TIDMJHD

RNS Number : 7855N

James Halstead PLC

04 October 2021

4 October 2021

JAMES HALSTEAD PLC

PRELIMINARY ANNOUNCEMENT OF AUDITED RESULTS

FOR THE YEARED 30 JUNE 2021

"Very much a year of dealing with successive situations rather

than tracking our budget forecast. Credit is due to our management

teams for what is an excellent performance."

Key Figures

-- Revenue at GBP266.4 million (2020: GBP238.6 million)

- up 11.6%

-- Profit before tax GBP51.3 million (2020: GBP43.9 million)

- up 16.9%

-- Earnings per 5p ordinary share of 19.2p (2020: 16.5p)

- up 16.4%

-- Final dividend per ordinary share proposed of 11.0p (2020:

10.0p) - an increase of 10% and once again a record dividend

-- Cash GBP83.3 million (2020: GBP67.4 million)

Mr Mark Halstead, Chief Executive, commenting on the results,

said :

"This was a complicated year. It was a year in which our top

management had to balance risks to the business whilst maintaining

key supplies to our core healthcare markets without compromising

employee safety. I applaud the efforts of our management team who

have faced difficulties from every direction.

In addition I am pleased to report that our flooring received

recognition in the year from the Contract Flooring Association

(CFA) in conjunction with the Contract Flooring Journal (CFJ) -

winning the "contract of the year" accolade in respect of the

Polyflor Quicksafe that was installed at the NHS Louisa Jordan at

the SEC in Glasgow, one of many "Nightingale" projects with which

we were connected".

Enquiries:

James Halstead:

Mark Halstead, Chief Executive Telephone: 0161 767 2500

Gordon Oliver, Finance Director

Hudson Sandler:

Nick Lyon Telephone: 020 7796 4133

Nick Moore

Panmure Gordon (NOMAD & Joint Broker):

Dominic Morley Telephone: 020 7886 2500

WH Ireland (Joint Broker):

Ben Thorne Telephone: 020 7220 1666

CHAIRMAN'S STATEMENT

Results

I am pleased to report turnover in the year was GBP266.4 million

(2020: GBP238.6 million), 11.6% ahead of last year. Profit before

tax at GBP51.3 million (2020: GBP43.9 million), was up 16.9%. Both

sales and profits are at record levels. The projects we have been

associated with in the year are as diverse as ever from

Knattspyrnufélagið Fram - perhaps the largest football stadium in

Iceland - to the Optimed Eye-Clinic in Belarus.

Our business, as have many, suffered disruptions in the year

with production at our factories affected by labour shortages and

raw material scarcity. However, healthy stock holdings supported

sales. I am pleased to report these efforts were greatly

appreciated by the trade and indeed we were recognised for those

efforts by, for example, ProCure22 (the Construction Procurement

Framework administrated by NHS England ) with an award for

outstanding support to the NHS during the pandemic.

The board, and I, are pleased to report we were able to continue

to supply the many independent flooring contractors who worked on

through the lock-downs. Our network of stockists were key to

supplying these contractors and I would note that our business was

also awarded the title "Flooring Manufacturer of the Year", which

was particularly gratifying as the voting for this award was by the

floor laying contractors (the Contract Flooring Association) that

install our products.

These results are more than satisfying against the backdrop that

all our major markets were faced with lockdowns of various

durations and severity affecting many of our end users' needs for

flooring. There were numerous delays and deferrals of maintenance

and refurbishment work as well as new build projects as priorities

and funding were diverted.

That said, the many global projects that we undertook involved

healthcare and Covid-19 related installations (whether in temporary

hospital wards, vaccination centres, test facilities or vaccine

manufacturing) but it did not fully replace our normal level of

healthcare directed flooring. One example was the flooring for a

significant number of "campaign" hospitals for Covid patients next

to main hospitals in eight different towns/cities in Portugal.

Another example was a series of mobile hospitals within the seven

emirates (Abu Dhabi, Dubai, Sharjah, Umm al-Qaiwain, Fujairah,

Ajman, and Ra's al-Khaimah), where each field hospital contained

150 to 259 beds. Our ability to respond to these demands from stock

was key to our strong performance.

The supply chain was under constant pressure over the year. Raw

material costs rose and availability was challenging particularly

on the supply of basic polymers as the global petrochemical

companies struggled to maintain production. The reasons for this

were varied but the most significant factors were:

-- the ravaging of one of the world's largest production plants

in Louisiana, USA, which was put out of action by Hurricane Ida.

This one plant serviced 40% of US demand for PVC and its closure

meant that these materials across the globe were in shorter

supply;

-- many of our basic materials are derived from the cracking

process that produces aviation fuel and the decimation of that

industry by the pandemic led to several refineries being

temporarily closed;

-- the Covid-19 virus and the related self-isolation protocols

led to severe shortages of labour and consequent output

reduction.

It was due to the dedication of our sourcing team and our long

and close relationships with suppliers that we kept our production

lines fed. It was not an easy task and this was at a time when we

also had severe production pressure owing to the non-availability

of labour.

The company and our strategy

James Halstead plc is a group of companies involved in the

manufacture and supply of flooring for commercial and domestic

purposes, based in Bury UK. James Halstead plc has been listed on

the London Stock Exchange for more than 70 years.

The group was established in 1914 and continues to operate out

of the original premises in Bury. In its factories in Bury and

Teesside it manufactures resilient flooring for distribution in the

UK and worldwide.

The company's strategy is to constantly develop its brand

identity and its reputation for quality, durability and

availability thereby enhancing and maintaining goodwill with the

aim of achieving repeat business. Our focus is to work with

stockists who in turn distribute those bulk deliveries whilst

promoting and representing the products to the end users and

specifiers who will purchase the stock from those stockists.

This approach is designed to increase and secure revenue streams

and drive profitability and cash flow which enables the

continuation of dividends thereby creating shareholder wealth. In

the normal course of business one key element of the company ethos

is having dedicated sales personnel to present our product to our

customers' clientele. In this last year face to face relationships

were not possible but I am pleased to say that our customer service

and reputation for delivery were enhanced despite the trials and

tribulations of the last year.

Over many years our strategy has also included a policy of

continual investment in both process improvement and in product

development to improve output efficiency and product offering. I

can be confident in saying that the loose lay flooring (both in

sheet and tile) that we have launched into the market some two

years ago was very well regarded over the last difficult year.

Corporate governance and corporate social responsibility and the

environment

The board has over many years recognised its responsibility

towards good corporate governance. It is part of our character and,

I believe, contributes to our ability to deliver long-term

shareholder value. Increasingly companies are, quite rightly,

tasked with demonstrating that their environmental credentials and

supply chain management are supported by social and economic

dimensions and stewardship.

We can now say that almost 100% of our electric usage is now

derived from renewables. Our bi-annual Sustainability Report is

about to be published and we have this report independently audited

to further underline our credentials.

PVC polymer is one of our main raw materials and we began

recycling waste into our processes in the 1950s and have continued

to use waste PVC as part of the process of manufacturing in ever

increasing volumes. For many years we have funded waste collection

with Recofloor - our UK joint venture that collects post

installation waste PVC within our industry. We are also founder

members of the European PVC recycling venture, the AgPr, which

funds the recycling of post-consumer PVC waste and diverts waste

from landfill back into the manufacturing process.

An important point to note about PVC is that it has evolved and

it is no longer just derived from petrochemicals. It is

increasingly produced from bio-mass. Indeed, the by-products of PVC

manufacturing, chlorine and caustic soda, are indispensable to the

medical and food industries. Often a maligned material, PVC

manufacture has the lowest consumption of primary energy of any of

the major commodity plastics and our PVC flooring is made with over

80% renewable materials (excluding recyclates which further lessen

the use of non-renewables).

As part of our focus on the future and the footprint of our

industry we are major partners in industry wide bodies. One example

is that our Technical Director is Chairman of the ERFMI (the

European Resilient Flooring Manufacturing Institute). ERFMI

activities range from involvement in the EU carbon neutral strategy

through to funding new recycling initiatives to extend the ability

of PVC to be recovered and recycled. In the past year initiatives

include:

The Circular Plastics Alliance, a plastics industry association,

to which ERFMI are a signatory has a target to achieve ten million

tonnes of recycled plastic in new products in Europe by 2025.

In addition ERFMI has engaged consultants, based in Belgium, to

undertake the following research:

-- Recycling technologies that can be used for the recycling of

PVC floor coverings, with particular focus on extraction of legacy

additives.

-- Identification and sorting technologies that can identify

flooring containing legacy additives and the ability to sort it

from flooring that does not contain legacy additives.

The scope of this engagement is to review technologies that have

been tried in the past, that are emerging or used for other

applications. This is just one example of working together for the

future and we feel it is part of our duty as a responsible

manufacturer (as opposed to importers) to be involved in a

sustainable future.

The UK may have left the EU but our work on standards, the

circular economy, sustainability and meaningful recycling is both

Europe wide and globally focused and is progressing at pace. In no

way has "Brexit" lessened our involvement as Europeans in the

flooring industry.

Dividend

Profits and earnings per share have increased and we continue

un-geared. Our cash balances stand at GBP83.3 million (2020:

GBP67.4 million), even after dividends paid in the last year that

amounted to GBP34.1 million, and taxation of GBP9.9 million. Our

cash reserves continue to provide the foundation of our strong

balance sheet.

It is pleasing to report that the Board proposes, subject to the

approval of the shareholders at the upcoming AGM, to pay a record

final dividend. The final dividend will be 11.0p (2020: 10.0p).

This, combined with the interim dividends paid in June of 4.25p

(2020: 4.25p), makes a total of 15.25p (2020: 14.25p) for the year,

an increase of 7.0%.

Bonus Issue

The board considered the merits and will be proposing a bonus

issue of one ordinary share for every share held at the upcoming

AGM.

James Halstead plc has a long history of such issues and these

have always been in addition to dividends not in substitution. The

board believes that bonus issues are welcomed by the smaller

holders of shares and promote liquidity amongst retail investors. A

bonus issue such as this is not an economic event in that no wealth

changes hands but nevertheless these issues have been popular with

shareholders and it emphasises the history of our share price

growth.

We would anticipate that, as in the past, the bonus will

increase liquidity of the shares.

Acknowledgements

I would like to thank our staff for outstanding diligence in the

face of significant turmoil during the course of the year. Many

employees faced confusion and concern as we entered the pandemic

tunnel and in many respects this was not helped by the headlines

and media reporting. Whilst as a Board we knew that our flooring

would be needed by healthcare authorities quickly and in volume,

the authorities did not, initially, identify key industries or

manufacturing as something to be encouraged to continue. We were

able to source PPE, sanitising equipment and supplies from our

global contacts to protect our workforce. Our health and safety

teams and management rose well to these challenges.

My thanks go to our staff in the UK and around the world whose

hard work continues to allow us to continue to grow the business.

This year was particularly challenging as we all faced

uncertainties and I would make particular mention of those who have

worked hard, not to just put the safeguards in place, but to move

the business forward in a positive way despite the prevailing

challenges. Our senior management across the globe have faced

dynamic challenges and have worked hard - thank you from myself and

the board.

Outlook

Currently, some three months into the new trading year, our

sales are on a par with the record trading of the comparative

period. Business has bounced back beyond our prior expectations

with refurbishment in some sectors buoyant, it is to be expected

that our markets around the globe will further recover as more

countries vaccination rollouts extend and they follow the European

model of a return to "normality".

Supply shortages continue to frustrate whether they be due to

the lack of availability of raw materials or to the widely

publicised shortages of drivers and ongoing concerns with

international freight. The cost of moving goods, the availability

of shipping space and extended delivery times are both ongoing

challenges. Our UK factories are in production and are tasked with

raising stock levels and we have taken on extra shop-floor labour

to assist in this task.

It is clear that ongoing issues with the global pandemic are not

at an end and the cost pressures continue to persist but we do see

signs of certain materials becoming more available and at a lower,

albeit still high, cost.

Notwithstanding these concerns, I, and the board, can only be

confident of another solid year of progress.

Anthony Wild

Chairman

CHIEF EXECUTIVE'S REVIEW

Turnover of GBP266.4 million (2020: GBP238.6 million) is a

record level for the group and an increase against last year of

11.6%. Since the comparative year was affected by the first UK

lockdown a more relevant comparison is against the year ended 30

June 2019 and turnover is some 5.3% ahead of that year.

Profit before tax at GBP51.3 million (2020: GBP43.9 million) is

16.9% ahead of the last year and against the 2019 comparative some

6.2% ahead.

As we entered this year our goal was to get back on track with

the 2019 levels and to surpass this was a major achievement.

Regarding sales turnover the split across areas was Europe 42%, UK

37%, Australasia 14% and the rest of the world 7% which is in line

with the spilt over recent years. The largest sales growth year on

year was in the sales within the UK with an increase of 24.0%

compared to last year though, of course last year was impacted by

the first national lockdown which had seen sales fall from 2019

levels. That being said, UK turnover was 10.9% ahead of 2019

levels.

Our contracts across the globe continue to expand and, for

example, we have been involved with many installations in the

Lebanon where we have supplied product used in the repair and

refurbishment of the ruined hospitals and buildings that were

devastated following the Beirut Port explosion in August 2020.

Overall there was a modest diminution in the gross margin

percentage which was due to the adverse effects of raw material

price increases, freight and other costs rising and adverse

manufacturing efficiencies due to lower volume throughput and

labour shortages. The labour shortages were principally due to

absenteeism and "self-isolation" protocols. These adverse gross

margin effects were offset to a large degree by a change in the

sales product mix (i.e. the sales were more biased to higher value

products) and the focus away from keenly priced volume

projects.

Our business has always been able to respond quickly to large

projects across the globe which are efficient to produce but almost

always very keenly priced. Given material and labour shortages we

placed less emphasis on this area of business during the year.

Overheads in the year rose as the administrative cost returned

to a normalised level of about 5% of turnover.

The balance sheet shows its normal level of robustness but some

key numbers do stand out. Stock has reduced and whilst this in

isolation is positive for cash flow and bank balances it is below

optimal levels and a key management focus is to increase stock

levels. Trade debtors and other receivables are much higher than

last year (GBP42.9 million this year and GBP28.4 million in the

prior year) but last year we had seen the UK closed in the three

months prior to the year end. The comparison of these two balance

sheet dates is mainly a contrast of two different situations and is

best summarised as healthy.

It continues to be the case that our worldwide manufacturing is

certified to Quality Management System ISO9001 and ISO14001 to

underline our robust environmental procedures. We are certified to

BES9001, the standard for responsible sourcing which takes our

credentials beyond our own factories to our suppliers. Added to

this is our SA8000 accreditation based on the UN declaration of

human rights that audits supplier provision of sound workplace

conditions and standards. Our quality of product, availability of

stock and adherence to strict standards set us apart from many

other manufacturers as we continue to cover the world.

Reviewing the businesses in more detail:

Objectflor / Karndean and James Halstead France, our European

operations

The level of turnover in our Central European business was

higher than last year by around 6%. This market encompasses

Germany, France, Austria, Benelux and several Eastern European

countries. Turnover increased in all these countries and we can

only describe this as a satisfactory situation. Our gross margins

in the region held up and consequently we have seen the increased

sales translate into an increased level of profit.

This was not an easily achieved result and the control of costs

has been an ongoing challenge. Freight costs into the region and

within the markets have seen upward pressure and our businesses

have, in common with many businesses in Europe, introduced freight

surcharges.

James Halstead France remained open but the staff faced

restrictions on movement and curfews. Stock movement was an ongoing

issue with inflationary pressure on the cost of transport. France

in particular faced difficulties in the weeks after "Brexit" and

whilst this is working better now, the situation is far from ideal.

The near 9% increase in sales was, I believe, commendable in the

circumstances. The sales force worked throughout the year although

face to face meetings could not take place. Our major competitors

manufacture in France and they were faced with raw material

shortages and consequent lack of product, factors which no doubt

helped in achieving this result.

Objectflor traded well but stock levels have been reducing as

suppliers have struggled with international freight. However, it

would seem clear that our competitors were worse hit and I believe

Objectflor took market share. There were shortages in the wood

laminate sector which is a competing product to our luxury vinyl

tile and this pushed demand up for our businesses. Whilst our

warehouses remained open throughout the year there were additional

procedures regarding personal protection that did affect

efficiency. There were no exhibitions during the year and much less

travel which reduced costs but Objectflor did re-open their in

house "campus" marketing facility and hosted many customer visits.

Throughout the year the cost and availability of shipping to

Germany became more problematic and Objectflor stock levels have

been under pressure due to increased demand. The company introduced

freight surcharges on sales which seems to have been generally

accepted in this marketplace.

Polyflor Pacific - encompassing Australia, New Zealand and

Asia

The region has been one the hardest hit by successive lockdowns

with Australia in particular lurching in and out of various

restrictions on a state by state basis. The confusion has affected

staff morale and made it difficult to forward plan. Having said

this, the turnover in Australia was some 8.2% ahead of the

comparative year and we have sought to hold stock at higher levels

to mitigate the uncertainty. We are confident that this has

differentiated us from our competitors and allowed us to take

market share. In addition, our regional warehousing in each of the

federal states has helped us to progress as individual state

lockdowns hampered interstate deliveries. As noted, in many markets

domestic demand was bolstered by spend being redirected from

holidays, car purchases etc to home improvement as a greater number

of people worked from home.

The almost weekly "knee-jerk" restrictions saw disruption to

logistics with customers premises sometimes closed as well as

several periods of congestion at the main import point in Sydney

Harbour.

In New Zealand we achieved record turnover with sales some 28%

above the prior year (albeit that the comparative was affected by a

closure of the economy in the spring of 2020). Having said this

turnover was still some 23% ahead of the 2019 comparative. As with

Australia the plan to bolster our stock levels in the market was

correct and the lack of availability of competitors stock (largely

supplied from Europe) increased sales and was very much appreciated

by our customers - the flooring contractors. In New Zealand we

continued to supply flooring to the national social housing

upgrades and new product launches of loose lay flooring projects

were very successful.

As noted in previous years the Asian markets have been brought

under the management of our Australian business and despite the

effects of the pandemic, we continue to progress.

In Malaysia we incorporated a new company and took on the trade

of our former long-term distributor in November 2020. This will now

act as our base for the South Asia markets of Malaysia, Singapore,

Indonesia, Thailand, the Philippines and Vietnam. This gives us a

local stockholding in Malaysia to continue and growing the sales of

our previous distributor, as well as holding stock in a free trade

zone that will be used to service the other countries listed above

on a timelier basis rather than shipping from the UK.

Unfortunately, activity since we began trading in Malaysia has

been hampered by movement controls and full lockdowns, but despite

this, sales across the region of Southern Asia for the period

increased by 23% over last year.

Our North Asian markets (China, Hong Kong, South Korea, Taiwan

and Japan) were similarly hampered by the pandemic with travel

restrictions, lockdowns and a slowdown and delay in projects and

renovation work. The effect was to reduce the sales in the region

from the previous year by 21%. In last year's annual report, we

noted plans to have a stock presence in mainland China and this is

now operational. This has helped service smaller ad hoc projects in

the region as well as helping supply some smaller orders to Hong

Kong and Macau. China sales have remained in line with last year,

helped by securing the prestigious Gansu Province Women &

Children's Medical Complex.

We expect further growth for the Pacific / Asia region as we

start to see the effects of easing lockdowns and travel

restrictions, vaccination rollouts and government stimulus

packages.

Polyflor & Riverside Flooring, based in UK

Sales at Polyflor were 11.4% ahead of last year. There was

strong sales growth in sales in the UK (increased by 24%) and a

continuation of good sales through our international businesses

though there was a decline in exports. The export business suffered

as a result of delays in government funded healthcare projects in

many parts of the globe as attention was focused on the immediate

issue of the pandemic and vaccine rollout. In addition, with raw

materials in short supply and manufacturing hampered by employee

absenteeism, the smooth flow of production was hampered throughout

the year. Raw material prices did start the financial year at lower

prices than we had seen in the period from March 2020 through to

June 2020 but very quickly rose to levels that were 70-80%

higher.

Riverside, which sells only to Polyflor had around an 8%

increase in turnover.

During the year for both our UK based companies were dogged by

manufacturing problems due to the shortage of basic raw materials.

Polymers, plasticisers, packaging and pallets were in short supply.

Each of our competitors faced the same problems and prices were

consequently higher and largely non-negotiable. As manufacturers we

have commitments to stockists in terms of price commitments that we

ourselves are not able to get. That said we put into the market

price increases. The increased volume of sales, most notably in the

UK, meant that we were able to increase profitability though it was

greatly assisted by stock levels. For many years as a manufacturer

we have committed to stock in the warehouse to smooth production

pressures and to be able to supply large projects "off the shelf"

rather than make to order. It is a key differentiator of our

business and it can have its challenges but in this year it was a

key strength. Despite the difficulties in maintaining output the

manufactured output was higher than the previous year but the prior

year included a ten week shutdown during the first lockdown and the

start of that year was affected by a significant breakdown that

affected one of the main production lines. In short output was

below our potential and indeed the demand requirements but better

than the year that preceded.

In our home market we have an extensive network of stockists and

this helped us to capitalise on a return to more normal levels of

demand for flooring as the year progressed. Our stock holding was

key to this. In addition there were new distributors added to the

UK market and there was a cross-over of our commercial product into

the domestic segment as the demand driven by household

refurbishment sought credible flooring solutions. In the year we

saw a significant growth in internet supply of our flooring by a

number of our existing customers and indeed some contractors have

extended their business model to online supply.

New product launches were deferred. This was not a cap on the

year's growth as there was simply not the need to compound the

complications of supply and delivery. It would seem to be clear

that Polyflor took market share in the UK during the year. In part

this gain was from overseas competitors that faced difficulties in

their own markets. It was perhaps also in part due to the "Brexit"

changes in January 2021 but more significantly due to the import

sector that sources Far Eastern product and re-brands for UK

consumers. I have no reason to doubt that the extension of Polyflor

into a wider consumer market (ie that of high end domestic) will

lessen; the very high demand levels of household spending may be

less pronounced but the product has performed and gained consumer

credibility. The lockdown shortages have brought Polyflor ranges to

a wider consumer base and contractor recommendation has become a

key driver of consumer choice.

Polyflor Nordic comprising Polyflor Norway based in Oslo and

Falck Design based in Sweden

Sales across this region are broadly comparable with those of

the prior year though the situation in Norway and Sweden contrasted

sharply. In Norway sales were 11% ahead of the prior year but in

Sweden down by a similar percentage. In Sweden the pandemic started

with the lightest of touches but has been the most affected over

the course of the year with staff on short time for a long time and

commercial flooring projects at a much lower level. Norway in

contrast remained open and adopted new working practices and

procedures.

Although there were restrictions arising out of the national

response to the pandemic in Norway the business remained open

throughout. To keep their economy more active, restrictions in

Sweden were less severe however some negative commercial impacts

came later in the year as the economy and refurbishment slowed.

There were many education projects in Sweden with examples being

Orkerstern School, and the Svärtingeschool . Across the

Scandinavian region, competitors had problems supplying some

specifications to the advantage of our businesses where we were

able to supply from stocks locally or from the UK. This is a trend

that has continued into the 2021/22 financial year.

Polyflor Canada, based in Toronto

Turnover in Canada was modestly ahead of last year and profit

increased. Canada as a market faced severe disruption with long

periods of business restrictions particularly in Ontario (where our

warehousing is based). In recent years Polyflor Canada has

undertaken a lot of business in hospitality and retail and these

sectors were hardest hit by the successive lockdowns. Our strategy

in Canada has been defensive - controlling costs and deferring

expenditure on expansion.

With broadly the same turnover and profit as the prior year we

are satisfied with the outcome but this was not easy to achieve.

Travel across the various regions has been subject to restrictions

for much of the year and day to day refurbishment was restricted by

the governments Covid-19 regulations.

Polyflor India, based in Mumbai

During the year we scaled back our business in India. It was

difficult to undertake local sales due to the scale of the pandemic

and we reluctantly reduced our sales representation. The business

remained operational throughout the year and it was noticeable that

projects were delayed or protracted due to working

restrictions.

Despite this, our turnover in India increased as did profits. In

part this was the result of product being sold to the Serum

Institute for vaccine manufacturing. Our business is largely

focused on healthcare, education and pharma and there is every

expectation of growth in the coming year. There are significant

challenges in terms of cost and availability of shipping to the

Indian continent which will resolve over time.

Rest of the World

During the year some of our markets did reduce their level of

sales and the common theme in these markets is that there were

delays in infrastructure projects that are government funded. The

Middle East, Hong Kong, Africa and North America were the markets

most affected. Projects such as Hamad International Airport and the

extension of the Aspire Museum both in Qatar and Extra Foods

Supermarkets in Trinidad and Tobago are examples of breadth of our

exports. In Argentina we have supplied the flooring for twelve

modular hospitals built for dealing with Covid-19.

Conclusion and outlook

Given the circumstances we can only be pleased with the results

for the year. The hard work, dedication and experience of our

subsidiary directors and management has been a key factor in this

achievement.

However, the challenges have not lessened. Though in many

markets the task of living with the Covid-19 virus is underway

there are issues in manufacturing manning levels at our UK

factories and logistical and transportation issues. At this point

in time it is frustrating that even where we have orders and stock

it is difficult to move goods internationally. The difficulties of

the Suez blockage and disruption of the Yantian port in China

continue to ripple into the present but should ameliorate.

In the UK our stockists handle distribution to end users and

there has been many issues within our sector relating to customer

delivery. Internationally it is difficult to compare the current

situation with any other time that has been as difficult.

To date we have continued to fulfil customer orders and demand

levels continue to be positive. Raw material prices continue to be

under pressure and we have in many cases had to pass on cost

increases to customers. Despite these pressures we are starting to

see some positives in raw material availability and though these

adversities may persist for several months I am confident we can

continue to grow our global activities.

Mark Halstead

Chief Executive

Audited Consolidated Income Statement

for the year ended 30 June 2021

Year Year

ended ended

30.06.21 30.06.20

GBP'000 GBP'000

Revenue 266,362 238,630

Cost of sales (154,722) (138,262)

----------------- -----------------

Gross profit 111,640 100,368

Selling and distribution costs (46,335) (45,297)

Administration expenses (13,532) (10,936)

Operating profit 51,773 44,135

Finance income 48 382

Finance cost (553) (660)

Profit before income tax 51,268 43,857

Income tax expense (11,407) (9,502)

Profit for the year attributable to equity shareholders 39,861 34,355

----------------- -----------------

Earnings per ordinary share of 5p:

-basic 19.2p 16.5p

-diluted 19.1p 16.5p

All amounts relate to continuing operations.

Audited Consolidated Statement of Comprehensive Income

for the year ended 30 June 2021

Year Year

ended ended

30.06.21 30.06.20

GBP'000 GBP'000

Profit for the year 39,861 34,355

------------ -----------

Other comprehensive income net of tax:

Items that will not be reclassified subsequently to the income statement:

Remeasurement of the net defined benefit liability 12,708 (5,062)

------------ -----------

12,708 (5,062)

------------ -----------

Items that could be reclassified subsequently to the income statement if specific

conditions

are met

Foreign currency translation differences (615) 336

Fair value movements on hedging instruments 1,089 (16)

474 320

------------ -----------

Other comprehensive income for the year 13,182 (4,742)

Total comprehensive income for the year 53,043 29,613

============ ===========

Attributable to equity holders of the

company 53,043 29,613

============ ===========

Items in the statement above are disclosed net of tax.

Audited Consolidated Balance Sheet

as at 30 June 2021

As at As at

30.06.21 30.06.20

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 37,242 38,520

Right of use assets 6,015 5,872

Intangible assets 3,232 3,232

Deferred tax assets 254 4,334

----------------- ------------------

46,743 51,958

----------------- ------------------

Current assets

Inventories 60,684 68,542

Trade and other receivables 42,949 28,361

Derivative financial instruments 848 73

Cash and cash equivalents 83,261 67,445

----------------- ------------------

187,742 164,421

----------------- ------------------

Total assets 234,485 216,379

----------------- ------------------

Current liabilities

Trade and other payables 65,551 47,444

Derivative financial instruments 92 883

Current income tax liabilities 1,160 773

Lease liabilities 2,948 2,568

69,751 51,668

----------------- ------------------

Non-current liabilities

Retirement benefit obligations 4,357 23,216

Other payables 447 449

Lease liabilities 3,236 3,371

Preference shares 200 200

----------------- ------------------

8,240 27,236

----------------- ------------------

Total liabilities 77,991 78,904

----------------- ------------------

Net assets 156,494 137,475

----------------- ------------------

Equity

Equity share capital 10,408 10,407

Equity share capital (B shares) 160 160

----------------- ------------------

10,568 10,567

Share premium account 4,122 4,072

Capital redemption reserve 1,174 1,174

Currency translation reserve 4,986 5,601

Hedging reserve 1,052 (37)

Retained earnings 134,592 116,098

Total equity attributable to shareholders of the parent 156,494 137,475

----------------- ------------------

Audited Consolidated Cash Flow Statement

for the year ended 30 June 2021

Year Year

ended ended

30.06.21 30.06.20

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 39,861 34,355

Income tax expense 11,407 9,502

--------------- ----------------

Profit before income tax 51,268 43,857

Finance cost 553 660

Finance income (48) (382)

--------------- ----------------

Operating profit 51,773 44,135

Depreciation of property, plant and equipment 3,541 3,185

Depreciation of right of use assets 3,115 2,937

Profit on sale of plant and equipment (64) (43)

Defined benefit pension scheme service cost 620 611

Defined benefit pension scheme employer contributions paid (4,144) (4,138)

Change in fair value of financial instruments (90) 14

Share based payments 8 13

Decrease in inventories 6,346 1,717

(Increase)/decrease in trade and other receivables (15,573) 4,388

Increase /(decrease) in trade and other payables 20,248 (10,450)

Cash inflow from operations 65,780 42,369

Taxation paid (9,895) (11,566)

Cash inflow from operating activities 55,885 30,803

--------------- ----------------

Purchase of property, plant and equipment (2,811) (4,215)

Proceeds from disposal of property, plant and equipment 131 110

--------------- ----------------

Cash outflow from investing activities (2,680) (4,105)

--------------- ----------------

Interest received 48 382

Interest paid (26) (30)

Lease interest paid (173) (202)

Lease capital paid (3,010) (2,873)

Equity dividends paid (34,083) (25,236)

Shares issued 51 28

--------------- ----------------

Cash outflow from financing activities (37,193) (27,931)

--------------- ----------------

Net increase /(decrease) in cash and cash equivalents 16,012 (1,233)

--------------- ----------------

Effect of exchange differences (196) 14

Cash and cash equivalents at start of year 67,445 68,664

Cash and cash equivalents at end of year 83,261 67,445

=============== ================

NOTES

1. The final dividend of 11p per ordinary share will be paid, subject to the approval of the

shareholders, on 17 December 2021 to shareholders on the register as at 26 November 2021.

The annual report and accounts will be posted to shareholders on 15 October 2021.

2. The financial information in this statement does not represent the statutory accounts of the

Group. Statutory accounts for the year ended 30 June 2020 have been delivered to the Registrar

of Companies, carrying an unqualified audit report and no statement under section 498 (2)

or (3) of the Companies Act 2006.

3. Statutory accounts for the year ended 30 June 2021 have not yet been delivered to the Registrar

of Companies. They will carry an unqualified audit report and no statement under section 498

(2) or (3) of the Companies Act 2006.

4. Earnings per ordinary share

2021 2020

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 39,861 34,355

-------------- --------------

Weighted average number of shares in issue 208,141,520 208,135,698

-------------- --------------

Dilution effect of outstanding share options 123,165 148,358

Diluted weighted average number of shares 208,264,685 208,284,056

-------------- --------------

Basic earnings per ordinary share 19.2p 16.5p

Diluted earnings per ordinary share 19.1p 16.5p

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPGRGUUPGGWG

(END) Dow Jones Newswires

October 04, 2021 02:00 ET (06:00 GMT)

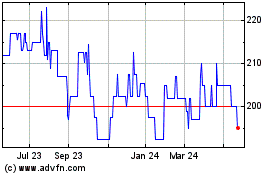

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

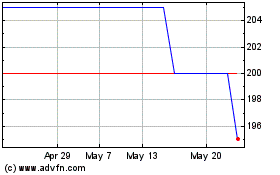

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024