Bitcoin Volatility Induces $700 Million Carnage In Crypto Futures

February 29 2024 - 7:00PM

NEWSBTC

Data shows the cryptocurrency futures market has seen liquidations

amounting to $700 million in the past day as Bitcoin has gone

through its volatility. Bitcoin Has Seen Intense Price Action In

Past 24 Hours The past day has been a bit of a rollercoaster for

Bitcoin, with the asset registering sharp price action in both

directions but ultimately going up as the bulls win out. Related

Reading: Bitcoin MVRV Hits Levels That Led To Parabolic Bull Run In

2020 The chart below shows what the price action for the

cryptocurrency has looked like recently. The price of the asset

seems to have enjoyed sharp bullish momentum recently | Source:

BTCUSD on TradingView From the graph, it’s visible that Bitcoin

initially witnessed some sharp bullish momentum, in which the coin

not only broke above the $60,000 level, but went up to touch the

$64,000 mark. This high, which is the peak for the year so far,

only lasted briefly, however, as BTC crashed down spectacularly to

under the $59,000 mark. The asset has since recovered to higher

levels, now floating around $62,700. The rest of the cryptocurrency

sector has also gone through its volatility, with prices

fluctuating across the coins. As is usually the case with such

sharp price action, the futures market has suffered many

liquidations. Crypto Futures Market Has Gone Through A Squeeze In

The Past Day According to data from CoinGlass, the cryptocurrency

futures market has witnessed the liquidation of contracts worth

more than $700 million in the last 24 hours. The table below

displays the relevant information about the liquidations. A massive

amount of liquidations appear to have occurred in the past day |

Source: CoinGlass It would appear that only $131 million of the

liquidations came within twelve hours, suggesting that most of the

flush was situated inside the preceding half-day period. This makes

sense, as Bitcoin was most volatile inside this window. It also

seems that the long-to-short ratio in this liquidation event has

been quite balanced, even though the price has increased in the

past day. This would suggest that some aggressive longing occurred

as Bitcoin approached $64,000, and the subsequent pullback wiped

these top buyers. The table below shows how the distribution has

looked for the various symbols. Looks like BTC has topped the

charts once more | Source: CoinGlass As is generally the case,

Bitcoin futures contracts have again been responsible for the

largest portion of the total market liquidations, contributing

around $270 million. Related Reading: TRON Hits 95 Million

Addresses Milestone, Will This Help Price? What’s different this

time, however, is that this share, although the largest, isn’t even

half the total liquidations. This could come down to the fact that

speculators may now be playing around with altcoin positions after

gaining confidence from the BTC price surge. Dogecoin, the best

performer among the top coins with its 34% jump, has occupied the

largest share among the alts, with almost $51 million in

liquidations. Featured image from André François McKenzie on

Unsplash.com, CoinGlass.com, chart from TradingView.com

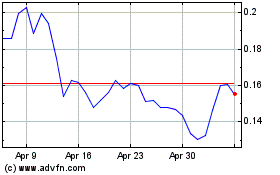

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024