UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No.______)

|

Filed

by the Registrant ☒

|

|

Filed

by a Party other than the Registrant ☐

|

|

Check

the appropriate box:

|

|

☐

|

Preliminary

Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

☒

|

Definitive

Proxy Statement

|

|

☐

|

Definitive

Additional Materials

|

|

☐

|

Soliciting

Material Pursuant to §240.14a-12

|

|

WidePoint Corporation

|

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the

Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was

determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

☐ Fee paid previously with preliminary

materials.

☐ Check box if any part of the fee is offset as

provided by Exchange Act Rule 0-11(a)(2) and identify the filing

for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or

Schedule and the date of its filing.

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

WIDEPOINT CORPORATION

11250 Waples Mill Road, South Tower, Suite 210

Fairfax, Virginia 22030

July

8, 2020

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To the

Stockholders of WidePoint Corporation:

We

hereby notify you that a Special Meeting of Stockholders (the

“Special Meeting”) of WidePoint Corporation, a Delaware

corporation, will be held at 10:00

a.m., EST, on Monday, August 24, 2020. Due to the public health

impact of the coronavirus outbreak (i.e., COVID-19) and to support

the health and well-being of our stockholders and other

stakeholders, the Special Meeting will be a completely virtual

meeting of stockholders, which will be conducted solely online via

live webcast. You will be able to participate in the Special

Meeting online and vote your shares electronically prior to and

during the meeting by visiting:

www.virtualshareholdermeeting.com/WYY2020SM. You must enter the

control number found on your proxy card, voting instruction form or

notice you previously received. There

is no physical location for the Special Meeting. The accompanying

notice of meeting and proxy statement describe the following

matters described in the accompanying proxy

statement:

(1)

to

approve an amendment to our amended and restated certificate of

incorporation, as amended (the “Restated Certificate of

Incorporation”), to effect a reverse stock split of our

issued and outstanding shares of common stock, $0.001 par value per

share, at a ratio to be determined in the discretion of the Board

of Directors within a range of one (1) share of common stock for

every five (5) to fifteen (15) shares of common stock (the

“Reverse Stock Split”), such amendment to be effected

after stockholder approval thereof only in the event the Board of

Directors still deems it advisable;

to

approve an amendment to the Restated Certificate of Incorporation,

to decrease the number of authorized shares of common stock to

30,000,000 (the “Authorized Common Stock Decrease”),

such amendment contingent upon the Reverse Stock Split being

approved and effected;

to

approve an adjournment of the Special Meeting, if the Board of

Directors determines it to be necessary or appropriate, if a quorum

is present, to solicit additional proxies if there are not

sufficient votes in favor of any of Proposal 1–the Reverse

Stock Split, and Proposal 2–the Authorized Common Stock

Decrease; and

(4)

to

transact such other business as may properly come before the

meeting or any adjournments or postponements of the

meeting.

Stockholders of record at the close of business

on July 6, 2020

are entitled to receive notice of, and

to vote at, the Special Meeting.

YOUR VOTE IS IMPORTANT. We

encourage you to read the proxy statement and vote your shares as

soon as possible. We ask that you vote your shares via the Internet

or by telephone, as instructed on the Notice of Internet

Availability of Proxy Materials or as instructed on the

accompanying proxy. If you received or requested a copy of the

proxy card by mail, you may submit your vote by completing,

signing, dating and returning the proxy card by mail. You may also

participate in the Special Meeting online and vote your shares

electronically. We encourage you to vote via the Internet or by

telephone. These methods save us significant postage and processing

charges. Please vote your shares as soon as

possible.

|

|

By

order of the Board of Directors,

|

|

|

Jin Kang

Chief Executive Officer

|

July 8, 2020

Table of Contents

|

Notice of

Electronic Availability Proxy Materials

|

1

|

|

Voting Procedures

and Securities

|

1

|

|

Proposal

One

|

3

|

|

Proposal

Two

|

8

|

|

Proposal

Three

|

9

|

|

Other Information

Regarding the Company

|

10

|

|

No

Dissenters’ or Appraisal Rights

|

11

|

|

Other

Information

|

11

|

|

Stockholder

Proposals For 2021 Annual Meeting

|

11

|

|

Other

Matter

|

11

|

WIDEPOINT CORPORATION

11250 Waples Mill Road, South Tower, Suite 210

Fairfax, Virginia 22030

PROXY STATEMENT

This Proxy Statement is furnished in connection

with the solicitation by the Board of Directors of WidePoint

Corporation, a Delaware corporation (referred to herein as

“WidePoint,” the “Company,”

“we” or “our”), of proxies of stockholders

to be voted at a Special Meeting of Stockholders to be held at

10:00 a.m., EST, on Monday, August 24, 2020. Due to the public

health impact of the coronavirus outbreak (i.e., COVID-19) and to

support the health and well-being of our stockholders and other

stakeholders, the Special Meeting will be a completely virtual

meeting of stockholders, which will be conducted solely online via

live webcast. You will be able to participate in the Special

Meeting online and vote your shares electronically prior to and

during the meeting by visiting:

www.virtualshareholdermeeting.com/WYY2020. You must enter the

control number found on your proxy card, voting instruction form or

notice you previously received. There

is no physical location for the Special Meeting. Any stockholder

executing a proxy retains the right to revoke it at any time prior

to its being exercised by giving written notice to the Secretary of

the Company.

The

Board of Directors is soliciting votes (1) FOR the approval of an amendment to our

amended and restated certificate of incorporation, as amended (the

“Restated Certificate of Incorporation”), to effect a

reverse stock split of our issued and outstanding shares of common

stock, at a ratio to be determined in the discretion of the Board

of Directors within a range of one (1) share of common stock for

every five (5) to fifteen (15) shares of common stock (the

“Reverse Stock Split”), such amendment to be effected

after stockholder approval thereof only in the event the Board of

Directors still deems it advisable; (2) FOR the approval of an amendment to the

Restated Certificate of Incorporation to decrease the number of

authorized shares of common stock from 110,000,000 to 30,000,000

(the “Authorized Common Stock Decrease”), such

amendment contingent upon the Reverse Stock Split being approved

and effected; and (3) FOR

approval to adjourn the Special Meeting, if the Board determines it

to be necessary or appropriate, if a quorum is present, to solicit

additional proxies if there are not sufficient votes in favor of

any of the Reverse Stock Split and the Authorized Common Stock

Decrease (the “Adjournment”).

This

Proxy Statement and the accompanying proxy are first being sent to

stockholders of the Company on or about July 8, 2020.

NOTICE OF ELECTRONIC AVAILABILITY OF PROXY MATERIALS

In

accordance with regulations adopted by the Securities and Exchange

Commission, instead of mailing a printed copy of our proxy

materials, including our annual report to stockholders, to each

stockholder of record, we may now furnish these materials by mail

or e-mail. On or about July 8, 2020, we mailed to our stockholders

who have not previously requested to receive these materials by

mail or e-mail a Notice of Internet Availability of Proxy Materials

containing instructions on how to access this proxy statement and

our annual report and to vote online. The Notice instructs you as

to how you may access and review all of the important information

contained in the proxy materials. The Notice also instructs you as

to how you may submit your proxy on the Internet or by telephone.

If you received the Notice by mail, you will not automatically

receive a printed copy of our proxy materials or annual report

unless you follow the instructions for requesting these materials

included in the Notice.

VOTING PROCEDURES AND SECURITIES

Your Vote is Very Important

Whether

or not you plan to attend the meeting, please take the time to vote

your shares as soon as possible. You may submit your vote by

completing, signing, dating and returning the proxy card by mail.

We encourage you to vote via the Internet or by telephone. These

methods save us significant postage and processing

charges.

Vote Required, Abstentions and Broker Non-Votes

Shares

of common stock represented by proxy will be voted according to the

instructions, if any, given in the proxy. Unless otherwise

instructed, the person or persons named in the proxy will vote (1)

FOR the approval of the

Reverse Stock Split; (2) FOR

the approval of the Authorized Common Stock Decrease; and (3)

FOR the Adjournment. The

Board of Directors has designated Jin Kang and Jason Holloway, and

each or any of them, as proxies to vote the shares of common stock

solicited on its behalf.

Votes

cast by proxy or in person at the Special Meeting will be tabulated

by an inspector of election appointed by the Company for the

meeting. A quorum of stockholders is necessary to hold a valid

meeting. A quorum will be present if at least a majority of the

outstanding shares of common stock of the Company entitled to vote

are present at the Special Meeting in person or by proxy.

Abstentions are treated as present for purposes of determining

whether a quorum exists. Your shares will be counted towards the

quorum only if you submit a valid proxy (or one is submitted on

your behalf by your broker, bank or other nominee) or if you vote

at the Special Meeting. Broker non-votes (which result when your

shares are held in “street name”, and you do not tell

the nominee how to vote your shares and the nominee does not have

discretion to vote such shares or declines to exercise discretion)

are treated as present for purposes of determining whether a quorum

is present at the meeting.

To

be approved, Proposal 1, which relates to the approval of the

Reverse Stock Split within a range of one (1) share of common stock

for every five (5) to fifteen (15) shares of common stock, must

receive FOR votes from the holders of a majority of the issued and

outstanding shares of common stock as of the record date.

Accordingly, abstentions and broker non-votes with respect this

proposal will have the same effect as voting AGAINST this proposal

(although no broker non-votes are expected to exist in connection

with Proposal 1 since this is a routine matter for which brokers

have discretion to vote if beneficial owners do not provide voting

instructions).

To

be approved, Proposal 2, which relates to the approval of the

Authorized Common Stock Decrease to decrease the number of

authorized shares of common stock from 110,000,000 to 30,000,000,

must receive FOR votes from the holders of a majority of the issued

and outstanding shares of common stock as of the record date.

Accordingly, abstentions and broker non-votes with respect this

proposal will have the same effect as voting AGAINST this proposal

(although no broker non-votes are expected to exist in connection

with Proposal 2 since this is a routine matter for which brokers

have discretion to vote if beneficial owners do not provide voting

instructions).

To

be approved, Proposal 3, which relates to the approval of the

Adjournment of the Special Meeting, if the Board determines it to

be necessary or appropriate to solicit additional proxies if there

are insufficient votes in favor of the Reverse Stock Split and the

Authorized Common Stock Decrease, must receive FOR votes from the

holders of a majority of the shares present in person or

represented by proxy at the meeting and entitled to vote at the

Special Meeting. Abstentions will be included in the vote tally and

will have the same effect as a vote AGAINST and broker non-votes

will not affect the outcome of this proposal (although no broker

non-votes are expected to exist in connection with Proposal 3 since

this is a routine matter for which brokers have discretion to vote

if beneficial owners do not provide voting

instructions).

If

your shares are held in “street name” and you do not

indicate how you wish to vote, your broker is permitted to exercise

its discretion to vote your shares on certain “routine”

matters. The routine matters to be submitted to our stockholders at

the Special Meeting are Proposals 1 and 2 and 3.

We encourage you to vote

FOR

all three (3)

proposals.

The

cost of soliciting proxies will be borne by the Company. Certain of

our officers and other employees may, without compensation other

than their regular compensation, solicit proxies by further mailing

or personal conversations, or by telephone, facsimile or other

electronic means. We will also, upon request, reimburse brokers and

other persons holding stock in their names, or in the names of

nominees, for their reasonable out-of-pocket expenses for

forwarding proxy materials to the beneficial owners of our stock

and to obtain proxies.

Shares Outstanding

As

of July 6, 2020, the record date for determining stockholders

entitled to vote at the Special Meeting, a total of 86,155,968

shares of common stock of the Company, par value $.001 per share,

which is the only class of voting securities of the Company, were

issued and outstanding. All holders of record of the common stock

as of the close of business on July 6, 2020 are entitled to one

vote for each share held when voting at the Special Meeting, or any

adjournment thereof, upon the matters listed in the Notice of

Special Meeting. Cumulative voting is not permitted.

Other Business

The

Board knows of no other matters to be presented for stockholder

action at the meeting. If other matters are properly brought before

the meeting, the persons named as proxies in the accompanying proxy

card intend to vote the shares represented by them in accordance

with their best judgment.

PROPOSAL ONE – REVERSE STOCK SPLIT

APPROVAL OF AN AMENDMENT TO OUR RESTATED CERTIFICATE OF

INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE ISSUED AND

OUTSTANDING SHARES OF COMMON STOCK AT A RATIO TO BE DETERMINED IN

THE DISCRETION OF THE BOARD OF DIRECTORS WITHIN A RANGE OF ONE (1)

SHARE OF COMMON STOCK FOR EVERY FIVE (5) TO FIFTEEN (15) SHARES OF

COMMON STOCK

General

The

Board of Directors has adopted, and is recommending that our

stockholders approve, a proposed amendment to our Restated

Certificate of Incorporation to effect a Reverse Stock Split of the

issued and outstanding shares of common stock. Such amendment will

be effected after stockholder approval thereof only in the event

the Board of Directors still deems it advisable. Holders of the

common stock are being asked to approve the proposal that Article

Four of our Restated Certificate of Incorporation be amended to

effect a Reverse Stock Split of the common stock at a ratio to be

determined in the discretion of the Board of Directors within the

range of one (1) share of common stock for every five (5) to

fifteen (15) shares of common stock and also to decide whether or

not to proceed to effect a Reverse Stock Split or instead to

abandon the proposed amendment altogether. Pursuant to the laws of

the State of Delaware, our state of incorporation, the Board of

Directors must adopt any amendment to our Restated Certificate of

Incorporation and submit the amendment to stockholders for their

approval. The form of proposed amendment to effect the Reverse

Stock Split is set forth in the certificate of amendment to our

Restated Certificate of Incorporation attached as Appendix A to this proxy

statement. If the Reverse Stock Split is approved by our

stockholders and if a certificate of amendment is filed with the

Secretary of State of the State of Delaware, the certificate of

amendment to the Restated Certificate of Incorporation will effect

the Reverse Stock Split by reducing the outstanding number of

shares of common stock by the ratio to be determined by the Board

of Directors. If the Board of Directors does not implement an

approved Reverse Stock Split prior to the one-year anniversary of

this meeting, the Board will seek stockholder approval before

implementing any Reverse Stock Split after that time. The Board of

Directors may abandon the proposed amendment to effect the Reverse

Stock Split at any time prior to its effectiveness, whether before

or after stockholder approval thereof.

By

approving this proposal, stockholders will approve the amendment to

our Restated Certificate of Incorporation pursuant to which any

whole number of outstanding shares, between and including five and

fifteen, would be combined into one share of common stock, and

authorize the Board of Directors to file a certificate of amendment

setting forth such amendment, as determined by the Board of

Directors in the manner described herein. If approved, the Board of

Directors may also elect not to effect any Reverse Stock Split and

consequently not to file any certificate of amendment to the

Restated Certificate of Incorporation. The Board of Directors

believes that stockholder approval of an amendment granting the

Board of Directors this discretion, rather than approval of a

specified exchange ratio, provides the Board of Directors with

maximum flexibility to react to then-current market conditions and,

therefore, is in the best interests of our Company and its

stockholders. The Board of Directors’ decision as to whether

and when to effect the Reverse Stock Split will be based on a

number of factors, including market conditions and existing and

expected trading prices for the common stock. Although our

stockholders may approve the Reverse Stock Split, we will not

effect the Reverse Stock Split if the Board of Directors does not

deem it to be in our best interest and the best interest of our

stockholders. The Reverse Stock Split, if authorized and if deemed

by the Board of Directors to be in our best interest and the best

interest of our stockholders, will be effected, if at all, at a

time that is not later than one year from the date of the Special

Meeting.

This

Proposal 1, the proposed approval of the Reverse Stock Split as set

forth in the certificate of amendment to our Restated Certificate

of Incorporation, will not change the number of authorized shares

of common stock or preferred stock, or the par value of common

stock or preferred stock; however effecting the Reverse Stock Split

will provide for additional shares of unissued authorized common

stock. If Proposal 2 (the Authorized Common Stock Decrease) is

approved and the Board of Directors determined to effect the

Authorized Common Stock Decrease and not abandon the Authorized

Common Stock Decrease, the authorized number of shares of common

stock will be decreased from 110,000,000 to 30,000,000. As of the

date of this proxy statement, our current authorized number of

shares of common stock is sufficient to satisfy all of our share

issuance obligations and current share plans and we do not have any

current plans, arrangements or understandings relating to the

issuance of the additional shares of authorized common stock that

will become available following the Reverse Stock

Split.

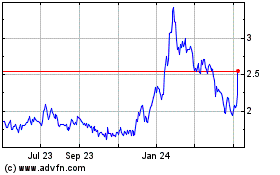

Purpose and Background of the Reverse Stock Split

The

Board of Directors believes that the current low per share market

price of the common stock has a negative effect on the

marketability of our existing shares. The Board of Directors

believes there are several reasons for this effect. First, certain

institutional investors have internal policies preventing the

purchase of low-priced stocks. Second, a variety of policies and

practices of broker-dealers discourage individual brokers within

those firms from dealing in low-priced stocks. Third, because the

brokers’ commissions on low-priced stocks generally represent

a higher percentage of the stock price than commissions on higher

priced stocks, the current share price of the common stock can

result in individual stockholders paying transaction costs

(commissions, markups or markdowns) that are a higher percentage of

their total share value than would be the case if the share price

of the common stock were substantially higher. This factor is also

believed to limit the willingness of some institutions to purchase

the common stock. The Board of Directors anticipates that a Reverse

Stock Split will result in a higher bid price for the common stock,

which may help to alleviate some of these problems.

We

expect that, if effected, a Reverse Stock Split of the common stock

will increase the market price of the common stock. However, the

effect of a Reverse Stock Split on the market price of the common

stock cannot be predicted with any certainty, and the history of

similar stock split combinations for companies in like

circumstances is varied. It is possible that the per share price of

the common stock after the Reverse Stock Split will not rise in

proportion to the reduction in the number of shares of the common

stock outstanding resulting from the Reverse Stock Split,

effectively reducing our market capitalization, and there can be no

assurance that the market price per post-reverse split share will

be for a sustained period of time. The market price of the common

stock may vary based on other factors that are unrelated to the

number of shares outstanding, including our future

performance.

PLEASE

NOTE THAT UNLESS SPECIFICALLY INDICATED TO THE CONTRARY, THE DATA

CONTAINED IN THIS PROXY STATEMENT, INCLUDING BUT NOT LIMITED TO

SHARE NUMBERS, CONVERSION PRICES AND EXERCISE PRICES OF OPTIONS,

DOES NOT REFLECT THE IMPACT OF THE REVERSE STOCK SPLIT THAT MAY BE

EFFECTUATED.

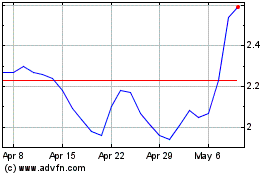

Board Discretion to Implement the Reverse Stock Split

If

Proposal No. 1 is approved by the stockholders and the Board

determines to effect the Reverse Stock Split, it will consider

certain factors in selecting the specific stock split ratio,

including prevailing market conditions and the trading price of the

common stock. Based in part on the price of the common stock on the

days leading up to the filing of the certificate of amendment to

the Restated Certificate of Incorporation effecting the Reverse

Stock Split, the Board of Directors will determine the ratio of the

Reverse Stock Split, in the range of 1:5 to 1:15.

Notwithstanding

approval of the Reverse Stock Split by the stockholders, the Board

of Directors may, in its sole discretion, abandon the proposed

amendment and determine prior to the effectiveness of any filing

with the Secretary of State of the State of Delaware not to effect

the Reverse Stock Split prior to the one year anniversary of the

Special Meeting of stockholders, as permitted under Section 242(c)

of the DGCL. If the Board fails to implement the amendment prior to

the one-year anniversary of this meeting of stockholders,

stockholder approval would again be required prior to implementing

any Reverse Stock Split.

Consequences if Stockholder Approval for Proposal Is Not

Obtained

If

stockholder approval for Proposal No. 1 is not obtained, we will

not be able to file a certificate of amendment to the Restated

Certificate of Incorporation to effect the Reverse Stock

Split.

Principal Effects of the Reverse Stock Split

If the

stockholders approve the proposal to authorize the Board of

Directors to implement the Reverse Stock Split and the Board of

Directors determines to implement the Reverse Stock Split, we will

publicly announce the selected ratio for the Reverse Stock Split

and file the certificate of amendment to amend the existing

provision of our Restated Certificate of Incorporation to effect

the Reverse Stock Split. The text of the form of proposed amendment

is set forth in the certificate of amendment to the Restated

Certificate of Incorporation is annexed to this proxy statement as

Appendix

A.

The

Reverse Stock Split will be effected simultaneously for all issued

and outstanding shares of common stock and the stock split ratio

will be the same for all issued and outstanding shares of common

stock. The Reverse Stock Split will affect all of our stockholders

uniformly and will not affect any stockholder's percentage

ownership interests in our Company or proportionate voting power,

except for minor adjustment due to the additional net share

fraction that will need to be issued as a result of the treatment

of fractional shares. No fractional shares will be issued in

connection with the Reverse Stock Split. Instead, the Company will

issue one full share of the post-Reverse Stock Split common stock

to any stockholder of record who would have been entitled to

receive a fractional share as a result of the process. After the

Reverse Stock Split, the shares of the common stock will have the

same voting rights and rights to dividends and distributions and

will be identical in all other respects to the common stock now

authorized, common stock issued pursuant to the Reverse Stock Split

will remain fully paid and non-assessable. The Reverse Stock Split

will not affect us continuing to be subject to the periodic

reporting requirements of the Exchange Act. The Reverse Stock Split

is not intended to be, and will not have the effect of, a

“going private transaction” covered by Rule 13e-3 under

the Exchange Act.

The

Reverse Stock Split may result in some stockholders owning

“odd-lots” of less than 100 shares of the common stock.

Brokerage commissions and other costs of transactions in odd-lots

are generally higher than the costs of transactions in

“round-lots” of even multiples of 100

shares.

Following the

effectiveness of any Reverse Stock Split approved by the

stockholders and implementation by the Board of Directors, current

stockholders will hold fewer shares of common stock, with such

number of shares dependent on the specific ratio for the Reverse

Stock Split. For example, if the Board approves of a 1-for-5

Reverse Stock Split, a stockholder owning a “round-lot”

of 100 shares of common stock prior to the Reverse Stock Split

would hold 20 shares of common stock following the Reverse Stock

Split. THE HIGHER THE REVERSE RATIO (1-FOR-10 BEING HIGHER THAN

1-FOR-5, FOR EXAMPLE), THE GREATER THE REDUCTION OF RELATED SHARES

EACH EXISTING STOCKHOLDER, POST REVERSE STOCK SPLIT, WILL

EXPERIENCE.

Risks Associated with the Reverse Stock Split

There

are risks associated with the Reverse Stock Split, including that

the Reverse Stock Split may not result in a sustained increase in

the per share price of our common stock. There is no assurance

that:

●

the

market price per share of our common stock after the Reverse Stock

Split will rise in proportion to the reduction in the number of

shares of our common stock outstanding before the Reverse Stock

Split;

the

Reverse Stock Split will result in a per share price that will

attract brokers and investors who do not trade in lower priced

stocks; and

●

the

liquidity of the common stock will increase.

Stockholders should

note that the effect of the Reverse Stock Split, if any, upon the

market price for our common stock cannot be accurately predicted.

In particular, we cannot assure you that prices for shares of our

common stock after the Reverse Stock Split will be five (5) to

fifteen (15) times, as applicable, the prices for shares of our

common stock immediately prior to the Reverse Stock Split.

Furthermore, even if the market price of our common stock does rise

following the Reverse Stock Split, we cannot assure you that the

market price of the common stock immediately after the proposed

Reverse Stock Split will be maintained for any period of time. Even

if an increased per-share price can be maintained, the Reverse

Stock Split may not achieve the desired results that have been

outlined above. Moreover, because some investors may view the

Reverse Stock Split negatively, we cannot assure you that the

Reverse Stock Split will not adversely impact the market price of

the common stock.

The

market price of the common stock will also be based on our

performance and other factors, some of which are unrelated to the

Reverse Stock Split or the number of shares outstanding. If the

Reverse Stock Split is effected and the market price of the common

stock declines, the percentage decline as an absolute number and as

a percentage of our overall market capitalization may be greater

than would occur in the absence of a Reverse Stock Split. The total

market capitalization of the common stock after implementation of

the Reverse Stock Split when and if implemented may also be lower

than the total market capitalization before the Reverse Stock

Split. Furthermore, the liquidity of the common stock could be

adversely affected by the reduced number of shares that would be

outstanding after the Reverse Stock Split.

We

believe that the Reverse Stock Split may result in greater

liquidity for our stockholders. However, it is also possible that

such liquidity could be adversely affected by the reduced number of

shares outstanding after the Reverse Stock Split, particularly if

the share price does not increase as a result of the Reverse Stock

Split.

Common Stock

After

the effective date of the Reverse Stock Split, each stockholder

will own fewer shares of the common stock. The following table sets

forth the approximate number of shares of the common stock that

would be outstanding immediately after the Reverse Stock Split

based on the current authorized number of shares of common stock at

various exchange ratios, based on 86,155,968 shares of common stock

actually outstanding as of June 30, 2020 (without giving effect to

any adjustments for fractional shares).

|

|

|

Approximate Shares of Common Stock

|

|

|

|

Outstanding After Reverse Stock Split

|

|

|

|

Based on Current Authorized

|

|

Ratio of Reverse Stock Split

|

|

Number of Shares

|

|

|

|

|

|

None

|

|

—

|

|

1:5

|

|

17,231,194

|

|

1:10

|

|

8,615,597

|

|

1:15

|

|

5,743,731

|

Procedure for Effecting Reverse Stock Split and Exchange of Stock

Certificates, if Applicable

If the

certificate of amendment is approved by the stockholders, and if at

such time the Board of Directors still believes that a Reverse

Stock Split is in our best interests and the best interests of our

stockholders, the Board of Directors will determine the ratio,

within the range approved by stockholders, of the Reverse Stock

Split to be implemented and will publicly announce the selected

ratio for the Reverse Stock Split. We will file the certificate of

amendment with the Secretary of State of the State of Delaware at

such time as the Board of Directors has determined the appropriate

effective time for the Reverse Stock Split. The Board of Directors

may delay effecting the Reverse Stock Split without re-soliciting

stockholder approval. The Reverse Stock Split will become effective

on the effective date set forth in the certificate of amendment.

Beginning on the effective date of the Reverse Stock Split, each

certificate representing pre-split shares will be deemed for all

corporate purposes to evidence ownership of post-split

shares.

As soon

as practicable after the effective date of the Reverse Stock Split,

stockholders will be notified that the Reverse Stock Split has been

effected. If you hold shares of common stock in a book-entry form,

you will receive a transmittal letter from our transfer agent as

soon as practicable after the effective time of the Reverse Stock

Split with instructions. After you submit your completed

transmittal letter, if you are entitled to post-split shares of the

common stock, a transaction statement will be sent to your address

of record as soon as practicable after the effective date of the

split indicating the number of shares of the common stock you

hold.

Some

stockholders hold their shares of common stock in certificate form

or a combination of certificate and book-entry form. We expect that

our transfer agent will act as exchange agent for purposes of

implementing the exchange of stock certificates, if applicable. If

you are a stockholder holding pre-split shares in certificate form,

you will receive a transmittal letter from our transfer agent as

soon as practicable after the effective time of the Reverse Stock

Split. The transmittal letter will be accompanied by instructions

specifying how you can exchange your certificate representing the

pre-split shares of the common stock for a statement of holding.

When you submit your certificate representing the pre-split shares

of the common stock, your post-split shares of the common stock

will be held electronically in book-entry form in the Direct

Registration System. This means that, instead of receiving a new

stock certificate, you will receive a statement of holding that

indicates the number of post-split shares you own in book-entry

form. We will no longer issue physical stock certificates unless

you make a specific request for a share certificate representing

your post-split ownership interest.

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT

ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Beginning on the

effective time of the Reverse Stock Split, each certificate

representing pre-split shares will be deemed for all corporate

purposes to evidence ownership of post-split shares.

Fractional Shares

No

fractional shares will be issued in connection with the Reverse

Stock Split. Instead, the Company will issue one full share of the

post-Reverse Stock Split common stock to any stockholder of record

who would have been entitled to receive a fractional share as a

result of the process. Each common stockholder will hold the same

percentage of the outstanding common stock immediately following

the Reverse Stock Split as that stockholder did immediately prior

to the Reverse Stock Split, except for minor adjustment due to the

additional net share fraction that will need to be issued as a

result of the treatment of fractional shares.

Effect of the Reverse Stock Split on Equity Incentive

Plans

We

maintain equity inventive plans (the “Plans”) pursuant

to which we have granted stock options and awards of restricted

stock that are presently outstanding and additional equity

incentive compensation awards may be granted in the future.

Pursuant to the terms of the Plans, the Board of Directors or a

committee thereof, as applicable, will adjust the number of shares

available for future grant under the Plans, the number of shares

underlying outstanding awards, the exercise price per share of

outstanding stock options and other terms of outstanding awards

issued pursuant to the Plans to equitably reflect the effects of

the Reverse Stock Split.

Accounting Matters

The

Reverse Stock Split will not affect the common stock capital

account on our balance sheet. However, because the par value of the

common stock will remain unchanged on the effective date of the

split, the components that make up the common stock capital account

will change by offsetting amounts. Depending on the size of the

Reverse Stock Split the Board of Directors decides to implement,

the stated capital component will be reduced to an amount between

one-fifth (1/5) and one-fifteenth (1/15) of its present amount, and

the additional paid-in capital component will be increased with the

amount by which the stated capital is reduced. The per share net

income or loss and net book value of the common stock will be

increased because there will be fewer shares of common stock

outstanding. Prior periods per share amounts will be restated to

reflect the Reverse Stock Split.

Material Tax Consequences of the Reverse Stock Split

Generally

The

following is a summary of the material U.S. federal income tax

consequences of the reverse stock split to holders of our common

stock and to the Company. This discussion is based on the Internal

Revenue Code of 1986, as amended (the “Code”),

existing, proposed and temporary Treasury Regulations promulgated

thereunder, Internal Revenue Service (“IRS”) rulings,

administrative pronouncements and judicial decisions in effect as

of the date of this Information Statement, all of which are subject

to change (possibly with retroactive effect) or to different

interpretations. The summary does not address all aspects of

federal income taxation that may apply to a stockholder as a result

of the Reverse Stock Split and is included for general information

only. In addition, the summary does not address any state, local or

non-U.S. income or other tax consequences of the Reverse Stock

Split.

The

summary does not address tax consequences to stockholders that are

subject to special tax rules, including, without limitation, banks,

insurance companies, regulated investment companies, personal

holding companies, non-U.S. entities, nonresident alien

individuals, broker-dealers, S corporations, entities treated as

partnerships or partners of such partnerships, persons who acquired

our common stock pursuant to the exercise of compensatory stock

options, estates, trusts and tax-exempt entities. The summary

further assumes that stockholders have held our common stock

subject to the Reverse Stock Split as a capital asset within the

meaning of Section 1221 of the Code, and will continue to hold such

common stock as a capital asset following the Reverse Stock Split.

No ruling from the IRS or opinion of counsel will be obtained

regarding the federal income tax consequences to stockholders as a

result of the Reverse Stock Split.

THE

FOLLOWING DISCUSSION IS BASED ON CURRENT LAW AND IS NOT INTENDED TO

CONSTITUTE A COMPLETE DESCRIPTION OF ALL U.S. FEDERAL INCOME TAX

CONSEQUENCES RELATING TO THE REVERSE STOCK SPLIT. STOCKHOLDERS

SHOULD CONSULT THEIR OWN TAX ADVISORS AS TO THE FEDERAL, STATE,

LOCAL AND NON-U.S. TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN

LIGHT OF THEIR INDIVIDUAL CIRCUMSTANCES. THIS DISCUSSION IS FOR

GENERAL INFORMATION ONLY AND DOES NOT CONSTITUTE TAX

ADVICE.

We

believe that the Reverse Stock Split, if implemented, would be a

tax-free recapitalization under the Code. If the Reverse Stock

Split qualifies as a recapitalization under the Code, then,

generally, for U.S. federal income tax purposes, no gain or loss

will be recognized by the Company in connection with the Reverse

Stock Split, and no gain or loss will be recognized by stockholders

that exchange their shares of pre-split common stock for shares of

post-split common stock. The post-split common stock in the hands

of a stockholder following the Reverse Stock Split will have an

aggregate tax basis equal to the aggregate tax basis of the

pre-split common stock held by that stockholder immediately prior

to the Reverse Stock Split. Similarly, a stockholder’s

holding period for the post-split common stock will be the same as

the holding period for the pre-split common stock exchanged

therefor.

Alternative

characterizations of the Reverse Stock Split are possible. For

example, while the Reverse Stock Split, if implemented, would

generally be treated as a tax-free recapitalization under the Code,

stockholders whose fractional shares resulting from the Reverse

Stock Split are rounded up to the nearest whole share may recognize

gain for federal income tax purposes equal to the value of the

additional fractional share. However, we believe that, in such

case, the resulting tax liability may not be material in view of

the low value of such fractional interest. Stockholders should

consult their own tax advisors regarding alternative

characterizations of the Reverse Stock Split for federal income tax

purposes.

THE

COMPANY’S VIEW REGARDING THE TAX CONSEQUENCE OF THE REVERSE

STOCK SPLIT IS NOT BINDING ON THE IRS OR THE COURTS. ACCORDINGLY,

EACH STOCKHOLDER SHOULD CONSULT WITH HIS OR HER OWN TAX ADVISORS

REGARDING ALL OF THE POTENTIAL TAX CONSEQUENCES TO HIM OR HER OF

THE REVERSE STOCK SPLIT.

Vote Required to Approve Amendment of our Restated Certificate of

Incorporation

Approval of the

Reverse Stock Split as set forth in the certificate of amendment to

our Restated Certificate of Incorporation included as Appendix A, requires an

affirmative vote of a majority of the common stock outstanding

entitled to vote at the Special Meeting as of the record date.

Abstentions and broker non-votes will have the same effect as

“against” votes. Approval by our stockholders of the

Reverse Stock Split is not conditioned upon approval by our

stockholders of the Authorized Common Stock Decrease.

Recommendation

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A

REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A RATIO TO BE DETERMINED

IN THE DISCRETION OF THE BOARD OF DIRECTORS IN THE RANGE OF ONE (1)

SHARE OF COMMON STOCK FOR EVERY FIVE (5) TO FIFTEEN (15) SHARES OF

COMMON STOCK, AND PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL

BE VOTED IN FAVOR OF THE AMENDMENT UNLESS A STOCKHOLDER INDICATES

OTHERWISE ON THE PROXY.

PROPOSAL 2

APPROVAL OF AMENDMENT (IN THE EVENT IT IS DEEMED BY THE BOARD TO BE

ADVISABLE) TO OUR RESTATED CERTIFICATE OF INCORPORATION TO DECREASE

THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 110,000,000 to

30,000,000

The

Board of Directors has adopted a resolution approving and

recommending to our stockholders for their approval, a proposed

amendment to our Restated Certificate of Incorporation to effect a

decrease in the number of shares of our authorized common stock

from the 110,000,000 shares that are currently authorized for

issuance pursuant to our Restated Certificate of Incorporation to a

total of 30,000,000 shares of common stock, contingent upon the

Reverse Stock Split being approved and effected in accordance with

Proposal 1. The proposed amendment to the Restated Certificate of

Incorporation reflecting the decrease to the Company's authorized

shares of common stock is included in Appendix B to this Proxy

Statement.

In the

event that the Board of Directors decides to effect the Reverse

Stock Split following stockholder approval of Proposal 1 and this

Proposal 2 is approved at the Special Meeting, the Board of

Directors will also effect an amendment to our Restated Certificate

of Incorporation that will result in a decrease in the number of

authorized shares of common stock from 110,000,000 to 30,000,000,

concurrently with the amendment to our Restated Certificate of

Incorporation to effect the Reverse Stock Split. In the event that

(i) Proposal 1 is approved by our stockholders at the Special

Meeting and the Board of Directors decides to effect the Reverse

Stock Split following such approval and (ii) this Proposal 2

is not approved at the Special Meeting, the authorized number of

shares of our common stock will remain at 110,000,000.

Even

if Proposal 2 is approved at the Annual Meeting, the Board of

Directors may determine in its sole discretion not to effect the

Reverse Stock Split and not to file any amendments to our Restated

Certificate of Incorporation. If the Board of Directors determines

not to implement the Reverse Stock Split in accordance with

Proposal 1, the number of authorized shares of our common stock

will not be reduced to 30,000,000 in accordance with this Proposal

2, even if this proposal is approved at the Special Meeting. If the

Board of Directors determines to change the number of authorized

shares of our common stock other than a reduction to 30,000,000

concurrently with effecting the Reverse Stock Split in accordance

with Proposal 1, further stockholder approval would be required

prior to the Company implementing any such change in the number of

authorized shares of our common stock.

If

Proposal 1 is not approved, then we will not amend our Restated

Certificate of Incorporation to decrease the number of authorized

shares of common stock.

No

changes to the Restated Certificate of Incorporation are being

proposed with respect to the number of authorized shares of

preferred stock.

Reasons

for the Amendment

In

the event that the Reverse Stock Split is approved and effected in

accordance with Proposal 1, the Board of Directors believes, based

on current information, that we will need fewer authorized shares

of common stock to meet our projected capital stock needs for

capital-raising transactions, issuance of equity-based compensation

and, to the extent opportunities may arise in the future, strategic

transactions that may involve our issuance of stock-based

consideration. Therefore, the Board of Directors is seeking

approval of an amendment to our Restated Certificate of

Incorporation to reduce our authorized capital stock.

Effects

of the Amendment

The

decrease of the number of shares of authorized common stock (if it

is approved by the Company's stockholders at the Special Meeting)

will not change any rights of any holder of our common stock as

such decrease would only apply to unissued authorized common stock.

Voting rights of the holders of the issued shares of common stock

will remain the same.

The

proposed amendment to our Restated Certificate of Incorporation

would decrease the total number of authorized shares of our common

stock to 30,000,000 shares. However, the proposed amendment would

not change any of the current rights and privileges of our common

stock or its par value.

In

addition, the amendment proposed in this Proposal 2 would not be

expected to limit our ability to use the remaining number of

authorized shares of common stock for appropriate future corporate

purposes, including equity financing transactions, debt-for-equity

refinancing transactions, refinancing transactions with an equity

component, acquisitions involving equity consideration and other

equity considerations that the board of directors may determine to

be in the best interests of the Company and its stockholders from

time to time.

The

proposed decrease in the number of authorized shares of our common

stock could have adverse effects on us. We will have less

flexibility to issue shares of common stock, including in

connection with a potential merger or acquisition, other strategic

transaction or follow-on offering if the number of authorized

shares of our common stock is reduced. In the event that our board

of directors determines that it would be in the best interests of

the Company and its stockholders to issue a number of shares of

common stock in excess of the number of then authorized but

unissued and unreserved shares, we would be required to seek the

approval of our stockholders to increase the number of shares of

authorized common stock. If we are not able to obtain the approval

of our stockholders for such an increase in a timely fashion, we

may be unable to take advantage of opportunities that might

otherwise be advantageous to us and our stockholders.

Vote Required to Approve the Amendment of our Restated Certificate

of Incorporation

Approval of the

amendment to our Restated Certificate of Incorporation to effect a

decrease in the number of shares of our authorized common stock as

set forth in the certificate of amendment to our Restated

Certificate of Incorporation included as Appendix B, requires an

affirmative vote of a majority of the common stock outstanding

entitled to vote at the Special Meeting as of the record date.

Abstentions and broker non-votes will have the same effect as

“against” votes. In the event that the Board of

Directors decides to effect the Reverse Stock Split following

stockholder approval of Proposal 1 and this Proposal 2 is approved

at the Special Meeting, the Board of Directors will also effect an

amendment to our Restated Certificate of Incorporation that will

result in a decrease in the number of authorized shares of common

stock from 110,000,000 to 30,000,000, concurrently with the

amendment to our Restated Certificate of Incorporation to effect

the Reverse Stock Split. In the event that (i) Proposal 1 is

approved by our stockholders at the Special Meeting and the Board

of Directors decides to effect the Reverse Stock Split following

such approval and (ii) this Proposal 2 is not approved at the

Special Meeting, the authorized number of shares of our common

stock will remain at 110,000,000.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR

APPROVAL OF THE AUTHORIZED COMMON STOCK DECREASE.

PROPOSAL 3

ADJOURNMENT OF THE SPECIAL MEETING OF STOCKHOLDERS, IF NECESSARY,

TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES IN

FAVOR OF PROPOSAL 1 OR PROPOSAL 2

Adjournment to Solicit Additional Proxies

If we

fail to receive a sufficient number of votes to approve any of

Proposal 1 (an amendment to the Restated Certificate of

Incorporation to effect the Reverse Stock Split), and/or Proposal 2

(an amendment to the Restated Certificate of Incorporation to

effect the Authorized Common Stock Decrease) we may propose to

adjourn the Special Meeting, if the Board of Directors determines

it to be necessary or appropriate for the purpose of soliciting

additional proxies to approve Proposal 1 and/or Proposal 2. We

currently do not intend to propose adjournment of the Special

Meeting, if there are sufficient votes in favor of each of Proposal

1 and Proposal 2. If our stockholders approve this proposal, we

could adjourn the Special Meeting and any adjourned session of the

Special Meeting and use the additional time to solicit additional

proxies, including the solicitation of proxies from our

stockholders that have previously voted. Among other things,

approval of this proposal could mean that, even if we had received

proxies representing a sufficient number of votes to defeat

Proposal 1 and Proposal 2, we could adjourn the Special Meeting

without a vote on such proposal and seek to convince our

stockholders to change their votes in favor of such

proposal.

If it

is necessary or appropriate (as determined in good faith by the

Board of Directors) to adjourn the Special Meeting, no notice of

the adjourned meeting is required to be given to our stockholders

under Delaware law, other than an announcement at the Special

Meeting of the time and place to which the Special Meeting is

adjourned, so long as the meeting is adjourned for 30 days or less

and no new record date is fixed for the adjourned meeting. At the

adjourned meeting, we may transact any business which might have

been transacted at the original meeting.

Required Vote

Approval of the

Adjournment requires an affirmative vote of a majority of the votes

cast at the Special Meeting. Abstentions and broker non-votes are

not votes cast and therefore will not affect the outcome of this

proposal.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS

VOTE “FOR” PROPOSAL 3 THE ADJOURNMENT OF THE SPECIAL

MEETING, IF THE BOARD DETERMINES IT TO BE NECESSARY OR APPROPRIATE,

TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN

FAVOR OF PROPOSAL 1 AND/OR PROPOSAL 2.

OTHER INFORMATION REGARDING THE COMPANY

Security Ownership of Directors and Executive

Officers

In

general, “beneficial ownership” includes those shares a

director or executive officer has the power to vote or transfer,

except as otherwise noted, and shares underlying stock options that

are exercisable currently or within 60 days. The calculation of the

percentage of outstanding shares is based on 86,155,968 shares

outstanding as of June 30, 2020. The mailing address for each of

our directors and officers is c/o WidePoint Corporation - 11250

Waples Mill Road, South Tower, Suite 210, Fairfax, Virginia

22030.

The

following tables set forth the number of shares of our common stock

beneficially owned as of June 30, 2020 by each director and

executive officer:

|

Directors and Executive Officers

|

Direct Common Stock Owned

|

Restricted Stock Owned

|

Stock Options Exercisable (1)

|

Number of Shares of Common Stock (1)

|

Percent of Common Stock Outstanding (1)

|

|

|

Otto Guenther (2) (3)

|

595,314

|

53,384

|

50,000

|

698,698

|

*

|

|

Jin Kang (4)

|

3,411,385

|

422,938

|

-

|

3,834,323

|

4.5%

|

|

Jason Holloway (5)

|

1,007,041

|

322,938

|

500,000

|

1,829,979

|

2.1%

|

|

Kellie Kim (6)

|

-

|

100,000

|

-

|

100,000

|

*

|

|

Julia Bowen (3)

|

167,968

|

64,103

|

-

|

232,071

|

*

|

|

Richard Todaro (3)

|

267,968

|

64,103

|

-

|

332,071

|

*

|

|

Philip Garfinkle (3)

|

113,722

|

64,103

|

-

|

177,825

|

*

|

|

All director and executive officers as a group (7 persons)

(7)

|

5,563,398

|

1,091,569

|

550,000

|

7,204,967

|

8.4%

|

_________________________

*Indicates ownership percentage is less than 1.0%.

(1) Assumes in the case of each stockholder listed above that all

options and/or restricted stock held by such stockholder that are

exercisable currently or vesting within 60 days of June

30, 2020 were fully exercised or

vested by such stockholder, without the exercise or vesting of any

shares of restricted stock or options held by any other

stockholders.

(2)

Includes 50,000 earned and exercisable options to purchase shares

from the Company at a price $0.44 per share.

(3)

Includes unvested shares of restricted stock of 64,103 for each

non-employee director and 53,384 for chairman.

(4)

Includes 422,938 shares of unvested restricted stock.

(5) Includes 500,000 earned and exercisable options to purchase

shares from the Company at a price $.70 per share and 322,938

shares of unvested restricted stock.

(6)

Includes 100,000 shares of unvested restricted stock.

(7)

Includes the shares referred to as

included in notes (2) through (6) above.

Security Ownership of Certain Beneficial Owners (Greater than 5%

Holders)

The following table sets forth beneficial owners of more than 5%

based on 86,155,968 outstanding

shares of common stock as of June 30, 2020:

|

|

Number of Shares

of

|

Percent of Common

Stock

|

|

Names and Complete Mailing Address

|

Common Stock

|

Outstanding

|

|

|

|

|

|

Nokomis Capital, L.L.C., and

Brett Hendrickson

2305 Cedar Springs Rd., Suite 420

Dallas, Texas 75201

|

8,378,081

|

9.7%(1)

|

|

|

|

|

(1)

Based

on information provided in Schedule 13G filed on May 29, 2020,

Nokomis Capital, L.L.C. is a Texas limited liability company and

Mr. Brett Hendrickson is the principal of Nokomis Capital, L.L.C.

The Schedule 13D relates to shares purchased by Nokomis Capital

through the accounts of certain private funds and managed accounts

(collectively, the “Nokomis Accounts”). Nokomis Capital

serves as the investment adviser to the Nokomis Accounts and may

direct the vote and dispose of the shares held by the Nokomis

Accounts. As the principal of Nokomis Capital, Mr. Hendrickson may

direct the vote and disposition of the shares held by the Nokomis

Accounts. Pursuant to Rule 16a-1, both Nokomis Capital and Mr.

Hendrickson disclaim such beneficial ownership. On July 3, 2018, we

entered into an appointment and standstill agreement with Nokomis.

The appointment and standstill agreement, among other things,

provided that (i) Nokomis shall be entitled to appoint one

qualified independent individual as a Class III director and as a

member of the Corporate Governance and Nominating Committee and the

Compensation Committee of the Board and we shall nominate such

appointee for election at the 2019 Annual Meeting of Stockholders

and (ii) we and Nokomis shall mutually select a qualified

independent individual to serve as a Class III director and as a

member of the Corporate Governance and Nominating Committee and the

Compensation Committee of the Board and we shall nominate such

appointee for election at the 2019 Annual Meeting of Stockholders.

On February 7, 2019 and in accordance with the terms of the

appointment and standstill agreement, the Board appointed Richard

L. Todaro and Julia A. Bowen as Class III directors of the Company,

with Mr. Todaro as the appointee by Nokomis and Ms. Bowen as the

mutual appointee. Also, on July 20, 2017, we previously entered

into an appointment and standstill agreement with Nokomis, pursuant

to which, among other things, the Company agreed to immediately

appoint Alan Howe and Philip Richter as Class II directors and as

members of the Corporate Governance and Nominating Committee and

the Compensation Committee of the Board and to nominate them for

election at the Company’s 2017 Annual Meeting of

Stockholders.

NO DISSENTERS’ OR APPRAISAL RIGHTS

The

corporate actions described in this proxy statement will not afford

stockholders the opportunity to dissent from the actions described

herein or to receive an agreed or judicially appraised value for

their shares.

OTHER INFORMATION

We

maintain an internet website at http://www.widepoint.com.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K, and any amendment to those reports,

are available free of charge on our website immediately after they

are filed with or furnished to the Securities and Exchange

Commission. WidePoint’s Code of Business Conduct, Corporate

Governance Principles and Charters of the Committees of the Board

of Directors are also available free of charge on our website or by

writing to WidePoint Corporation, 11250 Waples Mill Road, South

Tower, Suite 210, Fairfax, Virginia 22030, c/o Corporate Secretary.

WidePoint’s Code of Business Conduct applies to all

directors, officers (including the Chief Executive Officer and

Chief Financial Officer) and employees. Amendments to or waivers of

the Code of Conduct granted to any of the Company’s directors

or executive officers will be published on our website within four

business days of such amendment or waiver.

STOCKHOLDER PROPOSALS FOR 2021 ANNUAL MEETING

Proposals of stockholders intended to be presented

at the 2021 Annual Meeting must be received by the Secretary of the

Company, 11250 Waples Mill Road, South Tower, Suite 210, Fairfax,

Virginia 22030, no later than December 25, 2020 in order for them to be

considered for inclusion in the 2021 Proxy Statement. Any

such proposal must comply with Rule 14a-8 of Regulation 14A of the

proxy rules of the Securities and Exchange Commission. Based on our anticipated meeting date, a

stockholder desiring to submit a proposal to be voted on at next

year’s Annual Meeting of Stockholders, but not desiring to

have such proposal included in next year’s proxy statement

relating to that meeting, should submit such proposal to the

Company no later than December 25,

2020. Failure to comply with that advance notice requirement

will result in the proposal not being placed on the agenda at the

meeting.

OTHER MATTERS

Management

is not aware of any other matters to be considered at the Special

Meeting. If any other matters properly come before the Special

Meeting, the persons named in the enclosed Proxy will vote said

Proxy in accordance with their discretion.

APPENDIX A

FORM OF CERTIFICATE OF

AMENDMENT

TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

WIDEPOINT CORPORATION

(a Delaware Corporation)

WidePoint

corporation, a corporation organized and existing under the laws of

the State of Delaware (the “Corporation”),

does hereby certify:

1. The

Board of Directors of the Corporation has duly adopted a resolution

pursuant to Section 242 of the General Corporation Law of the State

of Delaware setting forth a proposed amendment to the Amended and

Restated Certificate of Incorporation of the Corporation, as

amended (the “Restated

Certificate”), and declaring said amendment to be

advisable. The requisite stockholders of the Corporation have duly

approved said proposed amendment in accordance with Section 242 of

the General Corporation Law of the State of Delaware. The Restated

Certificate is hereby amended by deleting Article FOURTH in its

entirety and substituting in lieu thereof the

following:

ARTICLE IV. CAPITAL STOCK

The

aggregate number of shares of stock that the Corporation shall have

authority to issue is one hundred twenty million (120,000,000), of

which ten million (10,000,000) shares, with a par value of $0.001

per share, are designated as Preferred Stock, and one hundred ten

million (110,000,000), with a par value of $0.001 per share, are

designated as Common Stock.

(a)

Provisions Relating to the Common Stock.

|

|

(1)

Each holder of Common Stock is entitled to one vote for each share

of Common Stock standing in such holder’s name on the records

of the Corporation on each matter submitted to a vote of the

stockholders, except as otherwise required by law.

|

|

|

(2) The

holders of the Common Stock shall have no preemptive rights to

subscribe for any shares of any class of stock of the Corporation

whether now or hereafter authorized.

(3)

Effective as of [date] (the

"Effective Time"), each [number to

be determined from five to fifteen] shares of Common Stock

issued and outstanding or held in treasury immediately prior to the

Effective Time shall be reclassified and combined into one (1)

validly issued, fully paid and non-assessable share of Common Stock

without any further action by the Corporation or any holder

thereof, subject to the treatment of fractional share interests as

described below (the "Reverse Stock Split"). The Reverse Stock

Split shall occur without any further action on the part of the

Company or the holder thereof and whether or not certificates

representing such holder's shares prior to the Reverse Stock Split

are surrendered for cancellation. No fractional interest in a share

of Common Stock shall be deliverable upon the Reverse Stock Split.

Stockholders who otherwise would be entitled to receive fractional

shares of Common Stock because they hold a number of shares not

evenly divisible by the Reverse Stock Split ratio will

automatically be entitled to receive an additional fraction of a

share of Common Stock to round up to the next whole share. Each

certificate that immediately prior to the Effective Time

represented shares of Common Stock ("Old Certificate"), shall

thereafter represent that number of shares of Common Stock into

which the shares of Common Stock represented by the Old Certificate

shall have been combined, plus any additional fraction of a share

of Common Stock to round up to the next whole share."

|

(b)

Provisions Relating to the Preferred Stock. The authority of the

Board with respect to each series shall include, but not be limited

to, determination of the following:

|

|

(1) The

number of shares constituting that series and the distinctive

designation of that series;

|

|

|

(2) The

dividend rate on the shares of that series, whether dividends shall

be cumulative, and if so, from which date(s), and the relative

rights of priority, if any, of payment of dividends on shares of

that series;

|

|

|

(3)

Whether that series shall have voting rights, in addition to the

voting rights provided by law, and, if so, the terms of such voting

rights;

|

|

|

(4)

Whether that series shall have conversion privileges, and, if so,

the terms and conditions of such conversion, including provision

for adjustment of the conversion rate in such events as the Board

of Directors shall determine;

|

|

|

(5) Whether

or not the shares of that series shall be redeemable, and, if so,

the terms and conditions of such redemption, including the date or

date upon or after which they shall be redeemable, and the amount

per share payable in case of redemption, which amount may vary

under different conditions and at different redemption

dates;

|

|

|

(6)

Whether that series shall have a sinking fund for the redemption or

purchase of shares of that series, and, if so, the terms and amount

of such sinking fund;

|

|

|

(7) The

rights of the shares of that series in the event of voluntary or

involuntary liquidation, dissolution or winding up of the

corporation, and the relative rights of priority, if any, of

payment of shares of that series;

|

|

|

(8) Any

other relative rights, preferences and limitations of that

series.

|

Dividends on outstanding shares of Preferred Stock shall be paid or

declared and set apart for payment before any dividends shall be

paid or declared and set apart for payment on the Common Stock with

respect to the same dividend period. If upon any voluntary or

involuntary liquidation, dissolution or winding up of the

corporation, the assets available for distribution to holders of

shares of Preferred Stock of all series shall be insufficient to

pay such holders the full preferential amount to which they are

entitled, then such assets shall be distributed ratably among the

shares of all series of Preferred Stock in accordance with the

respective preferential amounts (including unpaid cumulative

dividends, if any) payable with respect thereto.

2. This

Certificate of Amendment shall be effective as of ____ at ____

Eastern Time.

IN WITNESS WHEREOF, the Corporation has

caused this Certificate of Amendment to be signed this

[ ] day of [ ],

202[ ].

|

|

WIDEPOINT CORPORATION

|

|

|

|

|

|

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

APPENDIX

B

FORM OF CERTIFICATE OF

AMENDMENT

TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

WIDEPOINT CORPORATION

(a Delaware Corporation)

WidePoint

corporation, a corporation organized and existing under the laws of

the State of Delaware (the “Corporation”),

does hereby certify:

1. The

Board of Directors of the Corporation has duly adopted a resolution

pursuant to Section 242 of the General Corporation Law of the State

of Delaware setting forth a proposed amendment to the Amended and

Restated Certificate of Incorporation of the Corporation, as

amended (the “Restated

Certificate”), and declaring said amendment to be

advisable. The requisite stockholders of the Corporation have duly

approved said proposed amendment in accordance with Section 242 of

the General Corporation Law of the State of Delaware. The Restated

Certificate is hereby amended by deleting Article FOURTH in its

entirety and substituting in lieu thereof the

following:

ARTICLE IV. CAPITAL STOCK

The

aggregate number of shares of stock that the Corporation shall have

authority to issue is forty million (40,000,000), of which ten

million (10,000,000) shares, with a par value of $0.001 per share,

are designated as Preferred Stock, and thirty million (30,000,000),

with a par value of $0.001 per share, are designated as Common

Stock.

(a)

Provisions Relating to the Common Stock.

|

|

(1)

Each holder of Common Stock is entitled to one vote for each share

of Common Stock standing in such holder’s name on the records

of the Corporation on each matter submitted to a vote of the

stockholders, except as otherwise required by law.

|

|

|

(2) The

holders of the Common Stock shall have no preemptive rights to

subscribe for any shares of any class of stock of the Corporation

whether now or hereafter authorized.

(3)

Effective as of [date] (the

"Effective Time"), each [number to

be determined from five to fifteen] shares of Common Stock

issued and outstanding or held in treasury immediately prior to the

Effective Time shall be reclassified and combined into one (1)

validly issued, fully paid and non-assessable share of Common Stock

without any further action by the Corporation or any holder

thereof, subject to the treatment of fractional share interests as

described below (the "Reverse Stock Split"). The Reverse Stock

Split shall occur without any further action on the part of the

Company or the holder thereof and whether or not certificates

representing such holder's shares prior to the Reverse Stock Split

are surrendered for cancellation. No fractional interest in a share

of Common Stock shall be deliverable upon the Reverse Stock Split.

Stockholders who otherwise would be entitled to receive fractional

shares of Common Stock because they hold a number of shares not

evenly divisible by the Reverse Stock Split ratio will

automatically be entitled to receive an additional fraction of a

share of Common Stock to round up to the next whole share. Each

certificate that immediately prior to the Effective Time

represented shares of Common Stock ("Old Certificate"), shall

thereafter represent that number of shares of Common Stock into