UPDATE: Canadian Oil Sands Cuts Dividend 60%, Sees High Costs

December 03 2010 - 11:53AM

Dow Jones News

Canadian Oil Sands Trust (COSWF, COS.UN.T), the operator of

Canada's largest oil sands project, cut its dividend sharply Friday

on expectations of higher equipment-replacement costs.

The Calgary operator of the Syncrude oil sands mine said it will

cut its quarterly dividend next year to 20 Canadian cents a share

from 50 Canadian cents, as it saves capital to replace or relocate

four out of five of its mining trains over the next four years.

Canadian Oil Sands Trust shares dropped 8.6% to C$25.96 in

recent trading on the Toronto Stock Exchange.

"The distribution cut was much larger than expected, a 60% cut,

and the reason it's so large is that capital expenditures are so

much larger than people expected," UBS analyst Chad Friess said. He

cut his rating on the stock to sell from neutral.

A dividend cut was expected ahead of the company's conversion to

a corporation from an income trust at year-end. Income trusts get

tax breaks for paying out most of their cash flows to investors in

the form of dividends. Due to a change in Canadian law, some of the

tax benefits of income trusts expire next year.

"We recognize the importance of dividends to our shareholders,"

Chief Executive Marcel Coutu said in a release, but added that

"long-term value will continue to come primarily from investing in

our business."

Production for the Syncrude Project next year is expected to

increase by 5% over the expected 2010 rate, to 110 million barrels

(301,400 barrels a day). Net to Canadian Oil Sands, which owns a

37% stake in the project, expected production will total 40.4

million barrels, or 110,700 barrels a day.

Capital expenditures are seen totaling C$927 million next year,

roughly a third for maintenance, a third for large environmental

projects on emissions and tailings ponds, and a third to replace

its mining trains.

The mining-train replacement is the source of the largest

uncertainty for Canadian Oil Sands, Friess said, since it will cost

C$332 million next year, but the total cost through 2014 hasn't

been calculated.

"All of these mine-train moves are necessary to vacate depleted

pits to allow tailings placement and to shorten the haul distance

for our mining trucks," the company said in a release. Once

complete, the mining trains should be in operation for 10 to 20

years, it said.

The company estimated cash from operating activities of about

C$1.3 billion, or C$2.59 a share, in 2011.

Canadian Oil Sands is the largest owner of the Syncrude Project.

Other owners include China Petroleum & Chemical

Corp.(600028.SH), Imperial Oil Ltd. (IMO, IMO.T), Suncor Energy

Inc. (SU, SU.T), Nexen Inc. (NXY, NXY.T), Mocal Energy Ltd. and

Murphy Oil Corp. (MUR).

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

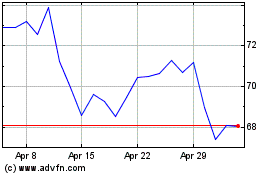

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024