TIDMBZT

RNS Number : 2074F

Bezant Resources PLC

18 March 2022

18 March 2022

Bezant Resources Plc

("Bezant" or the "Company")

Mankayan Project MPSA renewal

Bezant (AIM: BZT), the copper-gold exploration and development

company, further to its announcements dated 13 September 2021 and

21 October 2021 and 22 November 2021, confirms that the Mines and

Geosciences Bureau of the Department of Environment and Natural

Resources of the Philippines government ("MGB") has renewed

Crescent Mining Development Corporation's ("Crescent") Mineral

Production Sharing Agreement No. 057-96-CAR (the " MPSA ") for a

second 25 year term with effect from 12 November 2021 (the " MPSA

Renewal ").

Highlights

Mankayan project

-- The MPSA Renewal for 25 years is seen by the Company as a

catalyst for the development of the Mankayan Project which is a

potentially world class copper-gold porphyry project at a time when

the Philippines is looking to further develop its mining

industry.

-- Since the acquisition by IDM Mankayan Pty Ltd ("IDM") from

Mining and Minerals Industries Holding Pte Ltd. (MMIH) of MMIH's

interest in the project including project reports commissioned by

MMIH there has been an extensive review of the work undertaken in

relation to the project during 2019 to 2021 which is referred to

under the project's background information summary below.

Bezant's Interest in the Mankayan project

-- Bezant's interest in the Mankayan Project is via its 27.5%

shareholding in IDM, a company incorporated in Australia,

established to support Crescent in developing the Mankayan Project

in the Philippines, with the remaining 72.5% owned by established

investors in the mining sector. IDM owns 100% of Asean Copper

Investments Limited, further details of IDM and its interest in the

Mankayan Project were announced on 13 September 2021.

Project work underway and planned

-- Crescent has commenced the feasibility study process and has

engaged internationally recognised firms with in-country presence

and Philippine firms to complete the scoping phase of the project

and to plan a drill campaign to assist with geotechnical

studies.

ASX Listing

-- As previously announced on 13 September 2021 it is proposed

that IDM will be acquired by IDM International Limited (ACN

108029198) with the view that IDM International Limited in the

future may apply for a listing on the Australian Stock Exchange

("ASX").

Colin Bird, Executive Chairman of Bezant, commented: We are very

pleased with the renewal of the MPSA for 25 years which will be a

catalyst for the development of this world class copper gold

porphyry project. We are very confident that management in the

Philippines supported by IDM have the experience and expertise to

take the project forward through the next stages of evaluation and

development which will significantly enhance the value of the

project. We are also aware of the renewed focus of the Philippines

since the lifting in August 2021 of the moratorium on new mining

projects and the nationwide ban on open-pit mining method, in

ensuring that the Philippines considerable mining resources are

developed and play a significant role in the development of the

Philippine economy in the post COVID era."

Mankayan Copper-Gold Porphyry Deposit Background information

The Guinaoang (Mankayan) copper-gold deposit forms part of the

major Lepanto mineralisation system located approximately 240km

north of Manila on Luzon Island, Philippines. The district hosts a

number of large copper and gold deposits, including the Far

Southeast porphyry deposit, the Lepanto lodes, and the Suyoc

epithermal gold-silver veins.

The copper mineralisation encountered in the Guinaoang deposit

is typical of porphyry copper-gold style deposits. The Pliocene

intrusive stock complex is composed largely of quartz diorite

porphyry rocks, with two distinct phases of igneous intrusion, both

of which are host to copper and gold mineralisation. In plan view

the intrusives occupy an area which is approximately 400m wide and

900m long and it has been drilled to more than 900m depth.

By way of background information the following information is

provided as it is in the public domain:

-- Several phases of drilling defined a copper-gold resource

estimate by Snowden Mining Industry Pty Limited ("Snowden") in 2009

under JORC (2004) which defined an initial mineral resource as per

the table below. The Snowden report was prepared for the Company

and was JORC compliant when issued in 2009 but is not compliant

with JORC (2012).

Mankayan Resource Summary, JORC (2004) to a 0.4%

Cu cut-off

prepared by Snowden in 2009

Resource Tonnes Cu % Au g/t Cu metal Au metal

Category (Mt) (Mt) (Moz)

------------ -------- ----- ------- --------- ---------

Indicated 221.6 0.49 0.52 1.1 3.7

Inferred 36.2 0.44 0.48 0.2 0.6

-- In November 2020 MMIH announced an updated Mineral Resource

was prepared by Derisk Geomining Consultants Pty Ltd ("Derisk") for

MMIH under JORC (2012) and stated that "Mankayan is now estimated

to have combined Mineral Resources of 793 million tonnes containing

2.8 million tonnes of copper, 9.6million ounces of gold and 20

million ounces of silver. It has indicated Mineral Resource of 638

million tonnes @ 0.37% Cu, 0.40 g/t Au and 0.90 g/t Ag, and

inferred Mineral Resource of 155 million tonnes @ 0.29% Cu, 0.

30g/t Au and 0.5 g/t Ag." This information is provided as MMIH have

made it publicly available but it is not an updated JORC resource

statement in accordance with AIM Rules and should therefore not be

relied upon until it has been independently verified or updated by

the Company. As referred to above Crescent are undertaking further

technical studies and the Company will make further announcements

as soon as practical once these studies are completed.

A 2019 study by Mining Plus Pty Limited announced by Bezant on

12 February 2019 and based on the 2009 resource identified and

assessed a number of high-level alternative mining options for the

Mankayan project as well as substantially improving the underlying

economics of the proposed operations. In total, eleven options were

investigated, with the two main options being block cave

development routes at different scales. The highest mining rate

examined was 24Mtpa.

Further potential remains to extend the resource through

additional drilling, as well as delineating higher grade

copper-gold zones within the deposit as a potential focus for

mining start-up.

Bezant interest in the Mankayan project: The Company announced

on 13 September 2021 i) the Company's agreement with IDM under

which it was agreed that IDM would take the Mankayan Project

forward and the Company would own 27.5% of IDM with anti-dilution

rights to enable the Company to maintain its shareholding; and ii)

IDM's agreement with Mining and Minerals Industries Holding Pte

Ltd. ("MMIH") under which it acquired MMIH's interest in Asean

Copper Investments Ltd and MMIH's Project information ( the "IDM

Agreements").

Proposed ASX listing: As previously announced It is proposed

that IDM will be acquired by IDM International Limited (ACN

108029198) with the view that IDM International in the future may

apply for a listing on the Australian Stock Exchange ("ASX").

For further information, please contact:

Bezant Resources Plc

Colin Bird, Executive Chairman +44 (0) 20 3416 3695

Beaumont Cornish (Nominated Adviser)

Roland Cornish +44 (0) 20 7628 3396

Novum Securities Limited (Broker)

Jon Belliss +44 (0) 20 7399 9400

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law pursuant to the Market Abuse (Amendment) (EU Exit)

regulations (SI 2019/310).

Technical Sign-Off: Technical information in this announcement

has been reviewed by Edward (Ed) Slowey, BSc, PGeo, Technical

Director of Bezant. Mr Slowey is a geologist with more than 40

years' relevant experience in mineral exploration and mining, a

founder member of the Institute of Geologists of Ireland and is a

Qualified Person under the AIM rules. Mr Slowey has reviewed and

approved this announcement.

Technical Glossary

"Au" Gold

------------------- ------------------------------------------------------

"Cu" Copper

------------------- ------------------------------------------------------

"Cu eq" Copper equivalent: Copper equivalent grades

are based on a copper price of US$2.80/lb

and a gold price of US$1,800/oz Au.

------------------- ------------------------------------------------------

"g/t" grammes per tonne

------------------- ------------------------------------------------------

"Indicated Mineral That part of a Mineral Resource for which

Resource" quantity, grade (or quality), densities, shape

and physical characteristics are estimated

with sufficient confidence to allow the application

of Modifying Factors in sufficient detail

to support mine planning and evaluation of

the economic viability of the deposit. Geological

evidence is derived from adequately detailed

and reliable exploration, sampling and testing

gathered through appropriate techniques from

locations such as outcrops, trenches, pits,

workings and drill holes, and is sufficient

to assume geological and grade (or quality)

continuity between points of observation where

data and samples are gathered (JORC 2012)

------------------- ------------------------------------------------------

"Inferred Mineral An 'Inferred Mineral Resource' is that part

Resource" of a Mineral Resource for which quantity and

grade (or quality) are estimated on the basis

of limited geological evidence and sampling.

Geological evidence is sufficient to imply

but not verify geological and grade (or quality)

continuity. It is based on exploration, sampling

and testing information gathered through appropriate

techniques from locations such as outcrops,

trenches, pits, workings and drill holes.

------------------- ------------------------------------------------------

"kt" thousand tonnes

------------------- ------------------------------------------------------

"Mineral Resource" A 'Mineral Resource' is a concentration or

occurrence of solid material of economic interest

in or on the Earth's crust in such form, grade

(or quality), and quantity that there are

reasonable prospects for eventual economic

extraction. The location, quantity, grade

(or quality), continuity and other geological

characteristics of a Mineral Resource are

known, estimated or interpreted from specific

geological evidence and knowledge, including

sampling. Mineral Resources are sub-divided,

in order of increasing geological confidence,

into Inferred, Indicated and Measured categories.

------------------- ------------------------------------------------------

"Moz" million ounces

------------------- ------------------------------------------------------

"Mt" million tonnes

------------------- ------------------------------------------------------

"Mtpa" million tonnes per annum

------------------- ------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAPDXFSAAEFA

(END) Dow Jones Newswires

March 18, 2022 03:01 ET (07:01 GMT)

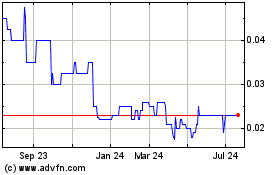

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

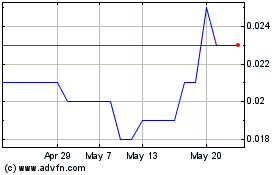

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025