TIDMBOD

RNS Number : 1086J

Botswana Diamonds PLC

25 April 2022

25(th) April 2022

Botswana Diamonds PLC

("Botswana Diamonds", "BOD" or the "Company")

Thorny River Open Pit Mining Evaluation

Botswana Diamonds, the London AIM and BSE listed diamond

explorer, is pleased to announce the results of a conceptual open

pit mine optimisation evaluation ("Evaluation") on the River Blow

on its Thorny River property ("the Property") in South Africa.

Highlights

-- An analysis of the River Blow and its extension indicates potential open pit options.

-- Assuming mid-range diamond values of $170/ct, mid-range

mining costs, a discount rate of 10%, a recovered grade of 40cpht

and 1.7M tons of kimberlite mined indicates that a mine is likely

to be commercial.

-- The results exclude any additional resources from adjacent

targets which will be drilled in the coming months.

Managing Director, James Campbell commented: "The purpose of

this exercise was to determine whether there was commercial

potential in the Thorny River discoveries. The conceptual open pit

evaluation shows that even at low revenue factors the kimberlite is

potentially commercial when applying current industry standard

mining and processing costs. This exercise will be updated

following drilling on the adjacent high priority targets".

Chairman, John Teeling commented: "The Evaluation shows that

there is potential for an open pit mine at Thorny River and that

there is the potential for operational positive cash flow even at

low levels of diamond recovery. We will continue to work on the

project including determining the capital cost. We anticipate that

drilling in the coming months will extend mineable kimberlite

volume".

Details

The Evaluation was completed by South African-based independent

mining advisory consultants, Practara (Pty) Ltd, together with

modelling input from ABGM Pty Limited of Australia. Conceptual open

pit mine plan models were developed under a number of scenarios to

assess the open pit mining potential of the River and River

Extension blows (collectively "the River"). The models used the

results of several drilling programmes. Grade and diamond value

data was based on previous microdiamond and bulk sampling data as

well as production results from the adjacent Klipspringer mine and

the Technical Economic and Evaluation Report ("TEE Report") on the

Thorny River Project as announced in June 2018 (and which was a

pre-scoping study analysis). Cost data was benchmarked against

similar operations.

Shareholders should note that the Evaluation is preliminary in

nature and was prepared from drilling and geophysical modelling

results and on which no resource has yet been declared. The

Evaluation is purely conceptual and indicative of what could

potentially be considered for more detailed work. The Evaluation is

based on pre-tax illustrative estimates of cashflow before

provision of capital expenditure or pre-production costs and which

have not yet been determined. The objective of the Evaluation was

to identify the best open pit mining option and considered low,

medium, and high-cost scenarios for mining.

The following graphic

http://www.rns-pdf.londonstockexchange.com/rns/1086J_1-2022-4-22.pdf

depicts the Evaluation's open pit models with the kimberlite for

reference, based on various revenue factors, for a mid-range

('medium') cost mining operation applicable to a deposit of this

nature.

The following are the illustrative results of the medium-cost

scenario in the Evaluation at a mid-range diamond value of $170/ct

and a discount rate of 10%. Grade and diamond values are stated at

a bottom cut-off of +1mm.

Discounted Cashflow

NPV(10%)

Open Pit Strip Average Grade (Exclu ding capex

Ore Open Pit Waste Ratio Recovered and taxation)

Tonnes Tonnes Tw:To cpht US$'M

---------- --------------- ------- -------------- --------------------

1,187,334 2,286,459 1.93 20 US$78.5

1,601,003 3,774,640 2.36 30 US$94.5

1,702,550 4,559,875 2.68 40 US$97.1

1,743,335 5,031,522 2.89 50 US$97.8

1,754,394 5,197,872 2.96 60 US$97.9

---------- --------------- ------- -------------- --------------------

The TEE stated that the kimberlite exploration target at Thorny

River area has a grade of between 46 and 74 cpht and diamond value

of between $120-220/ct at a bottom cut off of +1mm. For the

purposes of the Evaluation, a lower grade of 20 cpht was also

considered. The River medium-cost scenario mining model shows

positive operational cash flow net present values for potential

future open pit exploitation options at a conceptual level. Any

open pit that is formed on the basis of a low revenue assumption

(i.e. at revenue factors less than 80%) coupled with the maximum

open pit size are indicated to be commercial. Additional survey

work and in particular geological work to better understand the

level of dilution is required to further optimise these conceptual

mine models. In the high-cost scenario, an average grade recovery

of only 20 cpht would not be economic.

The scenarios examined exclude any benefit of the Company's new

contiguous targets which were identified through a recent ground

geophysics exercise and are indicative of additional kimberlite

blows. Drilling of these targets has the potential to add volumes

and impetus to a 'hub and spoke' mining model and this is scheduled

for the dry Southern African winter season. Following this, the

mine plan will be updated, and the capital expenditure assessed.

Subsequently, it is expected that mine permitting will then be

sought.

______ _______________

Qualified Person

This release has been approved by James Campbell, Managing

Director of Botswana Diamonds plc, a qualified geologist

(Pr.Sci.Nat), a Fellow of the Southern African Institute of Mining

and Metallurgy, the Institute of Materials, Metals and Mining (UK)

and the Geological Society of South Africa and who has over

35-years' experience in the diamond sector.

Practara (Pty) Ltd has reviewed the information in this

announcement which has been derived from the Evaluation and has

confirmed that the information so presented is balanced and

complete and not inconsistent with the Evaluation.

______

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014. The person who arranged

for the release of this announcement on behalf of the Company was

James Campbell, Director.

A copy of this announcement is available on the Company's

website, at www.botswanadiamonds.co.uk

Enquiries:

Botswana Diamonds PLC

John Teeling, Chairman +353 1 833 2833

James Campbell, Managing Director +27 83 457 3724

Jim Finn, Director +353 1 833 2833

Beaumont Cornish - Nominated Adviser

Michael Cornish

Roland Cornish +44 (0) 020 7628 3396

Beaumont Cornish Limited - Broker

Roland Cornish

Felicity Geidt +44 (0) 207 628 3396

First Equity Limited - Joint Broker

Jason Robertson +44 (0) 207 374 2212

BlytheRay - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Rachael Brooks +44 (0) 207 138 3206

Said Izagaren +44 (0) 207 138 3206

Naomi Holmes +44 (0) 207 138 3206

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Ross Murphy +353 (0) 1 661 4055

www.botswanadiamonds.co.uk

Glossary

" cpht" Carats per hundred tons

"NPV" Pre-tax net present value

"TW:TO" Tons waste : tons ore

Beaumont Cornish Limited, which is authorised and regulated in

the United Kingdom by the Financial Conduct Authority, is acting as

nominated adviser to the Company in relation to the matters

referred herein. Beaumont Cornish Limited is acting exclusively for

the Company and for no one else in relation to the matters

described in this announcement and is not advising any other person

and accordingly will not be responsible to anyone other than the

Company for providing the protections afforded to clients of

Beaumont Cornish Limited, or for providing advice in relation to

the contents of this announcement or any matter referred to in

it.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBUGDSSUDDGDD

(END) Dow Jones Newswires

April 25, 2022 02:00 ET (06:00 GMT)

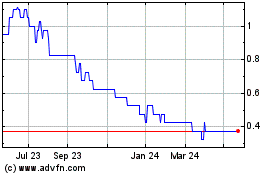

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

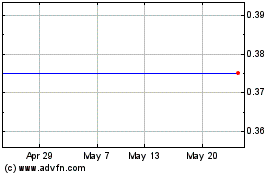

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024