Tetra Tech to Acquire Coffey International Limited

October 14 2015 - 3:00AM

Business Wire

- Establishes a global leader in

international development

- Combined company well positioned for

Australian infrastructure market growth

- Coffey Board unanimously recommends

Tetra Tech's bid of A$0.425 per share

Tetra Tech, Inc. (NASDAQ: TTEK) and Coffey International Limited

(ASX: COF) are pleased to announce the execution of a Bid

Implementation Agreement (BIA) under which Tetra Tech will make an

off-market takeover offer to acquire 100% of the outstanding shares

of Coffey for A$0.425 cash per share.

Founded in 1959 as Australia’s first geotechnical engineering

firm, Coffey employs 3,300 staff globally, delivering smart

solutions and providing innovation and insight across three core

service areas including international development, geoservices, and

project management. For the most recent fiscal year ended June 30,

2015, Coffey reported revenue of A$556 million (US$407

million).

The acquisition of Coffey expands Tetra Tech’s geographic

presence and positions Tetra Tech as the leading global consulting

firm for international development, supporting the U.S. Agency for

International Development, Australia’s Department for Foreign

Affairs and Trade, and the United Kingdom’s Department for

International Development.

“Coffey provides a platform for growth of our international

development business with multinational aid agencies,” said Dan

Batrack, Tetra Tech’s Chairman and CEO. “In addition to Coffey’s

expertise in geoservices and project management, the combined

company will also provide water and environmental services to

support Australia’s infrastructure expansion. Together, we will be

able to provide an expanded scope of services to our customers and

offer our combined staff even greater professional

opportunities.”

“Tetra Tech is an ideal partner for us,” said John Douglas,

Managing Director of Coffey. “This gives our people the chance to

be part of a larger team of technical experts and deliver an

expanded global offering to our clients. At the same time, it

offers Coffey shareholders the opportunity to realize immediate

value.”

Bid Implementation Agreement

(BIA)

The off-market takeover offer is governed by a Bid

Implementation Agreement (BIA). The BIA is conditional on the

satisfactory completion of customary conditions, including the

following:

- that Tetra Tech acquires relevant

interest in at least 90% of Coffey’s share capital during or at the

end of the offer period;

- receipt of all necessary regulatory

approvals;

- no material adverse change; and

- no prescribed occurrence in respect of

Coffey.

Coffey’s Board of Directors unanimously recommended that

shareholders tender their shares and indicated that they intend to

accept Tetra Tech’s offer in respect to any shares they own or

control.

Financial and Legal

Advisors

Tetra Tech’s financial advisor is ANZ Corporate Advisory and its

legal advisor is Thomson Geer. Coffey’s financial advisor is

Gresham Advisory Partners Limited and its legal advisor is Norton

Rose Fulbright.

About Coffey (www.coffey.com)

Coffey is a multi-disciplined consulting firm that provides

innovative solutions for international development, geoservices,

and project management. Coffey currently has 3,300 employees who

work collaboratively throughout its Australian and overseas

operations.

About Tetra Tech (www.tetratech.com)

Tetra Tech is a leading provider of consulting and engineering

services. The Company supports commercial and government clients

focused on water, environment, infrastructure, resource management,

and energy. With 13,000 staff worldwide, Tetra Tech provides clear

solutions to complex problems. For more information on Tetra Tech,

please visit www.tetratech.com, follow us on Twitter (@TetraTech),

or like us on Facebook.

Forward-Looking Statements

This news release contains forward-looking statements that are

subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

include information concerning future events and the future

financial performance of Tetra Tech that involve risks and

uncertainties. Readers are cautioned that these forward-looking

statements are only predictions and may differ materially from

actual future events or results. Readers are urged to read the

documents filed by Tetra Tech with the SEC, specifically the most

recent reports on Form 10-K, 10-Q, and 8-K, each as it may be

amended from time to time, which identify risk factors that could

cause actual results to differ materially from the forward-looking

statements. Among the important factors or risks that could cause

actual results or events to differ materially from those in the

forward-looking statements in this release are: worldwide political

and economic uncertainties; fluctuations in annual revenue,

expenses, and operating results; the cyclicality in demand for our

overall services; the cyclicality in demand for mining services;

the cyclicality in demand for oil and gas services; concentration

of revenues from U.S. government agencies and potential funding

disruptions by these agencies; violations of U.S. government

contractor regulations; dependence on winning or renewing U.S.

government contracts; the delay or unavailability of public funding

on U.S. government contracts; the U.S. government’s right to

modify, delay, curtail or terminate contracts at its convenience;

credit risks associated with certain commercial clients; risks

associated with international operations; the failure to comply

with worldwide anti-bribery laws; the failure to comply with

domestic and international export laws; the failure to properly

manage projects; the loss of key personnel or the inability to

attract and retain qualified personnel; the use of estimates and

assumptions in the preparation of financial statements; the ability

to maintain adequate workforce utilization; the use of the

percentage-of-completion method of accounting; the inability to

accurately estimate and control contract costs; the failure to

adequately recover on our claims for additional contract costs; the

failure to win or renew contracts with private and public sector

clients; acquisition strategy and integration risks; goodwill or

other intangible asset impairment; growth strategy management;

backlog cancellation and adjustments; the failure of partners to

perform on joint projects; the failure of subcontractors to satisfy

their obligations; requirements to pay liquidated damages based on

contract performance; changes in resource management,

environmental, or infrastructure industry laws, regulations, or

programs; changes in capital markets and the access to capital;

credit agreement covenants; industry competition; liability related

to legal proceedings, investigations, and disputes; the

availability of third-party insurance coverage; the ability to

obtain adequate bonding; employee, agent, or partner misconduct;

employee risks related to international travel; safety programs;

conflict of interest issues; liabilities relating to reports and

opinions; liabilities relating to environmental laws and

regulations; force majeure events; protection of intellectual

property rights; the interruption of systems and information

technology; the ability to impede a business combination based on

Delaware law and charter documents; and stock price volatility. Any

projections in this release are based on limited information

currently available to Tetra Tech, which is subject to change.

Although any such projections and the factors influencing them will

likely change, Tetra Tech will not necessarily update the

information, since Tetra Tech will only provide guidance at certain

points during the year. Readers should not place undue reliance on

forward-looking statements since such information speaks only as of

the date of this release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151014005588/en/

Tetra Tech, Inc.Jim Wu, Investor RelationsCharlie MacPherson,

Media & Public Relations(626) 470-2844

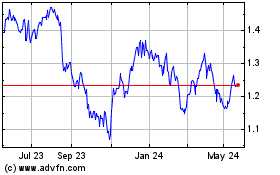

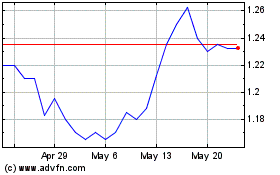

Centuria Office REIT (ASX:COF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Centuria Office REIT (ASX:COF)

Historical Stock Chart

From Feb 2024 to Feb 2025