TIDMMPO

RNS Number : 0161A

Macau Property Opportunities Fund

31 January 2022

31 January 2022

Macau Property Opportunities Fund Limited

("MPO" or the "Company")

Investor Update

Second Half 2021

Key Data

Inception date 5 June 2006

Exchange London Stock Exchange

---------------------- ----------------------

Domicile Guernsey

---------------------- ----------------------

Market capitalisation GBP29.2 million

---------------------- ----------------------

Portfolio valuation US$262.9 million(1) -0.4%

(vs 30 June 2021)

---------------------- ----------------------

Adjusted NAV US$126.1 million(1)

---------------------- ----------------------

Adjusted NAV per share US$2.04(1) /151p(2) -3.1%

(vs 30 June 2021)

---------------------- ----------------------

Share price 47.3p -29.9%

(vs 30 June 2021)

---------------------- ----------------------

Discount to Adjusted 68.7% 55.6%

NAV

(as at 30 June 2021)

---------------------- ----------------------

Cash balance US$9.7 million(1)

---------------------- ----------------------

Total debt US$134.7 million(1)

---------------------- ----------------------

Loan-to-Value ratio 49.4%(1)

---------------------- ----------------------

([1]) As at 30 September 2021.

(2) Based on a US$/GBP exchange rate of 1.3503318 as at 31

December 2021.

All other data are as at 31 December 2021.

Summary

Macau's economy grew 27.5% in Q1-Q3 2021, but overall sentiment

remained weak as the territory's zero-COVID strategy adversely

impacted the gaming and tourism sectors. The gaming industry was

buoyed by the announcement of the draft new gaming bill which set

out the key parameters for licensing and alleviated long-standing

uncertainty within the industry.

Portfolio

Macau's economy showed some improvement in Q3, but the luxury

segment of the residential property market remained quiet. The

determined pursuit of a zero-COVID strategy across mainland China,

Macau and Hong Kong has resulted in lockdowns of cities as a

primary public health tool. This has delayed the launch of the

travel bubble with Hong Kong, and has, alongside government

mortgage caps, continued to adversely weigh on sentiment.

We thank our Shareholders for their continued support at the

recent Annual Meeting and for the extension of the Company's life

during this challenging period.

The Waterside

The Waterside is MPO's flagship asset, comprising 59 luxury

apartments with commanding views of downtown Macau. At the end of

2021, 30% of The Waterside's apartments were occupied, yielding an

average monthly rental of US$2.3 per square foot.

Leasing demand for luxury property in Macau remains subdued due

to ongoing travel restrictions. COVID-19 outbreaks and three rounds

of citywide COVID testing in H2 2021 have also impacted sentiment.

While market conditions have challenged efforts to secure an

en-bloc sale of the property, there remains active investor

interest in this direction. We are reviewing the divestment

strategy against the market developments while engaging potential

buyers. Each apartment has a separate strata title.

The Fountainside

The Fountainside is a residential development in the Penha Hill

district that originally comprised 42 homes and 30 car-parking

spaces. The sale of the last remaining standard-type unit was

completed for HK$11.8 million (US$1.5 million, in line with its

latest valuation) in August 2021, bringing to an end the divestment

of all 36 standard units at the property.

In the remaining six units, reconfiguration work on the two

duplex units has commenced and is expected to be largely completed

in Q1 2022. This will result in the availability of three new units

and two new parking spaces for sale, with marketing expected to

commence in February following the Chinese New Year. We are also

continuing to market the property's four villas.

Penha Heights

Penha Heights is a prestigious, colonial-style villa atop Penha

Hill. Despite increased sales and marketing efforts, the potential

pool of buyers remains limited, a situation that will persist as

long as travel restrictions continue to inhibit viewings of the

property by potential investors from outside Macau. We will

continue to work with specialist agents to explore all possible

channels for an optimal exit from the asset.

Macau

COVID-19 containment - a successful management of the

pandemic

Macau's official COVID-19 case numbers remain remarkably low, at

total of 79, despite the emergence of the highly transmissible

Delta and Omicron variants that prompted closure of non-gaming

entertainment and leisure outlets and tightening of travel

restrictions. Follow-on citywide COVID testing on three occasions

confirmed that community infections were minimal and contained.

Nevertheless, these measures fostered an unprecedented level of

uncertainty in Macau's economy, with its main drivers - tourism and

gaming - among the sectors most affected.

As of the end of 2021, around 75% of Macau's population had been

fully vaccinated against the virus, and around 80% had received at

least one vaccine dose. Booster shots have also been available

since early November.

Economy - growth hit by zero-COVID strategy and termination of

junket operations

During the first three quarters of the year, GDP grew by 27.5%

YoY. Amid economic uncertainties, in October the International

Monetary Fund cut its full-year growth forecast for Macau to 20.4%

YoY, a sharp drop from its growth forecast of 61% issued in April.

This change reflects the adverse externally influenced factors

affecting Macau's economy which significantly altered the outlook

from that which was expected earlier in 2021. The numbers may be

revised further with the termination of junket operations as VIP

gaming contributes to 30% of Macau's gross gaming revenue.

Policy Address - further integration into the Greater Bay

Area

Macau Chief Executive Ho Iat Seng delivered his annual Policy

Address in November. He outlined the policies of mainland China,

including the diversification of Macau's economy to integrate with

the Greater Bay Area. Brief comments were made on the new framework

for the gaming industry emphasising the need to improve oversight

of gaming activities.

Tourism - an erratic recovery

With disruptions caused by the Delta and Omicron COVID variants,

Macau tourism operators were particularly disappointed as the

reopening of Hong Kong's borders with mainland China and Macau was

shelved yet again following local transmissions of the Omicron

variant in Hong Kong.

Macau welcomed a total of 6.9 million visitors from January to

November 2021, up 31% YoY. During the period from January to

October, the total number of guests in hotels and guesthouses was

94% higher YoY despite occasions of mass cancellation of travel

plans following the discovery of local COVID cases in Macau and

mainland China. The year ended on a high note as festivities drew

over 40,000 visitors on Christmas Eve.

Gaming - details of new gaming law announced

Gross gaming revenue (GGR) increased 44% YoY to MOP87 billion

(c.US$11 billion) in 2021, but was still less than a third of the

MOP292 billion (c.US$36 billion) reported in 2019 before the

pandemic. GGR in October and November was affected by travel

restrictions that saw tourist numbers plummet during the Golden

Week holiday.

Industry sentiment was also impacted by the escalation of the

mainland Chinese government's efforts to crack down on suspicions

of money laundering and capital flight. The chief executive of

Macau's largest junket operator was arrested, and regulatory orders

were subsequently issued for junket operators to stop providing

credit to clients.

While the VIP gaming segment had been in decline for several

years due to tightened regulations, the growth of the premium mass

market has been the industry sweet spot with the expansion of

China's middle class and their demands for memorable

experiences.

On a positive note, the industry's most pressing concerns over

the new gaming laws have been somewhat allayed by the announcement

of the results of the public consultation and government's

responses. The main features of the new licensing regime include a

maximum of six gaming concessions for 10 years with the potential

to extend for a further three years. Earlier government proposals

to increase gaming taxes, appoint delegates to the boards of

concessionaires and to approve dividend payouts were dropped.

Although the draft bill may be amended as it passes through the

legislature, industry players and analysts have commented

positively on the transparency of the public consultation and the

clarifications provided by the government.

Property

Impacted by renewed concerns over COVID created by the outbreaks

and mass testing, Macau's residential property market remained

relatively quiet in Q3 2021, with a total of 1,500 transactions - a

decline of 15% YoY. The luxury end of the market remained stagnant,

affected by external factors and muted by current sentiment.

Overall, prices rose slightly to an average of US$1,170 per square

foot - an increase of 0.76% YoY. For the first 11 months of the

year, a total of 5,557 residential units were transacted, down 6%

YoY. First-time buyers accounted for 83% of all transactions,

second time buyers accounted for 14%, and the remaining 3% were

buyers purchasing residential properties for at least the third

time.

Within the Greater Bay Area, luxury home sales in Hong Kong

appear to be en route to a new record high this year. The value of

transactions involving properties worth more than HK$100 million

(US$12.8 million) in the first 11 months of the year reached

HK$46.4 billion (US$5.95 billion), 60% higher than the total value

for full-year 2020. The figure is remarkable, given that Hong

Kong's borders have been closed throughout the pandemic. The boom

has been fuelled largely by "IPO billionaires" - founders of

Chinese companies recently listed on Hong Kong's stock

exchange.

Given Macau's track record on public health, alongside

infrastructure and connectivity improvements, investors may look to

the territory's luxury property market, prices of which are

considered to be at a five-year lows, as they return to the Greater

Bay Area and economic activity in the region resumes more

fully.

Outlook

Macau and mainland China are maintaining a stringent zero-COVID

policy that is expected to remain in place for some time and at

least until the end of the Winter Olympics in Beijing. Macau's

economy will nevertheless be vulnerable to disruption by COVID

outbreaks on the Chinese mainland and locally, as seen in H2 2021,

and more recently in January 2022, with a 14-day ban on

international flights to Macau aimed at curbing the spread of the

Omicron variant.

The Macau government has warned that the economic conditions are

expected to remain challenging in 2022 and a recovery from the

pandemic will take time. It has consistently outlined specific

plans for Macau's role within the Greater Bay Area to diversify

Macau's economy away from gaming and turn the territory into a

technology and tourism hub. Although the plan is still in its early

stages, the potential for the property market to gain is clear.

Fitch Ratings expects Macau's GGR to pick up in 2022,

particularly when the travel bubble with Hong Kong goes into

operation to boost the gaming and tourism industry and contribute

to a potential spill over into the retail and the property sectors.

The Macao Government Tourism Office had also predicted that the

border reopening together with the resumption of the e-visa

programme with mainland China may boost visitation to Macau to 10

million arrivals in 2022.

Restrictions on travellers from other countries will, however,

limit the number of potential buyers of the Company's properties

and continue to disrupt the Company's divestment plan. We will

continue to pursue the divestment of the remaining assets on

acceptable terms within current market conditions. A return of

capital to shareholders in the shortest possible timeframe remains

the primary objective.

- End -

About Macau Property Opportunities Fund

Macau Property Opportunities Fund Limited is a closed-end

investment company registered in Guernsey and is the only quoted

property fund dedicated to investing in Macau, the world's largest

gaming market and the only city in China where gaming is

legalised.

The Company is premium listed on the London Stock Exchange.

Launched in 2006, the Company targets strategic property

investment and development opportunities in Macau. Its portfolio of

property assets was valued at US$262.9 million as at 30 September

2021.

www.mpofund.com

About Sniper Capital Limited

The Company is managed by Sniper Capital Limited, an Asia-based

property investment manager with an established track record in

fund management and investment advisory.

For further information

Investor Relations

Sniper Capital Limited

Tel: +852 2292 6789

info@snipercapital.com

www.snipercapital.com

Corporate Broker

Liberum Capital

Darren Vickers / Owen Matthews

Tel: +44 20 3100 2234

Company Secretary & Administrator

Ocorian Administration (Guernsey) Limited

Kevin Smith

Tel: +44 14 8174 2742

Stock Code

London Stock Exchange: MPO

LEI

213800NOAO11OWIMLR72

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUBKFBKBBKDCDB

(END) Dow Jones Newswires

January 31, 2022 01:59 ET (06:59 GMT)

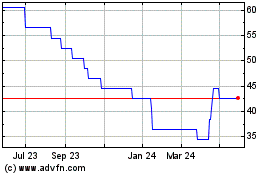

Macau Property Opportuni... (AQSE:MPO.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

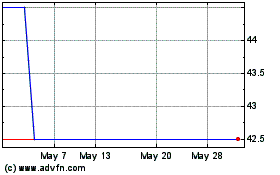

Macau Property Opportuni... (AQSE:MPO.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024