Airbus to Expand Production in China, Putting Further Pressure on Boeing -- Update

November 06 2019 - 9:25AM

Dow Jones News

By Benjamin Katz and Doug Cameron

Airbus SE plans to boost jetliner production in China,

bolstering its position in what is set to be the world's biggest

aviation market and piling further pressure on Boeing Co. as the

U.S. company contends with trade tensions and the grounding of its

737 MAX plane.

The France-based plane maker is gaining market share while

Boeing grapples with the global grounding of the MAX after two

fatal crashes and a dearth of orders for larger aircraft. The U.S.

aerospace giant's efforts in China are also being hindered by the

continuing trade dispute between the two countries.

Airbus said Wednesday that it would expand its A330 wide-body

completion center in Tianjin to be able to handle its bigger A350

model. The company is also lifting local production of its A320neo,

its 737 MAX competitor.

The agreement with the Chinese government was outlined during a

visit by French President Emmanuel Macron to his Chinese

counterpart, Xi Jinping, in Beijing.

The move comes weeks after Boeing was forced to cut back

production rates for its 787 Dreamliner, citing U.S. trade tensions

with China and a lack of demand from Chinese carriers. Boeing's

last China order was in November 2017.

Airbus has meanwhile been leveraging the fallout by boosting its

production in China and winning orders for its own models. Its last

order from China was as recent as March.

The plane maker's A320 plant, also in Tianjin, will reach a

monthly production rate of six by the end of this year, quicker

than earlier plans to hit that target in 2020. That is part of the

company's goal to reach a global monthly run rate of 63 planes a

month by the end of 2020, it said Wednesday. The new A350 facility

will be able to complete and deliver the wide-body jets from

Tianjin in the second half of 2020, with a first delivery by

2021.

"We attach great importance to our long-term strategic

partnership with China and its aviation industry," Chief Executive

Guillaume Faury said. "Airbus is committed to serving this growth

sector."

Boeing forecast in September that China will need more than

8,000 new aircraft valued at close to $1.3 trillion over the next

20 years to meet the travel demands of the rapidly growing Chinese

middle class.

Airbus faces a challenge itself to keep up with its plans to

ramp up production. Last month, it cut its key delivery goal for

the year because of production delays with a new variant of the

A320 family. Despite the setback, the company remains poised to

overtake Boeing as the world's biggest plane maker with deliveries

now expected to reach a reduced target of 860 commercial aircraft

this year, a company record.

Airbus and Boeing have for years been ramping up production as

they seek to meet surging demand for more fuel-efficient,

narrow-body jets. Boeing has been hit hard by the grounding of its

best-selling narrow-body since the second fatal MAX crash in March,

which has thrown the manufacturer into crisis and halted all hand

overs of that aircraft until it receives sign off from safety

agencies.

Ben Otto contributed to this article.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

November 06, 2019 09:10 ET (14:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

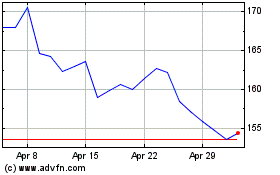

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024