TIDMSML

RNS Number : 3588X

Strategic Minerals PLC

25 April 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018.

25 April 2023

Strategic Minerals plc

("Strategic Minerals" or the "Company")

March Quarter 2023 Magnetite Sales, Cash Balances and

Directorate Change

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a profitable

producing mineral company , is pleased to provide the following

update on the Company's cash position and ore sales at the Cobre

magnetite operation in New Mexico, USA ("Cobre") for the quarter

ended 31 March 2023.

Highlights

-- March quarter revenue of US$0.415m (2022: US$0.663m)

reflected the anticipated reduced demand from some customers,

associated with the dip in US economic activity.

-- Group cash balance was US$0.281m as at 31 March 2023 (US$0.341m as at 31 December 2022).

-- Jeffreys Henry vacated its newly appointed auditor role and was replaced by Shipleys.

-- Increased mining costs and negative market sentiment has

impacted proposed debt-based funding for restart of production at

the Leigh Creek Copper Mine ("LCCM"), previously reported, and has

required a re-examination of blended debt and LCCM equity

funding.

-- The assessment of the grant application lodged by Cornwall

Resources Limited ("CRL") in December has been delayed by the

assessing body.

-- Jeff Harrison, Non-Executive Board member, provided

notification of his intention to retire as a Board member at the

end of April.

Sales update: Cobre magnetite tailings operations

Slower US economic growth continues to impact demand for the

magnetite product provided at Cobre in New Mexico, USA. While sales

to the Company's "fertilizer" customers appear somewhat unaffected,

sales to "cement" customers have been notably impacted with the

Company's largest client continuing to suspend purchases whilst it

runs down its existing stockpile.

The reduction in demand has been partially offset by the 20%

price increase in July 2022.

Sales comparisons on quarterly and annual periods to 31 March

2023, along with associated volume details, are shown in the table

below:

Tonnage Sales (US$'000)

----------------------------- ----------------------------

Year 3 months to 12 months to 3 months to 12 months to

Mar Mar Mar Mar

2023 4,734 30,405 415 2,198

2022 10,609 40,244 663 2,502

2021 13,002 51,567 771 3,032

During the quarter, there has been no formal update on

distributions from the CV Investments LLC ("CVI") receivership.

Accordingly, the Company has not included any potential receipt of

funds from the Receiver in its cash flow projections.

Financials and Operations

As at 31 March 2023, the Company's cash balance was US$0.281m

(30 September 2022: US$0.341m). The marginal reduction is

consistent with Cobre operations in the March quarter and reflects

continuing activity at both the Leigh Creek and Redmoor projects.

In light of the reduced income from Cobre, management and

Directors' cash remunerations have been adjusted to ensure

maintenance of healthy cash balances.

During the quarter, the new auditor, Jeffreys Henry informed the

Company that, due to staffing losses, they would be unable to

undertake the Company's 2022 audit as well as a number of its other

existing clients. Accordingly, the Company has now appointed

Shipleys as its new auditor. The Company and Shipleys believe that,

despite the late notice from Jeffreys Henry, the audit can be

completed and audited statements signed off prior to 30 June 2023.

However, this is likely to potentially postpone this year's AGM

into the latter part of July 2023.

Leigh Creek Copper Mine ("LCCM")

Prior to Christmas, the Company executed an exclusive,

non-binding Heads of Agreement ("HoA") for funding the

re-commencement of operations at the LCCM project. The proposed

debt facility was with a specialist resource focused investor,

subject to technical due diligence and appropriate legal

documentation. While the project passed technical due diligence,

the Company also undertook to refresh anticipated costs and obtain

quotes from contractors to commence mining and processing

operations.

Whilst the Company was aware of the impact of cost rises in the

industry and was factoring an element of that into forecasts, the

refreshed firm cost/quote enquiries indicated further material

increases in mining costs. Despite copper prices and exchange rates

continuing to favour the LCCM project, the level of profitability

has been reduced and, while it remains attractive, the level of

profitability no longer supports the lending ratios associated with

a pure debt facility. This, combined with the particularly negative

sentiment in investment markets, saw the HoA no longer apply and

the Company entering into discussions with the investor on the

possibility of a mixed debt/equity approach. As the Company is no

longer bound by exclusivity constraints, the Company has also begun

revisiting parties that have previously shown an equity interest in

LCCM.

Part of the reduction in the Company's cash balance, during the

March quarter, reflects the circa US $30,000 spent as part of this

due diligence process.

As yet, there has been no correspondence from the South

Australia's Department of Energy and Mining (DEM) in relation to

the Programme for Environmental Protection and Rehabilitation

(PEPR) lodged in December 2022. The Company's staff remain in

contact with DEM concerning this lodgement and expect that this is

likely to be cleared sometime in the second quarter. It should be

noted that, at present, this is not time critical.

Cornwall Resources Limited ("CRL")

During the March quarter, as part of its involvement in the Deep

Digital Cornwall ("DDC") project, CRL was involved in:

-- An aerial survey over the Redmoor Tungsten and Tin Project

("Redmoor" or the "Project") which collected electromagnetic and

magnetic data. Initial processed data from the aerial survey is

expected to be available to project partners during the June

quarter.

-- Continued DDC soil sampling across its license area, with 500

soil samples shipped to testing laboratories in Ireland. A final

set of soil samples are expected to be shipped in the June

quarter.

-- Accessed equipment used to scan over 400m of existing drill

core from a previously reported borehole, CRD032. Initial analysis

highlights areas of interest within the borehole section, outside

of the existing resource, for follow up and further investigation.

This has the potential to expand the inferred resource without

additional drilling.

As previously noted, in December, CRL submitted an application

to Cornwall and Isles of Scilly Council ("CIoS") for grant funds

from CIoS's Shared Prosperity Fund to undertake the planned

development of Redmoor. The Company considers that, whether it is

successful with this application or not, at some stage the Project

is likely to benefit from Governmental funding given it:

-- Falls within the UK Government's Critical Minerals Strategy;

-- Is anticipated to result in many well-paid jobs for decades in East Cornwall; and

-- East Cornwall being an area likely to benefit from the UK Government's "Levelling Up" policy.

The Company had expected to receive feedback on the application

during the March quarter. However, the assessment body is

continuing to review applications and the final review meeting is

now expected in late June. CRL has supplied additional information

which was recently requested and continues to respond to any

further queries. Currently, the Company considers it will be

informed of whether it is successful in receiving grant funding in

the September quarter.

While there can be no certainty on the allocation of a grant,

the Directors believe that the strategic nature of the Project

within East Cornwall provides reason to be confident that some

grant funding will be forthcoming.

Commenting, Jeffrey Harrison, Non-Executive Director of

Strategic Minerals, said:

" After seven years involvement with Strategic Minerals, five as

a Non-Executive Director, I am retiring as a director for personal

reasons.

"I will continue to support the Cornwall Resources Project, as a

consultant, as I remain passionate about the return of mining to

Cornwall and believe the Redmoor Tungsten and Tin project is a key

element of this revival.

"My thanks and greatest respect to my fellow Directors for their

considerable efforts over the years and I remain confident in their

ability to successfully carry forward SML's projects in the future

."

Commenting, John Peters, Managing Director of Strategic

Minerals, said:

"The Company has responded to the impact on Cobre sales from the

dip in US economic growth and reorganised overheads in line with

the still substantial revenues expected from Cobre in 2023.

"It has been disappointing to have come so far with a potential

debt funding of Leigh Creek only to have circumstances changed. We

continue to seek funding for Leigh Creek and feel that commodity

prices may yet enhance the project's profitability further.

"The Company now awaits the outcome of its grant application to

assess the scope of its operations at Redmoor in 2023.

"On behalf of the Board and Management at Strategic Minerals, we

would like to acknowledge the key role Jeff Harrison has played in

the development of the Redmoor Tungsten and Tin project in

Cornwall, along with his substantial contribution to the safety

culture within the Company and his operational advice in respect of

LCCM. Undoubtably, Jeff has played a key role in the revival of

mining in Cornwall and we hope to still call upon his vast

expertise, in a consulting capacity, in the future. We wish Jeff

all the very best in finally retiring."

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Ewan Leggat

Charlie Bouverat

Notes to Editors

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects aimed at supplying the

metals and minerals likely to be highly demanded in the future.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole 2018 drilling programme has now been completed and the

resource update that resulted was announced in February 2019. In

March 2019, the Company entered into arrangements to acquire the

balance of the Redmoor Tin/Tungsten project which was settled on 24

July 2019 by way of a vendor loan which was fully repaid on 26

September 2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Australia and brought the project temporarily into production in

April 2019. In July 2021, the project was granted a conditional

approval by the South Australian Government for a Program for

Environmental Protection and Rehabilitation (PEPR) in relation to

mining of its Paltridge North deposit and processing at the

Mountain of Light installation. In late September 2022, an updated

PEPR, addressing the conditions associated with the July 2021

approval, was approved. In December 2022, the Company signed a Term

Sheet for funding of operations at Leigh Creek and is progressing

documentation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASLSASSDEEA

(END) Dow Jones Newswires

April 25, 2023 02:00 ET (06:00 GMT)

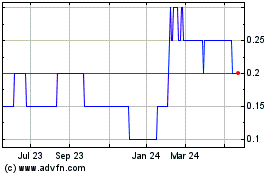

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

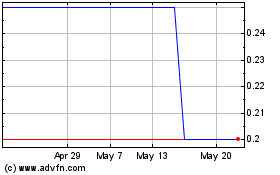

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024