TIDMBVXP

Bioventix plc

("Bioventix" or the "Company")

Unaudited Interim Results for the six months ended 31 December 2019

Bioventix plc (BVXP) ("Bioventix" or "the Company"), a UK company specialising

in the development and commercial supply of high-affinity monoclonal antibodies

for applications in clinical diagnostics, announces its unaudited interim

results for the six-month period ended 31 December 2019.

Highlights

* Revenue up 21% to GBP5.3 million (2018: GBP4.4 million)

* Profit before tax up 31% to GBP4.3 million (2018: GBP3.2 million)

* Closing cash balances unchanged at GBP5.5 million

* Interim dividend up 20% to 36p per share (2018: 30p)

Business review

We are pleased to announce a strong performance for the unaudited interim

results for the six-month period ended 31 December 2019 with revenues for the

half-year of GBP5.3 million (2018: GBP4.4 million) up 21% on the previous year.

Total profits before tax for the half-year increased by 31% to GBP4.3 million

(2018: GBP3.2 million). The cash balances remained very similar, finishing the

period unchanged at GBP5.5 million.

Vitamin D antibody sales growth continued at the healthy levels seen during the

previous financial year. Whilst this is very encouraging, we continue to see

evidence of a plateau in the downstream global vitamin D assay market. We have

previously commented on the impressive performance of two specific customers in

the downstream vitamin D test market - Diazyme (San Diego, US) and Boditech

(South Korea) - and their sales continued to grow.

Other revenue streams for the core of established antibodies showed modest

growth during the period. Added to this were increased sales of a number of

newer antibodies to T4 (thyroxine), androstenedione (a steroid closely related

to testosterone) and biotin (used as a replacement for streptavidin).

Sales relating to troponin antibodies grew significantly during the period.

Whilst the actual sales were slightly below our expectation, the percentage

growth provides further evidence of the roll-out of these new tests and

encouragement for the future sales performance.

Our research activities continue in line with the plans described in the 2019

annual report. Whilst we will report further on these various projects with

our full year results, we are particularly pleased with the development of our

pollution exposure assay. We have successfully tested a prototype lab-based

ELISA (enzyme-linked immunosorbent assay) and this will progress towards

commercial kit manufacture during the second half of calendar 2020. Our hope

is that we will have a lab-based kit available for sale to pollution

researchers sometime during calendar 2021. In addition to the pollution

research market, it is also possible that the test will have a degree of

utility in the health and safety field (i.e. industrial worker biomonitoring).

We will initially introduce the test directly to interested parties before

seeking appropriate commercial partners for the future.

With the exception of COVID-19, the overall context of the business and the

landscape in which we operate has not materially changed since the 2019 annual

report and we draw the attention of any new shareholders to this report.

We have continued with the development of our Farnham laboratory. The work on

our manufacturing facilities has been completed and we are now fully

operational. The last remaining phase of the development work (cost GBP100k)

covering the technology development lab is planned for later in 2020.

In relation to the comments below regarding COVID-19, Bioventix is a resilient

business and the Board will continue to follow our established dividend

policy. For the period under review, the Board is pleased to announce an

interim dividend of 36p per share which represents a 20% increase on last

year.

The shares will be marked ex-dividend on 9 April 2019 and the dividend will be

paid on 28 April 2019 to shareholders on the register at close of business on

14 April 2019.

We would like to offer some comments on COVID-19 and the possible impact on

Bioventix, accepting that perspectives on the infection have tended to be

overtaken by rapidly changing events. Like many companies, we will be subject

to the effects of COVID-19. Circumstances have changed quickly during the last

few weeks and therefore we will limit our comments to some general observations

that we believe to be accurate. In most affected countries, healthcare and

associated products and services have been prioritised and so we expect that

our customers will continue to operate and that we will continue to supply

antibodies to them. Within the field of our customers in downstream in vitro

diagnostics, it is possible that some routine diagnostic testing could be

reduced as hospitals refocus towards virus-infected patients and this could

have an impact on Bioventix into the future. Regarding our own activities in

Farnham, the welfare of our staff is our top priority. We will be following

Government guidelines on working practices which could result in staff

shortages. During 2020, we will aim to maintain the production and supply of

commercial SMAs to our customers. We have already implemented a raw material

purchasing strategy that minimises the possibility of reagent supply shortages

and we already hold large stocks of final products which offers a degree of

buffering against adverse effects.

In conclusion, we are encouraged by the performance for the six months ended

December 2019 and pleased with the continued success of our vitamin D antibody

and core antibody business. We remain optimistic about our troponin revenues

and the success of these high sensitivity troponin products around the world.

Whilst we are mindful as to the potential impact of COVID-19, we currently

expect further progress in the second half of the year.

P Harrison I J Nicholson

Chief Executive Officer Non-Executive Chairman

For further information please contact:

Bioventix plc Tel: 01252 728 001

Peter Harrison Chief Executive Officer

finnCap Ltd Tel: 020 7220 0500

Geoff Nash/Simon Hicks Corporate Finance

Alice Lane Corporate Broking

About Bioventix plc:

Bioventix (www.bioventix.com) specialises in the development and commercial

supply of high-affinity monoclonal antibodies with a primary focus on their

application in clinical diagnostics, such as in automated immunoassays used in

blood testing. The antibodies created at Bioventix are generated in sheep and

are of particular benefit where the target is present at low concentration and

where conventional monoclonal or polyclonal antibodies have failed to produce a

suitable reagent. Bioventix currently offers a portfolio of antibodies to

customers for both commercial use and R&D purposes, for the diagnosis or

monitoring of a broad range of conditions, including heart disease, cancer,

fertility, thyroid function and drug abuse. Bioventix currently supplies

antibody products and services to the majority of multinational clinical

diagnostics companies. Bioventix is based in Farnham, UK and its shares are

traded on AIM under the symbol BVXP.

The information communicated in this announcement contains inside information

for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

BIOVENTIX PLC

STATEMENT OF COMPREHENSIVE INCOME

for the six month period ended 31 December 2019

Six months Six months

ended ended

31 Dec 2019 31 Dec 2018

GBP GBP

TURNOVER 5,265,270 4,364,665

Cost of sales (393,673) (438,160)

GROSS PROFIT 4,871,597 3,926,505

Administrative expenses (643,819) (655,873)

Share option charge (67,294) (67,294)

Difference on foreign exchange 80,258 24,680

Research & development tax credit adjustment 5,369 8,319

OPERATING PROFIT 4,246,111 3,236,337

Interest receivable 17,521 9,662

Interest payable (0) (0)

PROFIT ON ORDINARY ACTIVITIES BEFORE TAXATION 4,263,632 3,245,999

Tax on profit on ordinary activities (700,893) (499,183)

PROFIT FOR THE FINANCIAL PERIOD 3,562,739 2,746,816

Earnings per share for the period:

Basic 69.28p 53.44p

Diluted 68.14p 52.54p

BIOVENTIX PLC

BALANCE SHEET

as at 31 December 2019

31 Dec 2019 31 Dec 2018

GBP GBP

FIXED ASSETS

Intangible fixed assets 0 0

Tangible fixed assets 718,921 524,761

Investments 579,375 388,377

1,298,296 913,138

CURRENT ASSETS

Stocks 219,007 258,814

Debtors 3,814,985 3,368,057

Cash at bank and in hand 5,530,539 5,456,257

9,564,531 9,083,128

CREDITORS: amounts falling due within one year (971,878) (797,616)

NET CURRENT ASSETS 8,592,653 8,285,512

TOTAL ASSETS LESS CURRENT LIABILITIES 9,890,949 9,198,650

PROVISIONS FOR LIABILITIES

Deferred Tax 63,020 31,989

NET ASSETS 9,827,929 9,166,661

CAPITAL AND RESERVES

Called up share capital 257,134 257,034

Share premium account 435,908 414,608

Capital redemption reserve 1,231 1,231

Profit and loss account 9,133,656 8,493,788

SHAREHOLDERS' FUNDS 9,827,929 9,166,661

BIOVENTIX PLC

STATEMENT OF CASH FLOWS

for the six month period ended 31 December 2019

31 Dec 2019 31 Dec 2018

GBP GBP

CASHFLOW FROM OPERATING ACTIVITIES

Cash flows from operating activities

Profit for the financial year 3,562,739 2,746,816

Depreciation of tangible fixed assets 57,391 30,349

Interest received (17,521) (9,662)

Taxation 224,267 (90,014)

Decrease / (increase) in stocks 20,288 24,276

Decrease / (increase) in debtors 118,930 448,733

(Decrease) /increase in creditors 28,574 63,281

Share option charge 67,294 67,294

Other tax movements (5,369) (8,319)

Net cash generated from operating 4,056,593 3,272,754

activities

Cash flows from investing activities

Purchase of tangible fixed assets (261,492) (57,307)

Interest received 17,521 9,662

Purchase of unlisted and other investments (190,998) (96,953)

Net cash from investing activities (434,969) (144,598)

Cash flows from financing activities

Issue of ordinary shares 0 100

Movement on share premium account 0 19,500

Dividends paid (4,628,407) (4,678,013)

Interest paid (0) (0)

Net cash used in financing activities (4,628,407) (4,658,413)

Cash and cash equivalents at the beginning of 6,537,322 6,986,514

the year

Cash and cash equivalents at the end of the 5,530,539 5,456,257

year

Cash and cash equivalents at the end of the

year comprise:

Cash at bank and in hand 5,530,539 5,456,257

BIOVENTIX PLC

Notes to the financial information

1. While the interim financial information has been prepared using the

company's accounting policies and in accordance with Financial Reporting

Standard 102, the announcement does not itself contain sufficient information

to comply with Financial Reporting Standard 102.

2. This interim financial statement has not been audited or reviewed by the

auditors.

3. The accounting policies which were used in the preparation of this interim

financial information were as follows:

3.1 Basis of preparation of financial statements

The financial statements have been prepared under the historical cost

convention and in accordance with FRS 102.

3.2 Revenue

*Turnover is recognised for product supplied or services rendered to the

extent that it is probable that the economic benefits will flow to the

Company and the turnover can be reliably measured. Turnover is measured as

the fair value of the consideration received or receivable, excluding

discounts, rebates, value added tax and other sales taxes. The following

criteria determine when turnover will be recognised:

*Direct sales are recognised at the date of dispatch.

*Subcontracted R & D income is recognised based upon the stage of

completion at the year end.

*Annual licence revenue is recognised, in full, based upon the date of the

invoice, and royalties are accrued over the period to which they relate.

Revenue is recognised based on the returns and notifications received from

customers and in the event that subsequent adjustments are identified,

they are recognised in the period in which they are identified.

3.3 Intangible fixed assets and amortisation

Goodwill is the difference between amounts paid on the acquisition of a

business and the fair value of the identifiable assets and liabilities. It

is amortised to the Profit and loss account over its estimated economic

life.

Amortisation is provided at the following rates:

Goodwill ? Over 10 years

Know how ? Over 10 years

3.4 Tangible fixed assets and depreciation

Tangible fixed assets are stated at cost less depreciation. Depreciation is

not charged on freehold land. Depreciation on other tangible fixed assets is

provided at rates calculated to write off the cost of those assets, less their

estimated residual value, over their expected useful lives on the following

bases:

Freehold property ? 2% straight line

Plant and equipment ? 25% reducing balance

Motor Vehicles ? 25% straight line

Equipment ? 25% straight line

3.5 Valuation of investments

Investments in unlisted Company shares, whose market value can be reliably

determined, are remeasured to market value at each balance sheet date.

Gains and losses on remeasurement are recognised in the Statement of

comprehensive income for the period. Where market value cannot be reliably

determined, such investments are stated at historic cost less impairment.

3.6 Stocks

Stocks are stated at the lower of cost and net realisable value, being the

estimated selling price less costs to complete and sell. Cost includes all

direct costs and an appropriate proportion of fixed and variable

overheads.

At each balance sheet date, stocks are assessed for impairment. If stock

is impaired, the carrying amount is reduced to its selling price less

costs to complete and sell. The impairment loss is recognised immediately

in profit or loss.

3.7 Debtors

Short term debtors are measured at transaction price, less any impairment.

Loans receivable are measured initially at fair value, net of transaction

costs, and are measured subsequently at amortised cost using the effective

interest method, less any impairment.

3.8 Cash and cash equivalents

Cash is represented by cash in hand and deposits with financial

institutions repayable without penalty on notice of not more than 24

hours. Cash equivalents are highly liquid investments that mature in no

more than three months from the date of acquisition and that are readily

convertible to known amounts of cash with insignificant risk of change in

value.

In the Statement of cash flows, cash and cash equivalents are shown net of

bank overdrafts that are repayable on demand and form an integral part of

the Company's cash management.

3.9 Financial instruments

The Company only enters into basic financial instruments transactions that

result in the recognition of financial assets and liabilities like trade

and other debtors and creditors, loans from banks and other third parties,

loans to related parties and investments in non-puttable ordinary shares.

3.10 Creditors

Short term creditors are measured at the transaction price. Other

financial liabilities, including bank loans, are measured initially at

fair value, net of transaction costs, and are measured subsequently at

amortised cost using the effective interest method.

3.11 Foreign currency translation

Functional and presentation currency

The Company's functional and presentational currency is GBP.

Transactions and balances

Foreign currency transactions are translated into the functional currency

using the spot exchange rates at the dates of the transactions.

At each period end foreign currency monetary items are translated using

the closing rate. Non-monetary items measured at historical cost are

translated using the exchange rate at the date of the transaction and

non-monetary items measured at fair value are measured using the exchange

rate when fair value was determined.

3.12 Finance costs

Finance costs are charged to the Statement of comprehensive income over

the term of the debt using the effective interest method so that the

amount charged is at a constant rate on the carrying amount. Issue costs

are initially recognised as a reduction in the proceeds of the associated

capital instrument.

3.13 Dividends

Equity dividends are recognised when they become legally payable. Interim

equity dividends are recognised when paid. Final equity dividends are

recognised when approved by the shareholders at an annual general meeting.

Dividends on shares recognised as liabilities are recognised as expenses

and classified within interest payable.

3.14 Employee benefits-share-based compensation

The company operates an equity-settled, share-based compensation plan. The

fair value of the employee services received in exchange for the grant of

the options is recognised as an expense over the vesting period. The total

amount to be expensed over the vesting period is determined by reference

to the fair value of the options granted. At each balance sheet date, the

company will revise its estimates of the number of options are expected to

be exercisable. It will recognise the impact of the revision of original

estimates, if any, in the profit and loss account, with a corresponding

adjustment to equity. The proceeds received net of any directly

attributable transaction costs are credited to share capital (nominal

value) and share premium when the options are exercised.

3.15 Research and development

Research and development expenditure is written off in the year in which

it is incurred.

3.16 Pensions

Defined contribution pension plan

The Company operates a defined contribution plan for its employees. A

defined contribution plan is a pension plan under which the Company pays

fixed contributions into a separate entity. Once the contributions have

been paid the Company has no further payment obligations.

The contributions are recognised as an expense in the Statement of

comprehensive income when they fall due. Amounts not paid are shown in

accruals as a liability in the Statement of financial position. The assets

of the plan are held separately from the Company in independently

administered funds.

3.17 Interest income

Interest income is recognised in the Statement of comprehensive income

using the effective interest method.

3.18 Provisions for liabilities

Provisions are made where an event has taken place that gives the Company a

legal or constructive obligation that probably requires settlement by a

transfer of economic benefit, and a reliable estimate can be made of the

amount of the obligation.

Provisions are charged as an expense to the Statement of comprehensive

income in the year that the Company becomes aware of the obligation, and

are measured at the best estimate at the Statement of financial position

date of the expenditure required to settle the obligation, taking into

account relevant risks and uncertainties.

When payments are eventually made, they are charged to the provision

carried in the Statement of financial position.

3.19 Current and deferred taxation

The tax expense for the year comprises current and deferred tax. Tax is

recognised in the Statement of comprehensive income, except that a charge

attributable to an item of income and expense recognised as other

comprehensive income or to an item recognised directly in equity is also

recognised in other comprehensive income or directly in equity

respectively.

The current income tax charge is calculated on the basis of tax rates and

laws that have been enacted or substantively enacted by the reporting date

in the countries where the Company operates and generates income.

Deferred tax balances are recognised in respect of all timing differences

that have originated but not reversed by the Statement of financial

position date, except that:

· The recognition of deferred tax assets is limited to the extent that it

is probable that they will be recovered against the reversal of deferred

tax liabilities or other future taxable profits; and

· Any deferred tax balances are reversed if and when all conditions for

retaining associated tax allowances have been met.

Deferred tax balances are not recognised in respect of permanent

differences except in respect of business combinations, when deferred tax

is recognised on the differences between the fair values of assets acquired

and the future tax deductions available for them and the differences

between the fair values of liabilities acquired and the amount that will be

assessed for tax. Deferred tax is determined using tax rates and laws that

have been enacted or substantively enacted by the reporting date.

END

(END) Dow Jones Newswires

March 30, 2020 02:00 ET (06:00 GMT)

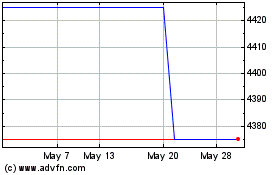

Bioventix (AQSE:BVXP.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bioventix (AQSE:BVXP.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025