TIDMTOWN

RNS Number : 5705S

Town Centre Securities PLC

15 July 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

15 July 2022

Town Centre Securities PLC

('The Company' or 'TCS')

Announcement of Tender Offer

Town Centre Securities PLC (the "Company" or "TCS") hereby

announces that it intends to return up to GBP7.40 million to

shareholders by way of a tender offer for cash with Liberum Capital

Limited ("Liberum") acting as principal (the "Tender Offer").

It is proposed that up to 4,000,000 Ordinary Shares be purchased

under the Tender Offer, representing approximately 7.61 per cent.

of the issued share capital of the Company, at a price of 185.0p

per Ordinary Share (the "Tender Price").

The Tender Price represents a premium over the price of Ordinary

Shares, as follows:

o a premium of 31.6 per cent. (31.6 %) to the average of the

Company's Ordinary Shares closing price of 140.6p for the 30

Business Days to 14 July 2022 (being the Latest Practicable Date);

and

o a premium of 19.4 per cent. ( 19.4%) to the Company's Ordinary

Shares closing price of 155.0p on 14 July 2022 (being the Latest

Practicable Date).

Qualifying Shareholders may tender some or all of their Ordinary

Shares, with a Guaranteed Entitlement to tender 7.61% of the

Ordinary Shares held by them at the Record Date, rounded down to

the nearest whole number .

A circular explaining the terms of a Tender Offer (the

"Circular") will today be posted to Shareholders and published on

the Company's website at www.tcs-plc.co.uk.

Capitalised terms and expressions shall have the same meanings

as those attributed to them in the Circular.

Tender Offer

Expected timetable of events

Announcement of the Tender Offer, publication 15 July 2022

of this Circular and the Notice of General

Meeting

Tender Offer opens 18 July 2022

Latest time and date for receipt of Forms 10.00 a.m. on 6 August

of Proxy 2022

General Meeting 10.00 a.m. on 8 August

2022

Announcement of results of the General Meeting 8 August 2022

Latest time and date for receipt of Tender 1.00 p.m. on 8 August

Forms and share certificates in relation 2022

to the Tender Offer (i.e. close of Tender

Offer)

Latest time and date for receipt of TTE Instructions 1.00 p.m. on 8 August

in relation to the Tender Offer (i.e. close 2022

of Tender Offer)

Tender Offer Record Date 6.00 p.m. on 8 August

2022

Announcement of results of the Tender Offer 10 August 2022

Purchase of Ordinary Shares under the Tender 10 August 2022

Offer

CREST accounts credited for revised, uncertificated by 15 August 2022

holdings of Ordinary Shares

CREST accounts credited in respect of Tender by 24 August 2022

Offer proceeds for uncertificated Ordinary

Shares

Cheques despatched in respect of Tender Offer by 24 August 2022

proceeds for certificated Ordinary Shares

Return of share certificates in respect of by 24 August 2022

unsuccessful tenders of certificated Ordinary

Shares

Despatch of balancing share certificates by 24 August 2022

(in respect of certificated Ordinary Shares)

for revised, certificated holdings in the

case of partially successful tenders

Background to and reasons for the Tender Offer

Subject to the passing of the Tender Offer Resolution by

Shareholders at the General Meeting as a special resolution, the

Directors will give Qualifying Shareholders the opportunity to

tender Ordinary Shares through the Tender Offer for cash. The

Tender Offer Resolution will give the Directors authority to return

a maximum amount of up to GBP7.40 million to Shareholders at a

fixed price of 185.0p per Ordinary Share.

Over the last 30 months the Company has successfully embarked on

a substantial disposal programme to degear and strengthen its

balance sheet whilst also reducing the Company's exposure to retail

and leisure tenants. The disposal proceeds have in the main been

applied to repay bank borrowings and buy GBP9.9 million of the

Company's debenture stock, which was subsequently cancelled. This

has resulted in the Company having significantly lower levels of

gearing, increased loan to value headroom on its individual bank

facilities, as well as surplus free cash.

While the Company intends to continue to maintain a robust and

prudent balance sheet, as well as evaluating further investment

opportunities, the Directors believe that it is now appropriate to

return further surplus of cash to Shareholders.

Over the last three years the underlying share price of an

Ordinary Share in the Company has traded at a significant discount

to the Net Tangible Asset ("NTA") value of an Ordinary Share in the

Company (last reported NTA per Ordinary Share - 305p per Ordinary

Share, stated as at 31 December 2021). Given the wide discount, the

Board believes the share price discount to its NTA is unjustified

and believes that it is in the best interests of all Shareholders

to take steps to reduce this discount. A return of cash to

shareholders by way of the Tender Offer which is being made will be

both accretive to NTA and earnings at a per share level for any

remaining Ordinary Shareholder.

The Board regularly reviews capital allocation to optimise

long-term returns for shareholders and has explored various options

for returning cash to Shareholders and has determined that the

Tender Offer to be made at an appropriate premium to the price per

Ordinary Share on the Latest Practicable Date would be the most

suitable way of returning capital to Shareholders in a quick and

efficient manner, taking account of the relative costs, complexity

and timeframes of the possible methods, as well as the likely tax

treatment for and equality of treatment of Shareholders. Further

information on the UK tax treatment of the Tender Offer for

Shareholders is contained in Part VI of the Circular.

The Board of Directors of the Company considers the Tender Offer

to be beneficial to the Shareholders as a whole, including, among

other reasons, in that the Tender Offer:

-- is available to all Qualifying Shareholders regardless of the size of their holding;

-- the Tender Price represents a premium over the price of Ordinary Shares, as follows:

o a premium of 31.6 per cent. (31.6 %) to the average of the

Company's Ordinary Shares closing price of 140.6p for the 30

Business Days to 14 July 2022 (being the Latest Practicable Date);

and

o a premium of 19.4 per cent. ( 19.4%) to the Company's Ordinary

Shares closing price of 155.0p on 14 July 2022 (being the Latest

Practicable Date).

-- provides Qualifying Shareholders who wish to reduce their

holdings of Ordinary Shares with an opportunity to do so at a

market-driven price with a premium;

-- permits Shareholders who wish to retain their current

investment in the Company and their Ordinary Shares to do so, as no

Shareholder is required to participate in the Tender Offer, and

thus providing Shareholders with flexibility; and

-- will reduce the number of Ordinary Shares in issue, and so

should, assuming earnings and net asset values of the Group's

properties stay the same, have a positive impact on the Group's net

asset value per share and earnings per share as the Company intends

to cancel all of the Ordinary Shares acquired in connection with

the Tender Offer.

The Tender Offer is being made in addition to the share buy-back

programme announced by the Company on 6 January 2022 (the "Buy-Back

Programme"). Pursuant to the Buy-Back Programme, the Company may

repurchase Ordinary Shares of up to a total value of GBP5.0 million

pursuant to the Company's general authority to repurchase Ordinary

Shares granted by Shareholders at the Company's annual general

meeting held on 29 December 2021, up to a maximum of 7,916,246

Ordinary Shares. Since launching the Buy-Back Programme, the

Company has acquired 244,378 Ordinary Shares. Any Ordinary Shares

that have been repurchased via the Buy-Back Programme were

purchased by Liberum, acting as principal, for cancellation. As

previously announced by the Company, the Company intended for the

Buy-Back Programme to continue until the end of the Company's

financial year ending 30 June 2022. Consequently, as at the date of

the Circular, the Buy-Back Programme is deemed to have been

discontinued.

Current trading and prospects of the Group

On 14 July 2022, the Company announced a trading update for its

financial year ended 30 June 2022, together with its announcement

of the sale of its equity investment in YourParkingSpace Limited,

the parking space platform (the "Trading Update"). An extract from

the Trading Update is reproduced below:

Year End Trading Update

-- Robust rent collections for the 24 March 2022 and 1 April 2022 quarter dates:

o 99.5% collected

o 0.1% agreed to be deferred and still outstanding

o 0.4% outstanding with no agreement with the tenant

-- Car Park revenue back to 89.1% of pre-Covid 19 levels.

-- ibis Styles hotel occupancy levels remain significantly

better than during the Covid period, and the hotel is on course to

make its highest contribution to overall Group profits since

2017.

-- Submission in April 2022 of the Whitehall Riverside

Masterplan in conjunction with our joint venture partner,

Glenbrook.

-- TCS has also sold, subject to planning, its two Port Street,

Manchester surface car parks, both of which form part of the

Company's wider Piccadilly Basin development site. Completion of

the sale is likely to occur in October 2022, subject to planning

permission being granted. The total consideration of GBP13.0m is

not materially different to the 31 December 2021 carrying value of

these properties.

-- TCS also recently submitted a pre-application presentation to

Leeds City Council in relation to the existing consented 100MC

office building and a three-storey vertical extension to Wade

House, both at the Merrion Centre, with a view to delivering a

further 1,078 student accommodation units.

There has been no change in the Board's assessment of the

matters described above since release of the Trading Update.

Sale of Investment in YourParkingSpace

In the same announcement made on 14 July 2022, the Company also

announced the unconditional sale of its equity investment in

YourParkingSpace Limited ("YPS") to Flowbird SAS for total cash

consideration (net of fees and associated deal costs) of up to

GBP20.7m (the "YPS Sale").

The consideration for the Sale comprises the following:

o Initial net cash consideration for the Company's equity

shareholding of GBP9.6m

o Deferred consideration of GBP7.5m in aggregate, due in two

instalments: GBP4.4m 12 months after completion of the sale, and

GBP3.1m after 24 months

o A final contingent element of cash consideration, based on the

trading performance of YPS in the 14 month period following

completion of the Sale, of up to GBP3.6m

In addition, the Company will receive repayment in full

(including all accrued interest) of the amounts loaned to YPS,

comprising a gross cash receipt of GBP1.95m.

At 31 December 2021, the book value of the Company's investment

in the YPS equity stake was GBP1.47m, with an additional GBP1.53m

loan to YPS. The Sale will be accretive to both NTA and earnings

for the Group, and the disposal proceeds will further reduce net

borrowings and will be redeployed into other accretive

opportunities in due course.

As stated in the Trading Update, the Board was encouraged by

another year of recovery for the Group's business, with robust rent

collection and further successes as the Company sought to reset and

reinvigorate the business for the future. Over the coming months

the Board hopes to be able to announce the completions of the

Whitehall Riverside and Piccadilly basin development site sales.

These sales, together with consideration from the YPS Sale, will

allow the Company to continue to strengthen the Group's balance

sheet through lowering the level of absolute debt and leverage,

whilst investing in the Group's development pipeline and making

further strategic investments.

Principal Terms of the Tender Offer

Liberum will implement the Tender Offer by acquiring, as

principal, the successfully tendered Ordinary Shares at the Tender

Price. Ordinary Shares purchased by Liberum pursuant to the Tender

Offer will be purchased by Liberum as principal and such purchases

will be market purchases in accordance with the provisions of the

Act and the rules of the London Stock Exchange and the FCA.

Immediately following completion of the Tender Offer, Liberum shall

sell such Ordinary Shares to the Company, at a price per Ordinary

Share equal to the Tender Price, pursuant to the Repurchase

Agreement. Purchases of Ordinary Shares by the Company pursuant to

the Repurchase Agreement will also be market purchases in

accordance with the provisions of the Act and the rules of the

London Stock Exchange and the FCA. All of the Ordinary Shares

purchased by the Company pursuant to the Repurchase Agreement in

connection with the Tender Offer will be cancelled. Further details

on the Repurchase Agreement are set out in Part V of the

Circular.

Qualifying Shareholders must consider carefully all of the

information contained in the Circular as well as their personal

circumstances when deciding whether to participate in the Tender

Offer.

The maximum number of Ordinary Shares that may be purchased

under the Tender Offer will equate to seven point six one per cent

(7.61%) of the Issued Ordinary Share Capital at the Tender Offer

Record Date. As at 14 July 2022, being the Latest Practicable Date,

there are 52,530,599 Ordinary Shares in issue with no shares being

held in treasury. The Tender Offer is conditional on, among other

matters, the receipt of valid Tenders in respect of at least

525,306 Ordinary Shares (representing approximately one per cent.

(1%) of the Company's issued share capital as at the Latest

Practicable Date) by 1.00 p.m. on the Closing Date.

Assuming the maximum number of Ordinary Shares is validly

tendered, up to 4 million (4,000,000) Ordinary Shares may be

purchased under the Tender Offer for a maximum aggregate

consideration of up to GBP7.40 million. If such maximum number of

Ordinary Shares that may be tendered is repurchased by the Company

for cancellation pursuant to the Tender Offer, the total number of

Ordinary Shares of the Company in issue following such cancellation

will be 48,530,599.

The Tender Offer has no impact on the payment of the 2.5 p per

Ordinary Share interim dividend which was paid on 24 June 2022 to

Shareholders who were on the Register on 20 May 2022, being the

record date for such interim dividend.

How to participate in the Tender Offer

Qualifying Shareholders are not obliged to tender any Ordinary

Shares if they do not wish to do so. If no action is taken by

Qualifying Shareholders, there will be no change to the number of

Ordinary Shares that they hold and they will receive no cash as a

result of the Tender Offer.

Each Qualifying Shareholder who wishes to participate in the

Tender Offer is entitled to submit a tender to sell some or all of

their Ordinary Shares.

The total number of Ordinary Shares tendered by any Qualifying

Shareholder should not exceed the total number of Ordinary Shares

registered in the name of that Qualifying Shareholder at the Record

Date. For example, a Qualifying Shareholder may decide to tender

fifty per cent. (50%) of their Ordinary Shares, but if a Qualifying

Shareholder returned a tender purporting to offer for sale more

than one hundred per cent. (100%) of their Ordinary Shares, they

would be deemed to have tendered only the number of Ordinary Shares

actually owned by that Shareholder on the Record Date, with the

tender in respect of any additional shares being deemed

invalid.

The Tender Offer will open on 18 July 2022 (unless such date is

altered by the Company in accordance with the Tender Offer). The

Tender Offer will close at 1.00 p.m. on 8 August 2022 and tenders

received after that time will not be accepted (unless the Closing

Date is extended by the Company in accordance with the Tender

Offer).

Tender Forms which have been, or are deemed to be, validly and

properly completed (for Ordinary Shares held in certificated form)

and submitted to Link Group acting as Receiving Agent and TTE

Instructions which have settled (for Ordinary Shares held in

uncertificated form) will become irrevocable and cannot be

withdrawn at or after 1.00 p.m. on 8 August 2022.

Purchase of Ordinary Shares

Successfully tendered Ordinary Shares will be purchased from

Qualifying Shareholders by Liberum (acting as principal), free of

commission and dealing charges.

Following the purchase of any Ordinary Shares from Qualifying

Shareholders by Liberum, acting as principal, such Ordinary Shares

will be repurchased by the Company from Liberum pursuant to the

terms of the Repurchase Agreement and subsequently will be

cancelled by the Company. Any rights of Qualifying Shareholders who

do not participate in the Tender Offer will be unaffected by the

Tender Offer.

All Shareholders who tender Ordinary Shares will receive the

Tender Price, subject, where applicable, to the scaling-down

arrangements described below and set out in full in paragraphs 2.14

to 2.17 of Part V of the Circular.

If more than 4 million Ordinary Shares are validly tendered by

Qualifying Shareholders and the Tender Offer is oversubscribed,

acceptances of validly tendered Ordinary Shares will be scaled-down

to determine the extent to which individual tenders are accepted.

Accordingly, where scaling-down applies, beyond a Qualifying

Shareholder's Guaranteed Entitlement (as defined in paragraph 2.6

of Part II of the Circular) there is no guarantee that all of the

Ordinary Shares which are tendered by Qualifying Shareholders will

be accepted for purchase.

Guaranteed Entitlement

Tenders in respect of approximately seven point six one per

cent. (7.61%) of the Ordinary Shares held by each Qualifying

Shareholder on the Record Date will be accepted in full at the

Tender Price and will not be scaled down even if the Tender Offer

is oversubscribed. This percentage is known as the "Guaranteed

Entitlement". Qualifying Shareholders may tender such number of

Ordinary Shares in excess of their Guaranteed Entitlement up to the

total number of Ordinary Shares held by each Qualifying Shareholder

on the Record Date ("Excess Entitlement") and, to the extent that

other Qualifying Shareholders do not tender any of their Ordinary

Shares or tender less than their Guaranteed Entitlement, those

Qualifying Shareholders may be able to such Excess Entitlement

through the Tender Offer. However, if the Tender Offer is

oversubscribed, the tender of any such Excess Entitlement will only

be successful to the extent that other Shareholders have tendered

less than their Guaranteed Entitlement and may be subject to

scaling-down.

Circumstances in which the Tender Offer may not proceed

There is no guarantee that the Tender Offer will take place. The

Tender Offer is conditional on the passing of the Tender Offer

Resolution as set out in the Notice of General Meeting and on

satisfaction of the other Tender Conditions specified in Part V of

the Circular. In particular, the Tender Offer is conditional on the

receipt by 1.00 p.m. on the Closing Date of valid Tenders in

respect of at least 525,306 Ordinary Shares (representing

approximately one per cent. (1%) of the Company's issued share

capital as at the Latest Practicable Date).

The Company has reserved the right at any time prior to the

announcement of the results of the Tender Offer, with the prior

consent of Liberum, to extend the period during which the Tender

Offer is open and/or vary the aggregate value of the Tender Offer,

based on market conditions and/or other factors, subject to

compliance with applicable legal and regulatory requirements. The

Company has also reserved the right, in certain circumstances, to

require Liberum not to proceed with the Tender Offer. Any such

decision will be announced by the Company through a Regulatory

Information Service.

To the extent that Qualifying Shareholders tender for

significantly less than the total amount that may be returned to

Shareholders pursuant to the Tender Offer, or where the Company

decides not to proceed with the Tender Offer, the Company will

consider alternative options regarding how best to deploy any such

cash surplus or to return these funds to Shareholders, including by

way of a share buyback programme, taking into consideration the

then prevailing market conditions and other relevant factors at the

relevant time.

General Meeting to approve the Tender Offer Resolution

The Tender Offer requires the approval by Shareholders of the

Tender Offer Resolution at a General Meeting of the Company. For

this purpose, the Company is convening a General Meeting for 10.00

a.m. on 8 August 2022 to consider and, if thought fit, pass the

Tender Offer Resolution to authorise and to approve the terms under

which the Tender Offer will be effected.

The Tender Offer Resolution must be passed on a poll by at least

seventy-five per cent. (75%) of those Shareholders present in

person or by proxy and entitled to vote at the General Meeting. The

Company will not purchase Ordinary Shares pursuant to the Tender

Offer unless the Tender Offer Resolution is duly passed.

A summary of action to be taken by Shareholders is set out in

paragraph 7 of Part II of the Circular, together with the notes to

the Notice of General Meeting as set out in Part IX of the

Circular.

Tax

Shareholders should be aware that there will be tax

considerations that they should take into account when deciding

whether or not to participate in the Tender Offer. Summary details

of certain UK taxation considerations are set out in Part VI of the

Circular.

Shareholders who are subject to tax in a jurisdiction other than

the UK, or who are in any doubt as to the potential tax

consequences of tendering their Ordinary Shares under the Tender

Offer, are strongly recommended to consult their own independent

professional advisers before tendering their Ordinary Shares under

the Tender Offer.

Overseas Shareholders

The attention of Shareholders who are not resident in, or

nationals or citizens of the United Kingdom is drawn to paragraph 6

of Part V of the Circular.

Share Plans

The Company operates an All Employee Share Incentive Plan

("SIP") approved by Shareholders in 2003. Participants in the SIP

who are also Qualifying Shareholders may participate in the Tender

Offer in accordance with the terms and conditions of the Tender

Offer set out in the Circular.

As at the Latest Practicable Date, TCS Trustees Limited, in its

capacity as trustee of the SIP, held 55,239 Ordinary Shares on

behalf of all participants in the SIP, representing approximately

zero point one per cent. (0.1%) of the Company's issued Ordinary

Share capital. The Tender Offer will not affect the terms and

conditions of the SIP, or the rights of the participants in the

SIP.

The Company has no other share option or warrant schemes

currently in operation and there are no outstanding or unexercised

options or warrants to subscribe for Ordinary Shares as at the

Latest Practicable Date.

Actions to be taken

General Meeting

Whether or not you intend to attend the General Meeting, you are

urged to complete, sign and return the Form of Proxy in accordance

with the instructions printed thereon and the notes to the Notice

of General Meeting. To be valid, a proxy appointment must be

received by post or by hand (during normal business hours only) by

the Company's Registrar at Link Group, 10th Floor, Central Square,

29 Wellington Street, Leeds, LS1 4DL, as soon as possible and, in

any event, not later than 10.00 a.m. on 6 August 2022 (or, in the

case of an adjournment of the General Meeting, not later than 48

hours before the time fixed for the holding of the adjourned

meeting).

If you hold Ordinary Shares in CREST, you may appoint a proxy by

completing and transmitting a CREST Proxy Instruction (in

accordance with the procedures set out in the CREST Manual) to the

Registrar, under CREST participant ID number RA10. Alternatively,

you may give proxy instructions by logging onto www.euroclear.com

and following the instructions. Proxies appointed electronically

must be completed online as soon as possible and, in any event, so

as to be received by no later than 10.00 a.m. on 6 August 2022 (or,

in the case of an adjournment, not later than 48 hours before the

time fixed for the holding of the adjourned meeting).

Alternatively, you may appoint a proxy electronically using the

link www.signalshares.com. and following the instructions. You will

need to log into your Signal Shares account, or register if you

have not previously done so. To register, you will need your

Investor Code, which is detailed on your share certificate or

available from the Company's Registrar, Link Group, 10th Floor,

Central Square, 29 Wellington Street, Leeds, LS1 4DL. Proxy votes

must be received no later than 10.00 a.m. on 6 August 2022 (or, in

the case of an adjournment, not later than 48 hours before the time

fixed for the holding of the adjourned meeting).

Completion and return of a Form of Proxy, the giving of a CREST

Proxy Instruction or the completion of a Form of Proxy online will

not preclude shareholders from attending and voting in person at

the General Meeting, or any adjournment thereof, (in each case, in

substitution for their proxy vote) if they wish to do so and are so

entitled, subject to any legislation in force temporarily limiting

such rights.

Please read the notes to the Notice of General Meeting at the

end of the Circular for further details of the General Meeting,

including the appointment of proxies.

Participation in the Tender Offer

If you are a Qualifying Shareholder and hold your Ordinary

Shares in certificated form and you wish to tender all or any of

your Ordinary Shares, you should complete the Tender Form in

accordance with the instructions printed on it and in Part V of the

Circular and return it by post in the accompanying reply-paid

envelope (for use in the UK only) or by hand (during normal

business hours only) to Link Group, Corporate Actions, 10th Floor,

Central Square, 29 Wellington Street, Leeds, LS1 4DL, together with

your share certificate(s) in respect of the Ordinary Shares

tendered.

If you are a Qualifying Shareholder and hold your Ordinary

Shares in uncertificated form and you wish to tender all or any of

your Ordinary Shares, you should arrange for the Ordinary Shares

tendered to be transferred into escrow by not later than 1.00 p.m.

on 8 August 2022 as described in paragraph 2.18 of Part V of the

Circular/send the TTE Instruction through CREST so as to settle by

no later than 1.00 p.m. on 8 August 2022.

If you have any questions about the procedure for tendering

Ordinary Shares or making a TTE Instruction, you require extra

copies of the Circular, the Form of Proxy and, or of the Tender

Form, or you want help filling in the Form of Proxy and, or Tender

Form, please telephone Link Group on 0371 664 0321. Calls are

charged at the standard geographic rate and will vary by provider.

Calls outside the United Kingdom will be charged at the applicable

international rate. Lines are open between 09.00 - 17.30 Monday to

Friday excluding public holidays in England and Wales. Calls may be

recorded and randomly monitored for security and training purposes.

Please note that for legal reasons the Shareholder Helpline will

only be able to provide information contained in the Circular and

the accompanying Form of Proxy and Tender Form and will be unable

to give advice on the merits of the Tender Offer or to provide

financial, investment or taxation advice.

If you do not wish to sell any of your Ordinary Shares in the

Tender Offer, do not complete and return the Tender Form or submit

a TTE Instruction (as applicable).

Notification of interests

Under the articles of association of the Company and applicable

law, Shareholders are required to notify the Company of their

interests in Ordinary Shares. Following the Company's purchase of

Ordinary Shares from Liberum pursuant to the terms of the

Repurchase Agreement, and regardless of whether a Shareholder

tenders any or all of their Ordinary Shares pursuant to the terms

of the Tender Offer, the number of Ordinary Shares in which a

Shareholder is interested when taken as a percentage of the

Company's aggregate issued Ordinary Share capital as a whole may

change, which may give rise to an obligation under the DTRs on the

part of such Shareholder to notify the Company of their interest in

Ordinary Shares within two days of becoming aware of such change.

Reference should also be made to section C of Part VI of the

Circular entitled Substantial Shareholders for further information

regarding the obligations applicable to all Shareholders.

If you are in doubt as to whether you should notify the Company,

or as to the form of that notification, please consult your

professional adviser.

Concert Party and impact of Tender Offer

For the purposes of the Takeover Code, certain Directors and

their families and related trusts which are deemed by the Takeover

Panel to be acting in concert (together, the "Concert Party") [1]

own, in aggregate, 27,347,485 Ordinary Shares representing

approximately fifty two point one per cent. (52.1%) of the issued

Ordinary Share capital of the Company as at the Latest Practicable

Date.

Rule 9 of the Takeover Code applies to any person who acquires

an interest in shares which, whether by a series of transactions

over a period of time or not, when taken together with shares in

which persons acting in concert with him are interested carry

thirty per cent. (30%) or more of the voting rights of a company

which is subject to the Takeover Code. Any such person is required,

in the absence of a waiver, to make a general offer to all

shareholders of that company and also to the holders of any other

class of transferable securities carrying voting rights to acquire

their securities in cash at not less than the highest price paid by

such person, or by any person acting in concert with him, for any

interest in shares within the 12 months prior to the offer. Such an

offer under Rule 9 of the Takeover Code must also be made, in the

absence of a waiver, where any person who, together with persons

acting in concert with him, is interested in shares which in the

aggregate carry not less than thirty per cent. (30%) of the voting

rights of a company but does not hold shares carrying more than

fifty per cent. (50%) of such voting rights and such person, or any

person acting in concert with him, acquires an interest in any

other shares which increase the percentage of shares carrying

voting rights in which he is interested.

Where such person is a director, or the group of persons acting

in concert includes directors, of a company, the acquisition of

Ordinary Shares by the Company through a Tender Offer would

normally be treated as an acquisition for the purposes of Rule 9,

where it would have the effect of increasing the percentage

holdings of (but not necessarily the number of shares actually or

beneficially held by) that person or group of persons acting in

concert, depending on the level of take up of the Tender Offer and

the identity of the participating Qualifying Shareholders.

Having regard to: (a) the maximum number of Ordinary Shares that

may be acquired and cancelled by the Company under the Tender Offer

and the Repurchase Agreement; (b) the beneficial interests of the

Concert Party in Ordinary Shares disclosed to the Company as at the

Latest Practicable Date; and (c) the impact of the Irrevocable

Undertakings received from certain members of the Concert Party,

the Board notes that the Concert Party will not, in aggregate, hold

less than fifty per cent. (50%) of the Ordinary Shares as at

completion of the Tender Offer.

Specifically, if the maximum number of Ordinary Shares are

acquired for cancellation pursuant to the Tender Offer, the

aggregate holding of the Concert Party may increase (depending on

the level of take up of the Tender Offer and the identity of the

participating Qualifying Shareholders) and, in any case, would not

hold less than fifty per cent. (50%) of the issued share capital of

the Company.

Consequently, the application of Rule 9 of the Takeover Code in

the current circumstances and context of the Tender Offer would not

result in the Concert Party being subject to an obligation to make

an offer for the Company. Furthermore, Shareholders should be aware

that, for so long as the Concert Party's aggregate holding of the

issued share capital of the Company remains above fifty per cent.

(50%) (which would be the case even if the maximum number of

Ordinary Shares is validly tendered and accepted under the Tender

Offer), the Concert Party will remain free to increase its

shareholding without being subject to any obligation to make a

general offer to all Shareholders to purchase their Ordinary Shares

under Rule 9 of the Takeover Code. Furthermore, individual members

of the Concert Party would be free to purchase further Ordinary

Shares to take their personal holdings to 29.9 per cent. (29.9%) of

the issued Ordinary Share capital of the Company without incurring

an obligation to make a general offer to all Shareholders to

purchase their Ordinary Shares under Rule 9 of the Takeover

Code.

If at any time after completion of the Tender Offer: (i) the

Concert Party's aggregate holding of the issued share capital of

the Company falls below fifty per cent. (50%) but not less than

thirty per cent. (30%); and (ii) the Concert Party subsequently

acquires more voting rights, then the Concert Party will normally

be required by the Takeover Panel to make a general offer to

purchase all shares from all shareholders of the Company pursuant

to and in accordance with Rule 9 of the Takeover Code, unless an

exempting condition applies, or if a dispensation or waiver from

the Takeover Panel is obtained (where available) and, if required,

such dispensation or waiver is approved by Shareholders.

Board intentions to tender Ordinary Shares

Each of the Directors who are also Shareholders have confirmed

that they do not intend to tender any of their current individual

beneficial holding of Ordinary Shares through the Tender Offer. In

this regard, the Company has received irrevocable undertakings from

each of Edward Ziff, Michael Ziff and Ben Ziff that they will each

respectively not participate in the Tender Offer in respect of any

Ordinary Shares of which they are the registered or beneficial

holder, or otherwise hold on trust as trustees (as applicable), and

to procure that their PCAs will each individually not participate

in the Tender Offer in respect of any Ordinary Shares of which they

are the registered or beneficial holders, nor will they otherwise

sell, transfer, encumber or otherwise dispose of, or grant any

option over or other interest in such holdings, or permit any of

the foregoing, nor otherwise enter into any agreement or

arrangement to do any of the foregoing.

Recommendation by the Board

The Directors consider that the Tender Offer is in the best

interests of the Shareholders as a whole. Accordingly, the Board

unanimously recommends that you vote in favour of the Tender Offer

Resolution, as the Directors intend to do for their respective

individual beneficial holdings of, in aggregate, 8,823,557 Ordinary

Shares, representing approximately 16.79% of the issued Ordinary

Share capital of the Company as at the Latest Practicable Date.

The Board makes no recommendation to Qualifying Shareholders in

relation to participation in the Tender Offer itself. Whether or

not Qualifying Shareholders decide to tender all, or any, of their

Ordinary Shares will depend on, among other things, their view of

the Company's prospects and their own individual circumstances,

including their own financial and tax position. Shareholders are

required to take their own decision and are recommended to consult

with their duly authorised independent financial or professional

adviser.

If you are in any doubt as to the action you should take, you

are recommended to seek your own independent advice. You are

advised to read all of the information contained in the Circular

before deciding on the course of action you will take in respect of

the General Meeting and the Tender Offer.

The results of the General Meeting will be announced through a

Regulatory Information Service and the Company's website as soon as

possible once known. It is expected that this will be announced on

8 August 2022.

For further information, please contact:

Town Centre Securities PLC www.tcs-plc.co.uk / @TCS PLC

Edward Ziff, Chairman and Chief Executive 0113 222 1234

Ben Ziff, Managing Director: CitiPark PLC, TCS Energy &

Technology

Stewart MacNeill, Group Finance Director

MHP Communications tcs@mhpc.com

Reg Hoare / Pauline Guenot 020 3128 8567

Liberum www.liberum.com

Jamie Richards / Lauren Kettle / Nikhil Varghese 020 3100

2123

Peel Hunt www.peelhunt.com

Carl Gough / Henry Nicholls 020 3597 8673 / 8640

Notes to Editors:

Town Centre Securities PLC (TCS) is a Leeds & London based

property investor, car park and hotel operator with assets of over

GBP360m. With more than 60 years' experience, a commitment to

sustainable development and a reputation for quality and

innovation, TCS creates mixed use developments close to transport

hubs in major cities across the UK.

For more information visit www.tcs-plc.co.uk

[1] The Concert Party includes Edward Ziff (Chairman and Chief

Executive), Ben Ziff (Managing Director CitiPark) and Michael Ziff

(Non-Executive Director) together with their immediate family

members, Edward Ziff and Michael Ziff's mother, Ann Manning and her

children, and a number of trusts that Edward Ziff and Michael Ziff

are not beneficiaries of but they do control.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENKZLFFLDLLBBK

(END) Dow Jones Newswires

July 15, 2022 02:00 ET (06:00 GMT)

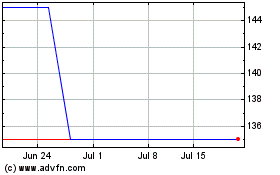

Town Centre (AQSE:TOWN.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Town Centre (AQSE:TOWN.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024