PEPE Slips Into Correction: Here Are Key Levels To Watch For A Rebound

November 08 2024 - 7:30PM

NEWSBTC

After a strong upward momentum, PEPE is showing signs of fatigue,

slipping into a correctional phase, with traders speculating on

what might come next. As the token retraces from recent highs,

attention now turns to pivotal support levels that could dictate

its recovery potential. Will these key levels hold the line and

fuel a bounce-back, or is PEPE in for a longer dip? This article

will provide an in-depth look at PEPE’s current price movement

within its correctional phase. By highlighting significant support

and resistance levels, this piece seeks to equip investors and

traders with valuable insights into possible rebound zones and the

factors that could influence its recovery or further declines.

Understanding PEPE’s Correction: What Triggered The Pullback? PEPE

has recently taken a bearish shift on the 4-hour chart,

encountering strong resistance at $0.00001152. This struggle to

sustain the uptrend has triggered a decline, pushing the asset

toward the 100-day Simple Moving Average (SMA). A drop below this

SMA could amplify selling pressure, while a rebound might signal a

potential price reversal. An analysis of the 4-hour Relative

Strength Index (RSI) suggests that bullish strength may be waning.

Currently, the RSI has fallen to around 68% from the overbought

zone, indicating that the buying pressure is diminishing. If the

RSI continues to drop, it may indicate that the market is becoming

more oversold, possibly paving the way for a deeper correction.

Related Reading: Analyst Says PEPE Bearish Continuation Is Possible

For A 50% Price Crash On the daily chart, PEPE is exhibiting

significant negative movement, as reflected by a bearish

candlestick. This ongoing downward trend highlights a prevailing

selling pressure within the market. Although the meme coin is

currently trading above the 100-day SMA, which is typically seen as

a bullish indicator, the strength of the bearish candlestick

suggests that upward momentum may be limited. Finally, on the 1-day

chart, the RSI signal line is approaching the critical 50% level

after rising above it. The 50% mark represents a neutral zone,

suggesting a balance between buying and selling pressure. A dip

below 50% could signal a shift towards bearish sentiment, while

holding above or climbing back above 50% may imply continued

bullish strength, possibly leading to more price gains. Where PEPE

Could Find Stability Key support levels are crucial price points

where PEPE could find stability and reverse its current downtrend.

One of the primary support levels to watch is the $0.000000766,

which has historically acted as a crucial level of support. If

PEPE’s price approaches this level, it could trigger renewed buying

interest, potentially leading to a rebound. Related Reading: PEPE

Midterm Price Prediction: Is A 326% Rally To $0.00003474 Possible

From Here? However, should the meme coin break this level, it could

lead to a prolonged decline, possibly pushing the price toward

$0.00000589 and beyond. Featured image from Shutterstock, chart

from Tradingview.com

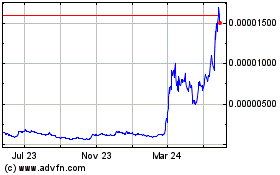

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

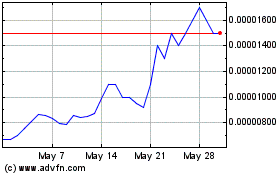

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025