ITM Power to Raise a Minimum of GBP150.0 Million

October 22 2020 - 1:45PM

Dow Jones News

By Anthony O. Goriainoff

ITM Power PLC said Thursday that it intends to raise a minimum

of 150.0 million pounds ($196.0 million) via a strategic

investment, a conditional placing, and nonunderwritten open

offer.

The London-listed hydrogen energy solutions manufacturer said

the strategic investment will be of GBP30.0 million at 235 pence

per share from energy infrastructure operator Snam SpA. The

conditional placing will consist of GBP120.0 million with certain

existing and new institutional investors, while the nonunderwritten

open offer will be for up to GBP7.0 million, and both of these at

the placing price.

"The net proceeds of the fundraising will be used by the group

principally to enable an acceleration of the group's technology,

manufacturing and operational capabilities in response to the

rapidly growing global demand for large-scale electrolysis," the

company said.

It said the firm placing was being conducted through an

accelerated bookbuild.

The company added that is has also entered into a commercial

partnership agreement with Snam, conditional upon the successful

completion of the share subscription. Under the agreement the

company will the preferred supplier for the first 100 megawatts of

polymer electrolyte membrane electrolysis projects ordered by

Snam.

"Our agreement and preferred supplier status with Snam more than

doubles our contract backlog, a signpost of future revenue

measuring amounts under contract and in the latter stages of

negotiations, to GBP118 million while our tender opportunity

pipeline, where we have provided written quotations over the last

12 months, now stands at some GBP325 million," Chief Executive

Graham Cooley said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

October 22, 2020 13:30 ET (17:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

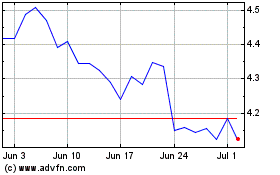

Snam (BIT:SRG)

Historical Stock Chart

From Dec 2024 to Jan 2025

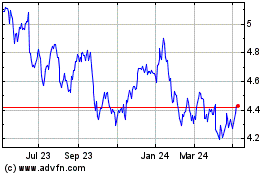

Snam (BIT:SRG)

Historical Stock Chart

From Jan 2024 to Jan 2025