Solana: Jupiter (JUP) Price Tumbles Amid Controversy – Buy Now?

February 01 2024 - 11:30AM

NEWSBTC

On Wednesday (January 31), the highly anticipated Jupiter (JUP)

airdrop took place. Jupiter, a decentralized exchange aggregator

built on the Solana blockchain, has been making waves in the crypto

space lately, even surpassing Uniswap in terms of trading volume.

However, the airdrop, while initially boosting JUP’s value, has

been followed by controversy. Jupiter (JUP) Airdrop Stats Tom Wan,

a researcher at 21.co, the parent company of 21Shares, commented on

the magnitude of the airdrop, stating, “It was one of the largest

airdrops on Solana ever, with over 440,000 addresses claiming 622

million JUP tokens, valued at approximately $3.6 billion.

Remarkably, 54% of eligible wallets have yet to claim their JUP,

leaving approximately 378 million JUP unclaimed.” 1/ One of the

largest Airdrop on @solana is live Over 440k Addresses claimed 622M

($3.6B) JUP token from @JupiterExchange. 54% of the eligible

wallets haven't claimed JUP yet, and there are ~378M unclaimed JUP

pic.twitter.com/7my3PLTo5I — Tom Wan (@tomwanhh) February 1, 2024

Wan went on to provide insights into the distribution of JUP

tokens, revealing that a majority of claimants received less than

1,000 JUP. He stated, “59% of claimants, or 261,000 wallets,

received only 200 JUP, while approximately 1,500 wallets received

between 100,000 and 200,000 JUP. Notably, those who received higher

airdrop amounts appear to be holding onto their JUP tokens, with

72% of recipients of less than 1000 JUP having already sold their

tokens.” Related Reading: Why Solana Beats Ethereum In This Bull

Cycle: Crypto Expert Regarding the Solana network itself, it

continued to perform exceptionally well during the airdrop event.

Solana handled 13% more transactions than in the past 90 days,

maintaining a block time of approximately 400 milliseconds. The

network also experienced a surge in active addresses, reaching a

one-year high on the day of the JUP airdrop. However, Solana

handled this increased activity perfectly. Despite the average

transaction fee doubling compared to the previous day, it remains

relatively low at around $0.017 per transaction. Additionally, the

minimum priority fee on the Solana network remained at 0,

indicating that the network still accommodated users’ transactions

without significant fees. JUP Price Quadruples, Then Plunges On

Controversy Initially, the JUP token’s price surged to over $2 on

some exchanges, such as KuCoin, quadrupling its value. However,

this enthusiasm was short-lived due to controversial actions taken

by the Jupiter team. It allegedly conducted a large-scale public

token sale, sparking outrage, fear, uncertainty, and doubt (FUD)

within the crypto community. Related Reading: Solana (SOL) Bulls

Imminent: Analyst Predicts Price Surge To $113 Among others, crypto

analyst Lord Ashdrake expressed his concerns, stating, “We

literally bought into an OpenMarket sale for JUP, akin to an IPO on

the stock market.” Similarly, Adam Cochran, a partner at CEHV,

criticized the team’s actions, highlighting that they retained a

significant portion of tokens without a lockup period. So [Jupiter]

gave 50% of token to themselves, it was not their first token, used

their own platform which also paid self, pulled liquidity from the

pool in cash, gave a cut to the dev team. So cash out $30m day one

with no lockup, and still own 50%? Shitty antics throwing away

reputation of what could have been a *very* successful business

long term. In response to the criticism, Jupiter co-founder Meow

defended the team’s decisions, clarifying that they only sold 250

million JUP tokens and reduced the sales ratio from 20% to 2.5%.

Meow emphasized the team’s willingness to experiment with new

concepts and prioritize the community’s interests. Meow stated, “We

are doing so to figure out a good open market dynamic that

prioritizes users, does not wreck early launch pool buyers, and

does not demoralize community hodlers. We think this system is a

good one because it compels the team to price it reasonably and

strengthens alignment between early buyers, the team, and community

hodlers.” Hi all, i got advice in discord to be even more clear so

let me say it simply: If i did an OTC deal or a regular IDO, we

would have gotten a similar amount if not more without any of the

confusion that comes with pioneering new concepts and absolutely

zero risk. Trust me, that… — meow 🥧 (@weremeow) February 1, 2024

Buy Or Sell Jupiter (JUP) Now? Despite the controversy, Jupiter

presented impressive statistics for January, including being the

most-used trading platform in DeFi, having a direct 80% organic

volume, and being the most-used protocol on the Solana network. The

project also ranked among the top 2 by volume on CoinGecko and was

one of the leading perpetual platforms with $1.4 billion in volume

over the past week. So, while the Jupiter (JUP) airdrop may have

faced initial controversy, the project is still showcasing

remarkable potential. As it positions itself as a direct competitor

to Ethereum’s Uniswap, the history of Uniswap’s UNI token price may

suggest JUP’s promising future, provided it navigates its early

tokenomics challenges effectively. At press time, JUP traded at

$0.6118 on Binance. Featured image from Kraken Blog, chart from

TradingView.com

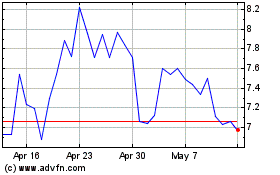

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024