TIDMDIS

RNS Number : 6362U

Distil PLC

24 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

Distil PLC

Placing and Subscription for, in aggregate, 218,571,428 new

Ordinary Shares at 0.35 pence per share Related Party Transactions;

and Notice of General Meeting

Majority of fundraising committed from three leading investors:

Grain GmbH, BERO SAS and Dr Graham Cooley

Transaction Highlights:

-- Placing and Subscription to raise GBP0.765 million (before

expenses) through the issue of 218,571,428 new Ordinary Shares at

the Issue Price

-- Grain GmbH, which is connected to Roland Grain, a

non-executive director of the Company, has agreed to invest

GBP200,000 and substantial shareholder BERO SAS, which is

associated with Baron Eric de Rothschild, has agreed to invest

GBP120,000 for, in aggregate, 91,428,571 Ordinary Shares in the

Subscription

-- Dr Graham Cooley is investing GBP200,000 for 57,142,857 Ordinary Shares in the Placing

Distil plc (AIM:DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, TRØVE Botanical Vodka and

Blavod Black Vodka, is pleased to announce it has conditionally

raised GBP0.765 million (before expenses) through a Placing and

Subscription (together, the "Fundraising").

As previously reported, Distil has undergone a remodelling of

its distribution model, as it moved away its distribution to the

on-trade and independent sectors to Marussia Beverages, whilst

handling sales and marketing to our major UK retail customers

directly, giving Distil control over this relationship.

The Fundraising will provide working capital to enable Distil to

service customers with stock at the busiest time for the business

and allow it to support its growth plan to the end of March 2025.

Plans include the opening of the Blackwoods gin experience at

Ardgowan, consumer brand activation at key events, development of

premium line-extensions, limited-edition bottlings, and the launch

of a new-to-world brand in an emerging category.

The Company has conditionally placed through its broker, Turner

Pope, 127,142,857 new ordinary shares of 0.1p each ("Ordinary

Shares") in the capital of the Company (the "Placing Shares") at a

price of 0.35p per Placing Share (the "Issue Price") to raise

GBP445,000, before expenses (the "Placing").

The Company also announces a conditional subscription of

91,428,571 Ordinary Shares (the "Subscription Shares") at the Issue

Price with existing shareholders to raise GBP320,000, before

expenses (the "Subscription").

Participation in the Subscription by Grain GmbH and BERO SAS,

both substantial shareholders in the Company, are related party

transactions under the AIM Rules. The Independent Directors, having

consulted with SPARK Advisory Partners, the Company's nominated

adviser, consider that the terms of the Subscription by Grain GmbH

and BERO SAS are fair and reasonable insofar as Shareholders are

concerned.

The Placing Shares and Subscription Shares will represent

approximately 24.1 per cent. of the Enlarged Share Capital

following Admission.

The Issue Price represents a discount of approximately 22 per

cent. to the Closing Price of 0.45 pence per Ordinary Share on 23

November 2023, being the last practical date prior to the date of

this announcement.

Don Goulding, Executive Chairman of the Company, commented:

"I am pleased to announce a successful round of fundraising and

thank our shareholders for the continued support shown to the

business. We are also delighted to welcome Dr Graham Cooley as a

significant shareholder, subject to General Meeting approvals. He

is a very successful business leader, entrepreneur and champion of

sustainability and we are encouraged by the interest he has shown

in our business.

Proceeds raised will be managed carefully by the business and

will not only allow us to service our key customers to a high

standard throughout the busiest time of the year, but will continue

to make positive impacts on the business, supporting growth through

to March 2025 and beyond.

An increase in working capital will allow us to lower frequency

but increase the size of production runs to take advantage of cost

savings afforded by working in this way. Cost management will

continue to be a key area of focus for the business.

Funds will also be used to support brand growth through a

programme of promotion and point of sale activation, supported by

direct-to-consumer events which will be used to drive brand

awareness and trial. Following a successful trial for RedLeg, plans

also include a calendar of limited edition packs to increase

engagement and rate of sale.

Design development of the Blackwoods brand experience at

Ardgowan is near finalisation, with plans to open to the public in

Q1 following commencement of gin distillation across the range in

February 2024.

Finally, proceeds will also be used to brand and bring to market

already developed liquid in an exciting emerging category in 2024.

This will take the business into a new space that is gaining

attention with a unique proposition.

The fundraising represents an important springboard for growth

and I look forward to sharing the benefits with shareholders in

future communications."

Fee Shares

In addition to the Fundraising shares, 2,142,857 new Ordinary

Shares are to be issued at the Issue Price, conditional upon

Admission, to an adviser in settlement of amounts owed by the

Company.

Notice of General Meeting

A General Meeting to approve the resolutions (the "Resolutions")

required to implement the Fundraising is to be held at Temple

Chambers, 3-7 Temple Avenue, London EC4Y 0DT at 10.00 a.m. on 12

December 2023. A detailed timetable of events is set out at the

bottom of this announcement.

Copies of a Circular convening a General Meeting for 10.00 a.m.

on 12 December 2023 will be sent to shareholders later today and

will shortly be available on the website of the Company at

http://www.distil.uk.com/investors.

Extracts from the Circular are set out below.

For further information:

Distil PLC

Don Goulding, Executive Chairman Tel: +44 203 283 4006

----------------------

SPARK Advisory Partners Limited

(NOMAD)

----------------------

Neil Baldwin Tel: +44 203 368 3550

Mark Brady

----------------------

Turner Pope Investments (TPI)

Ltd

(Broker)

----------------------

Andy Thacker Tel: +44 203 657 0050

James Pope

----------------------

Extracts from the Circular:

1. Background to and reasons for the General Meeting

Your Board announced on 24 November 2023 that the Company

proposes to raise GBP765,000 before fees and expenses by a placing

of, and subscription for, 218,571,428 new Ordinary Shares with

existing and new investors at an Issue Price of 0.35 pence per New

Ordinary Share. The Issue Price represents a discount of

approximately 22 per cent. to the Closing Price of 0.45 pence per

Ordinary Share on 23 November 2023, being the last practical date

prior to the date of the Announcement.

The Placing Shares and Subscription Shares will represent

approximately 24.1 per cent. of the Company's Enlarged Share

Capital. The Placing Shares have been placed, and the Subscription

Shares have been subscribed for, conditional, inter alia , on the

passing of the Resolutions being proposed at the General Meeting

and upon Admission (which is expected to become effective with

dealings in the Placing Shares and the Subscription Shares to

commence on or around 13 December 2023). Neither the Placing nor

the Subscription have been underwritten.

For the Placing and Subscription to proceed, the Company

requires Shareholders' approval to authorise the Directors to allot

the Placing Shares, the Subscription Shares and the Fee Shares and

to disapply statutory preemption rights in relation to the issue of

the Placing Shares, the Subscription Shares and the Fee Shares.

I am therefore writing to provide you with details of the

Proposals, and to give you notice of the General Meeting at which

the resolutions to authorise the Directors to allot and issue the

Placing Shares, the Subscription Shares and the Fee Shares , as

well as Ordinary Shares (and/or rights to subscribe for them) up to

the aggregate nominal value of GBP180,000 will be put to

Shareholders. The General Meeting is to be held at 10.00 a.m. on 12

December 2023 and the formal notice of General Meeting is set out

at the end of this document.

2. Reasons for the Fundraising

As previously reported Distil has undergone a re-modelling of

its distribution model, as it moved away its distribution to the

on-trade and independent sectors to Marussia Beverages, whilst

handling sales and marketing to our major UK retail customers

directly, giving Distil control over this relationship.

This had, as reported in our final results to 31 March 2023,

which showed a loss for the period of GBP748k, a one-off knock-on

effect in relation to sales as existing stock in the UK market was

depleted.

As we reported in our unaudited interim results for the 6 months

ended 30 September 2023 on 12 October 2023 : "H1 has not been

without its challenges, as the business continues to face

wide-spread cost of goods increases in response to inflation and

the war in Ukraine, as well as a UK duty increase on all alcoholic

beverages. Reflecting the economic climate, consumers globally

remain cautious, the impact of which is being felt in the trade and

is expected to continue in the short to medium term. However,

despite this, our year-on-year results are encouraging. We are

rebuilding from a stronger base under the new structure, and the

team is working diligently to ensure that we are well positioned to

continue this growth as we enter our busiest trading period."

The above challenges together with the change in distribution

model have impacted the Company's working capital needs

particularly during the run up to the busy Christmas trading

period. The Company has explored alternative means of raising

working capital. The Board concluded that an equity raise provides

the most cost effective and timely solution.

The fundraising will provide working capital to enable Distil to

service customers with stock at the busiest time of year for the

business, and allow it to support its growth plan to the end of

March 2025. Plans include the opening of the Blackwoods gin

experience at Ardgowan, consumer brand activation at key events,

development of premium line-extensions, limited-edition bottlings,

and the launch of a new-to-world brand in an emerging category.

3. Details of the Placing

The Placing has raised approximately GBP445,000 (before

expenses) for the Company by the issue of 127,142,857 Ordinary

Shares at the Issue Price with investors.

The Placing Shares are being placed conditional, inter alia, on

the passing of the Resolutions at the General Meeting.

The Company has agreed to pay all costs and expenses relating to

the Placing and the applications for Admission including commission

payable to Turner Pope.

The Placing is conditional upon, inter alia:

-- the Resolutions being duly passed at the General Meeting by

12 December 2023, or such later time and/or date as the Company,

Turner Pope and SPARK may agree in the event of an adjournment of

the General Meeting, but in any event by no later than 8.00 a.m. on

19 December 2023;

-- Admission becoming effective on or before 8.00 a.m. on 13

December 2023, or such later time and/or date as the Company,

Turner Pope and SPARK may agree, but in any event by no later than

8.00 a.m. on 20 December 2023; and

-- completion of the Subscription.

The Placing is not being underwritten. The Placing Shares are

expected to be allotted on 12 December 2023, with Admission

expected on 13 December 2023.

The Placing will result in the issue of 127,142,857 new Ordinary

Shares representing approximately 14.0 per cent. of the Enlarged

Share Capital. The Placing Shares, when issued and fully paid, will

rank pari passu in all respects with the Existing Ordinary Shares

on Admission.

4. Details of the Subscription

The Subscription has raised GBP320,000 for the Company by the

conditional issue of a total of 91,428,571 Ordinary Shares at the

Issue Price to (1) Grain GmbH and (2) BERO as set out in section 8

below.

The Subscription is conditional upon, inter alia:

-- the Resolutions being duly passed at the General Meeting by

12 December 2023, or such later time and/or date as the Company,

Turner Pope and SPARK may agree in the event of an adjournment of

the General Meeting, but in any event by no later than 8.00 a.m. on

19 December 2023; and

-- Admission becoming effective on or before 8.00 a.m. on 13

December 2023 or such later time and/or date as the Company, Turner

Pope and SPARK may agree, but in any event by no later than 8.00

a.m. on 20 December 2023.

The Subscription Shares are expected to be allotted on 12

December 2023. The Subscription will result in the issue of

91,428,571 new Ordinary Shares representing approximately 10.1 per

cent. of the Enlarged Share Capital. The Subscription Shares, when

issued and fully paid, will rank pari passu in all respects with

the Existing Ordinary Shares on Admission.

5. Fee Shares

2,142,857 new Ordinary Shares are to be issued at the Issue

Price, conditional upon Admission, to an adviser in settlement of

amounts owed by the Company. The Fee Shares are expected to be

allotted on 12 December 2023, with Admission expected on 13

December 2023.

6. Settlement and dealings

Application has been made to the London Stock Exchange for the

Placing Shares, the Subscription Shares and the Fee Shares to be

admitted to trading on AIM. It is expected that Admission will

become effective and that dealings in the Placing Shares, the

Subscription Shares and the Fee Shares will commence on 8.00 a.m.

on 13 December 2023, subject, inter alia , to the passing of the

Resolutions at the General Meeting.

7. Use of Proceeds

The gross proceeds amount to GBP765,000. The expenses of the

Proposals amount to approximately GBP64,200, of which approximately

GBP56,700 will be settled in cash, and GBP7,500 will be satisfied

by the issue of the Fee Shares on the same terms as the Placing and

Subscription. The net proceeds of the Placing and the Subscription

will be used by the Company for general working capital. As the

Company recently announced, cash reserves stood at GBP321,000 as at

30 September 2023 and so the net proceeds of the fundraising will

provide Distil with sufficient liquidity as the Company enters the

crucial Christmas season and its busiest trading period of the

year.

8. Related Party Transactions

Roland Grain is a non-executive Director of the Company and is

currently interested (via Grain GmbH) in 156,476,20 Existing

Ordinary Shares (representing 22.86 per cent. of the Company's

current issued share capital). As a Director and as a substantial

shareholder in the Company, Roland Grain is a related party under

the AIM Rules.

BERO is currently interested (via Bank of New York (Nominees)

Limited) in 106,289,231 Existing Ordinary Shares (representing

15.53 per cent. of the Company's issued share capital). As a

substantial shareholder in the Company, BERO is a related party

under the AIM Rules.

The participation of Grain GmbH and BERO in the Subscription are

related party transactions under AIM Rule 13 of the AIM Rules.

Mr Grain is not considered independent in relation to the

consideration of these related party transactions under AIM Rule

13. Therefore, Don Goulding and Shaun Claydon, being the

Independent Directors, have considered the participation of the

related parties in the Subscription in line with the AIM Rules for

Companies.

Grain GmbH's and BERO's participation in the Subscription

Name Holding Amount Number Number % of Ordinary

of Existing subscribed of Subscription of Ordinary Share capital

Ordinary in the Subscription Shares Shares held held post

Shares post Admission Admission

Grain GmbH* 156,476,250 GBP200,000 57,142,857* 213,619,017 23.60%

------------- --------------------- ----------------- ---------------- ---------------

BERO 106,289,231 GBP120,000 34,285,714 140,574,945 15.53%

------------- --------------------- ----------------- ---------------- ---------------

*Grain GmbH is a company to which Mr Roland Grain is

connected.

held via Bank of New York (Nominees) Limited.

The terms of the Subscription are essentially the same as the

terms of the Placing.

The Independent Directors have considered the participation of

Grain GmbH and BERO in the Subscription. Having consulted with

SPARK Advisory Partners, the Company's nominated adviser, the

Independent Directors consider that the terms of Grain GmbH's and

BERO's participation in the Subscription are fair and reasonable

insofar as Shareholders are concerned.

9. General Meeting

The Directors do not currently have existing authorities to

allot shares and dis-apply pre-emption rights under section 551 and

section 570 of the Act to enable the Company to allot and issue the

Placing Shares, the Subscription Shares and the Fee Shares.

Consequently, the Company needs to first obtain approval from its

Shareholders to grant to the Board additional authority to allot

the new Ordinary Shares and to disapply statutory pre-emption

rights which would otherwise apply to such allotment or grant. The

Company is also seeking Shareholder authority to increase the

Directors' general authority to allot securities and dis-apply

pre-emption rights pursuant to sections 551 and 570 of the Act,

respectively.

A summary and brief explanation of the resolutions to be

proposed at the General Meeting is set out below. Please note that

this is not the full text of the Resolutions and you should read

this section in conjunction with the Resolutions contained in the

Notice at the end of this document. The following resolutions will

be proposed at the General Meeting:

Resolution 1 , which will be proposed as an ordinary resolution,

is to authorise the Directors to allot or issue the Placing Shares,

the Subscription Shares, the Fee Shares and further new Ordinary

Shares (representing approximately 20 per cent. of the Enlarged

Share Capital) up to an aggregate nominal value of GBP180,000;

and

Resolution 2 , which will be proposed as a special resolution,

and which is subject to the passing of Resolution 1, dis-applies

statutory pre-emption rights, provided that such authority shall be

limited to the Placing Shares, the Subscription Shares, the Fee

Shares and further Ordinary Shares (representing approximately 20

per cent. of the Enlarged Share Capital) having an aggregate

nominal value of GBP180,000 .

The General Meeting will be held at 10.00 a.m. on 12 December

2023 at Temple Chambers, 3-7 Temple Avenue, London EC4Y 0DT.

10. Irrevocable Undertakings

Grain GmbH (156,476,250 Ordinary Shares) and BERO (106,289,231

Ordinary Shares) have each irrevocably undertaken to vote their

Ordinary Shares (which in aggregate amount to 38.39% of the issued

share capital) in favour of the Resolutions at the General

Meeting.

11. Action to be taken by Shareholders

A form of proxy for use at the General Meeting is enclosed.

Whether or not you intend to attend the General Meeting in person,

you are requested to complete and sign the form of proxy and return

it to the Company's Registrars at 3 The Millennium Centre, Crosby

Way, Farnham, GU9 7XX, so as to arrive no later than 10.00 a.m. on

8 December 2023. The return of the form of proxy will not prevent

you from attending the General Meeting and voting in person should

you wish to do so.

12. Importance of the vote

Shareholders should be aware that if the Resolutions are not

approved at the General Meeting, the Placing and Subscription will

not occur, and the net proceeds of the fundraising will not be

received by the Company. If this were to happen, unless the Company

was able to raise potentially more expensive and/or dilutive funds

from alternative sources in the immediate short term, the Company

would not have sufficient working capital to continue to trade for

the next 12 months without taking mitigating action to

significantly reduce the operating costs of the Company which would

in turn adversely impact the Company's important Christmas trading

period and would be materially detrimental to its future

prospects.

13. Board Recommendations

In relation to the Resolutions, as Mr Grain has participated in

the Subscription, he is not considered independent and as such has

not participated in the recommendation.

The Independent Directors consider that the Placing, the

Subscription, the issue of the Fee Shares and the Resolutions are

in the best interests of the Company and its Shareholders as a

whole. Accordingly, the Independent Directors recommend that you

vote in favour of the Resolutions as they intend to do in respect

to their shareholdings of 10,000,000 Ordinary Shares amounting to

1.46 per cent. of the issued share capital of the Company.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2023

Announcement of the Placing and Subscription 24 November

Posting of the Circular and the form of proxy 24 November

Latest time and date for receipt of forms of proxy for the

General Meeting 10.00 a.m. on 8 December

General Meeting 10.00 a.m. on 12 December

Announcement of the result of the General Meeting 12

December

Admission of the Placing Shares, Subscription Shares 8.00 a.m.

on 13 December

and Fee Shares to trading on AIM

Expected date of despatch of definitive share certificates for

the by 22 December

Placing Shares, Subscription Shares and Fee Shares in

certificated form (certificated holders only)

Notes:

1. References to times in this document are to London time unless otherwise stated.

2. If any of the above times or dates should change, the revised

times and/or dates will be notified to Shareholders by an

announcement on an RNS (and posted on the Company's website).

3. All events in the above timetable following the General

Meeting are conditional upon approval by the Shareholders of the

Resolutions.

PLACING STATISTICS

Existing Ordinary Shares in issue as at the date

of this Document 684,399,579

Number of Subscription Shares 91,428,571

Number of Placing Shares 127,142,857

Number of Fee Shares 2,142,857

Enlarged Share Capital 905,113,864

Percentage of the Enlarged Share Capital represented

by the Placing Shares and the Subscription Shares 24.1 %

Issue Price 0.35p

Gross proceeds of the Placing and the Subscription GBP765,000

Estimated net proceeds of the Placing and the GBP708,300

Subscription

DEFINITIONS

The following definitions apply throughout this document, unless

the context requires otherwise.

" Act " Companies Act 2006

"Admission " the admission of the Placing Shares, the

Subscription Shares and the Fee Shares to trading on AIM and such

admission becoming effective in accordance with the AIM Rules

" AIM " the market of that name operated by London Stock

Exchange plc

" AIM Rules " the AIM Rules for Companies whose securities are

traded on AIM, as published by the London Stock Exchange from time

to time

" Announcement " the notification issued by the Company on 24

November 2023, which sets out details of the Proposals

" Articles " the Company's articles of association

" BERO " BERO SAS, a substantial shareholder in the Company

" Board " or " Directors " the directors of the Company at the

date of this Document, whose names are set out on page 7 of this

Document

" Circular " or " Document " this document dated 24 November 2023

" Closing Price " 0.45 pence, being the closing mid-market share

price on 23 November 2023

" CREST " the relevant system (as defined in the CREST

Regulations) for paperless settlement of share transfers and the

holding of shares in uncertificated

form which is administered by Euroclear

" CREST Manual " the rules governing the operation of CREST

consisting of the CREST Reference Manual, the CREST International

Manual, the CREST Central Counterpart Service Manual, the CREST

Rules, the CCSS Operations Manual, the Daily Timetable, the CREST

Application Procedures and the CREST Glossary of Terms, as

published by Euroclear from time to time

" CREST Regulations " the Uncertificated Securities Regulations

2001(SI 2001/3755) (as amended)

" Distil " or " Company " Distil PLC, a company registered in

England and Wales with registered number 3727483

" Enlarged Share Capital " together the Existing Ordinary

Shares, the Placing Shares, the Subscription Shares and Fee

Shares

" Euroclear " Euroclear UK & International Limited

" Existing Ordinary Shares " the 684,399,579 Ordinary Shares in issue as at the date hereof

" Existing Shareholders " holders of Ordinary Shares at the date of this document

" Fee Shares " 2,142,857 new Ordinary Shares to be issued to an

adviser at the Issue Price in settlement of amounts owed by the

Company

" FCA " the Financial Conduct Authority

" form of proxy " the form of proxy accompanying this Document

(or otherwise available) for use at the General Meeting

" General Meeting " or " GM " the General Meeting of

Shareholders to be held at 10.00 a.m. on 12 December 2023

" Grain GmbH " a substantial shareholder in the Company

controlled by Mr Roland Grain, a non-executive director of the

Company

" Group " the Company and its subsidiaries as at the date of

this Document

" Independent Directors " Don Goulding and Shaun Claydon

" Issue Price " 0.35p per Placing Share, Subscription Share and Fee Share

" London Stock Exchange " London Stock Exchange plc

" Notice " or the notice of the General Meeting set out at the

end of this document " Notice of General Meeting "

" Ordinary Shares " ordinary shares of 0.1p each in the capital of the Company

" Placing " the conditional placing of the Placing Shares at the

Issue Price, further details of which are set out in section 3 of

the Letter from the Chairman

" Placing Shares " the 127,142,857 new Ordinary Shares the subject of the Placing

" Proposals " the Placing and the Subscription

" Resolutions " the resolutions set out in the notice of General Meeting

" SPARK " SPARK Advisory Partners Limited, the Company's

Nominated Adviser

" Shareholders " holders of Ordinary Shares in the Company from time to time

" Sterling " or " GBP " the lawful currency of the UK

" Subscription Agreements " the conditional agreements dated 23

November 2023 between the Company and (1) Grain GmbH (a company

with which Mr Roland Grain, a non-executive director, is

connected), and (2) BERO, relating to the Subscription

" Subscription " the subscription for the Subscription Shares by

(1) Grain GmbH and (2) BERO under the Subscription Agreements

" Subscription Shares " the 91,428,571 new Ordinary Shares the subject of the Subscription

" Turner Pope " Turner Pope Investments (TPI) Limited, the Company's brokers

" UK " or " United Kingdom " the United Kingdom of Great Britain and Northern Ireland

" US " or " United States " the United States of America, its

territories and possessions, any states of the United States of

America and the District of Columbia and all other areas subject to

its jurisdiction."

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFEFFELEDSEEF

(END) Dow Jones Newswires

November 24, 2023 07:30 ET (12:30 GMT)

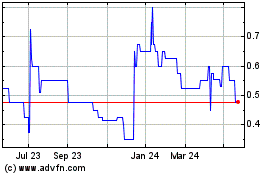

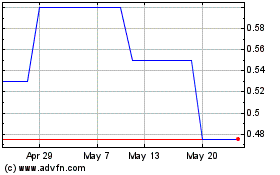

Distil (AQSE:DIS.GB)

Historical Stock Chart

From Nov 2024 to Nov 2024

Distil (AQSE:DIS.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024