Thanks to more fuel efficient cars, a sluggish economy, and

increased technological innovation, the U.S. is poised to become a

force in the energy market once again. New fracking methods and a

lack of demand in the domestic market has dramatically increased

oil production over the past few years, and simultaneously pushed

oil imports to their lowest level in decades.

In fact, the IEA recently projected that the U.S. would leapfrog

both Russia and Saudi Arabia to become the world’s biggest producer

of oil in just five years time. The international organization also

said that the U.S. could become self-sufficient in energy by 2035

and a net exporter of natural gas by the end of the decade (read

Three ETFs for the Unconventional Oil Revolution).

Clearly if these trends hold it could have an enormous impact on

the American economy and once again allow global energy firms to

focus on the U.S. market as opposed to dictator-run petro-powers

from across the Middle East and increasingly in smaller markets

across Asia and Latin America as well.

If this happens, it could continue a surge in investment

interest in the North American oil market as oil companies from

around the globe flock to a relatively safe place to drill, refine,

and export oil from. Obviously this situation would be good news

for many firms in the oil and gas industry, making a number of

companies in this space interesting investments for the long term

(although not necessarily in the short-term).

However, as we saw with the BP debacle, a look

to a single energy firm can be extremely risky, suggesting a more

diversified approach should probably be taken. Fortunately there

are a dozens of energy ETFs out there giving investors plenty of

choices in the space (see Inside The Forgotten Energy ETFs).

Below, we highlight three ETFs that we think could be

particularly intriguing choices for a continued American oil boom.

Any of these should benefit if America continues to expand its oil

production levels and once again become a leader in energy

development:

Market Vectors Oil Services ETF (OIH)

As more wells and drilling takes place across America, more oil

services and equipment will be required. Thanks to this expansion

in the home grown market, it seems likely that funds targeting this

segment of the oil industry could be a beneficiary of the boom,

with potentially a lower risk level as well.

Easily the most popular ETF in this segment is OIH, now from

Market Vectors. The ETF has over $1.2 billion in assets and sees

over four million shares in volume a day, suggesting low bid ask

spreads which only had to the fund’s favorable cost level as

expense are at 35 basis points a year (read Time to Buy Oil and Gas

Services ETFs?).

However, investors should note that the product is pretty

concentrated in Schlumberger (SLB) with 20% of the

assets, followed by NOV and HAL

at another 17% combined. Still, the product has a heavy U.S. focus

and a decent mid cap contingent, suggesting it should be driven by

the events in the North American market.

PowerShares S&P Small Cap Energy Portfolio

(PSCE)

As more large caps hone in on the fracking and oil production

trend at home, they will probably have to deal with small caps in

at least a few segments. That is because many of these pint sized

securities are 100% focused on the U.S. market and either have

claims to key and untapped areas, or important patents, factors

that are likely to make them top takeover targets as trend gets

further underway.

Yet since we can never be sure of which will be targeted,

investors should look to PSCE for diversified exposure to the space

to play a ‘rising tide lifts all boats’ theory. The fund holds

roughly 25 stocks in its basket, but it remains somewhat

unpopular—despite low fees of 0.29% a year—so bid ask spreads could

be relatively wide for this fund (see Crude Oil ETF Investing

101).

Still, the product offers up a nice mix between equipment and

exploration/production firms with roughly a 50/50 split.

Additionally, the fund is relatively well spread out as no one firm

makes up more than 10% of assets, although four do account for more

than 8% each.

Market Vectors Unconventional Oil & Gas ETF

(FRAK)

At the heart of the American energy boom is fracking technology.

This process, which injects fluids into rocks in order force oil

and gas up to an extraction point, has been used more extensively

and effectively over the past few years to boost yields at a number

of oil and gas fields across the country.

While a number of companies use the technology on a regular

basis, those in the aptly-named FRAK truly thrive on it. This fund

consists of roughly 45 companies that are in the Market Vectors

Unconventional Oil & Gas Index, a benchmark that looks to track

the coalbed methane, coal seam gas, shale oil & gas, and sands

market, charging 54 basis points a year in fees (see The

Comprehensive Guide to Natural Gas ETFs).

Top components include large caps like Anadarko

(APC) and Occidental (OXY), while

EOG Resources (EOG) is the third biggest

component. Volume and AUM are still quite low for this large cap

focused fund—suggesting modest bid ask spreads-- but it is arguably

one of the better ways to play booming American oil production in

ETF form.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

ANADARKO PETROL (APC): Free Stock Analysis Report

BP PLC (BP): Free Stock Analysis Report

MKT VEC-UNC O&G (FRAK): ETF Research Reports

MKT VEC-OIL SVC (OIH): ETF Research Reports

PWRSH-SP SC EGY (PSCE): ETF Research Reports

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

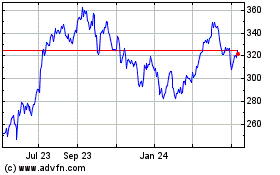

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Dec 2024 to Jan 2025

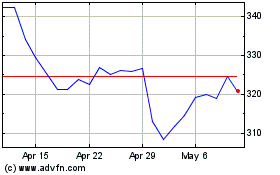

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Jan 2024 to Jan 2025