BUREAU VERITAS - Solid organic revenue growth in the third quarter;

2023 outlook confirmed

PRESS RELEASE

Neuilly-sur-Seine, France – October 25, 2023

Solid organic revenue growth in the third

quarter;2023 outlook confirmed

Q3 2023 Key

Figures1

- Revenue of EUR 1,423.8 million in

the third quarter of 2023, up 6.1% at constant currency, of which

5.8% organic

- Strong organic growth from Marine

& Offshore +13.4%, Industry +16.2% and Certification +11.7%

compared to the third quarter of 2022; growth of +2.6% for

Agri-Food & Commodities; and flat organic growth for both

Buildings & Infrastructure and Consumer Products Services

- Positive scope effect of 0.3% in

the third quarter of 2023, reflecting bolt-on deals realized last

year net of disposals

- Negative currency impact of 8.4%,

resulted from the strength of the euro against most currencies

Q3 2023 Highlights

- Growth driven by all geographies

(Middle East, Africa, Americas, Europe, and Asia Pacific)

- Strong momentum maintained for

Sustainability and energy transition solutions across the

portfolio, representing 55% of Group sales through the BV Green

Line of services and solutions

- Strategic partnership investment

with OrbitMI, a US based maritime software company, for shipping

journeys performance management

2023 Outlook confirmedBased on

the 9-month performance, a healthy sales pipeline and the

significant growth opportunities related to Sustainability and

energy transition, Bureau Veritas expects for full-year 2023 to

deliver:

- mid-to-high single-digit organic

revenue growth;

- a stable adjusted operating margin

at constant exchange rates;

- strong cash

flow, with a cash conversion2 above 90%.

Hinda Gharbi, Chief Executive Officer,

commented:

“Our operations continue to deliver robust

growth through consistent contract execution and to develop

business opportunities for the future. Our performance in the third

quarter is as expected, after a particularly strong Q3 last year.

Our strategic focus is firmly on high growth markets such as

sustainability and energy transition and on ensuring that our

business mix and investments generate long-term value for the

company and our stakeholders.

To that effect, we are reinforcing Bureau

Veritas’ leadership in sustainability services, by augmenting our

capabilities through partnerships. In Q3, we signed a promising

partnership with Capgemini to provide our customers with ESG

digital tools. We have also formed a strategic partnership and

invested in a US software company focused on enabling shipping

decarbonization through journeys performance management.”

-

Q3 2023 KEY REVENUE FIGURES

|

|

|

|

GROWTH |

|

IN EUR MILLIONS |

Q3 2023 |

Q3 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Marine & Offshore |

110.0 |

104.7 |

+5.1% |

+13.4% |

- |

(8.3)% |

|

Agri-Food & Commodities |

305.5 |

323.9 |

(5.7)% |

+2.6% |

- |

(8.3)% |

|

Industry |

309.0 |

305.0 |

+1.3% |

+16.2% |

(1.4)% |

(13.5)% |

|

Buildings & Infrastructure |

413.8 |

427.2 |

(3.1)% |

+0.1% |

+1.4% |

(4.6)% |

|

Certification |

106.7 |

101.2 |

+5.4% |

+11.7% |

- |

(6.3)% |

|

Consumer Products Services |

178.8 |

195.1 |

(8.4)% |

- |

+0.9% |

(9.3)% |

|

Total Group revenue |

1,423.8 |

1,457.1 |

(2.3)% |

+5.8% |

+0.3% |

(8.4)% |

Revenue in the third quarter of 2023 amounted to

EUR 1,423.8 million, a 2.3% decrease compared with Q3 2022. Organic

growth was 5.8% against a particularly strong Q3 last year. 9-month

organic revenue grew by 8.1%.

Leading the growth in Q3 were the three

activities, Marine & Offshore, Industry and Certification,

which delivered double-digit organic growth, driven by the

continued momentum in Sustainability and ESG, including marine

decarbonization and renewable energy projects. Agri-Food &

Commodities delivered low-single-digit organic revenue growth led

by Agri-Food markets and government services. Buildings &

Infrastructure and Consumer Products Services were flat. Buildings

& Infrastructure having seen particularly strong growth in Q3

2022 and Consumer Products Services continuing to be impacted by

the consequences of lower consumer spending seen throughout the

year.

By geography, activities in Americas were solid

(29% of revenue; up 6.6% organically), led by a double-digit

increase in Latin America (in Brazil and Chile notably), as well as

in Canada. Europe (33% of revenue; up 4.8% organically) was

primarily led by high activity levels in Southern Europe. In Asia

Pacific (29% of revenue; up 1.8% organically), robust growth was

achieved in Australia alongside Southern Asia (notably in India)

and South-East Asian countries. Finally, activity was also strong

in Africa and the Middle East (9% of revenue; up 19.8%

organically), primarily driven by Buildings & Infrastructure

and energy projects in the Middle East.

The scope effect was a positive 0.3%, reflecting

bolt-on acquisitions realized last year, largely offset by a minor

disposal.

Currency fluctuations had a significant negative

impact of 8.4%, mainly due to the strength of the euro against USD

and pegged currencies and some emerging countries’ currencies.

At September 30, 2023, the Group's adjusted net

financial debt was up on the level recorded at June 30, 2023, due

to the dividend payment in July 2023. The Group had EUR 0.9 billion

in available cash and cash equivalents and EUR 600 million in

undrawn committed credit lines. Bureau Veritas has a solid

financial structure with the bulk of its maturities beyond 2025 and

100% at fixed interest rates.

Based on the 9-month performance, a healthy

sales pipeline and the significant growth opportunities related to

Sustainability and energy transition, Bureau Veritas expects for

full-year 2023 to deliver:

- mid-to-high single-digit organic

revenue growth;

- a stable adjusted operating margin

at constant exchange rates;

- strong cash flow, with a cash

conversion3 above 90%.

-

COMMITMENT TOWARDS EXTRA-FINANCIAL PERFORMANCE

Corporate Social Responsibility (CSR) key

indicators

|

|

UNITED NATIONS’ SDGS |

9M 2023 |

FY 2022 |

2025 target |

|

SOCIAL & HUMAN CAPITAL |

|

|

|

|

|

Total Accident Rate (TAR) 4 |

#3 |

0.24 |

0.26 |

0.26 |

|

Proportion of women in leadership positions5 |

#5 |

27.5% |

29.1% |

35.0% |

|

Number of learning hours per employee (per year)6 |

#8 |

22.9 |

32.5 |

35.0 |

|

ENVIRONMENT |

|

|

|

|

|

CO2 emissions per employee (tons per year) 7 |

#13 |

2.39 |

2.32 |

2.00 |

|

GOVERNANCE |

|

|

|

|

|

Proportion of employees trained to the Code of Ethics |

#16 |

96.8% |

97.1% |

99.0% |

Bureau Veritas’ joined CAC SBT

1.5° index

On September 18, 2023, Bureau Veritas was

included in the CAC SBT 1.5° index. This new index is made up of

SBF 120 companies whose emissions reduction targets have been

approved by the Science Based Targets initiative (SBTi) as in line

with the 1.5°C goal of the Paris Agreement.

This announcement comes in the wake of the

SBTi’s validation last June of the Group’s commitments to:

-

Reduce its absolute scopes 1 and 2 greenhouse gas (GHG) emissions

by 42% (from 2021 levels) by 2030;

-

Reduce its absolute scope 3 GHG emissions by 25% over the same

period.

Bureau Veritas shares have been part of the CAC

40 ESG index since September 17, 2021. This is the Euronext’s index

of the top 40 companies from the CAC Large 60 index (CAC40 + Next

20) in terms of environmental, social and governance (ESG)

practices.

The Group is also included in various

Sustainability indices, such as the DJSI and Axylia’s Vérité 40,

and features in S&P Global’s Sustainability Yearbook 2022.

MARINE & OFFSHORE

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Q3 revenue |

110.0 |

104.7 |

+5.1% |

+13.4% |

- |

(8.3)% |

|

9M revenue |

338.6 |

309.2 |

+9.5% |

+14.8% |

- |

(5.3)% |

The Marine & Offshore business was among the

best performing businesses within the Group’s portfolio in the

third quarter of 2023 with organic growth of 13.4% (9-month organic

revenue growth of 14.8%) led by all geographies and activities:

-

Double-digit organic revenue growth in New

Construction (41% of divisional revenue), reflecting the

solid backlog and acceleration of new order conversion, pushed by

sector drivers across the shipping industry (renewal of the world

ageing fleet and decarbonization regulations).

-

Double-digit organic revenue growth in the Core

In-service activity (45% of divisional revenue), still led

by a sustained high level of occasional surveys, especially on old

ships, combined with price increases and the growth of the

classified fleet. Slower growth rate in percentage terms remains

expected in Q4 after an exceptionally strong Q4 2022 linked to

one-off regulatory benefits. At September 30, 2023, the fleet

classified by Bureau Veritas comprised 11,635 ships, representing

147.2 million of Gross Register Tonnage (GRT).

-

High-single digit organic revenue growth for

Services (14% of divisional revenue, including

Offshore) was driven by a combination of strong commercial

development for non-classification services, including consulting

services related to energy efficiency.

Bureau Veritas new orders reached 6.8 million

gross tons at September 30, 2023, bringing the order book to

21.6 million gross tons at the end of the quarter, up 14.3%

compared to 18.9 million gross tons at end-September 2022. It is

composed of LNG fueled ships, container ships and specialized

vessels.

Marine & Offshore continued to focus on

efficiency levers through digitalization and high added-value

services. In September 2023, the Group has announced a strategic

partnership with OrbitMI, the New York-based maritime software

company, formalized through Bureau Veritas investment in OrbitMI.

Aimed at accelerating the development of both existing and new

data-driven solutions, the collaboration will leverage combined

strengths to address the dual opportunities of the digital

transformation and the decarbonization of shipping (more

information by clicking here).

Sustainability achievements

This quarter, Bureau Veritas issued its Approval

in Principle (AiP) to a shipbuilding group for the design of the

newest largest Liquified Natural Gas Carrier (LNGC) in history. In

order to do so, a preliminary design review and hazard

identification analysis was carried out to help ensure the highest

levels of safety, feasibility, and performance of this design in

compliance with applicable classification Rules and

Regulations.

AGRI-FOOD & COMMODITIES

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Q3 revenue |

305.5 |

323.9 |

(5.7)% |

+2.6% |

- |

(8.3)% |

|

9M revenue |

917.1 |

911.9 |

+0.6% |

+5.1% |

- |

(4.5)% |

The Agri-Food & Commodities business

delivered organic revenue growth of 2.6% in the third quarter of

2023, with different trends for each activity. This brought the

9-month organic revenue growth to 5.1%.

Oil & Petrochemicals

(O&P, 31% of divisional revenue) achieved low-single digit

organic revenue growth overall. While Europe has been gaining

ground with key customers in specific locations (Belgium, Spain,

Greece) and is recording high-single-digit organic revenue growth,

the O&P Trade activity has also been facing tougher competition

in North America and Asia.

Throughout the third quarter, non-trade related

services and value-added segments such as Verifuel bunker quantity

services continued to expand across O&P. Elsewhere, the Group

continues to benefit from sustained good demand for its new

initiatives around biofuels and OCM (Oil Condition Monitoring).

Metals & Minerals (M&M,

32% of divisional revenue) faced contrasting trends. Upstream

activity’s (nearly two-thirds of M&M) underlying trends are

solid, but the growth rate was mitigated by the strong Q3 2022. The

Group continued to benefit from the success of its on-site

laboratories’ strategy with important wins this quarter. In mining

related testing, the Middle East region is starting to benefit from

the recent efforts in capabilities expansion and diversification.

Trade activities recorded robust revenue growth, with strong trade

volumes in Asia.

Agri-Food (22% of divisional

revenue) activities achieved mid-single-digit organic growth in the

third quarter, once again led by Agricultural products.

Agricultural trade-related activities showed strong growth,

benefiting from the massive exports of key players from Brazilian

ports following the exceptionally good harvests for different food

commodities (corn, soybean, cotton). The good momentum on biodiesel

in Latin America is also supporting the growth. Within the Food

business, which grew low-single-digit organically, testing

activities in Australia continue to gradually benefit from

diversification. The North American and Middle East areas also

strongly benefited from the ramp-up of new labs.

Government services (15% of

divisional revenue) recorded high single-digit organic revenue

growth in the third quarter, with a sustained strong growth

delivered in Asia, Middle East and Africa. This was driven by the

solid ramp-up of the newly signed VOC (Verification of Conformity)

and Single Window contracts across the World.

Sustainability achievements

In the third quarter of 2023, the group provided

cargo inspection and sampling services on biofuels products made

from multi-seed crush and vegetable oils on behalf of an American

global food corporation in Belgium. The Group was also

awarded a Sustainability data assurance contract for one of the

world’s largest Food companies.

INDUSTRY

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Q3 revenue |

309.0 |

305.0 |

+1.3% |

+16.2% |

(1.4)% |

(13.5)% |

|

9M revenue |

927.3 |

867.4 |

+6.9% |

+15.8% |

(0.5)% |

(8.4)% |

Industry delivered strong organic revenue growth

in the third quarter of 2023 with organic growth of 16.2%, in line

with the previous quarters. This brought the 9-month organic

revenue growth to 15.8%.

All segments and most geographies contributed to

the divisional growth, with Americas, Middle East and Africa

outperforming. Energy transition remained a key catalyst overall

and triggered clean energy investment and decarbonation solutions

which benefited the division.

By market, Power &

Utilities (14% of divisional revenue) remained a growth

driver for the portfolio with a double-digit organic performance

for Capex activities during the third quarter. In Latin America,

the Group continues to benefit from its leading grid Opex platform

and contract wins with various Power Distribution clients, although

the growth is cushioned by the Group’s desire to be more selective

on contract profitability, as illustrated by a large contract

termination in Chile in the last quarter of 2022. In Europe, the

nuclear power generation segment was a growth enhancer, notably in

the UK, France and in Eastern countries (dismantling projects in

Lithuania).

Renewable Power Generation

activities (solar, wind, hydrogen) maintained strong momentum

during the quarter, with a high double-digit organic performance

delivered across most geographies. The US delivered a stellar

performance led by Bureau Veritas’ Bradley Construction Management

activities focusing on solar, onshore wind and high-voltage

transmission projects. In the third quarter, Bureau Veritas

launched its Renewable Ammonia scheme, which helps assure safe,

sustainable ammonia production from renewable energy. This followed

the launch of its Renewable Hydrogen scheme early 2023.

In Oil & Gas (33% of

divisional revenue), double-digit organic revenue growth was

maintained in the third quarter. The two-thirds of the business

related to Opex services increased 22.9% led by the conversion of a

solid sales pipeline. Capex-related activities grew double-digit

organically, benefiting from to the startup of new projects in the

gas sector (LNG). Large contracts ramped up in the US, Australia,

Middle East, Africa and Latin America, in Brazil in particular.

The non-energy activities

performed well driven by both Opex and Capex services. They

benefited from a range of drivers around ageing assets, tightening

regulations, and willingness to manage assets in a more sustainable

way from different industries (towards net zero targets). In

Canada, Site Assessment & Remediation continued to drive

business with new infrastructure projects and increased concerns

about PFAS.

Sustainability achievements

In the third quarter of 2023, Bureau Veritas was

awarded a major contract in South Korea with Anma Offshore Wind

Energy Co. (a consortium of Hyundai Engineering & KHNP), to

provide integrated QA/QC services during the fabrication,

manufacture, and installation of all major components of the 0.5 GW

offshore wind farm. In Saudi Arabia, the Group was also selected to

deliver owner's engineering services including design review,

procurement support and construction supervision for a 1.4 GW solar

photovoltaic farm.

BUILDINGS &

INFRASTRUCTURE

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Q3 revenue |

413.8 |

427.2 |

(3.1)% |

+0.1% |

+1.4% |

(4.6)% |

|

9M revenue |

1,282.6 |

1,205.0 |

+6.4% |

+7.0% |

+2.0% |

(2.6)% |

The Buildings & Infrastructure (B&I)

business achieved an organic growth of 0.1% in the third quarter of

2023 against very challenging comparables. This brought the 9-month

organic revenue growth to 7.0%.

During the period, the building-in service

activity outperformed the construction-related

activities.

The Americas region (28% of divisional revenue)

delivered varied performance by geography. In Latin America, a

strong growth was recorded thanks to the ramp-up of large Capex

contracts for project management assistance. In Northern America,

the activity was lower after strong numbers in Q3 2022 and efforts

to improve contract revenue mix with enhanced selectivity on some

contracts. In addition, persistent high interest rates continued to

create headwinds for the commercial real estate transactions

business. The rest of the Group’s diversified portfolio performed

well with data center commissioning leading growth, up double-digit

organically; code compliance was robust as the business benefits

from its exposure to the most attractive geographies in terms of

population growth.

In Europe (49% of divisional revenue), moderate

growth was delivered led by a double-digit performance in Italy,

the Netherlands and the UK thanks to more stringent regulation

benefiting both Opex and Capex activities around energy efficiency

and building safety. The broadly stable activity in France (37% of

divisional revenue) stemmed from an expected seasonality effect on

revenue in relation to energy efficiency for the Opex business

(three quarter of French operations). Beyond, growth momentum

remained steady with continued price increases, while the capex

related activities grew slightly, above the market, as it is more

weighted towards infrastructure and public works versus residential

building. In the fourth quarter, the growth is expected to

resume.

The Asia-Pacific and Middle East region (23% of

divisional revenue) was slightly down year on year on an organic

basis. While outstanding performances were delivered in India and

Southeastern Asia, the Chinese activity suffered from the

unfavorable comparable following the reopening of the Chinese

market in the prior year (post lockdown measures in Q2 2022) and

from lower spend for infrastructure projects in the transportation

field. The Power-related construction activities remained robust

and benefited from the energy transition drive.

The Middle East & Africa region was the

best-performing area, recording a double-digit organic revenue

increase in the third quarter. In the Middle East, the Group

continued to deliver very high growth primarily led by the roll-out

of numerous development projects. In Saudi Arabia, the Group is

still strongly engaged in delivering QA/QC Services for the NEOM

smart city project.

Sustainability achievementsIn

the third quarter of 2023, the Group was awarded several contracts

in the field of energy audits and sustainability requirements. This

ranges from implementing several energy audit campaigns according

to the EU Energy Efficiency Directives for large asset owners to

establishing a decarbonization pathway by performing energy

assessments and simulating carbon trajectory for real estate

owners. The Group was also selected to co-develop a sustainability

standard for Unibail Rodamco Westfield, as part of its Better

Places 2030 strategy, followed by audits and monitoring of the

label on their european portfolio.

CERTIFICATION

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Q3 revenue |

106.7 |

101.2 |

+5.4% |

+11.7% |

- |

(6.3)% |

|

9M revenue |

334.5 |

310.4 |

+7.7% |

+11.4% |

- |

(3.7)% |

The Certification business recorded strong

organic growth of 11.7% in the third quarter of 2023, a similar

growth trend to the last two quarters (9-month organic revenue

growth of 11.4%).

This was supported by both volume and price

increases. The acceleration of our portfolio diversification also

continued to drive growth with a quarter of the divisional revenue

contributing to nearly half of the growth.

The growth was broad-based across the schemes

and the geographies. Americas, Asia Pacific and the Middle East and

Africa region delivered the strongest organic revenue performances

thanks to commercial development and exposure to new services

including Sustainability and CSR-driven solutions.

During the period, the business continued to be

led by the increased client demand for more brand protection,

traceability, and social responsibility commitments all along the

supply chain. Double-digit growth was recorded for QHSE

schemes, Supply Chain and Food

Safety. Sustainability-driven solutions

grew 21% fueled by a continuing high demand for verification of

greenhouse gas emissions and supply chain audits on ESG

topics. In the near future, it will benefit from the upcoming

regulatory changes (CS3D -Corporate Sustainability Due Diligence-,

EU Deforestation Regulation, EU CSRD -Corporate Sustainability

Reporting Directive-) which will require more audit and

certification services than done voluntarily today.

The momentum remained strong on solutions

dedicated to companies around IT Service Management and information

security. In particular, the Cybersecurity

offering posted stellar performance similarly to H1 2023. This is

due to an extremely robust commercial development and by rising

demand for more control on security systems.

Sustainability achievements

In the third quarter of 2023, Bureau Veritas has

signed a partnership with Capgemini, a global leader in business

consulting, technology and engineering. Both companies will jointly

deliver a structured and scalable approach to help companies bring

transparency and credibility to their ESG commitments and put their

Sustainability strategy in motion. Through its proprietary ESG

solution, Clarity, Bureau Veritas will be able to assess a customer

organization and prioritize the global digitalization of their ESG

data, monitor the progress and review the data collection in

accordance with relevant standards.

During the period, Bureau Veritas won numerous

contracts in the Sustainability field. For instance, the Group was

selected by the government of Dubai (Legal Affairs department) to

train and audit law firms on their sustainability and quality

practices yearly. The Group was also awarded the Sustainability

Assurance services for the 2023 annual report of a large

pharmaceutical company.

CONSUMER PRODUCTS SERVICES

|

IN EUR MILLIONS |

2023 |

2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Q3 revenue |

178.8 |

195.1 |

(8.4)% |

0.0% |

+0.9% |

(9.3)% |

|

9M revenue |

527.9 |

546.6 |

(3.4)% |

(2.0)% |

+4.2% |

(5.6)% |

The Consumer Products Services division recorded

a stable performance in the third quarter of 2023, a slight

improvement compared to the first half of 2023, with varying

geographical and service trends.

During the period, Asia remained the region most

impacted by the weak consumer spending backdrop, while the Americas

(especially Latin America) and the Middle East & Africa

continue to benefit from the diversification strategy implemented

over the last years.

Softlines, Hardlines & Toys

(49% of divisional revenue) saw low-single-digit organic growth in

the third quarter of 2023. Softlines showed mixed performance by

country: China returned to growth, Southern Asia maintained a

strong momentum (led by Bangladesh and India) -still benefiting

from the structural sourcing shift outside of China- and growth was

moderated in South-Eastern Asia facing challenging comparables.

Health, Beauty & Household

(8% of divisional revenue) recorded solid double-digit organic

growth in Q3, led by the US and Asia. China notably benefited from

two recent labs openings. Advanced Testing Laboratory (ATL) and

Galbraith Laboratories Inc., which were both acquired last year in

the US, progressed well with a promising sales pipeline.

Inspection & Audit services

(13% of divisional revenue) maintained their growth thanks to

strong momentum for Sustainability services over the course of the

third quarter of 2023. This includes organic, recycling, social

audits and green claim verification across most geographies.

Lastly,

Technology8 (30% of divisional

revenue), as expected, saw a single-digit organic contraction,

still affected by the global decrease in demand for electrical and

wireless equipment as well as the resulting temporary reduction in

new product launches. The New Mobility sub-segment

delivered double-digit growth, led by both Asia and the US, thanks

to the ramp-up of a new lab in Detroit, Michigan. This reflected

good traction on testing of electric vehicle systems and component.

In the third quarter of 2023, the Group continued to pursue its

geographical diversification strategy by opening an electronic ATEX

(European Directives for controlling explosive atmospheres)

regulated lab in Brazil.

Sustainability achievements

In the third quarter of 2023, the Group won a

contract with one of the world's leading sportswear and footwear

brand to help them in their supply chain decarbonization efforts

through SBTI & greenhouse gas reduction programs. Bureau

Veritas also performed social audits for a major European food

delivery service company as part of its supply chain due diligence

program for products used in their daily business (helmets,

delivery bags).

-

PRESENTATION

- Q3 2023 revenue

will be presented on Wednesday, October 25, 2023, at 6:00 p.m.

(Paris time)

- An audio conference

will be webcast live. Please connect to: Link to audio

conference

- The presentation

slides will be available on: https://group.bureauveritas.com

- All supporting

documents will be available on the website

- Live dial-in

numbers:

- France: +33 (0)1 70 37 71 66

- UK: +44 (0)33 0551 0200

- US: +1 786 697 3501

- International: +44 (0)33 0551 0200

- Password: Bureau Veritas

-

FINANCIAL CALENDAR

- Full Year 2023

Results: February 22, 2024

- Capital Markets

Day: March 20, 2024

- Q1 2024 revenue:

April 25, 2024

- Half Year 2024

Results: July 26, 2024

- Q3 2024 revenue:

October 23, 2024

About Bureau Veritas Bureau

Veritas is a world leader in laboratory testing, inspection and

certification services. Created in 1828, the Group has circa 84,000

employees located in nearly 1,600 offices and laboratories around

the globe. Bureau Veritas helps its 400,000 clients improve their

performance by offering services and innovative solutions in order

to ensure that their assets, products, infrastructure and processes

meet standards and regulations in terms of quality, health and

safety, environmental protection and social responsibility.Bureau

Veritas is listed on Euronext Paris and belongs to the CAC 40 ESG,

CAC Next 20, SBF 120 and SBT 1.5 indices. Compartment A, ISIN code

FR 0006174348, stock symbol: BVI.For more information, visit

www.bureauveritas.com, and follow us on Twitter (@bureauveritas)

and LinkedIn.

|

|

Our information is certified with blockchain technology.Check that

this press release is genuine at www.wiztrust.com. |

|

|

| |

|

|

|

|

ANALYST/INVESTOR CONTACTS |

|

MEDIA CONTACTS |

|

|

|

Laurent Brunelle |

|

Florence de Nadaï |

|

|

|

+33 (0)1 55 24 76 09 |

|

florence.denadai.ext@bureauveritas.com |

|

|

|

laurent.brunelle@bureauveritas.com |

|

|

|

|

|

|

|

|

|

|

|

Colin Verbrugghe |

|

Primatice |

|

|

|

+33 (0)1 55 24 77 80 |

|

thomasdeclimens@primatice.com |

|

|

|

colin.verbrugghe@bureauveritas.com |

|

armandrigaudy@primatice.com |

|

|

|

Karine Ansart+33 (0)1 55 24 76

19karine.ansart@bureauveritas.com |

|

|

|

|

This press release (including the appendices)

contains forward-looking statements, which are based on current

plans and forecasts of Bureau Veritas’ management. Such

forward-looking statements are by their nature subject to a number

of important risk and uncertainty factors such as those described

in the Universal Registration Document (“Document d’enregistrement

universel”) filed by Bureau Veritas with the French Financial

Markets Authority (“AMF”) that could cause actual results to differ

from the plans, objectives and expectations expressed in such

forward-looking statements. These forward-looking statements speak

only as of the date on which they are made, and Bureau Veritas

undertakes no obligation to update or revise any of them, whether

as a result of new information, future events or otherwise,

according to applicable regulations.

-

APPENDIX 1: Q3 AND 9M 2023 REVENUE BY BUSINESS

|

IN EUR MILLIONS |

Q3/9M 2023 |

Q3/9M 2022(a) |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Marine & Offshore |

110.0 |

104.7 |

+5.1% |

+13.4% |

- |

(8.3)% |

|

Agri-Food & Commodities |

305.5 |

323.9 |

(5.7)% |

+2.6% |

- |

(8.3)% |

|

Industry |

309.0 |

305.0 |

+1.3% |

+16.2% |

(1.4)% |

(13.5)% |

|

Buildings & Infrastructure |

413.8 |

427.2 |

(3.1)% |

+0.1% |

+1.4% |

(4.6)% |

|

Certification |

106.7 |

101.2 |

+5.4% |

+11.7% |

- |

(6.3)% |

|

Consumer Products |

178.8 |

195.1 |

(8.4)% |

- |

+0.9% |

(9.3)% |

|

Total Q3 revenue |

1,423.8 |

1,457.1 |

(2.3)% |

+5.8% |

+0.3% |

(8.4)% |

|

Marine & Offshore |

338.6 |

309.2 |

+9.5% |

+14.8% |

- |

(5.3)% |

|

Agri-Food & Commodities |

917.1 |

911.9 |

+0.6% |

+5.1% |

- |

(4.5)% |

|

Industry |

927.3 |

867.4 |

+6.9% |

+15.8% |

(0.5)% |

(8.4)% |

|

Buildings & Infrastructure |

1,282.6 |

1,205.0 |

+6.4% |

+7.0% |

+2.0% |

(2.6)% |

|

Certification |

334.5 |

310.4 |

+7.7% |

+11.4% |

- |

(3.7)% |

|

Consumer Products |

527.9 |

546.6 |

(3.4)% |

(2.0)% |

+4.2% |

(5.6)% |

|

Total 9M revenue |

4,328.0 |

4,150.5 |

+4.3% |

+8.1% |

+1.0% |

(4.8)% |

(a) Q3 and 9M 2022 figures by business have been

restated following a c. €2.9 million reclassification of activities

previously reported in Industry to the Buildings &

Infrastructure business.

-

APPENDIX 2: DEFINITION OF ALTERNATIVE PERFORMANCE INDICATORS AND

RECONCILIATION WITH IFRS

The management process used by Bureau Veritas is

based on a series of alternative performance indicators, as

presented below. These indicators were defined for the purposes of

preparing the Group’s budgets and internal and external reporting.

Bureau Veritas considers that these indicators provide additional

useful information to financial statement users, enabling them to

better understand the Group’s performance, especially its operating

performance. Some of these indicators represent benchmarks in the

testing, inspection and certification (“TIC”) business and are

commonly used and tracked by the financial community. These

alternative performance indicators should be seen as a complement

to IFRS-compliant indicators and the resulting changes.

GROWTH

Total revenue growth

The total revenue growth percentage measures

changes in consolidated revenue between the previous year and the

current year. Total revenue growth has three components:

- organic

growth;

- impact of changes

in the scope of consolidation (scope effect);

- impact of changes

in exchange rates (currency effect).

Organic growth

The Group internally monitors and publishes

“organic” revenue growth, which it considers to be more

representative of the Group’s operating performance in each of its

business sectors.

The main measure used to manage and track

consolidated revenue growth is like-for-like, or organic growth.

Determining organic growth enables the Group to monitor trends in

its business excluding the impact of currency fluctuations, which

are outside of Bureau Veritas’ control, as well as scope effects,

which concern new businesses or businesses that no longer form part

of the business portfolio. Organic growth is used to monitor the

Group’s performance internally.

Bureau Veritas considers that organic growth

provides management and investors with a more comprehensive

understanding of its underlying operating performance and current

business trends, excluding the impact of acquisitions, divestments

(outright divestments as well as the unplanned suspension of

operations – in the event of international sanctions, for example)

and changes in exchange rates for businesses exposed to foreign

exchange volatility, which can mask underlying trends.

The Group also considers that separately

presenting organic revenue generated by its businesses provides

management and investors with useful information on trends in its

industrial businesses, and enables a more direct comparison with

other companies in its industry.

Organic revenue growth represents the percentage

of revenue growth, presented at Group level and for each business,

based on constant scope of consolidation and exchange rates over

comparable periods:

- constant scope of

consolidation: data are restated for the impact of changes in the

scope of consolidation over a 12-month period;

- constant exchange

rates: data for the current year are restated using exchange rates

for the previous year.

Scope effect

To establish a meaningful comparison between

reporting periods, the impact of changes in the scope of

consolidation is determined:

- for acquisitions

carried out in the current year: by deducting from revenue for the

current year revenue generated by the acquired businesses in the

current year;

- for acquisitions

carried out in the previous year: by deducting from revenue for the

current year revenue generated by the acquired businesses in the

months in the previous year in which they were not

consolidated;

- for disposals and

divestments carried out in the current year: by deducting from

revenue for the previous year revenue generated by the disposed and

divested businesses in the previous year in the months of the

current year in which they were not part of the Group;

- for disposals and

divestments carried out in the previous year: by deducting from

revenue for the previous year revenue generated by the disposed and

divested businesses in the previous year prior to their

disposal/divestment.

Currency effect

The currency effect is calculated by translating

revenue for the current year at the exchange rates for the previous

year.

1 Alternative performance indicators are

presented, defined and reconciled with IFRS in appendices 6 and 8

of this press release.

2 Net cash generated from operating

activities/Adjusted Operating Profit.

3 Net cash generated from operating

activities/Adjusted Operating Profit.

4 TAR: Total Accident Rate (number of accidents

with and without lost time x 200,000/number of hours worked).

5 Proportion of women on the Executive Committee

in Band II (internal grade corresponding to an executive management

position) in the Group (number of women on a full-time equivalent

basis in a leadership position/total number of full-time

equivalents in leadership positions).

6 Indicator calculated over a 9-month period

compared to a 12-month period for FY 2022 and 2025 target

values.

7

Greenhouse gas

emissions from offices and laboratories, 12 months trailing tons of

CO2 equivalent per employee and per year for Scopes 1, 2 and 3

(emissions related to business travel).

8 The Technology segment comprises Electrical

& Electronics, Wireless testing activities and Automotive

connectivity testing activities.

- BUREAU VERITAS - 2023 10 25_Press release Q3 2023_vDEF

Bureau Veritas (EU:BVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

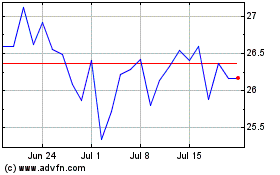

Bureau Veritas (EU:BVI)

Historical Stock Chart

From Apr 2023 to Apr 2024