Entain PLC Refinancing of EU1,125m Term Loan B due March 2024 (7257I)

December 06 2022 - 2:00AM

UK Regulatory

TIDMENT

RNS Number : 7257I

Entain PLC

06 December 2022

6 December 2022

Entain plc

("Entain" or the "Group")

Refinancing of EUR1,125m Term Loan B due March 2024

Entain plc (LSE: ENT), the global sports betting, gaming and

interactive entertainment group, today

announces the pricing and allocation of two new tranches of

First Lien Term Loan B ("the New Loans") as follows:-

1. EUR tranche of EUR800m, with maturity in June 2028, priced at

EURIBOR(1) + margin of 375 bps(2) and allocated at an original

issue discount of 97.5;

2. USD tranche of $375m (an add-on to the $1,000m loan issued in

October 2022), with maturity in October 2029, priced at Term

SOFR(3) + credit adjustment spread of 10 bps + margin of 350 bps(2)

and allocated at an original issue discount of 98.75.

The New Loans will fund in January 2023. The proceeds of the New

Loans will be used to immediately repay the entire EUR1,125m Term

Loan B due March 2024.

The Group intends to enter into hedging arrangements in respect

of the New Loans and details of these will be disclosed in due

course.

When the New Loans have been funded and the March 2024 loan

repaid, Entain's borrowings will be as follows:

Type of debt Quantum Date of issue/closing Maturity Interest

rate

Bonds GBP400m 08-Nov-2016 08-Sep-2023(4) 5.125% fixed

------------------ ---------------------- --------------- -------------------

Term Loan $1,125m(6,7) 29-Jul-2021 29-Mar-2027 LIBOR+2.50%(2)

B

------------------ ---------------------- --------------- -------------------

EUR800m January 2023 30-Jun-2028 EURIBOR +

3.75%

------------------ ---------------------- --------------- -------------------

$1,375m(6) 31-Oct-2022 31-Oct-2029 Term SOFR(3)

($1,000m) +3.60%(2)

/ January

2023 ($375m)

------------------ ---------------------- --------------- -------------------

Revolving GBP590m (undrawn) 12-Jul-2021 12-Jul-2026 SONIA(5) +2.50%(2)

Credit Facility

------------------ ---------------------- --------------- -------------------

Notes:

(1) Subject to a 0% floor

(2) +/- 25bps if Leverage as defined in the Senior Facilities

Agreement dated 7 July 2021 is greater than 3x / less than 2x (and

for RCF only, +/- a further 25bps if Leverage is greater than 4x /

less than 1.75x)

(3) Secured Overnight Financing Rate (SOFR), subject to a 0.5% floor

(4) Can be repaid at par in the 90 days prior to maturity i.e. from 10 June 2023

(5) SONIA applies for GBP drawings only - other reference rates

apply for other currencies, in all cases subject to a 0% floor

(6) Subject to 1% annual amortisation

(7) Effectively swapped into EUR via cross-currency swaps

Enquiries:

Investor Relations - Entain plc investors@entaingroup.com

Media - Entain plc media@entaingroup.com

Powerscourt Tel: +44 (0) 20 7250 1446

Rob Greening/Nick Hayns/Sam Austrums entain@powersco urt-group.com

About Entain plc

Entain plc (LSE: ENT) is a FTSE100 company and is one of the

world's largest sports-betting and gaming groups, operating both

online and in the retail sector. The Group owns a comprehensive

portfolio of established brands; Sports Brands include bwin, Coral,

Crystalbet, Eurobet, Ladbrokes, Neds, Sportingbet and Sports

Interaction; Gaming Brands include Foxy Bingo, Gala, GiocoDigitale,

Ninja Casino, Optibet, Partypoker and PartyCasino. The Group owns

proprietary technology across all its core product verticals and in

addition to its B2C operations provides services to a number of

third-party customers on a B2B basis.

The Group has a 50/50 joint venture, BetMGM, a leader in sports

betting and iGaming in the US. Entain provides the technology and

capabilities which power BetMGM as well as exclusive games and

products, specially developed at its in-house gaming studios. The

Group is tax resident in the UK, operating in over 40 regulated or

regulating territories. Entain is a leader in ESG, a member of

FTSE4Good, the DJSI and is AA rated by MSCI. The Group has set a

science-based target, committing to be carbon net zero by 2035 and

through the Entain Foundation supports a variety of initiatives,

focusing on safer gambling, grassroots sport, diversity in

technology and community projects. For more information see the

Group's website : www.entaingroup.com

LEI: 213800GNI3K45LQR8L28

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTFBATMTIMMIT

(END) Dow Jones Newswires

December 06, 2022 02:00 ET (07:00 GMT)

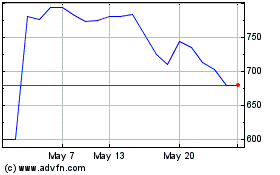

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024