Current Report Filing (8-k)

June 05 2020 - 5:10PM

Edgar (US Regulatory)

0001273441

false

0001273441

2020-05-31

2020-06-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest

event reported): June 1,

2020

GRAN TIERRA ENERGY INC.

(Exact Name of Registrant as Specified in

its Charter)

|

Delaware

|

|

001-34018

|

|

98-0479924

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

Suite 900, 520-3 Avenue SW

Calgary, Alberta, Canada

T2P 0R3

(Address of Principal Executive Offices)

(Zip Code)

(403) 265-3221

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name

of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

GTE

|

NYSE American

Toronto Stock Exchange

London Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On June 1, 2020, Gran Tierra Energy Inc. (the “Company”),

Gran Tierra Energy International Holdings Ltd., as borrower, The Bank of Nova Scotia, as administrative agent, and the lenders

party thereto entered into the Fourteenth Amendment to the Credit Agreement (the “Fourteenth Amendment”). The Fourteenth

Amendment amends the Credit Agreement, dated as of September 18, 2015, by and among the Company, Gran Tierra Energy International

Holdings Ltd., The Bank of Nova Scotia and the lenders party thereto (as amended, the “Credit Agreement”). The Fourteenth

Amendment is effective as of June 1, 2020 and, among other things, (i) reduces the Borrowing Base (as defined in the Credit Agreement)

to $225,000,000, (ii) provides for certain relief under the financial covenants until October 1, 2021 (the “Covenant Relief

Period”), including relief from compliance with the ratio of Total Debt to EBITDAX (each as defined in the Credit Agreement)

during the Covenant Relief Period, (iii) amends the interest rate to either, at the borrower’s option, LIBOR plus a spread

ranging from 2.90% to 4.90%, or base rate plus a spread ranging from 1.90% to 3.90%, with such spread in each case dependent upon

the Company’s Senior Secured Leverage Ratio (as defined in the Credit Agreement), provided that during the Covenant Relief

Period the spread shall be increased by 125 basis points, (iv) provides for a borrowing condition that the Company does not have

cash and cash equivalents (other than Excluded Cash, as defined in the Credit Agreement) in excess of $15,000,000, (v) adds certain

mandatory prepayments, including for cash balances in excess of $15,000,000 and (v) amends and adds certain negative covenants,

including, without limitation, certain additional limitations on incurrence of indebtedness, liens and investments, the making

of restricted payments, prepayments of indebtedness, and acquisitions and mergers.

From time to time, the agents, arrangers, book runners and lenders

under the Credit Agreement and their affiliates have provided, and may provide in the future, investment banking, commercial lending,

hedging and financial advisory services to the Company and its affiliates in the ordinary course of business, for which they have

received, or may in the future receive, customary fees and commissions for these transactions.

The foregoing description of the Fourteenth Amendment is not

complete and is qualified by reference to the full text of the Fourteenth Amendment, which will be filed with the Company’s

Quarterly Report on Form 10-Q for the three months ending June 30, 2020.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information provided under Item 1.01 in this Current Report

on Form 8-K is incorporated by reference into this Item 2.03.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Dated: June 5, 2020

|

GRAN TIERRA ENERGY INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Ryan Ellson

|

|

|

|

|

By: Ryan Ellson

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

|

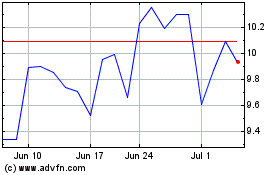

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

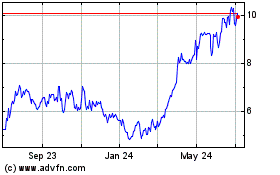

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Apr 2023 to Apr 2024