TIDMENT

RNS Number : 1202S

Entain PLC

02 November 2023

For Release at 7.00am

2 November 2023

THIS ANNOUNCEMENT CONTAINS INFORMATION THAT QUALIFIES OR MAY

QUALIFY AS INSIDE INFORMATION

Entain plc

("Entain" or the "Group")

Q3 performance in line with updated expectations

Business update on accelerating our operational strategy

Entain plc (LSE: ENT), the global sports betting and gaming

group, today reports trading for the period from 1 July to 30

September 2023 ("Q3") and provides an update on accelerating the

Group's operational strategy.

Q3 Highlights

-- Total Group (including US) Net Gaming Revenue ("NGR") up +7% (+10% cc(2) )

o Group NGR (excluding US) up +7% (+9% cc(2) ), -5% proforma(2,3)

-- Online NGR up +9% (+11%cc(2) ), -6% proforma(2,3) , in line with updated expectations(4)

o Excluding known regulatory impacts(5) , Online NGR up +17%cc(2) , flat proforma(2,3)

o 2-3ppt impact from customer-friendly sports results in September

o Continued strong growth in active customers, +26% YoY (+10% proforma(2,3) )

-- Robust performance in Retail (6) with NGR up 4% (+ 4% cc(2) ), -4% proforma(2,3)

-- BetMGM continues to perform strongly with Q3 NGR of approximately $458m, up c.15% YoY

o 18%(7) market share in markets where it operates (excluding

New York) in sports betting and online gaming

o Continued iGaming strength with 26%(8) market share

o Successful start to the NFL season as Online sports-betting

customers enjoy the benefits of significant investment enhancing

the customer experience

o On track for FY2023 NGR at the upper end of $1.8-$2.0bn

guidance and to be EBITDA positive in H2 2023(9)

-- Continued leadership and progress delivered across our Sustainability Charter

Accelerate Operational Strategy

Over the last three years Entain has undergone a significant

strategic transformation, improving the quality of earnings,

strengthening operations, and aligning structures to best position

the Group to capitalise on future growth opportunities and deliver

shareholder value.

At a presentation today, management will outline key initiatives

to accelerate the Group's operational strategy, including:

-- Focused market portfolio, optimised for organic growth and ROI

o Prioritisation of high growth, high return markets, including US, Brazil CEE and New Zealand

o Drive profitable growth in core markets, including the UK,

Australia, Italy, Germany and the Baltics

o Exit smaller non-core operations

-- Return to organic growth at least in line with our markets (c.7%(10) CAGR) from 2025

-- Drive US market share to 20%-25% through investment in

product & pricing capabilities, customer acquisition and

maximising the omnichannel opportunity

-- Delivery of Project Romer to support expansion of Online

EBITDA margin to 28% by 2026(11) and 30% by 2028(11)

o Simplification of the organisation to improve operational leverage and drive cost efficiencies

o Gross cost savings of GBP100m (net cost savings GBP70m) by 2025

-- Enhanced Governance:

o Plan to appoint four new non-executive directors, including

Amanda Brown's appointment from 8 November 2023

o Creation of a capital allocation committee of non-executive directors

Guidance

-- FY2023 Group EBITDA(12) (pre TAB NZ accounting) guidance:

o Q3 performance tracked to EBITDA guidance of GBP1.00bn -

GBP1.05bn(12,13) as stated on 25 September 2023

o During October, while volumes have been in line with

expectations, continued customer friendly results(14) have seen

sports margins impact EBITDA by approximately GBP45m

o This does not impact our expectations beyond Q4 2023

-- FY2024

o Pro forma Online NGR growth expected to be low single digit,

supported by return to growth during H2 2024

o Online EBITDA margin(11,15) expected to be 24%-25%

-- Detailed guidance available at: https://entaingroup.com/investor-relations/results-centre

Jette Nygaard-Andersen, Entain's CEO, commented :

"Entain has undergone a profound transformation over the last

few years, and now has strong foundations from which to move into

its next phase of growth. We have made significant investments in

responsible gambling initiatives. While these steps have impacted

EBITDA, they are unquestionably the right thing to do to improve

our long-term prospects.

From here, we have a clear plan to focus our portfolio for

organic growth, drive our market share in the US, improve our

operational leverage, and increase our EBITDA margins. The wide

range of initiatives that are underway will cement our position as

a customer-focused industry leader, enable us to achieve our

strategic ambitions, and deliver enhanced returns for all our

stakeholders."

Q3: 1 July to 30 September 2023

------------------ --------------------------------------------------------------------

Total Sport Sports

NGR Wagers Margin

------------------------------------ -------------------- --------

Reported(1) cc(2) Proforma(2,3) Reported(1) cc(2)

------------------ ------------ ------ -------------- ------------ ------ --------

Online

Sports 1% 4% (15%) (6%) (2%) +0.5pp

Gaming 14% 15% 1%

Total Online 9% 11% (6%)

Retail (6) 4% 4% (4%) 12% 11% (0.6pp)

Total Group

(ex US) 7% 9% (5%)

BetMGM 8% 15%

Total Group

incl 50% BetMGM 7% 10%

------------------ ------------ ------ -------------- ------------ ------ --------

YTD: 1 January to 30 September 2023

------------------ --------------------------------------------------------------------

Total Sport Sports

NGR Wagers Margin

------------------------------------ -------------------- --------

Reported(1) cc(2) Proforma(2,3) Reported(1) cc(2)

------------------ ------------ ------ -------------- ------------ ------ --------

Online

Sports 4% 4% (8%) (4%) (4%) +0.8pp

Gaming 19% 17% 4%

Total Online 13% 11% (2%)

Retail (6) 9% 8% 3% 12% 11% 0.3pp

Total Group

(ex US) 11% 10% in line

BetMGM 41% 40%

Total Group

incl 50% BetMGM 15% 14%

------------------ ------------ ------ -------------- ------------ ------ --------

Notes

(1) 2023 reported numbers are unaudited and relate to continuing operations

(2) Growth on a constant currency basis is calculated by

translating both current and prior year performance at the 2023

exchange rates

(3) Proforma for all 2022 and 2023 acquisitions for the full period in both years

(4) As stated in trading update on 25 September 2023

(5) Adjusted for impact of known regulatory changes and RG

measures including UK affordability measures and lack of

enforcement in Germany post licensing

(6) Retail operates in UK, Italy, Belgium, Republic of Ireland,

Croatia, New Zealand and Poland

(7) Market share for last three months ending August 2023 by GGR

including iGaming, retail and online sports betting, and only U.S.

markets where BetMGM was active excluding New York; internal

estimates used where operator-specific results are unavailable

(8) Market share for last three months ending August 2023 by

GGR, including only U.S. markets where BetMGM was active; internal

estimates used where operator specific results are unavailable

(9) Based on current assumption of future live markets

(10) Regulus Partners estimates of Online market growth weighted for Entain's market portfolio

(11) Includes impact from accounting treatment of TAB NZ profit share payment arrangement

(12) EBITDA is defined as earnings before interest, tax,

depreciation and amortisation, share based payments and share of JV

income. EBITDA is stated pre-separately disclosed items

(13) Excludes an estimated cGBP35m benefit to EBITDA from TAB NZ

profit share payments which are deemed to form part of

consideration under IFRS 3

(14) Since 2019, Entain's online business has only seen negative

football margins for a full week on three occasions, two of which

were the last two weeks of October 2023

(15) Reflecting the a nnualisation of TAB NZ acquisition, new

taxes in Brazil (assumed from 1 July), partially offset by Project

Romer savings

Enquiries:

Investor Relations - Entain plc investors@entaingroup.com

David Lloyd-Seed, Chief IR & Communications Officer

Davina Hobbs, Head of Investor Relations

Aimee Remey, VP US Investor Relations

Callum Sims, IR Manager

Media - Entain plc media@entaingroup.com

Lisa Attenborough, Head of Corporate Communications

Jay Dossetter, Head of Corporate PR

Jodie Hitch, PR Manager

Powerscourt Tel: +44 (0) 20 7250 1446

Rob Greening/Russ Lynch/Sam Austrums entain@powersco urt-group.com

Presentation

Entain will host a presentation and Q&A session at 12.00

noon today, Thursday 2(nd) November 2023.

Participants may join via the webcast through this link Entain 2

Nov presentation or attend in person, having registered via the

link In-person registration

A replay, transcript and slides will be available on our website

:

https://entaingroup.com/investor-relations/results-centre/

Upcoming dates:

BetMGM Business Update: 4 December 2023

Entain Sustain: Week of 11 December 2023

Inside Information

This announcement contains information that qualifies or may

qualify as inside information within the meaning of Article 7 of

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

English law by virtue of the European Union (Withdrawal) Act 2018.

The person responsible for releasing this announcement on behalf of

the Company is Simon Zinger, General Counsel. Upon the publication

of this announcement via a regulatory information service, this

inside information is now considered to be in the public

domain.

Forward-looking statements

This document contains certain statements that are

forward-looking statements. The words "believe", "expect",

"anticipate", "intend" and "plan" and similar expressions identify

forward-looking statements. They appear in a number of places

throughout this document and include statements regarding our

intentions, beliefs or current expectations and those of our

officers, directors and employees. These forward-looking statements

include all matters that are not historical facts and include,

without limitation, those statements regarding the Company's

financial position, potential business strategy, potential plans

and potential objectives. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors which may

cause the Company's actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such forward-looking statements are based on numerous

assumptions regarding the Company's present and future business

strategies and the environment in which the Company will operate in

the future. Further, certain forward-looking statements are based

upon assumptions of future events which may not prove to be

accurate. Any such forward-looking statements reflect knowledge and

information available at the date of preparation of this document.

Other than in accordance with its legal or regulatory obligations

(including under the Market Abuse Regulation (596/2014) as it forms

part of English law by virtue of the European Union (Withdrawal)

Act 2018, the Listing Rules, the Disclosure Guidance and

Transparency Rules and the Prospectus Rules), the Company

undertakes no obligation to update or revise any such

forward-looking statements. Nothing in this document should be

construed as a profit forecast. The Company and its directors

accept no liability to third parties in respect of this document

save as would arise under English law.

About Entain plc

Entain plc (LSE: ENT) is a FTSE100 company and is one of the

world's largest sports betting and gaming groups, operating both

online and in the retail sector. The Group owns a comprehensive

portfolio of established brands; Sports brands include BetCity,

bwin, Coral, Crystalbet, Eurobet, Ladbrokes, Neds, Sportingbet,

Sports Interaction, STS, SuperSport and TAB NZ; Gaming brands

include Foxy Bingo, Gala, GiocoDigitale, Ninja Casino, Optibet,

Partypoker and PartyCasino. The Group owns proprietary technology

across all its core product verticals and in addition to its B2C

operations provides services to a number of third-party customers

on a B2B basis.

The Group has a 50/50 joint venture, BetMGM, a leader in sports

betting and iGaming in the US. Entain provides the technology and

capabilities which power BetMGM as well as exclusive games and

products, specially developed at its in-house gaming studios. The

Group is tax resident in the UK and is the only global operator to

exclusively operate in domestically regulated or regulating markets

operating in over 40 territories.

Entain is a leader in ESG, a member of FTSE4Good, the DJSI and

is AA rated by MSCI. The Group has set a science-based target,

committing to be carbon net zero by 2035 and through the Entain

Foundation supports a variety of initiatives, focusing on safer

gambling, grassroots sport, diversity in technology and community

projects. For more information see the Group's website:

www.entaingroup.com .

LEI: 213800GNI3K45LQR8L28

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUPGMUGUPWUUP

(END) Dow Jones Newswires

November 02, 2023 03:00 ET (07:00 GMT)

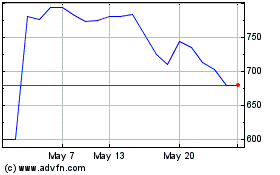

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024