Vector Capital to Acquire Bigtincan Holdings

December 05 2024 - 8:30AM

Business Wire

Vector Capital Management, L.P. (“Vector”), a leading private

equity firm specializing in transformational investments in

established technology businesses, today announced that it has

entered into a scheme implementation deed under which it will

acquire Bigtincan Holdings Limited (ASX: BTH) (“Bigtincan” or the

“Company”), a premier provider of sales enablement software and AI

solutions to global enterprises, including 100 of the Fortune

500.

Under the terms of the transaction, Vector is paying A$0.22 per

share in cash, for an approximate transaction value of A$183

million. Bigtincan’s management team, including Chief Executive

Officer and co-founder David Keane, are expected to remain in their

current roles leading the strategic direction of the Company and

delivering market-leading technologies to their customers.

Rob Amen, a Managing Director and 25-year veteran of Vector

Capital, said: “Bigtincan is loved by sales and marketing

organizations for its differentiated content and learning

capabilities. But what really excited Vector about this investment,

is the technology and growth trajectory of Genie AI™, the Company’s

generative AI-driven content creation and emulation-based training

platform. Vector is thrilled to partner with David and the

Bigtincan team to re-ignite revenue growth through product

innovation and a relentless focus on customer success.”

Founded in 2010 and headquartered in Waltham, MA, Bigtincan has

served thousands of sales and marketing organizations of the

world’s leading brands, including Nike, AT&T, Prudential,

Merck, Starwood Hotels, Winnebago, Red Bull, and Clorox, among

others. The Company’s product portfolio helps clients manage sales

collateral and training to enhance salesforce effectiveness, the

benefits of which are amplified by its recently released Genie AI™

offerings, which automate content creation and emulate real-world

sales training interactions to reduce sales cycles and improve

conversion rates.

David Keane, CEO and co-founder of Bigtincan, said: “This

transaction is an exciting step forward for Bigtincan and will

enable us to build on the strong momentum already underway.

Importantly, Vector and Bigtincan are aligned on what matters most

– our commitment to delivering the best products and service to our

current and future customers. Vector has a 28-year track record of

helping technology companies scale and strengthen their operational

capabilities. Moreover, we were impressed with how the Vector team

invested the time to really understand our business and put forward

a plan that will help us accelerate innovation and deliver for our

stakeholders over the long term.”

Tom Smith, a Principal at Vector Capital, added: “Vector has a

long and rich history of completing software take-private

transactions, including some of the earliest in the private equity

industry. Operating as a private company will free Bigtincan from

unnecessary distractions, and by partnering with Vector, it will

have the trusted financial partner the Company has long

deserved.”

Regal Funds Management and SQN Investors, who in aggregate own

approximately 30% percent of the Company’s outstanding shares, have

agreed to support the recommendation of Bigtincan’s Board of

Directors, which determined Vector’s revised November 25, 2024

proposal to be a superior proposal.

Completion of the transaction is subject to customary

conditions, including the approval of Bigtincan shareholders, an

independent expert concluding (and continuing to conclude) that the

scheme is in the best interest of Bigtincan shareholders, and

approval of the scheme by the Supreme Court of New South Wales,

among others. The transaction is expected to close in the first

quarter of 2025.

Vector Capital has engaged Johnson Winter Slattery and Sidley

Austin LLP as legal counsel, Deloitte LLP as tax advisors, and

Alvarez & Marsal as financial advisors in connection with the

transaction. Gilbert + Tobin is acting as legal counsel to

Bigtincan.

About Vector Capital Management, L.P.

Vector Capital is a leading, San Francisco-based investment firm

focused on transformational investments in middle-market technology

and technology-enabled businesses. Founded in 1997, Vector manages

over $4 billion of capital across its credit and private equity

strategies on behalf of a high-quality group of global limited

partners. For nearly 28 years, we have invested in technology

businesses concurrent with implementing an operational

transformation to deliver breakthrough operational and financial

results. For more information, please visit

www.vectorcapital.com.

About Bigtincan

Bigtincan helps the world’s leading brands facilitate the buying

experience of the future. Everything Bigtincan offers is designed

to be smart, flexible, and easily adapted to unique business

processes with highly personalized experiences that people and

brands love. Bigtincan is on a mission to help companies deliver

branded buying experiences that are engaging, personalized, provide

value and guide people to the best decisions with confidence.

Innovative companies like Nike, AT&T, Prudential, Merck,

Starwood Hotels, Winnebago and Clorox trust Bigtincan to enable

customer-facing teams to intelligently prepare, engage, measure and

continually improve the buying experience for their customers. For

more information about Bigtincan (ASX: BTH), visit:

www.bigtincan.com or follow @bigtincan on X.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205357927/en/

For Vector Capital: Nathaniel Garnick / Grace Cartwright

Gasthalter & Co. (212) 257-4170 vector@gasthalter.com For

Bigtincan: Denise Iverson Bigtincan (617) 981-7557

marketing@bigtincan.com

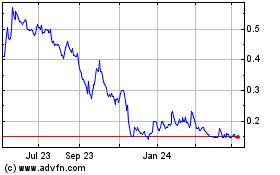

Bigtincan (ASX:BTH)

Historical Stock Chart

From Nov 2024 to Dec 2024

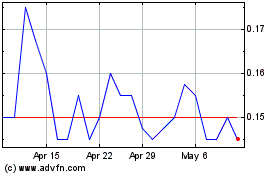

Bigtincan (ASX:BTH)

Historical Stock Chart

From Dec 2023 to Dec 2024