MicroStrategy Raises Stakes, Acquires $1.5 Billion In Bitcoin Amid Positive Market Outlook

December 16 2024 - 8:00PM

NEWSBTC

MicroStrategy, the business intelligence firm led by Michael

Saylor, has ramped up its Bitcoin (BTC) acquisition strategy for

the sixth consecutive week. This latest purchase comes as BTC has

surged to new all-time highs, with the leading cryptocurrency

recently surpassing the $106,00 mark on Monday. MicroStrategy’s

Bitcoin Stash Grows To 439,000 BTC On Monday, Michael Saylor

announced that MicroStrategy acquired an additional 15,350 BTC for

approximately $1.5 billion, averaging around $100,386 per

Bitcoin. This acquisition contributes to the firm’s

substantial Bitcoin portfolio, which now totals 439,000 BTC,

purchased for about $27.1 billion at an average price of $61,725

per Bitcoin. Related Reading: Solana (SOL) Faces Headwinds:

Can Bulls Revive Momentum? Interestingly, Saylor also disclosed in

a social media post on X (formerly Twitter) that the firm’s Bitcoin

holdings have yielded notable returns, boasting a 46.4% gain

quarter-to-date (QTD) and 72.4% gain year-to-date (YTD). This

bullish momentum in the market follows increased optimism since

November 5, when President-elect Donald Trump secured a new term in

the White House with key promises made throughout the year to the

industry. Investors are now confident that Trump’s new

administration would make regulatory changes that could create a

more favorable climate for digital assets. The US crypto market has

encountered considerable difficulties in recent years, particularly

from the US Securities and Exchange Commission (SEC).

Microstrategy’s MSTR Rises 3% On Nasdaq 100 News The recent uptick

in Bitcoin’s price is further evidenced by a significant trading

volume increase, with CoinGecko reporting a $92 million surge in

the past 24 hours—a 54% increase compared to the previous

day. However, MicroStrategy’s aggressive Bitcoin investment

strategy has not only influenced the cryptocurrency market but has

also positively affected its stock (MSTR) price. Following

the announcement that MicroStrategy would be listed on the Nasdaq

100 index last week, shares of the company rose over 3% in

premarket trading. Related Reading: Ex-Hedge Fund Guru Bets

Big On Dogecoin As ‘Core Crypto Bet’ The inclusion in the Nasdaq

100—a benchmark for technology stocks—takes effect on December 23

and is expected to attract significant investment flows,

potentially leading to $2.1 billion in stock purchases from over

200 exchange-traded products that track the index. Bernstein

analyst Gautam Chhugani remarked on Monday that MicroStrategy’s

strategy to Bitcoin purchase is “unprecedented,” establishing the

company as the largest corporate Bitcoin owner, with around 2% of

the total supply. Chhugani commented: MSTR’s Bitcoin buying program

is unprecedented on the street, and inclusion in Nasdaq 100 further

improves MSTR’s market liquidity, expanding its capital flywheel

and Bitcoin buying program. At the time of writing, BTC has managed

to consolidate at $103,900 for the past few hours after surging to

new all-time highs. The market’s leading crypto recorded gains of

2% and nearly 6% in the 24-hour and weekly time frames,

respectively. Featured image from DALL-E, chart from

TradingView.com

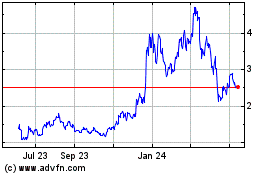

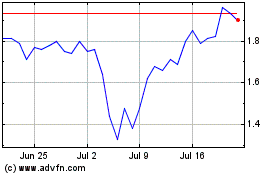

Optimism (COIN:OPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024