2nd UPDATE: ANZ Bank Bids For RBS's Asia Operations; To Raise A$2.85 Billion

May 26 2009 - 9:37PM

Dow Jones News

Australia and New Zealand Banking Group Ltd. (ANZ.AU) said

Wednesday it will raise up to A$2.85 billion by selling new shares

to help fund its bid to buy Asian banking assets from Royal Bank of

Scotland Group PLC (RBS).

The share placement will also boost ANZ's capital position and

help cushion against rising bad debts, with the bank warning that

charges for bad debts will rise around 20% in the second half from

the first half.

Melbourne-based ANZ said in a statement it has lodged a

non-binding bid to buy "selected" assets from RBS, which is selling

retail and commercial banking businesses in eight countries around

the region, including the key markets of India, China and Hong

Kong. The bank didn't say which assets it bid for, but said a deal

could weigh on earnings per share in the near term.

Despite volatile global financial markets, ANZ is pushing ahead

with plans to become a "super regional" lender in Asia as it looks

for new avenues of growth.

ANZ will raise A$2.5 billion through an underwritten

institutional share placement, at A$14.40 a share - a 7.5% discount

to its last traded price of A$15.57. It will also raise up to A$350

million through an offer to retail investors through a share

purchase plan.

Southern Cross Equities analystT.S. Lim said that while HSBC and

Standard Chartered are also in the hunt for RBS's Asian operations,

they may not be interested in all the assets on the block, which

could allow ANZ to secure some businesses. These might include

RBS's Indonesian and Singaporean units, he said.

ANZ said there is no certainty its bid will succeed, and that it

applies a "disciplined approach" to assessing investment

opportunities.

"An acquisition of the selected RBS Asia assets would initially

have a modest negative impact on reported earnings per share but

over the medium term the impact would be expected to be positive,"

the bank said.

If the RBS transaction proceeds, ANZ said its Tier 1 capital

ratio immediately afterwards would remain above its target range of

7.5% to 8.0%.

ANZ's major Australian rivals have all boosted their capital

positions in recent months, looking to build a buffer against

rising bad loans as Australia heads towards its first recession in

almost 20 years.

"The banking outlook remains uncertain and difficult to predict

especially with respect to credit provisions, revenue and the

market value of securities and derivatives," ANZ said.

While Australia's major banks have largely avoided the

credit-related troubles of their international peers, bad debts are

rising quickly and offsetting growth in revenues across the

sector.

ANZ said it expects second half provisions for bad debt will be

around 20% higher than the A$1.44 billion recorded in the six

months to March 31, with the commercial segment feeling increasing

pressure.

The bank said market conditions in New Zealand remain

challenging and it anticipates some further margin decline in the

second half in that market.

The company said its capital raising would initially boost its

capital ratios by around 90 basis points.

Southern Cross's Lim said that, while the outcome of the RBS

asset sales process is uncertain, ANZ probably decided to go ahead

with its capital raising after Australian authorities lifted a ban

on the short-selling of financial stocks. He said that not doing so

could have left the stock vulnerable to speculation that a share

placement was likely.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

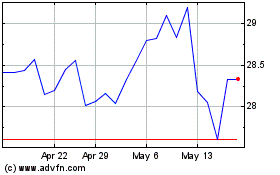

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

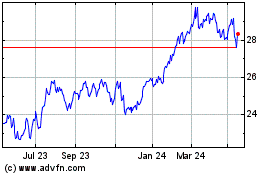

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Aug 2023 to Aug 2024