TIDMMPO

RNS Number : 1924G

Macau Property Opportunities Fund

23 July 2021

23 July 2021

Macau Property Opportunities Fund Limited

("MPO" or the "Company")

Investor Update

First Half 2021

Key Data

Inception date 5 June 2006

Exchange London Stock Exchange

---------------------- -----------------------

Domicile Guernsey

---------------------- -----------------------

Market capitalisation GBP41.7 million

---------------------- -----------------------

Portfolio valuation US$265.1 million(1) -0.3%

(vs 31 December 2020)

---------------------- -----------------------

Adjusted NAV US$130.1 million(1) -1.6%

(vs 31 December 2020)

---------------------- -----------------------

Adjusted NAV per share US$2.10(1) /152p(2)

---------------------- -----------------------

Share price 67.50p -2.5%

(vs 31 December

2020)

---------------------- -----------------------

Discount to Adjusted 55.6% 56.7%

NAV

(as at 31 December

2020)

---------------------- -----------------------

Cash balance US$13.0 million(1)

---------------------- -----------------------

Total debt US$136.5 million(1)

---------------------- -----------------------

Loan-to-Value ratio 49.1%(1)

---------------------- -----------------------

([1]) As at 31 March 2021.

(2) Based on a US$/GBP exchange rate of 1.38565 as at 30 June

2021.

All other data are as at 30 June 2021.

Summary

Macau started the year with a sense of guarded optimism over a

nascent recovery. Mainland Chinese tourists had been returning to

the territory since September and gross gaming revenue was on the

rise again. However, slow vaccine uptake in Macau and recent

concerns over COVID-19 outbreaks in neighbouring Guangdong Province

has moderated the optimism and weighed on near term investor

sentiment.

Portfolio

Although Macau's residential property market improved in H1

2021, the luxury end of the residential sector continued to lag the

market overall in both sales and leasing. We nevertheless remained

focused on divestment. During the period, we signed a preliminary

sale and purchase agreement to sell the final standard unit at The

Fountainside for HK$11.8 million (c.US$1.5 million), with expected

completion by November.

The Waterside

The Waterside is MPO's flagship asset, comprising 59 luxury

apartments for lease in downtown Macau with sweeping views of Nam

Van Lake. In H1 2021, the Manager's efforts were focused on

securing new tenants while continuing to seek potential buyers for

the property.

In the rental market, the Manager continues to promote The

Waterside via its agent network and various online platforms, while

offering more flexible leasing terms. However, as Macau's twin

economic engines - tourism and gaming - are running well below full

capacity, demand for luxury properties remains subdued.

Nevertheless, occupancy increased slightly over the period, rising

to 33% versus 31% at the end of 2020.

The Manager has continued to explore multiple channels for a

timely divestment of The Waterside, which has resulted in extensive

discussions with interested parties.

Currently, concerns remain as COVID-19 variants continue to

disrupt economic recovery around the world. Macau continues to be

closed to most international visitors, whereas it had been

anticipated that a progressive widening of the Greater Bay Area

bubble would create a more favourable environment. This ongoing

uncertainty has kept potential investors on the sidelines.

The Fountainside

The Fountainside is a residential development in the Penha Hill

district that comprises 42 homes and 30 car-parking spaces.

The sale of a standard unit agreed last November was completed

in February. In addition, we signed a preliminary sales and

purchase agreement for another standard unit in May for HK$11.8

million (c. US$1.5 million), in line with the property's latest

valuation. We expect this transaction to complete by November. This

will conclude the sale of all 36 standard units in the project.

Four villas and two duplexes remain in the portfolio. The villas

are being promoted through various channels, and we are following

up with potential buyers to secure a timely divestment. Considering

the current general market demand towards the more affordable

segment, we submitted plans to reconfigure the duplexes as three

units and two car-parking spaces in January, for which we received

approval in April. We are currently tendering the project and

barring any unexpected delays expect to substantially complete the

reconfiguration work by the end of 2021. Marketing for sale of the

units can commence during the reconfiguration process.

Penha Heights

We continued to showcase Penha Heights, a prestigious,

colonial-style villa atop Penha Hill, to potential buyers through

viewings in H1 2021. We have received positive feedback on the

property's enhanced appearance and positioning. The pool of

potential buyers able to visit the property remains curtailed due

to the pandemic and related restrictions on travel to Macau. The

Manager will continue to explore all potential avenues for an

optimal divestment.

Macau

COVID-19 contained; vaccination campaign to be ramped up

Since the beginning of 2021, Macau has registered only ten

additional COVID-19 cases - all imported - for a total of 56 cases

and zero deaths since the pandemic began. The reopening of Macau's

borders to mainland Chinese visitors has not led to a rise in

infections - a testament to the strict prevention and control

measures adopted by both governments. Macau's vaccination

programme, which began in February, has so far resulted in only

c.40% of the population receiving at least one dose of the vaccine.

More recently, however, the appointment rate has picked up, helped

by government and employer led campaigns.

Economic impact - FY2021 appears positive

For full-year 2020, Macau's economy shrank 56.3% YoY. In Q1

2021, its economy stabilised, helped by a notable increase in

exports of tourism services and goods. As a result, the economy

recorded a smaller contraction of 0.9% YoY. The International

Monetary Fund expects Macau's GDP to grow 61% and 43% in 2021 and

2022, respectively.

Tourism - nascent recovery hits a speed bump

In 2020, Macau recorded an 85% YoY decline in tourist arrivals,

with approximately 5.9 million visitors. This year, with largely

quarantine-free travel between Macau and mainland China, visitor

arrivals increased and accelerated in March, April and May to hit a

high of around 45,000 daily arrivals during May's Golden Week

holiday - c.60% of the daily average for mainland arrivals set in

2019. During the first five months of the year, Macau welcomed a

total of 3.4 million visitors, up 4.7% YoY.

In June, the territory's recovery hit a speed bump when

neighbouring Guangdong Province, the main source of visitors to

Macau, recorded new COVID-19 outbreaks which reduced visitation to

Macau. Fortunately, Guangdong authorities acted swiftly and appear

to have brought the situation under control and Macau authorities

expect the average daily number of visitors to return to around

30,000, similar to that in May, during the upcoming summer

holiday.

There was optimism that the long-awaited Macau-Hong Kong travel

bubble could be activated soon, provided there is no local

transmission of COVID-19 in Hong Kong for 14 days. However, Macau

authorities subsequently announced that they required more time to

assess the latest COVID situation in Hong Kong, and the potential

easing of travel restrictions with Hong Kong will be subject to

discussions with Chinese mainland authorities.

For 2021, the Macau government has revised down its forecast of

visitor arrivals from 10 million to 8 million, which was around 20%

of the pre-pandemic record of 39.4 million visitors in 2019.

Gross gaming revenue improving

GGR for the first six months of 2021 increased by 45% compared

to the same period in 2020. Morgan Stanley's current forecast is

for 2021 GGR to grow by 115% YoY to US$16.3 billion, c.45% of

2019's level. This represents a downward revision of 19% due to the

delay in restoring pre-pandemic travel levels between Macau,

mainland China and Hong Kong. Looking beyond the pandemic,

brokerage Bernstein expects Macau's GGR in 2025 to be 25% higher

than the level seen in 2019.

Despite the uncertainty, integrated resort operators continue to

launch new facilities, underscoring their confidence in the

territory's prospects. Sands China launched Phase 1 of The Londoner

Macao in February, and the Grand Lisboa Palace is expected to open

progressively in the third quarter. Galaxy is also expected to

unveil facilities for its Phase III in stages, including a new

convention centre, from the end of 2021.

With regard to the renewal of gaming concessions expiring in

June 2022, a public consultation on proposed amendments to Macau's

gaming legislation is expected to begin in H2 2021.

Government relief measures to boost domestic economy and

tourism

Macau's government has announced a third consumption subsidy

scheme, granting all local residents US$1,000 in e-coupons and

injecting approximately US$735 million into the local market

between June and December.

The Macao Government Tourism Office is continuing its Macao Week

campaign in mainland China to showcase the territory's diverse

range of tourist experiences and its potential as a safe, healthy

tourist destination. In a separate campaign aimed at Macau

residents, the "Stay, Dine and See Macao" initiative offers locals

a one-off subsidy for local tours and a hotel staycation.

Property

Macau's residential property market has stabilised further,

following the government's management of the pandemic and the

rollout of its vaccination programme. Potential buyers have been

more active, with viewings for smaller units having increased

notably since March, and new launches by developers have been well

received.

In the first five months of 2021, 2,634 residential units were

transacted, a YoY increase of 26%. The average transaction price

remained stable at c.US$1,200 per square foot by the end of May.

The market continued to be dominated by first-time buyers and

transactions involving less than MOP8 million (US$1 million). In Q1

2021, first-time buyers accounted for more than 84% of

transactions, second time buyers accounted for c.12%, and the other

4% were buyers acquiring properties for at least the third

time.

In the luxury segment, property agent Centaline believes that

prices are currently near a five-year low, and as market sentiment

improves in 2021, it expects the segment to grow by approximately

10% in terms of both volume and price. Nevertheless, Macau's strict

mortgage rules are likely to continue to weigh on the luxury

property segment.

Outlook

Although Macau has managed the COVID-19 pandemic successfully

thus far, its economic recovery to pre-COVID level is reliant on

regional and international containment of the virus and resumption

of travel. The recent COVID infections related to the Delta Variant

in Guangdong has already delayed the recovery in Macau's tourism

and gaming industries. Morgan Stanley and the Macau authorities

have revised down their 2021 forecasts for gaming and tourism

markets, respectively, amid continued travel restrictions between

Macau, mainland China and Hong Kong. The territory's low rate of

vaccination makes it vulnerable to COVID-19 variants, which have

demonstrated their ability to derail the reopening of economies,

even in countries with high vaccination rates, such as the United

Kingdom.

The slower than expected economic recovery and continued travel

restrictions have created challenges as a reduced pool of buyers

for the assets and dampened investor sentiment have significantly

affected our disposal timeline. While the situation remains fluid,

the potential restoration of quarantine-free travel between Macau

and Hong Kong, together with the speed in which the outbreaks in

Guangdong were brought under control, provide optimism that the

governments have the pandemic contained in the Greater Bay Area.

Despite the challenging conditions, we continue to identify and

pursue divestment opportunities for the portfolio, though remaining

mindful that any new outbreaks in the region may affect travel

bubbles and the divestment schedule further.

- End -

About Macau Property Opportunities Fund

Macau Property Opportunities Fund Limited is a closed-end

investment company registered in Guernsey and is the only quoted

property fund dedicated to investing in Macau, the world's largest

gaming market and the only city in China where gaming is

legalised.

The Company is premium listed on the London Stock Exchange.

Launched in 2006, the Company targets strategic property

investment and development opportunities in Macau. Its portfolio of

property assets was valued at US$265.1 million as at 31 March

2021.

www.mpofund.com

About Sniper Capital Limited

The Company is managed by Sniper Capital Limited, an Asia-based

property investment manager with an established track record in

fund management and investment advisory.

For further information

Investor Relations

Sniper Capital Limited

Tel: +852 2292 6789

info@snipercapital.com

www.snipercapital.com

Corporate Broker

Liberum Capital

Darren Vickers / Owen Matthews

Tel: +44 20 3100 2234

Company Secretary & Administrator

Ocorian Administration (Guernsey) Limited

Kevin Smith

Tel: +44 14 8174 2742

Stock Code

London Stock Exchange: MPO

LEI

213800NOAO11OWIMLR72

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUDKBBDPBKDQOB

(END) Dow Jones Newswires

July 23, 2021 02:00 ET (06:00 GMT)

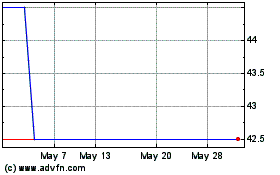

Macau Property Opportuni... (AQSE:MPO.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

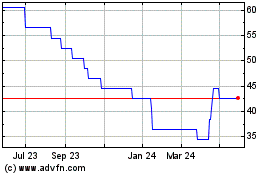

Macau Property Opportuni... (AQSE:MPO.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024