TIDMMPO

RNS Number : 9071O

Macau Property Opportunities Fund

06 October 2023

ANNOUNCEMENT

6 October 2023

MPO Announces 2023 Annual Results

Macau Property Opportunities Fund Limited announces its results for the year ended 30 June

2023. The Company, which is managed by Sniper Capital Limited, holds strategic property investments

in Macau.

FINANCIAL HIGHLIGHTS

Fund performance

* MPO's portfolio value(1) declined 1% over the year to

US$200.5 million.

* Adjusted NAV was US$ 90.4 million, which translates

to US$1.46 (116 pence(2) ) per share, a 12.6%

decrease year-on-year (YoY).

* IFRS NAV was US$65.7 million or US$1.06 (84 pence(2)

) per share, a 15.3% decrease YoY.

Capital management

* As at 30 June 2023, MPO's balance sheet held assets

worth a total of US$182.6 million, against combined

liabilities of US$116.9 million.

* The Company ended the financial year with a

consolidated cash balance (including deposits with

lenders) of US$6.7 million.

* As at 30 June 2023, gross borrowings stood at

US$105.6 million, which translates to a loan-to-value

ratio of 50.9%.

(1) Calculation was adjusted to reflect like-for-like comparisons to 30 June 2023 due to

the divestment of properties during the year.

(2) Based on the Dollar/Sterling exchange rate of 1.261 on 30 June 2023.

PORTFOLIO HIGHLIGHTS

* The Waterside

* Since the launch of The Waterside strata sales

programme in Q2 2022, the Company has achieved total

divestments of US$44.3 million (HK$348 million)

through the sale of 16 units.

* The units were sold at an average value of 65% above

cost, and an average 8% discount to their latest

average valuations.

* The completion of 13 units occurred during the period

under review. Of the three further sales of units,

two have settled and one completion is scheduled for

early October.

* Tenant occupancy increased by 19% YoY to 46%.

* The average rental remains at US$2.2 per square foot

per month.

* The Fountainside

* Two duplexes at the property have been reconfigured

into three smaller units and two car-parking spaces.

Occupancy permits are expected by the end of 2023,

clearing the way for sales.

* For the four villas, marketing efforts are expected

to increase investor interest as we enter 2024.

* Penha Heights

* During the period under review, Macau's zero-COVID

measures disrupted on-site viewings and weighed on

investor sentiment.

* Since Macau's zero-COVID measures were lifted in

early 2023, marketing activity for the property has

been stepped up.

Mark Huntley, Chairman of Macau Property Opportunities Fund, said:

"The financial year can be separated into two distinct periods. During the first six months,

Macau was subject to strict dynamic zero-COVID regulations, in lockstep with mainland China.

At the beginning of 2023, however, COVID controls were rapidly relaxed, triggering a dramatic

economic recovery which has seen both strong growth in gross gaming revenues and significantly

increased numbers of visitors to Macau.

The strata sales programme of selected apartments in the Waterside is delivering results and

has produced US$44.3 million of sale proceeds which has reduced our overall level of debt

from US$131 million to US$105 million in the last financial year. The environment in which

we operate has remained difficult; concerns have surfaced regarding China's economic performance

and inflationary pressures have driven global interest rates higher. Executing our divestment

strategy has therefore been challenging and we have had to be nimble and creative to deliver

this positive outcome.

We are continually assessing the market to apply the optimal divestment strategy for each

of our remaining property assets, including a whole portfolio disposal. Reducing our debt

levels continues to be the near term focus as we exercise patience and judgement in working

hard to realise the value of our remaining assets."

For more information, please visit http://www.mpofund.com for the Company's full 2023 Annual

Report.

The Manager will be available to speak to analysts and the media. If you would like to arrange

a call, please contact Investor Relations of Sniper Capital Limited at info@snipercapital.com

.

About Macau Property Opportunities Fund

Macau Property Opportunities Fund (MPO) is a closed-end investment fund and the only listed

company dedicated to investing in real estate in Macau, the world's largest gaming market

and the only city in China in which gaming is permitted.

Premium-listed on the London Stock Exchange, the Company has historically held multi-segment

property assets in Macau and Zhuhai, China. Its current portfolio comprises prime residential

assets valued at US$200.5 million, which are being progressively divested.

MPO is managed by Sniper Capital Limited, an Asia-based property investment manager with a

strong track record in fund management and investment advisory.

Stock Code

London Stock Exchange: MPO

LEI

213800NOAO11OWIMLR72

For further information, please contact:Manager Corporate Broker Company Secretary &

Sniper Capital Limited Liberum Capital Administrator

Group Communications Darren Vickers / Owen Ocorian Administration

Tel: +853 2870 5151 Matthews (Guernsey) Limited

Email: info@snipercapital.com Tel: +44 20 3100 2000 Kevin Smith

Tel: +44 14 8174 2742

MACAU PROPERTY OPPORTUNITIES FUND LIMITED

ANNUAL RESULTS & ACCOUNTS FOR THE YEARED 30 JUNE 2023

CORPORATE INTRODUCTION

M acau Property Opportunities Fund Limited, a closed-end

investment company, was incorporated and registered in Guernsey

under the Companies (Guernsey) Law, 2008 (as amended) on 18 May

2006, under registration number 44813. The Company is an authorised

entity under the Authorised Closed-Ended Investment Schemes Rules

2008. The Company is premium listed on the London Stock

Exchange.

Sniper Capital Limited, the Manager for Macau Property

Opportunities Fund, is responsible for the day-to-day management of

the Company's property portfolio and the identification and

execution of divestment opportunities.

The Company's entire remaining investment portfolio is allocated

to residential property investments in Macau. The Company is

managed with the objective of realising the value of all remaining

assets in its portfolio, individually, in aggregate or in any other

combination of disposals or transaction structures, in a prudent

manner, consistent with the principles of good investment

management with a view to making an orderly return of capital to

Shareholders. Its overriding aim is to deliver cost-effective and

timely divestments of the three remaining properties, to enable

further returns of capital to the shareholders. The Company has

ceased making any new investments and will not undertake additional

borrowings other than to refinance existing loans or for short-term

working capital purposes.

The Board reflects a diversity of ethnicity, gender and relevant

experience from a corporate, sectoral and geographical perspective,

coupled with a deep understanding of the unique features of Macau,

its property market and the Company's portfolio. The Board has

assessed that it has the capacity to fulfil its obligations in the

context of the latest corporate governance guidelines, taking full

account of the Company's late-stage divestment and its clearly

defined business objectives.

Pursuant to its Articles of Incorporation, MPO is subject to

annual continuation votes. At the annual general meeting (AGM) held

on 13 December 2022, Shareholders voted in favour of a Continuation

Resolution to extend the life of the Company for a further year

until the next continuation vote on 21 December 2023. The Board

will be recommending the Company's continuation of the Company at

the AGM, which is expected to be held in December.

KEY FACTS

Exchange

London Stock Exchange

Main Market

Symbol

MPO

Lookup

Reuters - MPO.L

Bloomberg - MPO:LN

Domicile

Guernsey

Shares in Issue

61,835,733

Shares Held in Treasury

Nil

Share Denomination

Pounds sterling; Reporting currency: US Dollars

Fee Structure

Realisation-focused fee structure that incentivises the Manager

to divest assets at realistic prices

Inception Date

5 June 2006

Net IPO Proceeds

GBP101 million (US$189 million)

Amount Returned to Shareholders Since Inception

US$173 million

(Distribution US$97.4m; Share buyback US$75.3m)

ADVISERS & SERVICE PROVIDERS

Company Secretary and Administrator

Ocorian Administration (Guernsey) Limited

Corporate Broker

Liberum Capital Limited

External Auditor

Deloitte LLP

CHAIRMAN'S MESSAGE

Our overriding priority remains optimising ways to deliver a

return of capital.

I present my report for the financial year ended 30 June 2023,

together with our perspective on the best way forward for the

Company.

The financial year can be separated into two distinct periods.

During the first six months, Macau was subject to strict dynamic

zero-COVID regulations, in lockstep with mainland China. At the

beginning of 2023, however, COVID controls were rapidly relaxed,

triggering a dramatic economic recovery. Yet the picture during the

financial year was nuanced and complex, with periods of optimism

during which we were able to advance our divestment strategy,

followed by severe setbacks. The environment in which we operate

has remained challenging as COVID-19 outbreaks prompted local

lockdowns, concerns surfaced regarding China's economic performance

and inflation concerns drove global interest rates higher.

Executing our divestment strategy has therefore been challenging

and we have had to be nimble and creative to deliver a positive

outcome for shareholders.

The Manager has worked successfully to exploit the periods of

opportunity and optimism, progressing the strata sales programme at

The Waterside. This programme yielded proceeds of approximately

US$44.3 million since commencement in July 2022 - a significant

achievement given the context in which those sales were made.

Correspondingly, debt levels have been reduced and the Company's

loan-to-value ratio has fallen. Repayment of debt remains the key

priority in the application of sales proceeds, as reducing interest

costs and meeting debt repayments are critical in the current

environment.

We are continually assessing the market to apply the optimal

divestment strategy for each of our remaining property assets,

including a whole portfolio disposal.

China and Macau

Mainland China experienced an economic rebound following the

relaxation of its COVID-19 restrictions, but as with other

jurisdictions where severe COVID measures were imposed, the length

of its closure, coupled with external factors - in particular the

global battle against inflation - has made that recovery brittle.

Weaker economic data has been widely reported, and although

specific details of the situation are difficult to ascertain, the

country's property-led economic woes are unmistakable, as is lower

consumer spending.

Mainland Chinese authorities appear willing to take targeted

action, with moves to support the country's currency and, more

recently, the property sector, in addition to a loosening of

monetary policy. Authorities may well seek to apply lessons learned

from other jurisdictions following the introduction of wide-ranging

economic stimulus measures. Any intervention by Chinese

authorities, however, is likely to be administered very carefully.

For such a large economy, this presents a significant challenge,

and one that could affect the Company's near-term opportunities. We

had anticipated that the economic recovery from the pandemic would

not be linear, and this has proved to be an accurate

assessment.

Against this somewhat uncertain backdrop and the widely reported

problems of some large Chinese developers, it is important to

distinguish between events affecting mainland Chinese property and

developers and the specific circumstances of Macau's economy and

real estate market. Macau's property sector was in a prolonged

downturn before the pandemic struck, and continued to flatline

ahead of the territory's economic recovery, particularly the luxury

property market. Relative to other regional cities therefore, our

portfolio can be seen as an exceptionally good investment

opportunity. However, accessing potential investors has taken time

as travel and the supporting transport infrastructure continue to

recover to pre-COVID levels. Many prospective purchasers remain

preoccupied with repairing the damage caused by COVID measures to

their investment and business operations before returning to the

market.

Macau's economy is driven by two main activities: gaming and

tourism. Under the territory's strict COVID-19 restrictions, both

were severely negatively affected. However, from a low base, a

recovery appears to be well under way. Visitor numbers have

increased significantly, and gross gaming revenue appears to be

holding up, with casinos revamping their offerings to meet the

demands of the new operating environment. It appears that the macro

situation in China is not affecting the recovery of tourism in

Macau, where many of the wealthy and middle class mainland Chinese

continue to spend on travel and entertainment. The renewal of

casino licences provided a welcome reminder that this key driver of

the economy and the associated tax revenue has a positive future.

We are already seeing that the return to more normal activity has

flowed through into new leasing enquiries relating to the remaining

apartments at The Waterside.

Although mainland Chinese authorities have relaxed certain

controls and enacted measures to stimulate the country's real

estate market, mainland capital control measures remain in place,

as do Macau's anti-speculation real estate policies. The latter

appears to serve a policy objective that has already been achieved,

and although property businesses and agents continue to lobby for

change, Macau's authorities are currently more focused on the

broader housing market than the high-end segment.

In the longer term, Macau's future looks promising, with

development initiatives on neighbouring Hengqin Island rivalling

MICE* destinations such as Orlando, Florida. Coupled with gaming,

these present compelling drivers for long-term growth. The return

of growth and investment opportunities is likely to attract

investors that are currently maintaining a "wait-and-see"

approach.

Our overriding priority remains optimising ways to deliver a

return of capital within a reasonable timeline for

shareholders.

* Meetings, incentives, conferences and exhibitions

Property portfolio

The Waterside

The commencement of the strata sales programme that we announced

earlier has delivered a combined total of US$44.3 million to date.

Sixteen units have now been divested to date, with buyers

originating from Macau, Hong Kong and mainland China. This leaves

43 units yet to be sold, including many on the development's

higher, more valuable floors. A carefully executed sales strategy

has been deployed to capitalise on current market dynamics and to

meet our debt repayment obligations. The active sales process

remains ongoing.

On a similarly positive note, The Waterside's leasing

performance has been encouraging, with 46% of the remaining units

leased. The tenant mix has improved alongside rental levels,

meaning that income has held up well in the face of competitive

market conditions.

The Fountainside

The Company is close to completing the process to enable the

three smaller units to be marketed and sold. Delays in receiving

the necessary consents and approvals affected the schedule for the

sale of these apartments. This segment of the market has held up

well and the sales process is now targeted for early 2024.

The Fountainside's four villas are still being marketed but no

sales have yet been completed.

Penha Heights

This property remains an exceptional asset in terms of both its

location and size. It has been maintained to appeal to a very

discerning target market. The Manager has adopted a focused

approach to reach prospective investors, with marketing timed to

the post-COVID recovery. Further patience will be required to

achieve a divestment, as the pool of buyers is limited, and

prospective purchasers seemingly remain preoccupied with their own

post-COVID issues.

Debt management and interest rates

Interest rates in Macau have increased significantly, in line

with those in other jurisdictions, notably the US, given the

currency linkage. Macau is not experiencing severe inflation,

meaning that the increased cost of debt is having a dampening

effect on the economy and the real estate market. This has been

exacerbated by the territory's ongoing mortgage restrictions.

Driven by events in mainland China, banks have continued to take

a cautious approach to lending and debt management. Ongoing and

active dialogue, driven by our Manager, is an essential part of

ensuring support from lenders. This has enabled the flexible

scheduling of our debt repayments, for example where sales proceeds

might overlap with repayments. This underscores the banks support

for our current approach of prudently managing the business and

producing results in challenging market dynamics.

During the year, the Company's debt was reduced from US$131

million to US$105.6 million. Our continued focus is on taking

pragmatic steps to dispose of sufficient assets to meet or exceed

scheduled debt repayments. Although there are signs that interest

rates may be close to their peak, troubling inflationary issues

remain in other parts of the world that may influence central

bankers' interest rate decisions. Overall, persistent high interest

rates are unhelpful to Macau and its real estate market.

It is important to highlight the divestment progress we have

made at The Waterside and in our focus on improving the Company's

financial position. At times, this has necessitated providing sales

incentives in order to generate cash to meet approaching debt

repayment obligations. In turn this has resulted in the need to

accept discounts to valuation levels on some disposals. On behalf

of the Board, I would like to commend the Manager for the way it

has handled both our sales programme and interactions with our

lenders. This approach informs our assessments of going concern and

viability. It will be a continuing requirement as we seek

opportunities to achieve our divestment objectives at realistic

prices and with a focus on our future debt repayment obligations.

Patience and judgement, however, are essential, as the disposals at

The Waterside represent a significant proportion of overall sales

in Macau's luxury property segment.

Financial performance

With Macau's economy on a path to recovery, our portfolio

valuation has stabilised, as reflected in the 1% decline from 30

June 2022 on a like-for-like comparison.

The Company's Adjusted Net Asset Value (NAV) was US$90.4 million

as of 30 June 2023. This is equivalent to US$1.46 (116 pence) per

share and represents a decline of 12.6% (16% in sterling terms)

compared to the previous year. NAV, which records inventory at cost

rather than market value, was US$1.06 per share, down 15.3% from

the previous year. The Company remained in compliance with its debt

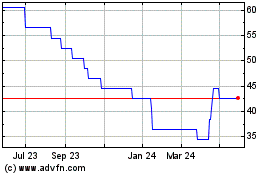

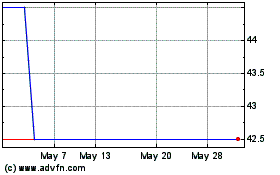

covenants. Its shares closed at 58.5 pence at the end of the

reporting period, an increase of 53% over the year. The share price

discount to Adjusted NAV narrowed to 50% as of 30 June 2023 from

72% the previous year. The recent weakness in the share price,

which may be partly driven by wider market sentiment, has been

noted, together with trading volumes which remain very low. Whilst

we retain the option to buy back shares, we believe it is better to

apply proceeds to reduce current debt levels and deliver sales

which support the NAV.

ESG considerations

Our development activities have, of course, been concluded,

delivered in accordance with our environmental, social and

governance (ESG) approach, as previously reported. Where we carry

out minor works, such as the completion of apartments at The

Fountainside and general property maintenance, those policies and

processes remain in place. Where apartments have been refurbished

between tenancies at The Waterside, environmental considerations

have been actively applied.

In the context of governance, our three-person board reflects a

diversity of skills, gender and ethnicity, and our ongoing

appraisal process concluded that the Board, as it is currently

constituted, functions very effectively. As the Company is in a

very late stage of its life, we continue to carefully assess our

board composition, although further changes in the context of that

time horizon would likely be unhelpful.

Our strategy is clearly defined, and our objectives are being

implemented in the context of the external factors through which we

must navigate. Our experience with our assets, the market and the

reality of day-to-day operations is a vital factor in the context

of governance.

Non-executive Director Alan Clifton has exceeded the normal

tenure set out in external codes. He continues to demonstrate

independence through action, and his experience is important in the

context of our broad functions. This, coupled with the challenges

of finding a suitable director for what will be a comparatively

short tenure amid such challenging market circumstances, is why we

are proposing that Mr Clifton continues to serve as a director.

We have determined that we will continue without any increase in

directors' remuneration at this time.

Extension of life

Pursuant to its Articles of Incorporation, MPO is subject to

annual continuation votes. At the AGM held on 13 December 2022,

Shareholders voted in favour of a Continuation Resolution to extend

the life of the Company for a further year until the next

Continuation Vote on 21 December 2023. The Board has the continued

support of major shareholders and all historic continuation votes

have passed by an overwhelming majority. A forced sale of assets,

particularly under current market conditions and at current levels

of gearing, would realise significantly lower returns than a

continued, measured disposal of our remaining assets.

Subject to a positive outcome from the Continuation Vote, the

Board intends to agree a revised fee agreement with the Manager

that will be at a level no higher than that during the year under

review. Any terms will be consistent with, and wholly focused on,

achieving the Company's strategic objectives, within a shortened

time frame where practically possible.

Outlook

It is the Company's intention to press ahead with its pragmatic

approach to achieving its divestment objectives through carefully

managed sales. Debt reduction will be the primary application of

proceeds from near-term sales.

External influences, namely the economic downturn in mainland

China and the high interest rate scenario, will continue to

complicate the operating environment in the short-term. The

recovery of the tourism and gaming markets have both been

promising; however, it is also important to restate that we expect

that Macau's recovery will not be linear, and that periods of

slower activity will be interspersed with increased optimism.

Through determination and a disciplined approach, we have achieved

positive divestment outcomes in this market context. We will

continue to apply all of our energies to returning capital to our

shareholders at the earliest opportunity.

MARK HUNTLEY

CHAIRMAN

MACAU PROPERTY OPPORTUNITIES FUND LIMITED

4 October 2023

BOARD OF DIRECTORS

MARK HUNTLEY

Chairman

Mark Huntley has more than 40 years of experience of fund

management, administration and fiduciary operations. He began his

career at NatWest before moving to the First National Bank of

Chicago, where his portfolio included overseas-owned US real

estate. He worked in a variety of roles at Barings, primarily in

fund administration specialising in alternative investment funds,

and served on the executive management committee. In 2006, he

established an independent financial services business within the

Heritage Group, retiring from the role of CEO upon the sale of the

business in 2017. His involvement in funds and private assets has

spanned real estate, private equity and emerging market investment.

He has served on the boards of listed and private investment funds

and of management/general partner entities. Mr Huntley is a

resident of Guernsey.

ALAN CLIFTON

Chairman of the Audit and Risk Committee

Alan Clifton began his career at stockbroker Kitcat &

Aitken, first as an analyst, thereafter becoming a Partner and then

a Managing Partner, prior to the firm's acquisition by the Royal

Bank of Canada. He was subsequently invited to take up the role of

Managing Director of the asset management arm of Aviva, the UK's

largest insurance group. He has had a long non-executive career as

an Independent Director of numerous investment and finance sector

companies. Mr Clifton is a UK resident.

CARMEN LING

Non-executive Director

Carmen Ling has more than 25 years of banking experience. She

has served as a Managing Director at Citigroup and Standard

Chartered Bank, and she has extensive experience of client

coverage, real estate, transaction banking and network strategies.

Her role as global head of RMB Internationalisation/Belt & Road

at Standard Chartered Bank added to her unique knowledge and

experience as an international banker. Before beginning her banking

career, Ms Ling worked in the hospitality industry for hotel

project developments in North Asia, including China and Japan. She

is a resident of Hong Kong.

FINANCIAL REVIEW

2018 2019 2020 2021 2022 2023

NAV (IFRS) (US$ million) 212.8 131.1 100.6 97.9 77.6 65.7

----- -------- ----- ----- ----- -----

NAV per share (IFRS; US$) 2.78 2.12 1.63 1.58 1.25 1.06

----- -------- ----- ----- ----- -----

Adjusted NAV (US$ million) (a) 260.6 174.9(c) 136.5 128.8 103.4 90.4

----- -------- ----- ----- ----- -----

Adjusted NAV per share (US$) (a) 3.41 2.83 2.21 2.08 1.67 1.46

----- -------- ----- ----- ----- -----

Adjusted NAV per share (pence) (1, a) 258 223 179 150 138 116

----- -------- ----- ----- ----- -----

Share price (pence) 194.0 146.0 61.75 67.5 38.2 58.5

----- -------- ----- ----- ----- -----

Portfolio valuation (US$ million) (b) 338.4 311.1 275.6 265.4 242.0 200.5

----- -------- ----- ----- ----- -----

Loan-to-value ratio (%) 34.7 43.5 49.6 49.3 53.3 50.9

----- -------- ----- ----- ----- -----

(1) Based on the following US dollar/sterling exchange rates on

30 June: 2018: 1.321; 2019: 1.270; 2020: 1.231; 2021: 1.386; 2022:

1.212; 2023: 1.261

(a) Refer to Note 18 for calculation of Adjusted NAV and Adjusted NAV per share

(b) Refer to Notes 6 & 7 for independent valuations of the

Group's portfolio including investment property and inventories

(c) MPO returned US$50.5 million (50p per share) to shareholders in 2018

The two halves of this financial year stand in stark contrast to

one another. Macau's worst economic performance in more than a

decade was followed by the territory's tourism and gaming numbers

roaring back to life following the abrupt dismantling of zero-COVID

measures in January.

However, the recovery has to date been uneven.

Economic activity has been centred on tourism and gaming, a

dynamic highlighted by the recovery of both hotel performance as

well as the tourism focused retail real estate segment. Meanwhile,

the luxury residential market, in which the Company operates, has

remained subdued, impacted by a weak economic recovery in mainland

China and a markedly higher interest rate environment.

Despite these challenges, the Manager continued to progress its

divestment programme, generating total sales of US$44.3 million

through the sale of sixteen units at The Waterside since the

programme's commencement.

Financial results

The Company's portfolio, comprising three main assets, was

valued at US$200.5 million as at 30 June 2023. On a like-for-like

basis after adjusting for the units sold during the year, the

portfolio valuation declined by 1% from the previous year. Although

property values have stabilised, liquidity has remained low, and

the long-awaited revival of Macau's real estate market has remained

hindered by the high interest rate environment, restrictive

mortgage policies, and continued caution among potential buyers

following the effects of the pandemic in mainland China, where

draconian COVID measures were relaxed only in early 2023. The

Manager is maintaining a cautious stance on property values moving

forward.

MPO's Adjusted NAV was US$90.4 million at the end of the period,

which translates to US$1.46 (116 pence) per share, a 12.6% decrease

year on year (YoY). The primary reasons for the decline were

increased financing costs due to a significant rise in interest

rates and the impact of The Waterside divestment programme. IFRS

NAV, which records inventory at cost rather than market value, was

US$65.7 million, or US$1.06 (84 pence) per share, a 15.3% drop over

the one-year period.

Capital management

As at 30 June 2023, MPO's balance sheet listed assets valued at

a total of US$182.6 million, offsetting combined liabilities of

US$116.9 million, of which US$105.1 million represented bank

borrowings.

The Company ended the financial year with a consolidated cash

balance of US$6.7 million, of which US$5.6 million was pledged with

lenders and restricted as to its usage. During the year, c.US$27.9

million, representing 75% of the sales proceeds generated from

sales at The Waterside, was deployed for loan repayments that

became due over the year, and for the partial prepayment of

upcoming instalments. The Company's ongoing operating expenses are

expected to be covered by sales proceeds released as free cash.

The Company's gross borrowings stood at US$105.6 million,

translating to a loan-to-value ratio of 50.9%, compared to 53.3% at

the end of the previous financial year. Gross borrowings are

expected to decline further to c.US$96 million following

completions of sales at The Waterside that occurred post year end,

improving the Company's loan-to-value ratio to 48.8%.

Extension of Company life and fee revision

At the Company's Annual General Meeting in December 2022,

shareholders passed a resolution to extend its life for a further

year, until 31 December 2023. Although Macau's economy is on the

road to recovery, economic activity is concentrated in tourism and

gaming-related activities. The ultra-luxury property market has not

yet seen a spillover effect.

Given these circumstances, the timely completion of the

Company's divestment programme is expected to be extended to

maximise valuations in sales transactions. Therefore, even though

the Manager will deploy all possible strategies to secure further

sales, it is expected that an extension of the Company's life to

the end of 2024 will be necessary to enable the divestment

programme to progress in an orderly manner and to achieve the best

possible returns for shareholders.

The Board and Manager are in discussion on how future fees will

be allocated in the next year.

PORTFOLIO OVERVIEW

Project Project

No. Acquisition development Market Changes composition

of Commitment cost cost valuation (based on market (based on market

Property Segment units (US $ million) (US $ million) (US $ million) (US $ million) value) value)

Over

the Since

year acquisition

------------ ----- -------------- -------------- -------------- -------------- ----- ------------- ----------------

The Waterside

------------ ----- -------------- -------------- -------------- -------------- ----- ------------- ----------------

Tower Six at

One

Central Luxury

Residences*/** residential 45 78.6 67.7 10.9 141.0 -1.0% 108% 70.3%

------------ ----- -------------- -------------- -------------- -------------- ----- ------------- ----------------

The Low-density

Fountainside** residential 7 6.3 2.0 4.3 17.8 -2.8% 788% 8.9%

------------ ----- -------------- -------------- -------------- -------------- ----- ------------- ----------------

Luxury

Penha Heights residential N.A. 28.5 26.8 1.7 41.7 -1.1% 56% 20.8%

------------ ----- -------------- -------------- -------------- -------------- ----- ------------- ----------------

Total 113.4 96.5 16.9 200.5 -1.2% 108% 100%

----- -------------- -------------- -------------- -------------- ----- ------------- ----------------

* One Central is a trademark registered in Macau SAR under the

name of Basecity Investments Limited. Sniper Capital Limited, Macau

Property Opportunities Fund Limited, MPOF Macau (Site 5) Limited,

Bela Vista Property Services Limited and The Waterside are not

associated with Basecity Investments Limited, Shun Tak Holdings

Limited or Hongkong Land Holdings Limited.

** Information listed refers to the remaining units and parking

spaces available for sale.

PORTFOLIO UPDATES

Divestment progress

Although the reopening of Macau's borders in December led to a

major revival of its tourism and gaming industries, investor

interest in high-end residential properties has remained

subdued.

The luxury residential segment faces a particularly challenging

environment due to a weaker-than-expected economic recovery in

China, high interest rates, and legacy anti-speculation policy

measures imposed by Macau's government before the pandemic period

that continue to dampen demand.

Nevertheless, Macau's demographics remain favourable. In

general, the territory's residents remain cash-rich with low levels

of personal debt. Furthermore, Macau's luxury residential

properties are currently at their lowest valuations in a decade,

both in absolute terms and on a relative basis compared with

neighbouring Hong Kong, Guangzhou and Shenzhen, and with other

regional markets such as Singapore.

During the financial year, while sales efforts at The Waterside

produced results amid headwinds, investor interest in Penha Heights

and The Fountainside remained muted.

The Waterside

The Waterside is the Company's flagship luxury residential

asset, located in a prime district on the Macau Peninsula.

The marketing strategy for The Waterside sales campaign has been

to seek out cash-rich buyers who intend to retain apartments for

their own long-term use, typically as primary residences or holiday

homes. Among the reasons these buyers cite for selecting The

Waterside are its attractive, central location on the Macau

Peninsula, its premium design, which offers the exclusivity of only

two units per floor, extensive clubhouse facilities, and the

availability of spacious, three-bedroom layouts.

Since the launch of The Waterside strata sales programme in Q2

2022, the Company has achieved total divestments of US$44.3 million

(HK$348 million) through the sale of 16 units to mainland Chinese,

Macau and Hong Kong investors.

The completion of 13 units occurred during the period under

review, while the remaining three units completed following the

Company's year-end. The 16 units were sold at an average value of

65% above cost, at approximately HK$8,800 (US$1,126) per square

foot of gross floor area, an average 8% discount to their latest

average valuations.

Following these transactions, 43 units remain available for

sale.

Among the remaining units at The Waterside, 46% of the units

were tenanted as at end-June 2023. Although this occupancy rate

reflects a 19% increase YoY, it is a combination effect of a 16%

increase in new leases and a 24% reduction in units available for

lease during the financial year. As a testament to the appeal of

The Waterside, rents have remained steady at an average monthly

rate of HK$17.02 per square foot, despite average rents in the

immediate vicinity falling 8.3% in Q1 2023. In addition, occupied

units yielding a steady rental stream are potentially more

attractive to prospective buyers.

The Fountainside

The Fountainside is a low-density, freehold residential

development in Macau's Penha Hill district. Of its original 42

units, all 36 standard units have been sold. Four villas and three

reconfigured apartments remain available for sale, as do two

car-parking spaces.

As previously reported, as market demand for affordable units

among small families and young individuals remains strong, The

Fountainside's original two duplexes have been reconfigured as

three smaller units, with on-site work having been completed in

2022. Occupancy permits from Macau's Land and Urban Construction

Bureau (DSSCU) for the three smaller units remain pending, delaying

the commencement of the sales and marketing campaign. The DSSCU

conducted its initial inspection of the reconfigured units only in

January 2023 and made requests for minor alterations to the final

drawings, which have since been submitted and approved.

The delays have been unfortunate, but the occupancy permits are

now finally expected to be issued at the end of 2023, allowing

sales to be progressed. Meanwhile, the divestment strategy for the

four villas is expected to generate increased investor interest as

we enter 2024.

Penha Heights

Penha Heights is a prestigious, five-storey, colonial-style

villa covering an area of more than 12,000 square feet, nestled

amid lush greenery atop Penha Hill, an exclusive and highly

desirable residential enclave. This trophy home, with its sweeping

bay views, has been immaculately maintained and enhanced through

works undertaken throughout the pandemic, ensuring it is at its

most attractive to prospective purchasers.

During the second half of 2022, despite the Manager's targeted

marketing efforts and implementation of various strategies to

divest the asset, including a sales and marketing drive with

specialist property agents, Macau's zero-COVID measures disrupted

on-site viewings, weighed on investor sentiment, and weakened the

appetite among ultra-high net worth individuals for homes in the

territory.

Since Macau's zero-COVID measures were lifted in early 2023,

marketing activity for the property has been stepped up. Real

estate market activity among ultra-high net worth individuals is

expected to increase as we enter 2024.

MACROECONOMIC OUTLOOK

ECONOMY

GDP Forecast

+58.9%

2023 full year

+20.6%

2024

Source: The International Monetary Fund (IMF)

Unemployment rate (local residents)

3.5%

-1.3pp YoY

Source: DSEC

TOURISM

Visitors from Mainland China

64%

2023 H1

Recovered to 53% of 2019 level

Visitors from Hong Kong

30%

2023 H1

Recovered to 93% of 2019 level

Visitors from Others Regions

6%

2023 H1

Recovered to 29% of 2019 level

GAMING

Mass Gaming

74%

2023 H1

+22pp vs. 2019

VIP Gaming

26%

2023 H1

-22pp vs. 2019

Gaming operator's commitment to non-gaming investment over 10

years

US$15 billion

A 180-degree turnaround, but full recovery only by late 2024

Macau maintained its zero-COVID policy in lockstep with mainland

China throughout 2022, deploying strict dynamic zero-COVID

measures, including travel restrictions, lockdowns and closures of

non-essential businesses. A rapid reversal of those measures in

late December 2022 marked an abrupt exit from this uncompromising

approach.

By then, the three years of strict public health measures had

taken their toll on the economy. Macau's economy bottomed out with

a sharp decline of 27% in gross domestic product in 2022. This had

a spillover effect on all parts of the economy, including

property.

By contrast, H1 2023 saw a 180-degree turnaround in Macau's

economic performance, with the lifting of all zero-COVID

restrictions by January. Fuelled by tourism and gaming activity, in

H1 2023, GDP grew 71.5% YoY to reach approximately 71% of H1 2019

levels. The economic recovery had also reduced unemployment among

local residents to 3.5% in Q2 2023, compared to 4.8% in the same

period in 2022.

The Economist Intelligence Unit (EIU) expects Macau's economy to

return to its pre-pandemic size only in late 2024 due to the extent

of the shocks it suffered during 2020-22. That projection is ahead

of previous forecasts, which were for a full recovery only by early

2025, although the EIU also expects Macau's growth to moderate amid

China's recent slowing economic activity.

Tourism boom in H1 2023

Since the lifting of travel restrictions in January 2023,

visitor numbers have rebounded and totalled approximately 11.6

million visitors in the first half of 2022 - around 60% of

pre-pandemic tourist arrivals in 2019, and a stark contrast with

the 5.7 million visitors throughout the whole of 2022, a threshold

that was surpassed by April 2023.

Tourists from mainland China continue to account for the bulk of

visitors to Macau, at approximately 55% of 2019's numbers. By

contrast, the number of visitors from Hong Kong has reached 90% of

pre-pandemic levels. Visitor arrivals from elsewhere, however, have

recovered to only 30% of pre-pandemic levels due to the lead time

and resources required by airlines to restore international

connectivity to Macau, although numbers are expected to improve in

the second half of 2023.

With the opening of several new hotel properties, Macau's hotel

room supply has increased by 5,000 units compared to pre-pandemic

levels, with 47,000 rooms throughout the territory at the end of H1

2023. The hotel occupancy rate in H1 2023 was 82%, an improvement

of 42% YoY while average room rates leapt 58% to MPO1,247 (US$156),

an indication of the heightened demand. Nevertheless, a shortage of

labour remains, which has impacted the tourism industry's efforts

to scale up further.

Stability and recovery in the gaming sector

Macau's gaming operators endured an immensely difficult

operating environment during the pandemic, marked by low revenues,

unprecedented temporary casino closures, uncertainties over licence

renewals, and a crackdown on junket operators. Gross gaming revenue

(GGR) for 2022 stood at a dismal 14% of 2019's pre-pandemic figure.

Nevertheless, in H2 2022, industry players welcomed the

government's announcement of the renewal of all six licences for a

further 10 years, ushering in a period of greater stability and

certainty for the gaming industry.

The lifting of travel restrictions at the beginning of 2023 has

enabled GGR to grow rapidly, and in May and June 2023, gaming

revenues had recovered to approximately 64% of 2019 levels.

Analysts expect GGR to reach more than 60% of 2019's levels by

end-2023, but a full recovery is expected only in 2024. However,

given the dominance of the more profitable premium mass-market and

mass-market gaming segments following the demise of the junket

business, gaming operators are currently enjoying unprecedented

operating margins.

In addition, guided by the government's expectation that gaming

operators focus on diversification in expanding non-gaming tourism

and attracting customers from outside the region immediately

surrounding Macau, operators have committed to collectively

investing US$15 billion over their concession periods, of which 90%

is to be spent on non-gaming activities such as the conventions and

exhibitions business, entertainment and performances, sports

events, culture, art, healthcare and theme parks. They will also be

required to make further non-gaming investments for every year that

GGR exceeds an annual threshold of US$22.4 billion. In the long

term, this is likely to reduce Macau's dependency on gaming

revenues while also attracting a wider range of tourists.

PROPERTY MARKET OVERVIEW

Residential property volumes slowly recovering

With zero-COVID measures in place in H2 2022, sales of

residential properties declined 51% YoY to 1,318 units, according

to Macau's Financial Services Bureau. Residential prices also fell,

with the average price per square foot measured by gross floor area

dropping 4% YoY to HK$6,160 (US$787). During full-year 2022, a

total of 2,950 units were transacted, a decline of 51% YoY, marking

the territory's worst year for residential sales in two

decades.

In H1 2023, the residential property market appears to be slowly

recovering from this trough level. For 2023, available data until

June indicates that a total of 1,793 residential properties were

transacted, an increase of 10% YoY but still 54% lower than the

corresponding period in 2019. Price data available for H1 2023

indicates an increase of 2% YoY to HK$5,919 per square foot of

gross floor area, 14% lower than the corresponding quarter in

2019.

Luxury residential segment continues to face challenges

In the luxury residential segment, for units above 150 square

metres, just 85 sales were recorded in H1 2023, an increase of 8%

YoY and 2% higher than the corresponding quarter in 2019. In Q2,

prices for units above 150 square metres averaged HK$6,033 per

square foot, an increase of 7% YoY but 9% lower than Q2 2019

prices.

In July 2023, the Monetary Authority of Macau announced a

further increase in the prime lending rate, resulting in the base

rate reaching 5.75%. Its decision was in alignment with similar

interest rate hikes by the Hong Kong Monetary Authority and the

United States Federal Reserve. This interest rate hike - the 11th

since March 2022 - marks a 15-year high for Macau's base rate.

The high interest rate environment has added to the challenges

the luxury residential segment faces, driving potential investors

to seek increased yields when considering investment opportunities,

or to seek price reductions to compensate for lower expected

returns. But sellers are also exhibiting strong holding power, with

many reluctant to accept lower prices at a time when the tourism

sector is seeing such a strong rebound. The depreciation of the

Chinese yuan, which is currently at a 15 year low versus the US

dollar, has also dampened potential investor interest from mainland

China.

In addition, measures taken by the Macau government to curb real

estate speculation have a weighed heavily on the sector since the

pre-pandemic era. These include additional ad valorem stamp duty of

up to 20% if a property is resold within two years of purchase,

buyer's stamp duty of 10% for properties purchased by companies or

non-residents, and an additional stamp duty of up to 10% for those

owning more than one residential property. The residential mortgage

lending ratio for buyers, which was tightened in 2018, has resulted

in maximum financing levels of only 40-50% of purchase prices for

properties valued at more than MOP8 million (approximately US$1

million), which affects all the properties in the Company's

portfolio.

China's property woes have dampened investor sentiment

China's current difficulties, with its slowing economic growth

and troubled property sector, have dampened investor interest in

Macau real estate. In Q2 2023, China's economy expanded 6.3% YoY,

falling short of market expectations, weighed down by tepid export

demand and declining property prices. On a quarter-on-quarter

basis, growth slowed to 0.8% in Q2 2023 from 2.2% in the first

quarter.

The property sector in China is also facing a crisis resulting

from the lingering effects of the pandemic slowdown, a housing

market that depended on debt and pre-sales to fund construction, a

borrowing cap imposed by the government in 2020, and ensuing cash

crunches and debt defaults at several property giants. Despite the

lifting of zero-COVID restrictions, China's property market has

failed to sustain a rebound in sales, deepening the sector's

woes.

As real estate accounts for approximately one-quarter of China's

economy, the government has announced several policy measures to

aid property developers by boosting consumer demand. However, it is

uncertain whether these measures, which fall short of constituting

a clear stimulus package, will provide the necessary relief for the

ailing industry. More than US$100 billion of Chinese property bonds

have defaulted over the past two-and-a-half years, creating a

spillover effect on high net worth individuals in Macau, who have

seen a portion of their capital vanish.

LOOKING AHEAD

Macau's economy appears to be on a path to recovery, but

economic growth has been concentrated in the tourism and gaming

industries, with the property market continuing to face a unique

set of challenges; a deteriorating Chinese economy, high interest

rates, and Macau's outdated anti-speculation property measures.

Collectively, these have adversely impacted market sentiment,

limiting the progress of the Company's divestment programme.

Although a sustained improvement in investor sentiment and a

recovery in mainland China will most likely be required for the

Company to realise the full potential value of its portfolio, MPO's

assets remain among the most sought-after in Macau. The Manager

will continue to act decisively to identify potential pockets of

interest among investors through a wide range of marketing

initiatives with the aim of returning capital to shareholders as

soon as possible.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT

1 About this report

This ESG report has been prepared with reference to the Ten

Principles of the United Nations Global Compact (UNGC). The report

elaborates the environmental and social responsibility measures and

the related performance of Macau Property Opportunities Fund

Limited.

1.1 Company core business

The Company is in the process of an orderly and managed

divestment of its three remaining portfolio properties. No new

construction or development activities will be undertaken aside

from a limited reconfiguration at The Fountainside.

The Company is focused on and exposed solely to the high-end

residential property market in Macau. It has never had any exposure

to any property or other investments in the gaming or associated

hospitality sectors, and each investment is in full compliance with

the parameters set out in the Company's prospectus.

1.2 Report boundary

The ESG report focuses on the environmental and social

responsibility performance of the Company's core business of

investment in properties in Macau, as listed below:

-- The Waterside

-- The Fountainside

-- Penha Heights

1.3 Overall ESG approach

The Board understands the significance of ESG and has

incorporated ESG-related risks into the Company's risk management

processes. The Company's overall ESG approach is aimed at

generating returns for shareholders in a responsible manner while

taking into consideration environmental and social responsibility

and supply chain management.

The Company's ESG approach has been developed based on the Ten

Principles of UNGC. The UNGC is a voluntary, multi-stakeholder

platform that convenes multinational companies to align with The

Ten Principles relating to human rights, labour, the environment

and anti-corruption standards. The Board is committed to the basic

concepts of fairness, honesty and respect for people and the

environment in its business activities.

2 Environment

2.1 Commitment principle

The Company aims at all times to adopt environment-friendly

practices in its business operations to minimise any potential

negative impacts on the environment and natural resources. It

complies strictly with all applicable environmental laws and

regulations in Macau. Different environmental protection measures

have been implemented at key stages of property development,

alongside the incorporation of green building designs and the

implementation of responsible construction practices at work sites.

The Company also upholds the principles of recycling and reuse at

its properties.

2.2 Initiatives and performance

Property design

The Company follows local green building requirements that take

into consideration green design principles relating to project

elements such as building materials, indoor air quality, site

selection and energy use. Examples of green building designs and

features are as follows:

- preservation and retention of cultural heritage such as façades of historic buildings;

- incorporation of passive building designs to improve ventilation and optimise natural light;

- use of water-efficient fixtures; and

- greening of rooftops.

Indoor air quality is improved through the introduction of air

purifying equipment. Measures for monitoring temperature and

humidity in residential units and thus enhancing living conditions

for residents have been implemented at One Central and The

Fountainside.

Property management

Various green measures have been adopted at our properties to

improve overall environmental performance, for example:

- Energy efficiency: Energy consumption has been reduced by (i)

replacing incandescent, halogen and fluorescent lighting with LED

lighting, (ii) reducing the amount of lighting used in common

areas, and (iii) installing air-conditioning systems with

energy-efficiency labelling, in accordance with local

requirements.

- Resident engagement: Residents are encouraged to minimise

their consumption of electricity, water and materials, and are

provided with recycling facilities to reduce waste.

- Rechargeable battery recycling: Collection points for

rechargeable battery recycling have been provided, and tenants are

encouraged to use these facilities for battery disposal. Certain

materials in rechargeable batteries, such as cadmium, are hazardous

to human health and the environment.

An effective environmental management system has been

implemented. Some of the Company's main environmental objectives in

its property management activities are as follows:

- using pesticides and cleansing agents in accordance with

relevant regulations, and aiming for zero adverse incidents

involving their use and storage; and

- managing community wastewater, waste and noise according to local standards.

Regulatory compliance

The Company is not aware of any non-compliance with

environmental regulatory requirements that may significantly impact

its business.

2.3 Climate risk

We have considered climate risk and concluded that there is no

material impact on the Annual Report.

3 Social responsibility and supply chain management

The Company strongly believes that quality property is a pathway

to quality living. It strives to provide a quality property

experience through innovation and sensitivity, and by operating

with integrity. Through such efforts, its aim is to enhance

residents' quality of life and become their trusted partner.

3.1 Supply chain management

During the process of property construction and redevelopment,

the Company carefully appoints external contractors by taking into

consideration factors such as human rights protection,

non-discrimination in employment and occupation, environmental

protection, construction safety and product safety. When selecting

contractors for property construction, the Company seeks

contractors that are familiar with environmental, social and safety

requirements, and which are committed to the abolition of child

labour and corruption. The Company maintains close relations with

contractors relating to all construction and sourcing activities,

holding regular meetings to facilitate two-way communication. It

also performs regular assessments of contractors based on

environmental and social risk considerations.

3.2 Quality services

To ensure consistently high quality in its property management

services, the Company aims to:

- develop quality properties that embrace innovation and enhance their locales;

- provide committed service and improve its property management offering on an ongoing basis;

- achieve high standards by through rigorous property management

practices to maximise customer satisfaction; and

- provide a tasteful living environment for residents.

3.3 Protection of privacy

To ensure residents' wellbeing, regular communication is

maintained through satisfaction surveys that help to identify

potential areas for improvement. Residents' identities are kept

confidential and access to information gathered is restricted.

Regulatory Compliance

The Company is not aware of any non-compliance with supply chain

management regulations that may significantly impact its

business.

4 Human rights and labour

The Company strongly believes that businesses should support and

respect the protection of internationally recognised human

rights.

4.1 Gender Equality and Diversity

To ensure that we have an equitable platform to perform, the

Company aims to:

- ensure the hiring process is performance-based despite gender;

- ensure there is diverse gender representation at all levels of

the Company (as of June 2023, one of our three board members is

female); and

- ensure our service providers embrace diversity in their workforces.

ABBREVIATIONS AND ACRONYMS

IMF INTERNATIONAL MONETARY FUND

DSEC STATISTICS AND CENSUS SERVICE (MACAU)

-------------------------------------------------

DICJ GAMING INSPECTION AND COORDINATION BUREAU (MACAU)

-------------------------------------------------

DSF FINANCIAL SERVICES BUREAU (MACAU)

-------------------------------------------------

MICE MEETINGS, INCENTIVES, CONFERENCES AND EXHIBITIONS

-------------------------------------------------

Manager and Adviser

Sniper Capital

Manager Investment Adviser

Sniper Capital Limited Sniper Capital (Macau) Limited

--------------------------------------------------------------------------------------------------------

Research & Transaction Project Development Asset Management Corporate Communications Finance & Administration

* Macro & micro analysis * Consultant appointment & coordination * Property & estate management * Investor & media relations * Administration & accounting

* Forecasting & modelling * Project monitoring & reporting * Sales & leasing * Marketing & product positioning * Compliance & reporting

* Sourcing * Project delivery & handover * Facilities management * Statutory & regulatory communication * Cash management & treasury

* Due diligence * Asset value enhancement

* Divestment

-------------------------------------------- ------------------------------------- ------------------------------------------- ----------------------------------

Manager

The day-to-day responsibility for the management of the Macau

Property Opportunities Fund's ("MPOF", "Company" or "Group")

portfolio rests with Sniper Capital Limited.

Founded in 2004, Sniper Capital Limited focuses on capital

growth from carefully selected investment, development and

redevelopment opportunities in niche and undervalued property

markets.

Sniper Capital Limited's team of over 25 professionals covers

all the required investment and development disciplines, including

research, site acquisition, project development, asset management,

divestment, investor relations and finance.

Working closely with Headland Developments Limited and Bela

Vista Property Services Limited, Sniper Capital Limited ensures

that all necessary project management skills and services are

provided in a way that will deliver each MPOF project to the right

standards and on budget.

With its 29 August 2023 holding of 12.08 million shares or

19.54% of the Company's issued share capital, Sniper Investments

Limited - an investment vehicle associated with Sniper Capital

Limited - is the largest shareholder in MPOF, which bears witness

to Sniper Capital Limited's belief in the Company.

The Manager is committed to the full disposal of the Company's

Portfolio within the current expected timeline while striving to

return maximum possible values to shareholders.

Adviser

The Company's Board of Directors and Manager are advised by

Sniper Capital (Macau) Limited, which has a highly developed

network of contacts and associates spanning Macau's financial and

business community.

The Investment Adviser's brief is to source, analyse and

recommend potential divestment opportunities, whilst providing the

Board with property investment and management advisory services in

relation to the Company's real estate assets.

For more information, please visit www.snipercapital.com

Investment Policy

The Company is managed with the objective of realising the value

of all remaining assets in the portfolio, individually, in

aggregate or in any other combination of disposals or transaction

structures, in a prudent manner consistent with the principles of

sound investment management with a view to making an orderly return

of capital to shareholders at the earliest opportunity.

The Company may sell or otherwise realise its investments

(including individually, or in aggregate or other combinations) to

such persons as it chooses, but in all cases with the objective of

achieving the best exit values reasonably available within shortest

acceptable time scales.

The Company has ceased to make any new investments and will not

undertake additional borrowing other than to refinance existing

borrowing or for short-term working capital purposes.

Any net cash received by the Company after discharging any

relevant loans as part of the realisation process will be held by

the Company as cash on deposit and/or as cash equivalents prior to

its distribution to shareholders.

The Company's Articles of Incorporation do not contain any

restriction on borrowings.

DIRECTORS' REPORT

The Directors present their report and audited financial

statements of the Group for the year ended 30 June 2023. This

Directors' report should be read together with Corporate Governance

Report.

Principal activities

Macau Property Opportunities Fund Limited (the "Company") is a

Guernsey-registered closed-ended investment fund traded on the

London Stock Exchange (the "LSE"). Following the passing of all

resolutions at the Extraordinary General Meeting held on 28 June

2010, the Company's shares obtained a Premium Listing on the LSE

Main Market on 30 June 2010.

The Company is an authorised entity under the Authorised

Closed-Ended Investment Schemes Rules and Guidance, 2021 and is

regulated by the Guernsey Financial Services Commission ("GFSC").

During the year, the principal activities of the Company and its

subsidiaries as listed in Note 4 to the Consolidated Financial

Statements (together referred to as the "Group") were property

investment in Macau.

Business review

A review of the business during the year, together with likely

future developments, is contained in the Chairman's Message on and

in the Manager's Report.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

are set out in the Manager's Report. The financial position of the

Group, its cash flows and its liquidity position are described in

the Capital Management section of the Manager's Report.

The financial risk management objectives and policies of the

Group and the exposure of the Group to credit risk, market risk and

liquidity risk are discussed in Note 2 to the Consolidated

Financial Statements.

In accordance with provision 30 of the 2018 revision of the UK

Corporate Governance Code, (the "UK Code"), and as a fundamental

principle of the preparation of financial statements in accordance

with IFRS, the Directors have assessed as to whether the Company

will continue in existence as a going concern for a period of at

least 12 months from signing of the financial statements, which

contemplates continuity of operations and the realisation of assets

and settlement of liabilities occurring in the ordinary course of

business.

The financial statements have been prepared on a going concern

basis for the reasons set out below and as the Directors, with

recommendation from the Audit and Risk Committee, have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the next twelve months after date of

approval of the Annual Report.

In reaching its conclusion, the Board have considered the risks

that could impact the Group's liquidity over the period to 30

September 2024. This period represents the period of at least 12

months from the date of signing of the Annual Report.

As part of their assessment the Audit and Risk Committee

highlighted the following key considerations:

1. Whether the Group can repay or refinance its loan facilities

to discharge its liabilities over the period to 30 September

2024

2. Extension of life of the Company

1. Whether the Group can repay or refinance its loan facilities

to discharge its liabilities over the period to 30 September

2024

As at 30 June 2023, the Group has major debt obligations to

settle during the going concern period being:

i) principal repayments for The Waterside loan facility of

approximately US$7.7 million, US$9.6 million and US$11.5 million

due for settlement in September 2023, March 2024 and September

2024, respectively;

ii) principal repayments for The Fountainside loan facility of

approximately US$1.9 million and US$3.7 million due for settlement

in September 2023 and March 2024, respectively;

iii) principal repayments for the Penha Heights Tai Fung Bank

loan facility of approximately US$1.6 million due for settlement in

quarterly instalment of US$318,900; and

iv) principal repayments for the Penha Heights BCM loan facility

of approximately US$0.4 million and US$7.6 million due for

settlement in September 2023 and December 2023, respectively.

The Fountainside US$1.9 million loan repayment due in September

has been settled in full. The Waterside US$7.7 million loan

repayment due in September 2023 has been partially settled in the

amount of US$4.4 million, with the remaining balance to be settled

upon completion of a confirmed sale as agreed with the lender. By

reference to the Company's comprehensive working capital

projections, it is anticipated that the remaining debt obligations

that are due over the going concern period would be settled from

sales proceeds that are to be generated from the ongoing

divestments of remaining units in The Waterside and The

Fountainside. The Board has considered stress-tested scenarios

which indicated that a conservative, modest sales programme would

provide sufficient working capital.

The Company has agreed in principle with lenders of the banking

facilities for Penha Heights to defer principal repayments that are

due in September and December 2023. The loan facility with BCM is

to be extended to mature in March 2025. As a result, the loan

repayments for the two Penha Heights facilities that would then

become due over the going concern period are reduced from US$9.7

million to approximately US$1.7 million. It is anticipated that

this US$1.7 million debt obligation would be settled from the sales

proceeds from The Waterside and The Fountainside units, in the

event that Penha Heights is not disposed of during the period.

The Manager is responsible for maintaining relationships with

the Group's lenders, monitoring loan terms and covenants to ensure

compliance, and reporting to the Board on regular basis for all key

matters arising. Throughout the year ended 30 June 2023 and up to

the financial statements issuance date, the Group has been in

compliance with all loan covenants. Over the years, the Manager

always maintains proactive dialogue with the lenders and in turn

receives their strong support to the Group, even during the very

challenging market environment amid the prolonged COVID period.

Post COVID, the existing lenders continue to indicate their support

for the Group as well as the underlying properties. Further, the

upcoming debt servicing obligations over the going concern period

are expected to be met by sales proceeds. Meanwhile, the Manager

has also started to explore financing options with other banks as

part of its contingency planning. Based on the Manager's proven

track record in executing property sales and managing lender

relationships, the Board is confident that the Group will be able

to meet its debt obligations during the going concern period

provided the sales velocity can be maintained.

Notwithstanding the above, given that it remains uncertain that

adequate proceeds could be generated from sales of properties to

settle payment obligations over the going concern period, and given

that any necessary refinancing of debt obligations would still be

subjected to lenders' approval, the Directors consider that there

is a material uncertainty that may cast significant doubt over the

Group's and Company's ability to continue as a going concern.

2. Extension of life of the Company

After the Ordinary Resolution was passed by an overwhelming

majority at the Annual General Meeting ("AGM") of the Company in

its 2022 AGM to extend the Fund's life until 31 December 2023, the

Directors assessed the impact of the Continuation Vote on the

Fund's ability to continue as a going concern. The Directors have

also considered the going concern assumption outside the primary

going concern horizon.

In line with Article 38 of the Articles of Incorporation, the

Company will put forward a resolution for its continuation at the

next AGM (to be held before 31 December 2023). If any continuation

resolution is not passed, the Directors are required to formulate

proposals to be put to Members to reorganise, unitise, reconstruct

or wind up the Company.

The Directors anticipate receiving continuation support from

major shareholders and note that 50% of shareholder support is

required to ensure continuation. The Board and the Company's broker

maintain ongoing communication with shareholders and the feedback

regarding the Continuation Vote is broadly positive. It is likely

that returns from the sale of properties would be significantly

lower if the Fund was forced to sell under some form of fire sale

arrangement as a result of a failed Continuation Vote and it is

therefore commercially sensible for the Fund to continue in

business.

Given that the Continuation Vote has not taken place at the date

of issue of the financial statements, the Directors consider that

there is a material uncertainty related to events or conditions

that may cast significant doubt over the Company's ability to

continue as a going concern and, therefore, that it may be unable

to realise assets and discharge liabilities in the normal course of

business.

Going Concern Conclusion

After careful consideration and based on the reasons outlined

above, including the Manager's continuing dialogue with lenders and

shareholders, whilst there is material uncertainty related to going

concern, the Board have a reasonable expectation that the Company

will continue in existence as a going concern for 12 months from

the date of signing the Annual report. They are therefore satisfied

that it is appropriate to adopt the going concern basis in

preparing the financial statements.

Viability Statement

The Board has carried out a robust assessment of the principal

risks facing the Company, including those that would threaten its

business model, future performance, solvency and liquidity. The

Directors consider each of the Company's principal risks and

uncertainties, during the quarterly Board meetings, supported by

the twice monthly reporting from the Manager. The Directors also

considered the Company's policy for monitoring, managing and

mitigating its exposure to these risks and the impact on the

Company's operations. This assessment involved an evaluation of the

potential impact on the Company of these risks occurring. Where

appropriate, the Company's financial model was subject to a

sensitivity analysis involving flexing a number of key assumptions

in the underlying financial forecasts in order to analyse the

effect on the Company's net cash flows and other key financial

ratios. A base case and adverse scenario where projections

calculated based upon flexing these key assumptions had both

resulted in positive cash held balances throughout the two-year

projection period with ending cash balances of over US$2 million

under both scenarios. The Board expects the payments obligation of

the loan facilities which will be due within the next 12 months

will be repaid while the Company continues to comply with the loan

covenants and that the Company's life will be further extended at

the 2023 AGM.

In accordance with provision 31 of the 2018 revision of the UK

Code, the Directors have assessed the prospects of the Company over

a longer period than the 12 months required by the going concern