Three Best Gold ETFs - Commodity ETFs

December 06 2011 - 4:01AM

Zacks

As the future of the U.S dollar as global reserve currency

remains uncertain, many investors—both here and abroad—have begun

to diversify their assets out of greenbacks and into other mediums.

While euros and other currencies such as the yen were popular for a

while, the structural problems facing those economies are becoming

extremely apparent to nearly every investor, forcing many to

consider alternatives for diversification exposure. Ultimately,

this quest tends to end up with the precious metals market, and

more specifically, gold.

The precious metal remains a great diversifying agent for

portfolios and a quality hedge for those looking to protect against

broad market declines or a collapse in the dollar. Yet, while gold

can be easily purchased online or at a local bullion dealer, there

are some issues that one has to be aware off before going down this

path. First, one must consider the wide spreads that dealers have

for the precious metals, which are sometimes in excess of 5%. This

added fee, which is generally on both sides of the transaction, is

a heavy cost to bear for most investors and especially those

dealing with small quantities of gold. Furthermore, there is also

the issue of storage; unless one wants to throw their gold in the

sock drawer, a safe or safety deposit box must also be purchased,

again adding to the total costs incurred by precious metal

investors (also see Avoid Turmoil With The Community Bank ETF).

Thanks in part to these issues, investors have begun to embrace

ETFs as a trading tool that can offer the same exposure to gold but

without many of the headaches outlined above. Trading is available

throughout the day on all of these products, bid/ask spreads are

extremely tight, and fees, thanks to intense competition, have been

pushed to rock-bottom levels. However, investors should note that

there are quite a few choices in the space and while all of them

have their selling points, they are not created equal by any means.

In light of this, we decided to take a closer look at three of our

favorite products in the gold ETF space below:

SPDR Gold Shares

(GLD)

For investors seeking extreme levels of liquidity, GLD is tough

to beat in the gold space. The fund has over $71 billion in AUM and

trades close to 17.2 million shares a day. In other words, the

trust behind GLD holds more gold in its reserve than the nations of

China or Switzerland, enough to put it in fifth if it were a

sovereign country. Obviously with numbers like this it shouldn’t

surprise anyone to know that the product trades almost as much in a

day as all the other gold ETFs combined. However, investors should

note that the product has expenses at the higher end of the scale

in the gold ETF space, as the annual fee is 0.4%. Furthermore,

investors should note that from time to time, the product isn’t

100% allocated to gold and can thus deviate slightly from the

performance of the metal when markets are oscillating wildly. For

performance, GLD has gained 20% since the start of the year and has

lost 4.3% over the past three months (see Is USCI The Best

Commodity ETF?).

iShares Gold Trust

(IAU)

If expenses are your primary concern, IAU is the gold standard

in this corner of the market. The fund charges just 0.25% in

expenses per year, making it the lowest by far in the category.

Investors should also note that the product allocates 100% of its

assets to gold on a daily basis, ensuring a very accurate picture

in terms of tracking error. For volume, the levels are pretty

solid; IAU trades a little over 8.6 million shares a day. While

this is good, it is obviously far less than GLD, suggesting that

wider bid/ask spreads may be possible in this product (although it

is unlikely). Additionally, investors should note that the product

trades in increments of 1/100th of an ounce, giving it a

far lower price per share than either of the other two products on

the list which employ a 1/10th of an ounce of gold

methodology instead. In terms of performance, IAU has slightly

edged out GLD gaining 20.1% in year-to-date terms but it has led on

the downside as well, falling by 4.3% over the past three months

(also see Top 3 Best Performing Precious Metals ETFs).

ETFS Physical Swiss Gold Shares

(SGOL)

SGOL is an interesting product in the gold space as it can’t

compete with either fund on volume—trading less than 200,000 shares

a day—nor can it really compete on price as expenses are 0.39% a

year. Still, the product has developed a cult following

thanks to its unique storage system, allowing the fund to rack up

close to $1.8 billion in assets. While the other gold ETFs hold

securities in London, and North America, SGOL holds all of its gold

in the nation of Switzerland. Specifically, all of the bullion is

held in secure vaults in Zurich, a major city in the small

landlocked country in Europe. This appears to have tempted

investors who are worried about a gold confiscation program hitting

the U.S. again, or those that are just looking to spread their

assets around to one of the world’s premier banking destinations

(see The Best Commodity ETF For 2011 And 2012).

For performance, SGOL has finished in the middle of the pack in

year-to-date terms, gaining a tad over 20%. However, in terms of

the last three months, SGOL has actually beaten out its

counterparts by a few basis points, as the product has lost about

4.25% in the time period, thanks in part to SGOL trading at a

slight premium to NAV. Nevertheless, this desire to move assets to

Switzerland-based vaults appears to have, at least in the short

term, allowed SGOL to beat out its counterparts in the gold ETF

space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Author is long IAU and gold bullion.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

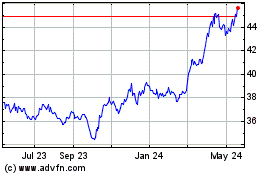

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jul 2023 to Jul 2024