Cegedim: FY 2018 Revenue

Cegedim_Revenue_4Q2018_ENG

Full year Financial Information at December 31, 2018 IFRS -

Regulated Information - Not Audited

Cegedim: like-for-like growth picked up speed in fourth

quarter 2018

- LFL revenue growth climbed to 2.9% in the final quarter

- LFL revenues rose 1.9% over the full year

- The Healthcare professionals division posted growth in Q4

|

Disclaimer: This press release is available in French and

in English. In the event of any difference between the two

versions, the original French version takes precedence. This press

release may contain inside information. It was sent to Cegedim’s

authorized distributor on January 29, 2019, no earlier than 5:45 pm

Paris time.The terms “business model

transformation” and “BPO” are defined in the

glossary.Owing to the disposal of the Group’s

Cegelease and Eurofarmat businesses, announced in 2017 and

completed on February 28, 2018, the consolidated 2017 and 2018

financial statements are presented according to IFRS 5,

“Non-current assets held for sale and discontinued”. The Group also

applies IFRS 15, “Revenue from contracts with

customers”. |

|

CONFERENCE CALL ON JANUARY 29, 2019, AT 6:15PM

CET |

|

FR : +33 1 72 72 74 03 |

USA : +1 646 722 4916 |

UK: +44 (0)207 1943 759 |

PIN CODE: 68707970# |

|

The webcast is available at the following address:

www.cegedim.fr/webcast |

Boulogne-Billancourt, France, January 29, 2019, after

the market close

Cegedim, an innovative

technology and services company, posted consolidated Q4 2018

revenues from continuing activities of €131.2 million, up 3.8% on a

reported basis and 2.9% like for like compared with the same period

in 2017.

All of the operating divisions contributed

positively to the Group’s fourth-quarter like-for-like revenue

growth compared with the year-earlier period.

Over the full year 2018,

Cegedim posted consolidated revenues from

continuing activities of €467.7 million, up 2.2% on a reported

basis an1.9% like for like compared with the same period in

2017.

BPO revenues rose 7.0% in the fourth quarter of

2018 and amounted to €35.9 million over FY 2018, an 11.5% increase

compared with FY 2017.

Revenue trends by division

|

|

|

Fourth quarter |

|

In € million |

|

2018 |

2017 |

Chg. L-f-l |

Chg. Reported |

| Health

insurance, HR and e-services |

|

86.5 |

82.9 |

+3.1 |

% |

+4.4 |

% |

| Healthcare

professionals |

|

43.7 |

42.7 |

+2.3 |

% |

+2.5 |

% |

| Corporate and

others |

|

1.0 |

0.9 |

+6.3 |

% |

+6.3 |

% |

|

Cegedim |

|

131.2 |

126.5 |

+2.9 |

% |

+3.8 |

% |

In the fourth quarter of 2018, Cegedim posted

consolidated revenues from continuing activities of €131.2 million,

up 3.8% on a reported basis. Excluding a favorable currency

translation effect of 0.1% and a 0.8% boost from acquisitions,

revenues rose 2.9%.

Currency translation had a positive impact of

€0.1 million, or 0.1%, as both the US dollar (2.1% of Group

revenues) and the pound sterling (10.2% of Group revenues) were

stable against the euro.

The €1.1 million positive impact from

acquisitions, or 0.8%, was due to the acquisition of Rue de la Paye

in France in March 30, 2018.

LFL revenues rose at every division. The Health

insurance, HR and e-services division grew by 3.1% and the

Healthcare professionals division, by 2.3%.

|

|

|

Full year |

|

In € million |

|

2018 |

2017 |

Chg. L-f-l |

Chg. Reported |

| Health

insurance, HR and e-services |

|

307.7 |

291.1 |

+4.7 |

% |

+5.7 |

% |

| Healthcare

professionals |

|

156.2 |

162.5 |

(3.1 |

)% |

(3.9 |

)% |

| Corporate and

others |

|

3.8 |

3.9 |

(1.5 |

)% |

(1.5 |

)% |

|

Cegedim |

|

467.7 |

457.4 |

+1.9 |

% |

+2.2 |

% |

For the full year 2018, Cegedim posted

consolidated revenues from continuing activities of €467.7 million,

up 2.2% on a reported basis. Excluding an unfavorable currency

translation effect of 0.3% and a 0.6% boost from acquisitions,

revenues rose 1.9%.

The unfavorable currency translation impact of

€1.3 million, or 0.3%, is chiefly due to the negative impacts of

€0.7 million from the US dollar, which represents 2.4% of Group

revenues, and of €0.5 million from the pound sterling, which

represents 10.0% of Group revenues.

Acquisitions added €2.9 million, or 0.6%, mainly

as a result of the March 30, 2018, acquisition of Rue de la Paye in

France.

The Health insurance, HR and e-services division

grew by 4.7%, whereas the Healthcare professionals division

experienced a drop of 3.1%.

Analysis of business trends by division

- Health insurance, HR and e-services

The division’s Q4 2018 revenues came to

€86.5 million, up 4.4% on a reported basis. The March 30,

2018 Rue de la Paye acquisition

in France made a positive contribution of 1.3%. Currency

translation had virtually no impact. Like-for-like revenues rose

3.1% over the period.The division’s 2018 revenues

came to €307.7 million, up 5.7% on a reported basis. The March 30,

2018 Rue de la Paye acquisition

in France made a positive contribution of 1.1%. Currency

translation had virtually no impact. Like-for-like revenues rose

4.7% over the period.

The businesses that made the biggest

contributions to growth were Cegedim SRH (HR management solutions),

Cegedim Health Data (sales statistics for pharmaceutical products),

Cegedim e-business (digitalization and data exchange), and – in the

field of health insurance – third-party payment flow management and

BPO activities.

The Health insurance, HR and e-services division

represented 65.8% of consolidated revenues, compared with 63.6%

over the same period a year earlier.

The division’s Q4 2018 revenues came to

€43.7 million, up 2.5% on a reported basis. Currency translation

had a positive impact of 0.3%. There was virtually no impact from

acquisitions or divestments. Like-for-like revenues rose 2.3% over

the period.The division’s 2018 revenues came to

€156.2 million, down 3.9% on a reported basis. Currencies had a

negative impact of 0.7%. There was virtually no impact from

acquisitions or divestments. Like-for-like revenues fell 3.1% over

the period.

The businesses that made the strongest

contributions to this growth were software for doctors and allied

health professionals in France and Belgium, and the BCB medication

database. The strong year-on-year growth in computerization

services for doctors in the UK in the fourth quarter was

particularly noteworthy.

The Healthcare professionals division

represented 33.4% of consolidated revenues from continuing

activities, compared with 35.5% over the same period a year

earlier.

The division’s Q4 2018 revenues came to

€1.0 million, up 6.3% on a reported basis and like for like. There

was no currency impact and no acquisitions or

divestments.The division’s 2018 revenues came to

€3.8 million down 1.5% on a reported basis and like for like. There

was no currency impact and no acquisitions or

divestments.

The Corporate and others division represented

0.8% of consolidated revenues from continuing activities in 2018

and 2017.

Highlights

Apart from the items cited below, to the best of

the company’s knowledge, there were no events or changes during the

period that would materially alter the Group’s financial

situation.

- Bpifrance sells Cegedim shares

Bpifrance Participations sold 1,682,146 Cegedim

shares via an accelerated bookbuilding process to French and

international institutional investors at a price of €35 per share

on February 13, 2018. In the context of the transaction, the

shareholders’ agreement dated October 28, 2009, between Mr.

Jean-Claude Labrune, FCB (the family holding company controlled by

Mr. Labrune), and Bpifrance – as well as the concert between the

parties – has been terminated. Following the sale, Cegedim’s free

float increased to 44% of capital (vs. 32% before the

transaction).

- Cegelease and Eurofarmat definitively sold

On February 28, 2018, Cegedim announced that it

had completed the disposal of Cegelease and Eurofarmat to

FRANFINANCE of the Société Générale Group for an amount of €57.5

million plus reimbursement of the shareholder’s loan account, which

amounted to €13 million. Of this amount, Cegedim used €30 million

to pay down its debt.

The parties have decided that Cegelease and the

Cegedim Group will continue to collaborate in France under the

current terms as part of a six-year collaboration agreement.

- Rue de la Paye acquired in France

On March 30, 2018, Cegedim acquired French

company Rue de la Paye via its Cegedim SRH subsidiary. The deal

will enable the Group to market digital payroll solutions to 2

million SMEs and small businesses in France, including –

importantly – thousands of healthcare professionals that are

already Cegedim Group clients.

Rue de la Paye’s 2017 revenues were equivalent

to around 1% of 2017 consolidated Group revenues, and it earned a

profit. It began contributing to the Group’s consolidation scope in

April 2018.

On February 21, 2018, Cegedim S.A. received

notice that French tax authorities would perform an audit of its

accounts covering the period January 1, 2015, to December 31,

2016.

- Independent director appointed to Cegedim SA’s board

At the annual general meeting on August 31,

2018, shareholders appointed Ms. Béatrice Saunier to a six-year

term as an independent director. Her term will expire following the

AGM held to approve the financial statements for the year 2023.

- New financing structure for €200 million

On October 9, 2018, Cegedim set up a new

financing structure for a total amount of €200 million consisting

of a €135 million, 7-year Euro PP bond with a coupon of

3.50%, and a €65 million, 5-year syndicated revolving credit

facility with a one-year extension option. The interest rate on the

new revolving credit facility is 20 basis points lower than that of

the previous one.

Along with IQVIA (formerly IMS Health), Cegedim

had been sued by Euris for unfair competition. Cegedim filed a

motion asking for the court to dismiss any claims against the

Group. The Paris Commercial Court granted Cegedim’s request in a

ruling on December 17, 2018.

Significant post December 31th

transactions and events

- Acquisition of XimantiX in Germany

On January 21, 2019, Cegedim acquired German

company XimantiX.

Building on its presence in the digitalization

market in Belgium, France, the United Kingdom, and Morocco, Cegedim

now has a solid base for this activity in Germany, Europe’s leading

economy. By acquiring a German leader positioned on the midmarket

segment, Cegedim e-business will be able to develop its offer for

SMEs. XimantiX customers will gain access to a wider range of

services, thanks to Cegedim’s international scope.

XimantiX’s 2018 revenues came to €2.2 million,

and it earned a profit. It began contributing to the Group’s

consolidation scope in January 2019

To the best of the company’s knowledge, except

for the aforementioned, there were no events or changes after the

September 30th that would materially alter the Group’s financial

situation.

Outlook

Building on the efforts that it executed with

success in 2017, Cegedim continues to pursue its strategy of

focusing on organic growth, fueled by a policy of sustained

innovation.

With revenues in line with the Group’s outlook,

Cegedim still expects EBITDA to be stable compared with 2017.

The Group does not communicate earnings

estimates or forecasts.

- Potential impact of Brexit

Cegedim deals in local currency in the UK, as it

does in every country where it is present. Thus, Brexit is unlikely

to have a material impact on consolidated Group EBIT before special

items.

With regard to healthcare policy, the Group has

not identified any major European programs at work in the UK and

expects UK policy to be only marginally affected by Brexit.

The figures cited above include guidance on

Cegedim's future financial performances. This forward-looking

information is based on the opinions and assumptions of the Group’s

senior management at the time this press release is issued and

naturally entails risks and uncertainty. For more information on

the risks facing Cegedim, please refer to Chapter 2 points 4.2,

“Risk factors and insurance”, and 5.5, “Outlook”, of the 2017

Registration Document filed with the AMF on March 29, 2018, under

number D.18-0219.

Additional information

Revenue figures for FY 2018 have not yet been

audited by the Statutory Auditors.

|

|

March 27, 2019, after the

market close March 28, 2019, at 11:00 am CET

May 15, 2019, after the market close June

19, 2019, at 9:30 am CET |

FY 2018 results Analyst meeting (SFAF) in Cegedim’s

auditorium First-quarter 2019 revenues Cegedim shareholders’

meeting |

Financial calendar, H1 2019

|

January 29, 2019, at 6:15pm (Paris

time) |

|

The Group will hold a conference call hosted by Jan Eryk

Umiastowski, Cegedim Chief Investment Officer and Head of Investor

Relations. The webcast is available at the following address:

www.cegedim.fr/webcast The presentation on FY 2018 revenues is

available: The website:

http://www.cegedim.fr/finance/documentation/Pages/presentations.aspx

The Group’s financial communications app, Cegedim IR. To download

the app, visit:

http://www.cegedim.fr/finance/profil/Pages/CegedimIR.aspx |

|

Contact Numbers : |

France: +33 1 72 72 74 03 United

States: +1 646 722 4916 UK and

others: +44 (0)207 1943 759 |

PIN Code: 68707970# |

Appendices

Breakdown of revenues from continuing activities by

quarter and division

|

In € thousands |

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Health insurance, HR et e-services |

|

72,923 |

|

76,613 |

71,620 |

86,526 |

307,684 |

|

|

| Healthcare

professionals |

|

38,029 |

|

38,133 |

36,291 |

43,731 |

156,184 |

|

|

| Corporate and

others |

|

989 |

|

947 |

900 |

985 |

3,820 |

|

|

|

Revenue from continuing activities |

|

111,941 |

|

115,693 |

108,811 |

131,242 |

467,688 |

|

|

| Revenue from

activities held for sale |

|

2,066 |

|

0 |

0 |

0 |

2,066 |

|

|

| IFRS 5

restatement |

|

(36 |

) |

0 |

0 |

0 |

(36 |

) |

|

|

Group revenue |

|

113,970 |

|

115,693 |

108,811 |

131,242 |

469,717 |

|

|

|

In € thousands |

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Health insurance, HR et e-services |

|

68,610 |

|

71,653 |

|

67,958 |

|

82,856 |

|

291,077 |

|

|

| Healthcare

professionals |

|

40,320 |

|

41,495 |

|

37,999 |

|

42,672 |

|

162,486 |

|

|

| Corporate and

others |

|

1,058 |

|

933 |

|

961 |

|

926 |

|

3,878 |

|

|

|

Revenue from continuing activities |

|

109,989 |

|

114,081 |

|

106,918 |

|

126,454 |

|

457,441 |

|

|

| Revenue from

activities held for sale |

|

3,926 |

|

2,935 |

|

2,476 |

|

3,664 |

|

13,001 |

|

|

| IFRS 5

restatement |

|

(209 |

) |

(103 |

) |

(100 |

) |

(78 |

) |

(490 |

) |

|

|

Group revenue |

|

113,705 |

|

116,913 |

|

109,294 |

|

130,040 |

|

469,952 |

|

|

Breakdown of revenue by geographic zone and

division

|

As a % of consolidated revenues from continuing activities |

|

France |

EMEA excl. France |

Americas |

APAC |

|

Health insurance, HR et e-services |

|

96.7 |

% |

3.3 |

% |

- |

|

- |

| Healthcare

professionals |

|

61.3 |

% |

31.2 |

% |

7.5 |

% |

- |

| Corporate and

others |

|

100.0 |

% |

- |

|

- |

|

- |

|

Cegedim |

|

84.9 |

% |

12.6 |

% |

2.5 |

% |

- |

Breakdown of revenue by currency and

division

|

As a % of consolidated revenues from continuing activities |

|

Euro |

GBP |

USD |

Others |

|

Health insurance, HR et e-services |

|

96.7 |

% |

2.3 |

% |

0.0 |

% |

1.0 |

% |

| Healthcare

professionals |

|

65.5 |

% |

25.3 |

% |

7.2 |

% |

2.0 |

% |

| Corporate and

others |

|

100.0 |

% |

- |

|

- |

|

- |

|

|

Cegedim |

|

86.3 |

% |

10.0 |

% |

2.4 |

% |

1.3 |

% |

BPO (Business Process Outsourcing): BPO is

the contracting of non-core business activities and functions to a

third-party provider. Cegedim provides BPO services for human

resources, Revenue Cycle Management in the US and management

services for insurance companies, provident institutions and mutual

insurers. Business model transformation: Cegedim

decided in fall 2015 to switch all of its offerings over to SaaS

format, to develop a complete BPO offering, and to materially

increase its R&D efforts. This is reflected in the Group’s

revamped business model. The change has altered the Group's revenue

recognition and negatively affected short-term profitability

Corporate and others: This division encompasses

the activities the Group performs as the parent company of a listed

entity, as well as the support it provides to the three operating

divisions. EPS: Earnings Per Share is a specific

financial indicator defined by the Group as the net profit (loss)

for the period divided by the weighted average of the number of

shares in circulation. Operating expenses:

Operating expenses is defined as purchases used, external expenses

and payroll costs. Revenue at constant exchange

rate: When changes in revenue at constant exchange rate

are referred to, it means that the impact of exchange rate

fluctuations has been excluded. The term “at constant exchange

rate” covers the fluctuation resulting from applying the exchange

rates for the preceding period to the current fiscal year, all

other factors remaining equal. Revenue on a like-for-like

basis: The effect of changes in scope is corrected by

restating the sales for the previous period as follows:

- by removing the portion of sales originating in the entity or

the rights acquired for a period identical to the period during

which they were held to the current period;

- similarly, when an entity is transferred, the sales for the

portion in question in the previous period are eliminated.

Life-for-like data (L-f-l): At constant scope and

exchange rates. Internal growth: Internal growth

covers growth resulting from the development of an existing

contract, particularly due to an increase in rates and/or the

volumes distributed or processed, new contracts, acquisitions of

assets allocated to a contract or a specific project. |

|

External growth: External growth covers

acquisitions during the current fiscal year, as well as those which

have had a partial impact on the previous fiscal year, net of sales

of entities and/or assets. EBIT: Earnings Before

Interest and Taxes. EBIT corresponds to net revenue minus operating

expenses (such as salaries, social charges, materials, energy,

research, services, external services, advertising, etc.). It is

the operating income for the Cegedim Group. EBIT before

special items: This is EBIT restated to take account of

non-current items, such as losses on tangible and intangible

assets, restructuring, etc. It corresponds to the operating income

from recurring operations for the Cegedim Group.

EBITDA: Earnings before interest, taxes,

depreciation and amortization. EBITDA is the term used when

amortization or depreciation and revaluations are not taken into

account. “D” stands for depreciation of tangible assets (such as

buildings, machines or vehicles), while “A” stands for amortization

of intangible assets (such as patents, licenses and goodwill).

EBITDA is restated to take account of non-current items, such as

losses on tangible and intangible assets, restructuring, etc. It

corresponds to the gross operating earnings from recurring

operations for the Cegedim Group. Adjusted EBITDA:

Consolidated EBITDA adjusted, for 2016, for the €4.0m of

negative impact from impairment of receivables in the Healthcare

Professional division Net Financial Debt: This

represents the Company’s net debt (non-current and current

financial debt, bank loans, debt restated at amortized cost and

interest on loans) net of cash and cash equivalents and excluding

revaluation of debt derivatives. Free cash flow:

Free cash flow is cash generated, net of the cash part of the

following items: (i) changes in working capital requirements, (ii)

transactions on equity (changes in capital, dividends paid and

received), (iii) capital expenditure net of transfers, (iv) net

financial interest paid and (v) taxes paid. EBIT

margin: EBIT margin is defined as the ratio of

EBIT/revenue. EBIT margin before special

items: EBIT margin before special items is defined as the

ratio of EBIT before special items/revenue. Net

cash: Net cash is defined as cash and cash equivalent

minus overdraft |

Glossary

|

About Cegedim: Founded in 1969, Cegedim is an innovative technology

and services company in the field of digital data flow management

for healthcare ecosystems and B2B, and a business software

publisher for healthcare and insurance professionals. Cegedim

employs more than 4,500 people in more than 10 countries and

generated revenue of €468 million in 2018. Cegedim SA is listed in

Paris (EURONEXT: CGM).To learn more, please visit:

www.cegedim.comAnd follow Cegedim on Twitter: @CegedimGroup,

LinkedIn and Facebook. |

| Aude

BalleydierCegedim Media Relations and

Communications ManagerTel.: +33 (0)1 49 09 68

81aude.balleydier@cegedim.com |

Jan Eryk

UmiastowskiCegedimChief Investment

Officerand head of Investor RelationsTel.: +33 (0)1 49 09 33

36janeryk.umiastowski@cegedim.com |

Marina

RosoffFor Madis Phileo

Media RelationsTel: +33 (0)6 71 58 00

34marina@madisphileo.com |

Follow Cegedim:

|

- Cegedim_Revenue_4Q2018_ENG

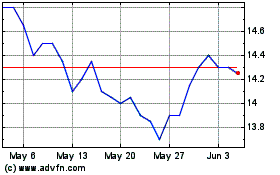

Cegedim (EU:CGM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cegedim (EU:CGM)

Historical Stock Chart

From Jul 2023 to Jul 2024