Splash Beverage Group Reports 2023 First Quarter Financial Results

June 06 2023 - 9:16AM

via NewMediaWire – Splash Beverage Group, Inc. (NYSE American:

SBEV) ("Splash" or the "Company"), a portfolio company of leading

beverage brands, today reported financial results for the first

quarter period ended March 31, 2023. Investors are encouraged to

read the Company’s quarterly report on Form 10-Q which was filed

with the Securities and Exchange Commissions (the “SEC”), contains

additional information, and is posted at

https://splashbeveragegroup.com/.

First Quarter

Financial Performance

- Net revenue for the first quarter was

$5.8 million compared to $3.9 million in the prior year period, an

increase of 48%. The increase in revenues was primarily due to

increases in all beverage brands which increased 28.5% as well as

sales from the Company’s ecommerce division distribution platform,

Qplash which increased 60.3% over the prior year period.

- Gross profit for the first quarter was

$1.8 million compared to $1.3 million in the prior year

period.

- First quarter net loss narrowed to

$3.73 million compared to $5.99 million in the prior year period.

The decrease in net loss was due to higher sales offsetting a lower

gross margin and higher operating expenses.

- As of March 31, 2023, the company had

total cash and cash equivalents of $2.1 million, compared to $4.4

million at December 31, 2022.

Robert Nistico, CEO of Splash Beverage Group said, “Our 2023

first quarter results are consistent with the preliminary results

of $5.8 million in NET revenue ($6.1M gross), which is not only

another record quarter for sales, but solid improvement in many of

the key data points we outline in our April announcement, brands

authorized in national and regional chains, selling universe as

measured by more than 24,000 store doors. We continue to expand our

footprint of distribution relationships such that we are now

available throughout the US.

“As we noted previously, one or more of our brands have been

authorized in more than a dozen national and retail chains in the

last six months. As I mentioned in the April update it takes time

to activate all our new store door universe, but we have made good

progress through the end of Q1 and have placed one or more of our

brands on 3,120 new shelves.

“We expect TapouT Energy Drink to add to this effort this

quarter. Earlier we estimated that launch would begin in May but

unfortunately, we had a can production delay, but we do expect to

launch later this month.

“Regarding the late filing of our Q, as mentioned in the 8k

filed with the SEC and in our press release, this was a function of

our audit firm merging with a much larger firm and adding

additional several layers of review,” Nistico added. “We were

unaware of the extra procedures and the additional time required as

a result. Now that we know, this should not happen

again.”

About Splash Beverage Group,

Inc.Splash Beverage Group, an innovator in the beverage

industry, owns a growing portfolio of alcoholic and non-alcoholic

beverage brands including Copa di Vino wine by the glass, SALT

flavored tequilas, Pulpoloco sangria, and TapouT performance

hydration and recovery drink. Splash’s strategy is to rapidly

develop early-stage brands already in its portfolio as well as

acquire and then accelerate brands that have high visibility or are

innovators in their categories. Led by a management team that has

built and managed some of the top brands in the beverage industry

and led sales from product launch into the billions, Splash is

rapidly expanding its brand portfolio and global

distribution.

For more information visit:

www.SplashBeverageGroup.com www.copadivino.com

www.drinksalttequila.com www.pulpo-loco.com

www.tapoutdrinks.com

Forward-Looking StatementThis

press release includes “forward-looking statements” within the

meaning of U.S. federal securities laws. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue” and similar expressions are

intended to identify such forward-looking statements. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results and, consequently, you should

not rely on these forward-looking statements as predictions of

future events. These forward-looking statements and factors that

may cause such differences include, without limitation, the risks

disclosed in the Company’s Annual Report on Form 10-K filed with

the SEC on March 31, 2022, and in the Company’s other filings with

the SEC. Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Except as required by law, the Company disclaims any obligation to

update or publicly announce any revisions to any of the

forward-looking statements contained in this press release.

Contact Information:Splash

Beverage GroupInfo@SplashBeverageGroup.com954-745-5815

Consolidated Balance Sheets

|

|

|

March 31,2023 |

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,145,797 |

|

|

$ |

4,431,745 |

|

|

Accounts Receivable, net |

|

|

2,190,681 |

|

|

|

1,812,110 |

|

|

Prepaid Expenses |

|

|

926,273 |

|

|

|

348,036 |

|

|

Inventory |

|

|

3,144,793 |

|

|

|

3,721,307 |

|

|

Other receivables |

|

|

490,126 |

|

|

|

344,376 |

|

|

Total current assets |

|

|

8,897,670 |

|

|

|

10,657,574 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

Deposit |

|

$ |

49,368 |

|

|

$ |

49,290 |

|

|

Goodwill |

|

|

154,573 |

|

|

|

256,823 |

|

|

Intangible assets, net |

|

|

4,759,711 |

|

|

|

4,851,377 |

|

|

Investment in Salt Tequila USA, LLC |

|

|

250,000 |

|

|

|

250,000 |

|

|

Right of use asset |

|

|

674,106 |

|

|

|

750.042 |

|

|

Property and equipment, net |

|

|

461,217 |

|

|

|

489.597 |

|

|

Total non-current assets |

|

|

6,348,975 |

|

|

|

6,647,129 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

15,246,645 |

|

|

$ |

17,304,703 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

2,918,991 |

|

|

$ |

3,383,187 |

|

|

Liability to issue shares |

|

|

2,131,800 |

|

|

|

91,800 |

|

|

Right of use liability - current |

|

|

250,734 |

|

|

|

268,749 |

|

|

Notes payable, current portion |

|

|

2,913,136 |

|

|

|

1,080,257 |

|

|

Shareholder advances |

|

|

200,000 |

|

|

|

— |

|

|

Accrued interest payable |

|

|

162,915 |

|

|

|

141,591 |

|

|

Total current liabilities |

|

|

8,577,576 |

|

|

|

4,965,584 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term Liabilities: |

|

|

|

|

|

|

|

|

|

Notes payable |

|

|

2,432,288 |

|

|

|

2,536,319 |

|

|

Right of use liability - noncurrent |

|

|

423,173 |

|

|

|

480,666 |

|

|

Total long-term liabilities |

|

|

2,855,461 |

|

|

|

3,016,985 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

11,433,037 |

|

|

|

7,982,569 |

|

|

|

|

|

|

|

|

|

|

|

|

Deficiency in stockholders’ equity (deficit): |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value, 5,000,000 shares authorized, no

shares issued |

|

|

— |

|

|

|

— |

|

|

Common Stock, $0.001 par, 300,000,000 shares authorized, 41,085,520

and 41,085,520 shares issued, 41,085,520 and 41,085,520 shares

outstanding, at March 31, 2023 and December 31, 2022,

respectively |

|

|

41,086 |

|

|

|

41,086 |

|

|

Additional paid in capital |

|

|

121,749,517 |

|

|

|

121,632,547 |

|

|

Accumulated Other Comprehensive Income |

|

|

(47,098 |

) |

|

|

(20,472 |

) |

|

Accumulated deficit |

|

|

(117,929,897 |

) |

|

|

(112,331,027 |

) |

|

Total stockholders’ equity |

|

|

3,813,608 |

|

|

|

9,322,134 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

15,246,645 |

|

|

$ |

17,304,703 |

|

Splash Beverage

GroupConsolidated Statements of

Operations

|

|

|

Three months ended March 31, |

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

|

Gross sales |

|

$ |

6,134,398 |

|

|

$ |

4,071,356 |

|

|

Customer discounts |

|

|

(311,671 |

) |

|

|

(144,783 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

|

5,822,727 |

|

|

|

3,926,573 |

|

|

Cost of goods sold |

|

|

(4,061,228 |

) |

|

|

(2,635,310 |

) |

|

Gross profit |

|

|

1,761,499 |

|

|

|

1,291,263 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Contracted services |

|

|

381,006 |

|

|

|

431,545 |

|

|

Salary and wages |

|

|

1,234,127 |

|

|

|

785,651 |

|

|

Non-cash share-based compensation |

|

|

2,255,759 |

|

|

|

2,355,542 |

|

|

Other general and administrative |

|

|

2,623,684 |

|

|

|

2,681,498 |

|

|

Sales and marketing |

|

|

736,827 |

|

|

|

720,979 |

|

|

Total operating expenses |

|

|

7,231,403 |

|

|

|

6,975,215 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

|

(5,469,904 |

) |

|

|

(5,683,953 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other income/(expense): |

|

|

|

|

|

|

|

|

|

Other Income |

|

|

38,154 |

|

|

|

— |

|

|

Interest expense |

|

|

(167,121 |

) |

|

|

(85,879 |

) |

|

Total other (expense) |

|

|

(128,967 |

) |

|

|

(85,879 |

) |

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations, net of tax |

|

|

(5,598,871 |

) |

|

|

(5,769,832 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss /income from discontinued operations, net of tax |

|

|

— |

|

|

|

(224,576 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(5,598,871 |

) |

|

$ |

(5,994,408 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss foreign currency translation loss |

|

|

(26,625 |

) |

|

|

--- |

|

|

|

|

|

|

|

|

|

|

|

|

Total Comprehensive income |

|

|

(5,625,497 |

) |

|

|

(5,994,408 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss per share - continuing operations |

|

|

|

|

|

|

|

|

|

Basic and dilutive |

|

$ |

(0.15 |

) |

|

$ |

(0.16 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding - continuing

operations |

|

|

|

|

|

|

|

|

|

Basic and dilutive |

|

|

37,389,990 |

|

|

|

35,188,404 |

|

|

|

|

|

|

|

|

|

|

|

|

Income/(loss) per share - discontinued operations |

|

|

|

|

|

|

|

|

|

Basic and dilutive |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding - discontinued

operations |

|

|

|

|

|

|

|

|

|

Basic and dilutive |

|

|

37,389,990 |

|

|

|

35,188,404 |

|

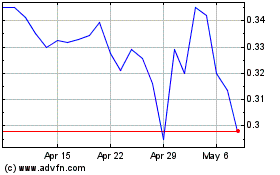

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Apr 2024 to May 2024

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From May 2023 to May 2024