Mutual Fund Summary Prospectus (497k)

November 01 2012 - 4:09PM

Edgar (US Regulatory)

INVESTMENT OBJECTIVE

The Fund seeks to earn the highest level of interest income, exempt from federal income taxes, as is consistent with prudent investment management, preservation of capital, and the quality and maturity characteristics of the Fund. This objective may be changed by the Fund’s Board of Trustees without shareholder approval.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Calvert non-money market mutual funds. More information about these and other discounts is available from your financial professional and under “Reduced Sales Charges” on page 12 of the Fund’s Prospectus, and under “Method of Distribution” on page 22 of the Fund’s SAI.

|

Shareholder Fees (fees paid directly from your investment)

|

|

|

Maximum sales charge (load) on purchases (as a % of

|

3.75%

|

|

offering price)

|

|

|

Maximum deferred sales charge (load) (as a % of

|

None

|

|

amount purchased or redeemed, whichever is lower)

|

|

|

Redemption fee (as a % of amount redeemed or

|

2.00%

|

|

exchanged within 30 days of purchase)

|

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a %

|

|

of the value of your investment)

|

|

|

Management fees

|

0.64%

|

|

Distribution and service (12b-1) fees

|

0.09%

|

|

Other expenses

|

0.18%

|

|

Total annual fund operating expenses

|

0.91%

|

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that:

• you invest $10,000 in the Fund for the time periods indicated and then either sell or hold your shares at the end of those periods;

• your investment has a 5% return each year; and

• the Fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, under these assumptions your costs would be:

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$464

|

$654

|

$860

|

$1,453

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (“turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the “Example”, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 10% of its portfolio’s average value.

INVESTMENTS, RISKS AND PERFORMANCE

Principal Investment Strategies

Under normal market conditions, at least 80% of the income from the Fund will be exempt from federal income tax.

The Fund typically invests at least 65% of its net assets in investment grade, U.S. dollar-denominated debt securities, as assessed at the time of purchase. A debt security is investment grade when assigned a credit quality rating of BBB or higher by Standard & Poor’s Ratings Services or an equivalent rating by another nationally recognized statistical rating organization (‘‘NRSRO”), including Moody’s Investors Service or Fitch Ratings, or if unrated, considered to be of comparable credit quality by the Fund’s Advisor. The Advisor looks for securities with strong credit quality that are attractively priced in various maturity ranges. To the extent it may do so consistent with its investment objective, the Fund follows a strategy to also seek to provide a competitive rate of total return. The Fund may invest in securities without limitation as to their maturity or duration, and there is no upper or lower limit on the Fund’s average maturity or average duration. At the sole discretion of the Fund’s portfolio manager, the Fund may seek out attractive investment opportunities across the yield curve based upon the evaluation of then-prevailing and anticipated economic, financial and business conditions.

The Fund is non-diversified, which means it may invest more of its assets in a smaller number of issuers than a diversified fund.

SUMMARY PROSPECTUS APRIL 30, 2012

1

The Fund may invest in a variety of tax-exempt obligations, including tax-supported debt (general obligation bonds of state and local issuers), various types of revenue debt (transportation, housing, utilities, hospital), special tax obligations, qualified private activity bonds, municipal leases, and certificates of participation in such investments.

Tobacco Exclusion.

The Fund seeks to avoid investing in companies classified under the tobacco industry sector of the Barclays Global Aggregate Index, the Barclays U.S. High Yield Index or the Barclays Global Emerging Market Index; or, in the opinion of the Fund’s Advisor, any similar securities in the Barclays Municipal Index.

Principal Risks

You could lose money on your investment in the Fund, or the Fund could underperform, because of the risks described below. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Non-Diversification Risk.

Because the Fund may invest more of its assets in a smaller number of issuers than a diversified fund, the gains or losses on a single bond may have greater impact on the Fund than on a diversified fund.

Bond Market Risk.

The market prices of bonds held by the Fund may fall.

Management Risk.

The individual investments of the Fund may not perform as expected, due to credit, political or other risks and/ or the Fund’s portfolio management practices may not achieve the desired result.

Credit Risk.

The credit quality of fixed-income securities may deteriorate, which could lead to default or bankruptcy of the issuer where the issuer becomes unable to pay its obligations when due. Unanticipated credit events could adversely impact net asset value (“NAV”).

Unrated Security Risk.

Unrated securities may be less liquid than rated securities determined to be of comparable quality. When the Fund purchases unrated securities, it will depend on the Advisor's analysis of credit risk without the assessment of an NRSRO. The credit risk of an unrated security will vary depending on its equivalent credit quality and whether it is supported by a credit enhancement.

Interest Rate Risk.

A change in interest rates may adversely affect the value of fixed-income securities. When interest rates rise, the value of fixed-income securities will generally fall. Longer-term securities are subject to greater interest rate risk.

Junk Bond Risk.

Investments in junk bonds can involve a substantial risk of loss. Junk bonds are considered to be speculative with respect to the issuer’s ability to pay interest and principal. These securities, which are rated below investment grade, have a higher risk of issuer default, are subject to greater price volatility and may be illiquid.

Municipal Bond Risk.

In addition to interest rate risk and credit risk, different types of municipal bonds may be affected differently, based on many factors, including economic and regulatory developments, changes or proposed changes in the federal and state tax structure, deregulation, and court rulings.

Performance

The following bar chart and table show the Fund’s annual returns and its long-term performance, which give some indication of the risks of investing in the Fund. The bar chart shows how the performance of the Fund has varied from year to year. The table compares the Fund’s performance over time with that of an index and an average.

The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. For updated performance information, visit www.calvert.com.

The bar chart does not reflect any sales charge that you may be required to pay upon purchase or redemption of the Fund’s shares. Any sales charge will reduce your return.

Calendar Year Total Returns (at NAV)

|

|

Quarter

|

Total

|

|

|

Ended

|

Return

|

|

|

|

Best Quarter (of periods shown)

|

9/30/02

|

6.27%

|

|

Worst Quarter (of periods shown)

|

12/31/10

|

-4.52%

|

The average total return table shows the Fund’s returns with the maximum sales charge deducted, and no sales charge has been applied to the indices used for comparison in the table.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. The after-tax returns shown are not relevant to you if you hold your Fund shares through a tax-deferred arrangement such as a 401(k) plan or individual retirement account. The return after taxes on distributions and sale of Fund shares may be higher than the return before taxes because the calculation assumes that shareholders receive a tax benefit for capital losses incurred on the sale of their shares.

SUMMARY PROSPECTUS APRIL 30, 2012

2

|

|

|

|

|

|

Average Annual Total Returns

|

|

|

|

|

(as of 12/31/11) (with maximum

|

|

|

|

|

sales charge deducted)

|

1 year

|

5 years

|

10 years

|

|

Return before taxes

|

4.46%

|

1.96%

|

3.57%

|

|

|

|

Return after taxes on distributions

|

3.27%

|

0.70%

|

2.13%

|

|

|

|

Return after taxes on distributions

|

2.89%

|

0.92%

|

2.21%

|

|

and sale of Fund shares

|

|

|

|

|

|

|

Barclays Capital Municipal

|

10.70%

|

5.22%

|

5.38%

|

|

Bond Index

|

|

|

|

|

(reflects no deduction for fees,

|

|

|

|

|

expenses or taxes)

|

|

|

|

|

|

|

Lipper General Municipal Debt

|

10.56%

|

3.71%

|

4.36%

|

|

Funds Average

|

|

|

|

|

(reflects no deduction for taxes)

|

|

|

|

PORTFOLIO MANAGEMENT

Investment Advisor.

Calvert Investment Management, Inc. (“Calvert” or the “Advisor”)

|

|

|

|

|

Portfolio

|

Title

|

Length of Time

|

|

Manager Name

|

|

Managing Fund

|

|

Thomas A. Dailey

|

Vice President, Portfolio

|

Since January 2004

|

|

|

Manager

|

|

BUYING AND SELLING SHARES

You can buy, sell (redeem) or exchange shares of the Fund, either through a financial professional or directly from the Fund, on any day that the New York Stock Exchange is open. The share price is based on the Fund’s net asset value determined after receipt of your request in good order.

|

Minimum to Open Fund Account

|

Minimum Additional Investments

|

|

$2,000

|

$250

|

The Fund may waive investment minimums and applicable service fees for certain investors.

To buy shares, contact your financial professional or open an account by completing and signing an application (available at www.calvert.com or by calling 800-368-2748). Make your check payable to the Fund.

|

|

|

|

To Buy Shares

|

|

|

New Accounts (include application):

|

Calvert, P.O. Box 219544, Kansas

|

|

|

City, MO 64121-9544

|

|

|

|

Subsequent Investments (include

|

Calvert, P.O. Box 219739, Kansas

|

|

investment slip):

|

City, MO 64121-9739

|

|

|

|

By Registered, Certified or Overnight

|

Calvert, c/o BFDS, 330 West 9th

|

|

Mail:

|

Street, Kansas City, MO 64105-1514

|

|

|

|

|

To Sell Shares

|

|

|

|

|

|

By Telephone

|

Call 800-368-2745

|

|

|

|

|

By Mail

|

Calvert, P.O. Box 219544, Kansas City,

MO 64121-9544

|

TAX INFORMATION

Dividends derived from interest on municipal obligations constitute exempt interest dividends, on which you are not subject to federal income tax. However, dividends which are from taxable interest and any distributions of short term capital gain are taxable to you as ordinary income. If the Fund makes any distributions of long-term capital gains, then these are taxable to you as long-term capital gains, regardless of how long you held your shares of the Fund. Dividends attributable to interest on certain private activity bonds must be included in federal alternative minimum tax for individuals and for corporations. The Fund may derive up to 20% of its income from taxable investments, for liquidity purposes or pending investment. Interest earned from taxable investments will be taxable as ordinary income. See “Dividends, Capital Gains and Taxes” in the Prospectus for additional information.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares of the Fund through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

Investment Company Act file:

No. 811-03101 (Calvert Tax-Free Reserves)

SUMMARY PROSPECTUS APRIL 30, 2012

3

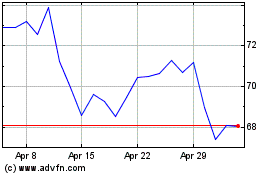

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024