ANZ: Talks With Royal Bank Of Scotland Progressing, Incomplete

July 09 2009 - 1:38AM

Dow Jones News

Australia and New Zealand Banking Group Ltd. (ANZ.AU) said

Thursday talks to buy some of Royal Bank of Scotland Group Plc's

(RBS.LN) Asian assets are progressing but remain incomplete.

In a statement, Melbourne-based ANZ said it raised A$2.2 billion

through its share purchase plan, which was more than originally

flagged. Chief Executive Mike Smith said this was a "strong

endorsement of ANZ's super regional strategy".

The group has been in talks buy RBS' commercial and retail

banking operations. It hasn't said which countries it wants to buy

in, but Smith recently said that the lender is targeting general

growth in countries including Taiwan, Hong Kong, Singapore,

Indonesia and Vietnam.

ANZ also said that, while the economic outlook remains subdued

and unpredictable, it is sticking to its previous guidance on bad

debt provisioning. It said in late May it expects its second half

provisioning charge to be around 20% higher than the A$1.435

billion charge booked for the six months to March 31.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

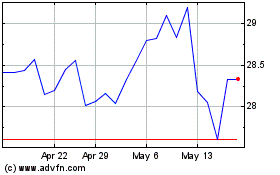

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

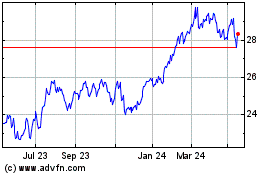

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Aug 2023 to Aug 2024