UPDATE: ConocoPhillips Gives Glimpse Of Last Quarter Before Split

April 05 2012 - 11:28AM

Dow Jones News

HOUSTON (DOW JONES)--ConocoPhillips (COP) said Thursday its

preliminary first-quarter average production was about 1.62 million

barrels of oil equivalent a day, in line with expectations, and

that its refining operations could be affected by weaker profit

margins.

The information was part of an interim operational update the

company released ahead of the split of its refining business, to be

called Phillips 66, expected by the end of the month.

ConocoPhillips said it expects its refining operations to see

mostly improved crack spreads, though the segments results are

expected to be negatively affected by weaker spreads between

crudes, among other things.

At its chemicals and midstream business, the company projects

improved results, mostly on higher ethylene margins, which it said

were among the highest in the past 20 years. Higher natural-gas

liquids are expected to boost its midstream results.

ConocoPhillips said it expects to post an after tax write-down

of about $525 million related to a pipeline and gathering-system

project with three other energy companies in northern Canada as its

co-ventures decided to suspend funding amid deteriorating market

conditions.

The cancellation of the project, in which Exxon Mobil Corp.

(XOM), Royal Dutch Shell PLC (RDSA) and Imperial Oil are also

partners, was not a surprise because the vast new resources of

shale gas in the U.S. have made other sources of gas unattractive

and too expensive, said Mornigstar analyst Allan Good.

Conoco also said it spent $1.9 billion in share repurchases in

the first quarter.

The company also anticipates an after-tax gain of about $940

million related to the recent sale of its Vietnam business, part of

a broader asset-sale plan that aimed to raise $10 billion last

year. The company said other asset sales in the North Sea and North

America are set to close in the current quarter and third

quarter.

Conoco expects to make a final decision on the second train of

its Australia Pacific LNG Project in the current quarter, and

expects to post a second-quarter after-tax loss of about $135

million related to the resulting dilution of interest.

Conoco expects to release first-quarter financial results on

April 23.

-By Tess Stynes and Isabel Ordonez,Dow Jones Newswires;

212-416-2481;Tess.Stynes@dowjones.com

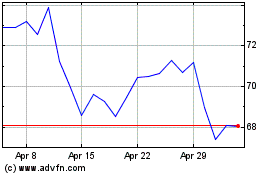

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024