Shell Seeks To Sell Stake In C$16 Billion MacKenzie Gas Pipeline Project

July 15 2011 - 5:37PM

Dow Jones News

Royal Dutch Shell PLC (RDSA, RDSB, RDSA.LN, RDSB.LN) said Friday

it plans to sell its stake in a C$16.2-billion Northwest

Territories natural-gas pipeline project, as well as its other

assets in a vast natural-gas basin in the territory.

The fate of the MacKenzie Gas Project, which would bring natural

gas from fields bordering the Arctic Ocean to markets in North

America, has long been in doubt. Regulators approved the project

last year, but other partners including ConocoPhillips (COP) and

Imperial Oil Ltd. (IMO, IMO.T), controlled by Exxon Mobil Corp.

(XOM), haven't committed to build it.

A Shell spokesman wouldn't provide details on the company's

decision to sell its assets in MacKenzie, other than that it was

part of Shell's normal review of its holdings. "Shell still

believes the project is important for Canada," the spokesman

said.

Work on the MacKenzie gas pipeline was suspended in 2007 after a

regulatory process dragged on. It was finally approved by

regulators late last year, after a six-year review process.

But during that review, the economic rationale for bringing

natural gas from the far north eroded, as a surge in new shale gas

supplies were being unlocked in the U.S. and other parts of Canada

by new drilling technology.

In addition to its stake in the pipeline project, which would

include a gathering system and processing facility, Shell's

Niglintgak natural-gas field in the area will also be put up for

sale.

The Shell spokesman said the company has prepared a package of

data on its assets in the MacKenzie Delta and has made it available

to potential buyers.

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

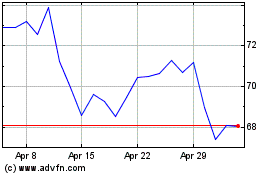

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024