecina Nom (EU:GFC)

Historical Stock Chart

From Apr 2024 to May 2024

Gecina Nom (EU:GFC)

Historical Stock Chart

From May 2023 to May 2024