Will Gold Regain Its Luster? - Real Time Insight

July 31 2012 - 7:04AM

Zacks

Gold prices have been trending up in the last month due to

renewed hopes for QE3. In the past few days, the prices have also

benefited by the rise of the Euro against the US Dollar.

While the gold is now up about 3.6% year-to-date (vs. 10.2% for

S&P 500), it is still down about 17% from its peak in September

last year. (Read: The Comprehensive Guide to Gold ETF

Investing)

Near-term direction for the gold will be guided by the outcome

of the FOMC. If the Fed announces a new round of monetary easing,

the Dollar will trend lower while the gold may continue its

uptrend.

Gold has suffered due to slowdown in China and India, which

together account for more than 40% of the global demand.

Additionally, the demand in India has also been affected due to the

jump in gold price resulting from the decline of the Indian rupee

against the US Dollar. In India the prices are near all-time high

in the Rupee terms. Not to mention some of the bizarre theories

about the gold price manipulation by the central banks, which have

gained momentum of late, in the wake of Libor manipulation

scandal.

I believe in the long-term investment case for gold, due to its

diversification benefits and ability to act as a hedge against

inflation. Further though the metal does not provide any income

yield, the opportunity costs of holding it are now very low now due

to record-low interest rate environment. The central banks,

especially in the emerging countries have continued to add to their

gold holdings, in order to diversify their reserves, which will

also provide support to the price.

However the short-term trend may not be very favorable due to

continued strength in the US Dollar, concerns over deflation and

reduced demand from China and India.

Zacks consensus forecasts for gold calls for 1.15% appreciation

by the end of June 2012, somewhat similar to 1.92% appreciation for

silver. Popular gold ETFs GLD and IAU have Zacks ETF Rank 3 (Hold)

currently. Please visit Zacks ETF Center to read research reports

on these ETFs.

On the other hand, other precious metals platinum and palladium

are expected to rise of 6.72% and 11.16%, respectively over the

same period. Please see Will Palladium ETF Shine Brightest This

Year? And Time to Invest in Platinum ETFs?

Do you think that the gold will regain its luster if the Fed and

other central banks announce additional easing measures or the 12

year bull run of gold is over now?

.

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-GOLD TR (IAU): ETF Research Reports

ETFS-PALLADIUM (PALL): ETF Research Reports

ETFS-PLATINUM (PPLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

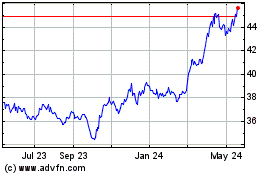

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jul 2023 to Jul 2024