UPDATE: Amcor Still In Rio Tinto Talks On Packaging Assets

July 10 2009 - 12:55AM

Dow Jones News

Amcor Ltd. (AMC.AU), an Australian packaging company, said

Friday that talks with Rio Tinto PLC (RTP) about parts of its Alcan

Packaging businesses were continuing and there was no assurance

that any transaction may result.

Rio, the world's third-largest miner, wants to sell the unit,

which provides packaging to the food, drug and tobacco industries,

to cut its debt after last year's US$38.1 billion takeover of the

Canadian aluminum producer.

Amcor chief executive Ken MacKenzie has said that Amcor, the

world's largest maker of plastic soft drink bottles, wants to

expand production of flexibles, tobacco and custom PET plastic

bottle packaging.

"As part of Amcor's consideration of this potential transaction,

it is considering all its funding options," the company said in

response to an enquiry from the Australian Securities Exchange

about its stock's 12% gain from July 3 to Thursday's high of

A$5.21.

"Amcor believes that it is possible that the market has been

speculating that Amcor is considering an equity raising to

partially fund the possible acquisition of part, but not all, of

the Alcan Packaging businesses," it said.

The company said that speculation had increased with Rio's

announcement earlier this week that it would sell its food

packaging assets to Wisconsin-based Bemis Co. (BMS) for US$1.2

billion.

Rio would have preferred to sell the business in a single deal,

but after more than 18 months of ownership and debt mounting, it

has been persuaded to break up the unit, analysts have said.

The company has sold US$3.7 billion of assets this year and has

an US$8.9 billion debt payment looming next month.

The Wall Street Journal reported Thursday that Amcor is close to

a deal with Rio worth as much as US$2.4 billion for parts of Alcan

Packaging, its closest competitor in Europe for both flexible and

tobacco packaging.

Amcor would buy Alcan's European and Asian flexible packaging

assets and its tobacco and pharmaceutical packaging businesses,

which have annual revenue of about US$4.3 billion, the newspaper

said.

The WSJ said that private equity firms have backed away from the

deal because of tighter credit market conditions.

While Amcor's hand may be strengthened, analysts say the company

still may face trouble raising capital, gaining approval from

competition regulators and convincing investors that the move is

right for a company that has struggled to generate returns from a

series of acquisitions.

Amcor's balance sheet looks stretched, with net debt of A$3.29

billion at Dec. 31 and a net debt over net debt plus equity gearing

of 49.6%.

Citi analysts in a client note said any deal including the

European flexibles and tobacco packaging assets would be a "sound

strategic fit" and let Amcor gain meaningful market share and

pricing power in their respective markets.

Alcan's assets in Asia, where Amcor has been growing its

presence, would enhance its business and suit its strategy of

targeting emerging and low-cost markets for growth, rather than

buying share in mature markets.

Citi reiterated its Buy recommendation on Amcor stock and target

price of A$6.00.

"We believe that defensive stocks are not yet out of style, and

with a reasonably defensive earnings profile, Amcor will provide

relative safety in a deteriorating economic environment," Citi

said.

Shares in Amcor at 0425 GMT were down 0.8% at A$5.13, compared

with the broader market's 0.4% gain.

-By Andrew Harrison, Dow Jones Newswires; 61-3-9292-2095;

andrew.harrison@dowjones.com

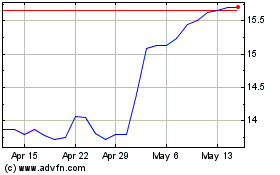

Amcor (ASX:AMC)

Historical Stock Chart

From May 2024 to Jun 2024

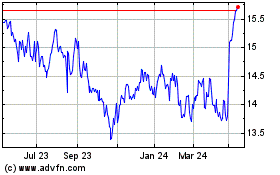

Amcor (ASX:AMC)

Historical Stock Chart

From Jun 2023 to Jun 2024