Pre-Halving Jitters: Bitcoin Price Briefly Slips Below $60,000

April 17 2024 - 10:30PM

NEWSBTC

The Bitcoin price has recently experienced heightened volatility,

causing the largest cryptocurrency in the market to briefly drop

below the significant threshold of $60,000 for the first time since

March 5. This price decrease comes just days before the

highly anticipated Halving event scheduled for Friday. This event

has traditionally been viewed as a positive catalyst for Bitcoin’s

value due to its impact on token supply. However, market

participants are questioning whether the Halving’s effects are

already factored into the current market conditions, leading to

extended bearish sentiment. Long-Term Bullish Outlook Prevails

Bitcoin’s decline saw it plummet by 5% to $59,890, though it

recovered some losses shortly afterward. Since reaching an all-time

high (ATH) of $73,700 on March 14, the Bitcoin price has now

retraced by approximately 18%. The downward trend extended to

other major cryptocurrencies, including Ethereum (ETH), Solana

(SOL), and Dogecoin (DOGE), which also experienced slumps on

Wednesday. The impending Halving, a quadrennial code update in

Bitcoin, has raised concerns among investors as to whether it will

be a significant market-moving event or a non-event overshadowed by

other factors, such as the ongoing discussions surrounding the

Bitcoin ETF market, which has seen a significant decrease in terms

of outflows. Related Reading: Crypto Exchanges Bitcoin

Supply Can Only Last For 9 Months, ByBit Report Nathanaël Cohen,

co-founder of INDIGO Fund, noted that market participants are

de-risking due to this uncertainty and the additional macro factor

of tensions in the Middle East involving Israel and Iran, putting

further pressure on risk assets. The recent decline in Bitcoin’s

price was further exacerbated by a wave of liquidations in long

positions for digital assets. Last Friday alone, approximately $780

million worth of bullish crypto wagers were liquidated within 24

hours. Despite the recent market turbulence, some

participants maintain a bullish long-term outlook for Bitcoin. Some

see the recent liquidations and subsequent flushing out of leverage

in the crypto market as a positive development. Ravi Doshi,

head of markets at FalconX, reported increased buying of

longer-dated call options on their derivatives desk, suggesting

that clients anticipate higher prices in the latter half of the

year. Bitcoin Price Rebounds Above $61,000 Following the brief dip

below the $60,000 mark, the Bitcoin price has rebounded, currently

trading at $61,600. This recovery is viewed as a bullish sign, with

the cryptocurrency’s macro uptrend structure remaining intact as

long as price levels of $51,000 and $42,000 are maintained.

The market is closely watching whether the theory suggesting that

the Halving price catalyst is already factored into the current

market conditions holds. Additionally, the performance of Bitcoin

ETFs in the United States and their potential impact on driving the

cryptocurrency’s price back to previous highs are of significant

interest. Related Reading: 69% Of PEPE Holders Left In Profits

After 26% Plunge Furthermore, the recent approval of the spot

Bitcoin ETF market in Hong Kong is expected to contribute to

increased adoption of the leading cryptocurrency. Although some

experts do not consider it as significant as the US ETF market, it

is anticipated to generate a surge in price and further strengthen

Bitcoin’s position. Ultimately, the outcome of the Halving event,

combined with the developments in both the US and Hong Kong ETF

markets, remains uncertain. The ability of Bitcoin to regain its

bullish momentum and drive increased demand will be closely

monitored. Featured image from Shutterstock, chart from

TradingView.com

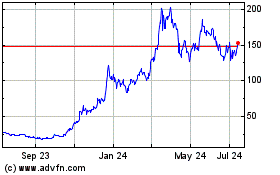

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024