UPDATE: Rio Tinto Sells Alcan Americas Food Pkg Arm To Bemis

July 06 2009 - 12:37AM

Dow Jones News

Rio Tinto Ltd. (RIO.AU) said Monday it has agreed to sell its

Alcan food packaging arm in the Americas to Bemis Company Inc.

(BMS) for US$1.2 billion as it continues to offload assets to help

bolster its balance sheet.

Rio Tinto first flagged the sale of the packaging arm soon after

completing its US$38.1 billion takeover of Canadian aluminum

producer Alcan in late 2007.

The group still has food packaging operations in Asia and

Europe, which remain on the block. It is also looking to sell its

tobacco, pharmaceutical and cosmetic packaging arms.

"The sale of the Food Americas division is the first significant

step in reducing the asset portfolio acquired with Alcan," Rio

Tinto Chief Financial Officer Guy Elliott said in a statement. "The

transaction represents solid value given the challenging financial

environment," he said.

The company said its divestment program continues for other

assets identified for sale, including the remainder of Alcan

Packaging and Alcan Engineered Products.

Rio Tinto, one of the world's largest producers of iron ore,

copper, aluminum and other metals, has sold several businesses over

the last year in advance of several looming debt maturities,

including a US$8.9 billion payment due next month.

It recently completed a US$15.2 billion rights issue to raise

money, and has sold assets worth US$3.7 billion so far this year.

The group has nearly US$39 billion in debt.

Analysts have estimated that Rio Tinto's Alcan packaging

operations could be worth more than US$5 billion in total. Its food

packaging operations in Asia and Europe remain on the block and Rio

is also looking to sell Alcan's pharmaceutical and cosmetic

packaging arms.

But the group warned it is reviewing the carrying value of the

remaining Alcan packaging operations, which could result in some

downward revision at its half year results.

Australian packaging group Amcor Ltd. said earlier this year it

was interested in some of Alcan's packaging operations, but didn't

specify particular targets.

An Amcor representative wasn't immediately available to comment

on the group's interest in the assets Monday.

The Americas food packaging operations sold to Bemis generated

sales of around US$1.5 billion in 2008, representing around a

quarter of the packaging arm's total sales, Rio Tinto said.

Bemis will acquire 23 operations spread across the U.S., Canada,

Mexico, Brazil, Argentina and New Zealand that package and wrap

everything from meats and cheese to bagged lettuce and snack

foods.

The deal significantly boosts Bemis' role in many foods and

beverages purchased in grocery stores across the U.S. The deal

should push its sales from around US$3.5 billion to US$5.2 billion

annually, Bemis said. The deal is slated to close in early

September. It will be financed with US$1.0 billion in cash and

US$200 million in equity.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

(Ross Kelly in Sydney contributed to this article)

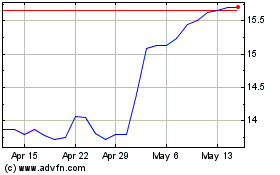

Amcor (ASX:AMC)

Historical Stock Chart

From May 2024 to Jun 2024

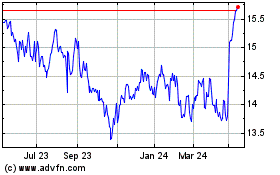

Amcor (ASX:AMC)

Historical Stock Chart

From Jun 2023 to Jun 2024