Filed Pursuant to Rule 424(b)(3)

Registration No. 333-274440

PROSPECTUS SUPPLEMENT

(To Prospectus Dated September 18, 2023)

GLOBALSTAR, INC.

37,457,207 Shares of Common Stock

This prospectus supplement amends and supplements the prospectus dated September 18, 2023, as supplemented or amended from time to time (the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (No. 333-274440). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Quarterly Report on Form 10-Q, which was filed with the Securities and Exchange Commission on November 2, 2023 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the sale of certain selling stockholders identified in the Prospectus of 37,457,207 shares of common stock, par value $0.0001, of Globalstar, Inc. (the “Common Stock”).

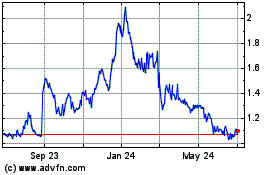

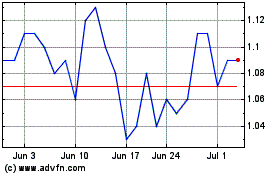

You should read the Prospectus, this prospectus supplement and any further prospectus supplement or amendment carefully before you invest in our securities. Our Common Stock are listed on NYSE American (“NYSE”) under the symbol “GSAT”. The last reported sale price on NYSE of our common stock on November 1, 2023 was $1.40 per share.

Investing in our Common Stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider the risks that we have described in “Risk Factors” beginning on page 12 of the Prospectus and in the documents incorporated by reference into the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 2, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33117

GLOBALSTAR, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | | 41-2116508 |

| (State or Other Jurisdiction of | | (I.R.S. Employer Identification No.) |

| Incorporation or Organization) | | |

1351 Holiday Square Blvd.

Covington, Louisiana 70433

(Address of Principal Executive Offices)

Registrant's Telephone Number, Including Area Code: (985) 335-1500

| | | | | | | | | | | | | | |

| Securities registered pursuant to section 12(b) of the Act: | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.0001 per share | | GSAT | | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| (Do not check if a smaller reporting company) | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of October 27, 2023, 1.9 billion shares of voting common stock were outstanding, 0.1 million shares of preferred stock were outstanding, and no shares of nonvoting common stock were authorized or outstanding. Unless the context otherwise requires, references to common stock in this Report mean the Registrant’s voting common stock.

FORM 10-Q

GLOBALSTAR, INC.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| |

| | | |

| Item 1. | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| |

| | | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | | |

| |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

GLOBALSTAR, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| September 30,

2023 | | September 30,

2022 | | September 30,

2023 | | September 30,

2022 |

| Revenue: | | | | | | | |

| Service revenue | $ | 53,643 | | | $ | 33,301 | | | $ | 155,245 | | | $ | 95,693 | |

| Subscriber equipment sales | 4,040 | | | 4,325 | | | 16,154 | | | 11,505 | |

| Total revenue | 57,683 | | | 37,626 | | | 171,399 | | | 107,198 | |

| Operating expenses: | | | | | | | |

| Cost of services (exclusive of depreciation, amortization, and accretion shown separately below) | 13,872 | | | 11,294 | | | 37,938 | | | 32,783 | |

| Cost of subscriber equipment sales | 3,458 | | | 3,490 | | | 13,429 | | | 9,153 | |

| Cost of subscriber equipment sales - reduction in the value of inventory | — | | | 8,537 | | | — | | | 8,553 | |

| Marketing, general and administrative | 12,090 | | | 8,607 | | | 31,843 | | | 25,166 | |

Stock-based compensation | 4,346 | | | 2,100 | | | 10,638 | | | 4,575 | |

| Reduction in the value of long-lived assets | 35 | | | 166,001 | | | 35 | | | 166,526 | |

| Depreciation, amortization and accretion | 21,865 | | | 24,238 | | | 65,688 | | | 72,151 | |

| Total operating expenses | 55,666 | | | 224,267 | | | 159,571 | | | 318,907 | |

| Income (loss) from operations | 2,017 | | | (186,641) | | | 11,828 | | | (211,709) | |

| Other (expense) income: | | | | | | | |

| Loss on extinguishment of debt | — | | | — | | | (10,403) | | | — | |

| Interest income and expense, net of amounts capitalized | (3,945) | | | (7,583) | | | (11,047) | | | (24,300) | |

| Foreign currency loss | (4,151) | | | (9,406) | | | (206) | | | (13,297) | |

| Derivative gain (loss) and other | 25 | | | (884) | | | 373 | | | (2,223) | |

| Total other expense | (8,071) | | | (17,873) | | | (21,283) | | | (39,820) | |

| Loss before income taxes | (6,054) | | | (204,514) | | | (9,455) | | | (251,529) | |

| Income tax expense (benefit) | 115 | | | (153) | | | 185 | | | 51 | |

| Net loss | $ | (6,169) | | | $ | (204,361) | | | $ | (9,640) | | | $ | (251,580) | |

| | | | | | | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation adjustments | 2,503 | | | 6,613 | | | (233) | | | 11,249 | |

Defined benefit pension plan liability adjustment | $ | — | | | $ | 2,073 | | | $ | — | | | $ | 2,073 | |

| Comprehensive loss | $ | (3,666) | | | $ | (195,675) | | | $ | (9,873) | | | $ | (238,258) | |

| | | | | | | |

Net loss attributable to common shareholders (Note 11) | (8,842) | | | (204,361) | | | (17,572) | | | (251,580) | |

| | | | | | | |

| Net loss per common share: | | | | | | | |

| Basic | $ | 0.00 | | | $ | (0.11) | | | $ | (0.01) | | | $ | (0.14) | |

| Diluted | 0.00 | | | (0.11) | | | (0.01) | | | (0.14) | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 1,836,251 | | | 1,800,504 | | | 1,820,582 | | | 1,799,364 | |

| Diluted | 1,836,251 | | | 1,800,504 | | | 1,820,582 | | | 1,799,364 | |

See accompanying notes to unaudited interim condensed consolidated financial statements.

GLOBALSTAR, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except par value and share data)

(Unaudited)

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 64,136 | | | $ | 32,082 | |

Accounts receivable, net of allowance for credit losses of $2,086 and $2,892, respectively | 43,218 | | | 26,329 | |

| Inventory | 12,197 | | | 9,264 | |

| Prepaid expenses and other current assets | 24,087 | | | 13,569 | |

| Total current assets | 143,638 | | | 81,244 | |

| Property and equipment, net | 612,911 | | | 560,371 | |

| Operating lease right of use assets, net | 34,273 | | | 30,859 | |

| Prepaid satellite costs and customer receivable | 13,600 | | | 27,570 | |

Intangible and other assets, net of accumulated amortization of $12,060 and $10,908, respectively | 106,190 | | | 38,425 | |

| Total assets | $ | 910,612 | | | $ | 738,469 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 32,200 | | | $ | — | |

| Accounts payable | 3,631 | | | 3,843 | |

| Vendor financing | — | | | 59,575 | |

| Accrued expenses | 24,837 | | | 22,554 | |

| Accrued satellite construction costs | 65,744 | | | 36,139 | |

| Payables to affiliates | 153 | | | 326 | |

| Deferred revenue, net | 58,091 | | | 74,639 | |

| Total current liabilities | 184,656 | | | 197,076 | |

| Long-term debt | 307,130 | | | 132,115 | |

| Operating lease liabilities | 29,524 | | | 27,635 | |

| Deferred revenue, net | 2,020 | | | 62,877 | |

| Other non-current liabilities | 3,916 | | | 3,995 | |

| Total non-current liabilities | 342,590 | | | 226,622 | |

| | | |

| Commitments and contingencies (Note 9) | | | |

| | | |

| Stockholders’ equity: | | | |

Preferred Stock of $0.0001 par value; 99,700,000 shares authorized and none issued and outstanding at September 30, 2023 and December 31, 2022, respectively | — | | | — | |

Series A Preferred Convertible Stock of $0.0001 par value; 300,000 shares authorized and 149,425 issued and outstanding at September 30, 2023 and December 31, 2022, respectively | — | | | — | |

Voting Common Stock of $0.0001 par value; 2,150,000,000 shares authorized; 1,876,120,002 and 1,811,074,696 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 188 | | | 181 | |

| Additional paid-in capital | 2,424,073 | | | 2,345,612 | |

| Accumulated other comprehensive income | 9,009 | | | 9,242 | |

| Retained deficit | (2,049,904) | | | (2,040,264) | |

| Total stockholders’ equity | 383,366 | | | 314,771 | |

| Total liabilities and stockholders’ equity | $ | 910,612 | | | $ | 738,469 | |

See accompanying notes to unaudited interim condensed consolidated financial statements.

GLOBALSTAR, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(In thousands)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | Common Stock | Additional

Paid-In

Capital | Accumulated Other Comprehensive Income (Loss) | Retained

Deficit | Total |

| | Shares | Amount | Shares | Amount |

| Balances – January 1, 2023 | 149 | | $ | — | | 1,811,075 | | $ | 181 | | $ | 2,345,612 | | $ | 9,242 | | $ | (2,040,264) | | $ | 314,771 | |

| Net issuance of restricted stock awards and employee stock options and recognition of stock-based compensation | — | | — | | 2,037 | | — | | 3,795 | | — | | — | | 3,795 | |

| Contribution of services | — | | — | | — | | — | | 47 | | — | | — | | 47 | |

| Issuance and recognition of stock-based compensation of employee stock purchase plan | — | | — | | — | | — | | 102 | | — | | — | | 102 | |

| Series A Preferred Stock Dividends | — | | — | | — | | — | | (3,952) | | — | | — | | (3,952) | |

| Other comprehensive loss | — | | — | | — | | — | | — | | (1,429) | | — | | (1,429) | |

| Net loss | — | | — | | — | | — | | — | | — | | (3,480) | | (3,480) | |

| Balances – March 31, 2023 | 149 | | $ | — | | 1,813,112 | | $ | 181 | | $ | 2,345,604 | | $ | 7,813 | | $ | (2,043,744) | | $ | 309,854 | |

| Net issuance of restricted stock awards and stock for employee stock options and recognition of stock-based compensation | — | | — | | 363 | | — | | 1,874 | | — | | — | | 1,874 | |

| Contribution of services | — | | — | | — | | — | | 47 | | — | | — | | 47 | |

| Net issuance of stock through employee stock purchase plan and recognition of stock-based compensation | — | | — | | 497 | | — | | 636 | | — | | — | | 636 | |

| Series A Preferred Stock Dividends | — | | — | | — | | — | | (2,644) | | — | | — | | (2,644) | |

| Fair value of Thermo guarantee associated with the 2023 Funding Agreement | — | | — | | — | | — | | 6,897 | | — | | — | | 6,897 | |

| Other comprehensive loss | — | | — | | — | | — | | — | | (1,307) | | — | | (1,307) | |

| Net income | — | | — | | — | | — | | — | | — | | 9 | | 9 | |

| Balances – June 30, 2023 | 149 | | $ | — | | 1,813,972 | | $ | 181 | | $ | 2,352,414 | | $ | 6,506 | | $ | (2,043,735) | | $ | 315,366 | |

| Net issuance of restricted stock awards and stock for employee stock options and recognition of stock-based compensation | — | | — | | 2,171 | | 1 | | 3,870 | | — | | — | | 3,871 | |

| Contribution of services | — | | — | | — | | — | | 47 | | — | | — | | 47 | |

| Series A Preferred Stock Dividends | — | | — | | — | | — | | (2,673) | | — | | — | | (2,673) | |

| Issuance of stock in connection with License Agreement with XCOM | — | | — | | 59,977 | | 6 | | 70,415 | | — | | — | | 70,421 | |

| Other comprehensive income | — | | — | | — | | — | | — | | 2,503 | | — | | 2,503 | |

| Net loss | — | | — | | — | | — | | — | | — | | (6,169) | | (6,169) | |

| Balances – September 30, 2023 | 149 | | — | | 1,876,120 | | $ | 188 | | $ | 2,424,073 | | $ | 9,009 | | $ | (2,049,904) | | $ | 383,366 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | Common Stock | Additional

Paid-In

Capital | Accumulated Other Comprehensive Income (Loss) | Retained

Deficit | Total |

| Shares | Amount | Shares | Amount |

| Balances – January 1, 2022 | — | | $ | — | | 1,796,529 | | $ | 180 | | $ | 2,146,710 | | $ | 1,890 | | $ | (1,783,349) | | $ | 365,431 | |

| Net issuance of restricted stock awards and stock for employee stock options and recognition of stock-based compensation | — | | — | | 703 | | — | | 2,230 | | — | | — | | 2,230 | |

| Contribution of services | — | | — | | — | | — | | 47 | | | | 47 | |

| Recognition of stock-based compensation of employee stock purchase plan | — | | — | | — | | — | | 117 | | — | | — | | 117 | |

Common stock issued in connection with conversion of 2013 8.00% Notes | — | | — | | 2,253 | | — | | 2,548 | | — | | — | | 2,548 | |

| Other comprehensive loss | — | | — | | — | | — | | — | | (679) | | — | | (679) | |

| Net loss | — | | — | | — | | — | | — | | — | | (20,462) | | (20,462) | |

| Balances – March 31, 2022 | — | | $ | — | | 1,799,485 | | $ | 180 | | $ | 2,151,652 | | $ | 1,211 | | $ | (1,803,811) | | $ | 349,232 | |

| Net issuance of restricted stock awards and stock for employee stock options and recognition of stock-based compensation | — | | — | | 546 | | — | | 879 | | — | | — | | 879 | |

| Contribution of services | — | | — | | — | | — | | 47 | | — | | — | | 47 | |

| Net issuance of stock through employee stock purchase plan and recognition of stock-based compensation | — | | — | | 446 | | — | | 617 | | — | | — | | 617 | |

| Other comprehensive income | — | | — | | — | | — | | — | | 5,315 | | — | | 5,315 | |

| Net loss | — | | — | | — | | — | | — | | — | | (26,757) | | (26,757) | |

| Balances – June 30, 2022 | — | | $ | — | | 1,800,477 | | $ | 180 | | $ | 2,153,195 | | $ | 6,526 | | $ | (1,830,568) | | $ | 329,333 | |

| Net issuance of restricted stock awards and stock for employee stock options and recognition of stock-based compensation | — | | — | | 46 | | — | | 1,815 | | — | | — | | 1,815 | |

| Contribution of services | — | | — | | — | | — | | 47 | | — | | — | | 47 | |

| Recognition of stock-based compensation of employee stock purchase plan | — | | — | | — | | — | | 60 | | — | | — | | 60 | |

| Other comprehensive income | — | | — | | | | | 8,686 | | | 8,686 | |

| Net loss | — | | — | | — | | — | | — | | — | | (204,361) | | (204,361) | |

| Balances – September 30, 2022 | — | | — | | 1,800,523 | | $ | 180 | | $ | 2,155,117 | | $ | 15,212 | | $ | (2,034,929) | | $ | 135,580 | |

See accompanying notes to unaudited interim condensed consolidated financial statements.

GLOBALSTAR, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Nine Months Ended |

| | September 30,

2023 | | September 30,

2022 |

| Cash flows provided by operating activities: | | | |

| Net loss | $ | (9,640) | | | $ | (251,580) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation, amortization and accretion | 65,688 | | | 72,151 | |

| Stock-based compensation expense | 10,638 | | | 4,433 | |

| Noncash consideration, net, associated with wholesale capacity contract | (2,216) | | | — | |

| Reduction in value of long-lived assets and inventory | 35 | | | 175,079 | |

| Noncash interest and accretion expense | 12,304 | | | 23,788 | |

| Unrealized foreign currency loss | 131 | | | 13,399 | |

| Write off of debt discount and deferred financing costs upon extinguishment of debt | 10,194 | | | — | |

| | | |

| Noncash expenses associated with SSA, net of amortization | 892 | | | — | |

| Other, net | (477) | | | 738 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 2,082 | | | (952) | |

| Inventory | (2,029) | | | (1,295) | |

| Prepaid expenses and other current assets | (145) | | | 1,788 | |

| Other assets | (515) | | | 352 | |

| Accounts payable and accrued expenses | (5,435) | | | (10,272) | |

| Payables to affiliates | (173) | | | (303) | |

| Other non-current liabilities | 45 | | | (2,602) | |

| Deferred revenue | (12,823) | | | 6,981 | |

| Net cash provided by operating activities | 68,556 | | | 31,705 | |

| Cash flows used in investing activities: | | | |

| Payments under the satellite procurement agreement | (110,215) | | | — | |

| Other network upgrades to support the Service Agreements | (18,085) | | | (18,604) | |

| Payments of capitalized interest | (8,810) | | | — | |

| Network upgrades to support product development | (4,960) | | | (5,839) | |

| | | |

| Purchase of intangible assets | (315) | | | (863) | |

| Net cash used in investing activities | (142,385) | | | (25,306) | |

| Cash flows provided by (used in) financing activities: | | | |

| Principal and interest payments of the 2019 Facility Agreement | (148,281) | | | (6,341) | |

Proceeds from 2023 13% Notes | 190,000 | | | — | |

| Proceeds from 2023 Funding Agreement | 87,730 | | | — | |

| Principal payment of 2021 Funding Agreement | (6,250) | | | — | |

| Dividends paid on Series A Preferred Stock | (9,269) | | | — | |

| Payments for debt issuance costs | (8,556) | | | — | |

| Proceeds from issuance of common stock and exercise of options | 528 | | | 455 | |

| Net cash provided by (used in) financing activities | 105,902 | | | (5,886) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (19) | | | (68) | |

| Net increase in cash, cash equivalents and restricted cash | 32,054 | | | 445 | |

| Cash, cash equivalents and restricted cash, beginning of period | 32,082 | | | 14,304 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 64,136 | | | $ | 14,749 | |

| | | | | | | | | | | |

| As of: |

| September 30,

2023 | | December 31,

2022 |

| Reconciliation of cash and cash equivalents | | | |

| Cash and cash equivalents | $ | 64,136 | | | $ | 32,082 | |

| Total cash and cash equivalents cash shown in the statement of cash flows | $ | 64,136 | | | $ | 32,082 | |

| | | |

| | Nine Months Ended |

| | September 30,

2023 | | September 30,

2022 |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 13,512 | | | $ | — | |

| | | |

| Supplemental disclosure of non-cash financing and investing activities: | | | |

| Increase in capitalized accrued interest for network upgrades | $ | 3,547 | | | $ | 8,615 | |

| Capitalized accretion of debt discount and amortization of prepaid financing costs | 3,620 | | | 1,305 | |

| Satellite construction assets acquired through vendor financing arrangement | — | | | 69,896 | |

| Re-characterization of 2021 Funding Agreement to debt | 87,950 | | | — | |

| Fair value of common stock issued for License Agreement | 58,534 | | | — | |

| Fair value of common stock issued for SSA | 11,887 | | | — | |

See accompanying notes to unaudited interim condensed consolidated financial statements.

GLOBALSTAR, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. BASIS OF PRESENTATION

Globalstar, Inc. (“Globalstar” or the “Company”) provides Mobile Satellite Services (“MSS”) including voice and data communications and wholesale capacity services through its global satellite network. The Company’s only reportable segment is its MSS business. Thermo Companies, through commonly controlled affiliates, (collectively, “Thermo”) is the principal owner and largest stockholder of Globalstar. The Company’s Executive Chairman of the Board controls Thermo.

The Company has prepared the accompanying unaudited interim condensed consolidated financial statements in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information. Certain information and footnote disclosures normally included in financial statements have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”); however, management believes the disclosures made are adequate to make the information presented not misleading. These financial statements and notes should be read in conjunction with the consolidated financial statements and notes thereto included in the Globalstar Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 1, 2023 (the “2022 Annual Report”).

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from estimates. The Company evaluates estimates on an ongoing basis. The Company has made certain reclassifications to prior period condensed consolidated financial statements to conform to current period presentation.

These unaudited interim condensed consolidated financial statements include the accounts of Globalstar and all its subsidiaries. Intercompany transactions and balances have been eliminated in the consolidation. In the opinion of management, the information included herein includes all adjustments, consisting of normal recurring adjustments, that are necessary for a fair presentation of the Company’s condensed consolidated statements of operations, consolidated balance sheets, condensed consolidated statements of stockholders' equity and condensed consolidated statements of cash flows for the periods presented. The results of operations for the three and nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the full year or any future period.

Recently Issued Accounting Pronouncements

In September 2022, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update ("ASU") No. 2022-04: Liabilities — Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Program Obligations. ASU 2022-04 added certain disclosure requirements for buyers in supplier finance programs. The amendments in the update require that buyers disclose qualitative and quantitative information about their supplier finance programs. Interim and annual requirements include disclosure of outstanding amounts under the obligations as of the end of the reporting period, and annual requirements include a rollforward of those obligations for the annual reporting period, as well as a description of payment and other key terms of the programs. This update is effective for annual periods beginning after December 15, 2022, and interim periods within those fiscal years, except for the requirement to disclose rollforward information, which is effective for fiscal years beginning after December 15, 2023. The Company adopted this standard when it became effective on January 1, 2023 and revised its disclosures pursuant to ASU 2022-04.

Recently Adopted Accounting Pronouncements

In January 2017, the FASB issued ASU No. 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. ASU 2017-04 eliminates the requirement to calculate the implied fair value of goodwill, eliminating Step 2 from the goodwill impairment test. Under ASU 2017-04, goodwill impairment will be tested by comparing the fair value of a reporting unit with its carrying amount, and recognizing an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. ASU 2017-04 should be applied prospectively and is effective for annual and interim periods beginning after December 15, 2022, with early adoption permitted. Prior to August 2023, the Company did not have any recorded goodwill on its consolidated balance sheets. In connection with the License Agreement (discussed below) entered into in August 2023, the Company recorded goodwill and is now subject to the guidance pursuant to ASU 2017-04. The Company adopted ASU 2017-04 effective July 1, 2023. The adoption of the new standard did not have a material impact on the Company’s consolidated financial statements.

2. LICENSE AGREEMENT

As more fully described in the Company’s Current Report on Form 8-K filed with the Commission on August 31, 2023, on August 29, 2023, the Company entered into an Intellectual Property License Agreement (the “License Agreement”) with XCOM Labs, Inc. (“Licensor” or “XCOM”). Under the License Agreement, the Company purchased an exclusive (subject to the qualifications set forth in the license agreement) right and license (the “License”) as well as Intellectual Property Assets (as defined in the License Agreement) relating to the development and commercialization of XCOM’s technologies for wireless spectrum innovations.

As consideration for the License and other agreements of Licensor in the License Agreement, the Company issued 60.6 million shares of its common stock, par value $0.0001 per share (the “Stock Consideration”), representing a transaction value of approximately $68.7 million, subject to adjustment and a holdback to provide for certain liabilities related to the Intellectual Property Assets. The number of shares issued as Stock Consideration was calculated using the volume-weighted average market price of the Common Stock on the NYSE American for the 20 trading days immediately preceding August 29, 2023.

In connection with the License Agreement, the Company also entered into a Support Services Agreement (the “SSA”) with XCOM. Pursuant to the SSA, XCOM is required to provide services to the Company assisting with certain operations of the business relating to the Intellectual Property Assets and to make available to the Company certain employees and facilities associated with the foregoing. Fees payable by Globalstar pursuant to the SSA will be based on costs incurred to provide the services and will be paid in shares of Globalstar common stock or cash at its option.

The Company accounted for the License Agreement under ASC 805, Business Combinations and allocated the preliminary purchase price based on the fair value of tangible and intangible assets acquired. If, prior to the end of the one-year measurement period for finalizing the purchase price allocation, information becomes available about facts and circumstances that existed as of the transaction date, which would indicate adjustments are required to the purchase price allocation, such adjustments will be included in the purchase price allocation retrospectively.

As discussed above, the fair value of the consideration transferred totaled $70.4 million and was paid in Globalstar common stock. Approximately 18.8 million shares transferred were subject to legal trading restrictions. These shares were valued using a Black-Scholes pricing model (refer to Note 8: Fair Value Measurements for further discussion) and the fair value on the transaction date was $19.0 million. Approximately 41.8 million shares transferred were not subject to legal trading restrictions and, pursuant to applicable accounting guidance and the Company's accounting policy election, were valued using the low price on the transaction date with a fair value of $51.4 million. The fair value of the consideration transferred included $58.5 million associated with the purchase price and the reimbursement of the seller's transaction costs as well as $11.9 million associated with the initial service period under the SSA. The Company recorded this amount as a prepaid asset on its consolidated balance sheets and will amortize the prepayment to cost of services and management, general and administrative expenses over the initial service period of nine months.

The allocation of the purchase price on August 29, 2023 is reflected in the tables below (amounts in thousands):

| | | | | | | | |

Identifiable assets acquired | | |

Developed intellectual property (included in intangible assets) | | $ | 25,980 | |

Other | | 1,929 | |

Total identifiable assets acquired | | 27,909 | |

Goodwill (included in intangible assets) | | 30,624 | |

Net assets acquired | | $ | 58,533 | |

There were no liabilities assumed by the Company at the time of the License Agreement. Other items in the table above include primarily equipment, inventory and the fair value of the trade name.

The table below reflects the intangible assets acquired and weighted-average useful lives (amounts in thousands):

| | | | | | | | | | | | | | |

Intangible Asset | | Initial Fair Value | | Weighted-Average Useful Life (years) |

| Trade name (included in Other in the table above) | | $ | 560 | | | 5 |

| Developed intellectual property | | 25,980 | | | 10 |

The fair values of the intangible assets are provisional pending receipt of the final valuations for those assets. The trade name was valued using an income approach, specifically a relief from royalty method. The developed intellectual property was valued using the income approach, specifically a discounted cash flow method.

Goodwill represents the excess of the purchase price of the net identifiable tangible assets acquired. At the transaction date, the goodwill of $30.6 million is attributable to the workforce of the acquired entity and significant synergies. All of the goodwill was assigned to Globalstar's MSS business, its only reportable segment. The total goodwill is expected to be deductible for income tax purposes.

During the three months ended September 30, 2023, the Company incurred $2.9 million of acquisition-related costs, which primarily consisted of transaction fees as well as legal, accounting and other professional fees. These costs are recorded in management, general and administrative expenses on the Company's condensed consolidated statements of operations.

3. REVENUE

Disaggregation of Revenue

The following table discloses revenue disaggregated by type of product and service (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Service revenue: | | | | | | | |

| Subscriber services | | | | | | | |

| Duplex | $ | 7,978 | | | $ | 9,021 | | | $ | 20,088 | | | $ | 22,103 | |

| SPOT | 11,350 | | | 11,753 | | | 33,703 | | | 34,544 | |

| Commercial IoT | 6,347 | | | 4,673 | | | 16,881 | | | 14,381 | |

| Wholesale capacity services | 27,517 | | | 6,972 | | | 83,406 | | | 22,640 | |

| Engineering and other services | 451 | | | 882 | | | 1,167 | | | 2,025 | |

| Total service revenue | 53,643 | | | 33,301 | | | 155,245 | | | 95,693 | |

| | | | | | | |

| Subscriber equipment sales: | | | | | | | |

| SPOT | 1,746 | | | 1,558 | | | 6,185 | | | 4,707 | |

| Commercial IoT | 2,262 | | | 2,713 | | | 9,975 | | | 6,427 | |

| Other | 32 | | | 54 | | | (6) | | | 371 | |

| Total subscriber equipment sales | 4,040 | | | 4,325 | | | 16,154 | | | 11,505 | |

| | | | | | | |

| Total revenue | $ | 57,683 | | | $ | 37,626 | | | $ | 171,399 | | | $ | 107,198 | |

The Company is the operator for certain satellite-enabled services offered by Apple ("Partner") (the "Services") pursuant to the agreement (the “Service Agreement”) and certain related ancillary agreements (such agreements, together with the Service Agreement, the “Service Agreements”). The Service Agreements generally require Globalstar to allocate network capacity to support the Services, which launched in November 2022. Revenue associated with the Service Agreements is included in "Wholesale capacity services" in the table above.

As consideration for the services provided by Globalstar under the Service Agreements, payments include a recurring service fee, payments relating to certain service-related operating expenses and capital expenditures, and potential bonus payments subject to satisfaction of certain licensing, service and other related criteria. During the third quarter of 2023, revenue recognized in connection with the Service Agreements included approximately $4.4 million for a bonus earned for the

maintenance of the Company's global MSS authorizations. During the first quarter of 2023, revenue recognized included $6.5 million received in connection with the amendment of the Service Agreements in February 2023 as consideration related to performance obligations completed in prior periods.

Accounts Receivable

The Company records trade accounts receivable from its customers, including MSS subscribers and its wholesale capacity customer, when it has a contractual right to receive payment either on demand or on fixed or determinable dates in the future. In addition to receivables arising from the sale of goods or services, the Company also has certain arrangements whereby it acts as an agent to procure goods and perform services under the Service Agreements.

Receivables are included in "Accounts receivable, net of allowance for credit losses," on the Company's consolidated balance sheets except for the long-term portion of the wholesale capacity accounts receivable, which is included in "Prepaid satellite costs and customer receivable." The Company's receivable balances by type and classification are presented in the table below net of allowance for credit losses and may include amounts related to earned but unbilled receivables (amounts in thousands).

| | | | | | | | | | | | | | |

| | As of: |

| | September 30, 2023 | | December 31, 2022 |

| Accounts receivable, net of allowance for credit losses | | | | |

| Subscriber accounts receivable | | $ | 20,203 | | | $ | 14,850 | |

| Wholesale capacity accounts receivable | | 21,322 | | | 7,234 | |

| Agency agreement accounts receivable | | 1,693 | | | 4,245 | |

| Total accounts receivable, net of allowance for credit losses | | $ | 43,218 | | | $ | 26,329 | |

| Long-term wholesale capacity accounts receivable | | — | | | 16,100 | |

| Total accounts receivable (short-term and long-term), net of allowance for credit losses | | $ | 43,218 | | | $ | 42,429 | |

During the third quarter of 2023, the Company reclassified $16.1 million of accounts receivable associated with the Service Agreements from long-term accounts receivable to short-term accounts receivable. This balance is associated with amounts that are contractually owed to the Company for meeting performance obligations related to the next-generation satellite constellation prior to the Phase 2 Service Period. The Company expects that this amount will be paid during the next twelve months.

In February 2022, the Company entered into an agreement for the purchase of new satellites that will replenish the Company's HIBLEO-4 U.S.-licensed system under the satellite procurement agreement, as amended, with Macdonald, Dettwiler and Associates Corporation ("MDA") and certain other costs incurred for the new satellites; these payments are expected to be paid to the Company on a straight-line basis commencing with the launch of these satellites through their estimated useful life ("Phase 2 Service Period"). Based on construction in progress incurred by Globalstar, amounts expected to be billed by the Company associated with this phase of the Service Agreements were $177.7 million as of September 30, 2023.

In prior year filings, the Company recorded a long-term unbilled receivable and related long-term deferred revenue reflecting its Partner’s obligation to fund certain construction costs to the Company associated with the satellites that are being constructed to provide service during the Phase 2 Service Period. During 2023, the Company revised this presentation and applied this change to its December 31, 2022 balance sheet. This change in accounting presentation has no impact on Partner’s obligation to provide funding for the satellite construction costs nor the expected revenue the Company will recognize during the Phase 2 Service Period.

Contract Liabilities

Contract liabilities, which are included in deferred revenue on the Company’s consolidated balance sheet, represent the Company’s obligation to transfer service or equipment to a customer from whom it has previously received consideration. Contract liabilities reflect balances from its customers, including MSS subscribers and its wholesale capacity customer under the Service Agreements. The Company's contract liabilities by type and classification are presented in the table below (amounts in thousands).

| | | | | | | | | | | | | | |

| | As of: |

| | September 30, 2023 | | December 31, 2022 |

| Short-term contract liabilities | | | | |

| Subscriber contract liabilities | | $ | 24,281 | | | $ | 21,987 | |

| Wholesale capacity contract liabilities | | 33,810 | | | 52,652 | |

| Total short-term contract liabilities | | $ | 58,091 | | | $ | 74,639 | |

| Long-term contract liabilities | | | | |

| Subscriber contract liabilities | | $ | 1,605 | | | $ | 1,704 | |

| Wholesale capacity contract liabilities, net of contract asset | | 415 | | | 61,173 | |

| Total long-term contract liabilities | | $ | 2,020 | | | $ | 62,877 | |

| Total contract liabilities | | $ | 60,111 | | | $ | 137,516 | |

For subscriber contract liabilities, the amount of revenue recognized during the nine months ended September 30, 2023 and 2022 from performance obligations included in the contract liability balance at the beginning of these periods was $18.9 million and $22.8 million, respectively. For wholesale capacity contract liabilities, the amount of revenue recognized during the nine months ended September 30, 2023 and 2022 from performance obligations included in the contract liability balance at the beginning of these periods was $41.6 million and less than $0.1 million, respectively.

The duration of the Company’s contracts with subscribers is generally one year or less. As of September 30, 2023, the Company expects to recognize $24.3 million of its remaining performance obligations to its subscribers during the next twelve months. The Service Agreements have no expiration date; therefore, the related contract liabilities may be recognized into revenue over various periods driven by the expected related service or recoupment periods. As of September 30, 2023, the Company expects to recognize $33.8 million of its remaining performance obligations during the next twelve months.

The components of wholesale capacity contract liabilities are presented in the table below (amounts in thousands).

| | | | | | | | | | | | | | |

| | As of: |

| | September 30, 2023 | | December 31, 2022 |

| Wholesale capacity contract liabilities, net: | | | | |

Advanced payments for services expected to be performed with the second-generation satellite constellation during Phase 1 (2) | | $ | 6,079 | | | $ | 99,671 | |

Additional consideration associated with the 2021 and 2023 Funding Agreements (3) | | 13,921 | | | — | |

| Advanced payments for services expected to be performed with the ground spare satellite launched in June 2022 during Phases 1 and 2 | | 24,113 | | | 25,438 | |

| Advanced payments contractually owed for services expected to be performed with the next-generation satellite constellation prior to the Phase 2 Service Period | | 15,700 | | | 22,540 | |

Advanced payments for the Phase 1 service fee and service-related operating expenses and capital expenditures | | 20,496 | | | 18,872 | |

Contract asset (1) | | (46,084) | | | (52,696) | |

| Wholesale capacity contract liabilities, net | | $ | 34,225 | | | $ | 113,825 | |

(1)In November 2022, the Company issued warrants to Partner (the "Warrants"). The initial fair value of the Warrants at the time of issuance was $48.3 million and recorded in equity with an offset to a contract asset on the Company's consolidated balance sheets. The fair value of the Warrants is recorded as a reduction to revenue over the period in which the Company performs its performance obligations through the estimated completion of the contract term, consistent with the period in which the customer benefits from the services provided.

(2)During 2021, the Company received payments from Partner totaling $94.2 million (the "2021 Funding Agreement"). In February 2023, the Service Agreements were amended. This amendment, which was effective in April 2023, changed certain terms in the 2021 Funding Agreement, resulting in $88.0 million previously recorded as deferred revenue being re-characterized as debt. See further discussion in Note 6: Long-Term Debt and Other Financing Arrangements.

(3)In connection with the Company recording the fair value of its financial obligations in the amended 2021 and 2023 Funding Agreements, it recorded a debt discount of $11.6 million and $4.5 million, respectively, representing the difference between the present value of the future principal payments discounted using the prevailing market rate at the date of issuance of the debt and the effective rate. The offset was recorded to deferred revenue and is being recognized into revenue over the Phase 1 and 2 Service Periods, respectively.

4. LEASES

The following tables disclose the components of the Company’s finance and operating leases (amounts in thousands):

| | | | | | | | | | | | | | |

| | As of: |

| | September 30, 2023 | | December 31, 2022 |

| Operating leases: | | | | |

| Right-of-use asset, net | | $ | 34,273 | | | $ | 30,859 | |

| | | | |

| Short-term lease liability (recorded in accrued expenses) | | 2,946 | | | 2,747 | |

| Long-term lease liability | | 29,524 | | | 27,635 | |

| Total operating lease liabilities | | $ | 32,470 | | | $ | 30,382 | |

| | | | |

| Finance leases: | | | | |

| Right-of-use asset, net (recorded in intangible and other current assets, net) | | $ | 85 | | | $ | 104 | |

| | | | |

| Short-term lease liability (recorded in accrued expenses) | | 17 | | | 16 | |

| Long-term lease liability (recorded in non-current liabilities) | | 58 | | | 71 | |

| Total finance lease liabilities | | $ | 75 | | | $ | 87 | |

Lease Cost

The components of lease cost are reflected in the table below (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Operating lease cost: | | | | | | | | |

Amortization of right-of-use assets, net | | $ | 769 | | | $ | 369 | | | $ | 2,144 | | | $ | 1,206 | |

| Interest on lease liabilities | | 707 | | | 571 | | | 1,954 | | | 1,848 | |

| Finance lease cost: | | | | | | | | |

| Amortization of right-of-use assets | | 12 | | | 4 | | | 22 | | | 7 | |

| Short-term lease cost | | 163 | | | 205 | | | 674 | | | 413 | |

| Total lease cost | | $ | 1,651 | | | $ | 1,149 | | | $ | 4,794 | | | $ | 3,474 | |

Interest on finance lease liabilities was less than $0.1 million for the three and nine months ended September 30, 2023 and 2022; accordingly, these amounts are not shown in the table above.

Weighted-Average Remaining Lease Term and Discount Rate

The following table discloses the weighted-average remaining lease term and discount rate for finance and operating leases.

| | | | | | | | | | | | | | |

| | As of: |

| | September 30, 2023 | | December 31, 2022 |

| | | | |

| Weighted-average lease term | | | | |

| Finance leases | | 3.9 years | | 4.6 years |

| Operating Leases | | 9.9 years | | 10.1 years |

| | | | |

| Weighted-average discount rate | | | | |

| Finance leases | | 10.2 | % | | 10.2 | % |

| Operating leases | | 8.6 | % | | 8.5 | % |

Supplemental Cash Flow Information

The below table discloses supplemental cash flow information for operating leases (in thousands):

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 |

| Cash paid for amounts included in the measurement of lease liabilities: | | | | |

| Operating cash flows for operating leases | | $ | 4,420 | | | $ | 3,675 | |

| | | | |

| | | | |

Operating and financing cash flows from finance leases were each less than $0.1 million for each of the nine months ended September 30, 2023 and 2022; accordingly, these cash flows are not shown in the table above.

Maturity Analysis

The following table reflects undiscounted cash flows on an annual basis for the Company’s lease liabilities as of September 30, 2023 (amounts in thousands):

| | | | | | | | | | | | | | |

| | Operating Leases | | Finance Leases |

| | | | |

| 2023 (remaining) | | $ | 1,422 | | | $ | 6 | |

| 2024 | | 5,562 | | | 23 | |

| 2025 | | 5,591 | | | 23 | |

| 2026 | | 5,638 | | | 23 | |

| 2027 | | 5,516 | | | 15 | |

| Thereafter | | 24,119 | | | |

| Total lease payments | | $ | 47,848 | | | $ | 90 | |

| Imputed interest | | (15,378) | | | (15) | |

| Discounted lease liability | | $ | 32,470 | | | $ | 75 | |

5. PROPERTY AND EQUIPMENT

Property and equipment consists of the following (in thousands):

| | | | | | | | | | | |

| As of: |

| September 30,

2023 | | December 31,

2022 |

| Globalstar System: | | | |

| Space component | $ | 1,230,433 | | | $ | 1,246,343 | |

| | | |

| Ground component | 98,966 | | | 102,567 | |

| Construction in progress: | | | |

| Space component | 213,414 | | | 110,068 | |

| Ground component | 12,718 | | | 5,316 | |

| Other | 11,233 | | | 9,167 | |

| Total Globalstar System | 1,566,764 | | | 1,473,461 | |

| Internally developed and purchased software | 23,324 | | | 22,509 | |

| Equipment | 10,630 | | | 8,042 | |

| Land and buildings | 2,601 | | | 1,681 | |

| Leasehold improvements | 2,083 | | | 2,083 | |

| Total property and equipment | 1,605,402 | | | 1,507,776 | |

| Accumulated depreciation | (992,491) | | | (947,405) | |

| Total property and equipment, net | $ | 612,911 | | | $ | 560,371 | |

In 2022, the Company entered into an agreement with MDA for the purchase of new satellites that will replenish the Company's HIBLEO-4 U.S.-licensed system. This agreement had an initial contract price of $327 million, of which $182.5 million had been incurred as of September 30, 2023. The "space component" of construction in progress in the table above includes costs incurred under the MDA contract as well as associated personnel costs and capitalized interest. Accrued satellite construction costs on the Company's condensed consolidated balance sheets as of September 30, 2023 and December 31, 2022 included $65.7 million and $36.1 million, respectively, of work completed, but not yet invoiced, under the satellite procurement agreement. As of September 30, 2023 and December 31, 2022, the Company also recorded $7.4 million and $11.5 million, respectively, as prepaid satellite construction costs for the first milestone payment made upon signing of the contract; these costs are recorded in Prepaid satellite costs and customer receivable on the Company's condensed consolidated balance sheets.

6. LONG-TERM DEBT AND OTHER FINANCING ARRANGEMENTS

Long-term debt and vendor financing consists of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of: |

| | September 30, 2023 | | December 31, 2022 |

| | Principal

Amount | | Unamortized Discount and Deferred Financing Costs | | Carrying

Value | | Principal

Amount | | Unamortized Discount and Deferred Financing Costs | | Carrying

Value |

| 2023 Funding Agreement | $ | 87,730 | | | $ | 11,125 | | | $ | 76,605 | | | $ | — | | | $ | — | | | $ | — | |

| 2021 Funding Agreement | 81,700 | | | 8,312 | | | 73,388 | | | — | | | — | | | — | |

2023 13% Notes | 205,958 | | | 16,621 | | | 189,337 | | | — | | | — | | | — | |

| 2019 Facility Agreement | — | | | — | | | — | | | 143,213 | | | 11,098 | | | 132,115 | |

| Vendor financing | — | | | — | | | — | | | 59,575 | | | — | | | 59,575 | |

| Total debt and vendor financing | $ | 375,388 | | | $ | 36,058 | | | $ | 339,330 | | | $ | 202,788 | | | $ | 11,098 | | | $ | 191,690 | |

| Less: current portion | 32,200 | | | — | | | 32,200 | | | 59,575 | | | — | | | 59,575 | |

| Long-term debt and vendor financing | $ | 343,188 | | | $ | 36,058 | | | $ | 307,130 | | | $ | 143,213 | | | $ | 11,098 | | | $ | 132,115 | |

The principal amounts shown above include payment of in-kind interest, as applicable. The carrying value is net of deferred financing costs and any discounts to the loan amounts at issuance, including accretion. All amounts outstanding associated with the Company's vendor financing arrangement were due in March 2023 and, therefore, were reflected as a current liability on the Company's consolidated balance sheet as of December 31, 2022. As of September 30, 2023, the current portion of long-term debt is associated with the 2021 Funding Agreement and represents the amounts to be paid under the Service Agreements during the next twelve months.

2023 Funding Agreement

In February 2023, the Company and its Partner agreed to amend its Service Agreements to provide for, among other things, payment of up to $252 million to the Company (the “2023 Funding Agreement”), which the Company will use to fund 50% of the amounts due under its agreement with MDA, as well as launch, insurance and ancillary costs incurred in connection with the construction and launch of these satellites. The 2023 Funding Agreement replaces the Company’s requirement to raise third-party financing for such costs as previously required under the Service Agreements and will be funded on a quarterly basis, as needed and subject to certain conditions in the agreement. The remaining amount of the satellite costs is expected to be funded from Globalstar’s operating cash flows. The first payment under the 2023 Funding Agreement was made to the Company in April 2023 in the amount of $87.7 million. These proceeds were used to pay amounts owed to MDA for milestones completed as of the payment date.

The total amount paid to the Company under the 2023 Funding Agreement, including fees, is expected to be recouped from amounts payable by the Partner for services provided by the Company under the Service Agreements. The total balance is expected to be recouped in installments for a period of 16 quarters beginning no later than the third quarter of 2025. The balance may also be repaid over time through excess cash flow sweeps or voluntary prepayments, as provided under the terms of the 2023 Funding Agreement. For as long as any amount funded under the 2023 Funding Agreement is outstanding, the Company will be subject to certain covenants, including (i) maintenance of a minimum cash balance of $30 million, (ii) interest coverage and leverage ratios, and (iii) other customary negative covenants, including limitations on certain asset transfers, expenditures and investments.

Thermo has agreed to provide support of certain of the Company’s obligations under the 2023 Funding Agreement. Currently, this support agreement is directly between Thermo and Partner, and the parties have agreed to replace it with agreement between Thermo, the Company and the Partner. Entry into this guarantee agreement received shareholder approval in June 2023, and it is expected to be effective during the fourth quarter of 2023. See further discussion regarding Thermo's guarantee in Note 10: Related Party Transactions.

The Company recorded the fair value of the 2023 Funding Agreement using a discounted cash flow model. The Company recorded debt discounts for the difference between the fair value of the debt and the proceeds received. This difference is

attributed to the fair value of the Thermo guarantee (recorded as additional paid in capital) and the fair value of the economic benefit received due to the existing customer relationship (recorded as deferred revenue); both of these debt discounts are netted against the face value of the 2023 Funding Agreement. The Company is accreting the debt discounts to interest expense through the maturity date using an effective interest rate method.

Additionally, the prepayment features included in the 2023 Funding Agreement required bifurcation from the debt and were valued separately. The Company recorded the embedded derivative liability as a non-current liability on its condensed consolidated balance sheet with a corresponding debt discount, which is netted against the face value of the 2023 Funding Agreement. The Company is accreting the debt discount associated with the embedded derivative liability to interest expense through the maturity date using an effective interest rate method. Refer to Note 7: Derivatives and Note 8: Fair Value Measurements for further discussion on the compound embedded derivative bifurcated from the 2023 Funding Agreement.

As the Company makes additional draws under the 2023 Funding Agreement, the amount of each draw will be recorded at fair value and the Company will assess the fair value of embedded features within the debt.

The table below outlines the components of the first draw under the 2023 Funding Agreement at funding (amounts in thousands):

| | | | | |

| Principal | $ | 87,730 | |

| Debt Discount - Thermo Guarantee | (6,897) | |

| Debt Discount - Customer Relationship | (4,509) | |

| Debt Discount - Embedded Derivative | (341) | |

| Fair Value at Issuance | $ | 75,983 | |

2021 Funding Agreement

During 2021, the Company received payments under the 2021 Funding Agreement totaling $94.2 million. In connection with the February 2023 amendment of the Service Agreements (discussed above), certain terms of the 2021 Funding Agreement were amended to align with the terms of the 2023 Funding Agreement, including granting Partner a first-priority lien in substantially all of the assets of the Company and its domestic subsidiaries to secure the Company's repayment of amounts funded. This amendment resulted in the Company re-characterizing the previously recorded deferred revenue to debt. On the amendment date, the Company recorded the funding under the 2021 Funding Agreement at fair value, net of a debt discount. The Company is accreting the debt discount to interest expense through the maturity date using an effective interest rate method.

The table below outlines the components of the 2021 Funding Agreement (amounts in thousands):

| | | | | |

| Principal | $ | 94,200 | |

Less: Amount Repaid Prior to Amendment | (6,250) | |

| Debt Discount - Customer Relationship | (11,626) | |

| Fair Value at Issuance | $ | 76,324 | |

2023 13% Notes

In March 2023, the Company completed the sale of $200.0 million in aggregate principal amount of non-convertible 13% Senior Notes due 2029 (the “2023 13% Notes”). The 2023 13% Notes were sold pursuant to a Purchase Agreement (the “Purchase Agreement”) dated March 28, 2023 among the Company, as issuer, the subsidiary guarantors party thereto (each, a “Subsidiary Guarantor” and collectively, the “Subsidiary Guarantors”), an affiliate of Värde Partners and the other purchasers party thereto (collectively, the “Purchasers”). The 2023 13% Notes were issued pursuant to an indenture, dated as of March 31, 2023 (the “Indenture”), among the Company, the Subsidiary Guarantors, as guarantors, and Wilmington Trust, National Association, as trustee.

The 2023 13% Notes are senior, unsecured obligations of the Company and have a stated maturity of September 15, 2029. The 2023 13% Notes were sold at an issue price of 95% of the principal amount of the 2023 13% Notes. The Company used a portion of the net proceeds to pay financing costs of $7.8 million, which were recorded on the Company's condensed consolidated balance sheet as a reduction in the carrying amount of the debt. The 2023 13% Notes bear interest initially at a rate of 13.00% per annum payable semi-annually in arrears. The Company is required to pay interest (i) at a rate per annum of 4.00% which must be paid in cash and (ii) at a rate per annum of 9.00% which may be paid either (a) in-kind (“PIK”) by increasing the principal amount of the 2023 13% Notes outstanding or (b) in cash, in such proportion as the Company may choose, with a step up in the PIK component of the interest if any 2023 13% Notes remain outstanding after March 15, 2028. Pursuant to the Service Agreements, the Company has agreed to pay cash interest on the 2023 13% Notes at a rate of 6.5% per annum and PIK interest at a rate of 6.5% per annum.

The 2023 13% Notes may be redeemed at the option of the Company at any time, subject to the conditions of the Indenture. Among other things, prior to March 15, 2025 (the “First Call Date”), the Company will be permitted to redeem the 2023 13% Notes in whole or in part at the redemption price equal to 100% of the principal amount of the 2023 13% Notes redeemed plus a premium based on the net present value of the remaining interest payments through the First Call Date. Beginning on the First Call Date, the 2023 13% Notes may be redeemed at a redemption price equal to 103% of the principal amount, declining to 100% of the principal amount after March 15, 2027, in each case, together with accrued and unpaid interest.

Additionally, in the event of a Change of Control (as such term is defined in the Indenture) or certain other events, holders of the 2023 13% Notes have the right to require the Company to repurchase all or a portion of their 2023 13% Notes at a price (as calculated by the Company) in cash equal to 101% of the aggregate principal amount thereof plus accrued and unpaid interest and certain tax payments. The Indenture includes customary terms and covenants, including restrictions on the Company’s and the Subsidiary Guarantors’ ability to incur indebtedness, make guarantees, sell equity interests, and customary events of default after which the holders may accelerate the maturity of the 2023 13% Notes and become due and payable immediately.

2019 Facility Agreement

In November 2019, the Company entered into a $199.0 million facility agreement with Thermo, an affiliate of EchoStar Corporation and certain other unaffiliated lenders (the "2019 Facility Agreement"). The 2019 Facility Agreement was scheduled to mature in November 2025. The loans under the 2019 Facility Agreement bore interest at a rate of 14.0% per annum to be paid in kind (or in cash at the option of the Company).

The Service Agreements required the Company to refinance all loans outstanding under the 2019 Facility Agreement. A portion was refinanced in November 2022 and the remaining portion was refinanced in March 2023. Using a portion of the proceeds from the sale of the 2023 13% Notes, the Company repaid all of its outstanding obligations under the 2019 Facility Agreement of approximately $148 million.

The Company recorded a loss on extinguishment of debt of $10.4 million in the first quarter of 2023 representing the difference between the net carrying amount prior to extinguishment (including unamortized deferred financing costs, debt discounts and derivatives) and the reacquisition price of the debt. Refer to Note 7: Derivatives and Note 8: Fair Value Measurements for further discussion on the compound embedded derivative bifurcated from the 2019 Facility Agreement.

Vendor Financing

In February 2022, the Company entered into a satellite procurement agreement with MDA (see Note 9: Commitments and Contingencies for further discussion). This agreement (as amended in October 2022 and January 2023) provided for deferrals of milestone payments through March 15, 2023. Interest accrued on the amount outstanding at an annual rate of 7%, which increased to 10.5% on balances between December 2022 and March 2023. The Company has made payments totaling $76.1 million to MDA under this vendor financing arrangement, of which $62.1 million (including $2.5 million of interest) was paid during the first quarter of 2023 to fully repay the outstanding vendor financing balance.

Reflected in the table below is a rollforward of the Company's obligations under its vendor financing arrangement with MDA (amounts in thousands):

| | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| Confirmed obligations outstanding, January 1, 2023 and 2022, respectively | | $ | 59,575 | | | $ | — | |

| Invoices confirmed during the periods | | — | | | 73,575 | |

| Confirmed invoices paid during the periods | | (59,575) | | | (14,000) | |

Confirmed obligations outstanding, September 30, 2023 and December 31, 2022, respectively | | $ | — | | | $ | 59,575 | |

2022

Series A Preferred Stock

In November 2022, the Company issued 149,425 shares of its 7.0% Perpetual Preferred Stock, Series A, liquidation preference $1,000 per share (the “Series A Preferred Stock”) in exchange for $149.4 million outstanding principal amount of its 2019 Facility Agreement held by affiliates of Thermo and certain other lenders. The Company recorded the Series A Preferred Stock at fair value of the shares totaling $105.3 million on its consolidated balance sheet.

Holders of Series A Preferred Stock are entitled to receive, when, as and if declared by the Company's Board of Directors or a committee thereof, cumulative cash dividends based on the liquidation preference of the Series A Preferred Stock, at a fixed rate equal to 7.00% per annum, payable quarterly in arrears on January 1, April 1, July 1 and October 1 of each year. The table below reflects the dividends approved by the Company's Board of Directors (amounts in thousands):

| | | | | | | | | | | | | | |

| Payment Period | | Payment Date | | Payment Amount |

| November 15, 2022 - December 31, 2022 | | January 2023 | | $ | 1,337 | |

| January 1, 2023 - March 31, 2023 | | April 2023 | | 2,615 | |

| April 1, 2023 - June 30, 2023 | | June 2023 | | 2,644 | |

July 1, 2023 - September 30, 2023 | | September 2023 | | 2,673 | |

The shares of Series A Preferred Stock do not possess voting rights, other than certain matters specifically affecting the rights and obligations of the Series A Preferred. Series A Preferred Stock may be redeemed by the Company, in whole or in part, at any time. The holders of the Series A Preferred Stock do not have any rights to convert or require the Company to redeem such stock.

7. DERIVATIVES

The Company has identified various embedded derivatives resulting from certain features in the Company’s borrowing arrangements, requiring recognition on its consolidated balance sheets. None of these derivative instruments are designated as a hedge. Derivative liabilities are recorded in "Other non-current liabilities" on the Company's consolidated balance sheet. The fair value of each embedded derivative is marked-to-market at the end of each reporting period, or more frequently as deemed necessary, with any changes in value reported in the Company's condensed consolidated statements of operations and its condensed consolidated statements of cash flows as a non-cash operating activity.

The instruments and related features embedded in the debt instruments that are required to be accounted for as derivatives are described below. See Note 8: Fair Value Measurements for further discussion.

2023 Funding Agreement

The 2023 Funding Agreement contains certain prepayment features that are required to be bifurcated and recorded as an embedded derivative liability on the Company's condensed consolidated balance sheet with a corresponding debt discount that is netted against the principal amount of the draws under the 2023 Funding Agreement. The Company determined the fair value of the embedded derivative liability using a discounted cash flow model. During the three and nine months ended September 30, 2023, the Company recorded a derivative loss of $0.1 million and a derivative gain of $0.2 million, respectively, which is reflected in derivative gain (loss) and other in the Company’s condensed consolidated statement of operations. As of September 30, 2023, the fair value of the embedded derivative within the 2023 Funding Agreement was $0.1 million.

Compound Embedded Derivative within 2013 8.00% Notes

The 2013 8.00% Notes contained a conversion option and contingent put feature that were required to be bifurcated and recorded as a compound embedded derivative. The Company determined the fair value of the compound embedded derivative liability using a Monte Carlo simulation model. During the nine months ended September 30, 2022, the Company recorded a derivative gain totaling $0.2 million, which is reflected in derivative gain (loss) and other in the Company’s condensed consolidated statement of operations.

During the first quarter of 2022, the remaining principal amount of the 2013 8.00% Notes was converted into shares of Globalstar common stock; accordingly, the associated derivative was extinguished and is no longer outstanding.

Compound embedded derivative within the 2019 Facility Agreement

The 2019 Facility Agreement contained certain contingently exercisable put features that were required to be bifurcated and recorded as a compound embedded derivative. The Company determined the fair value of this derivative using a probability weighted discounted cash flow model. During the three and nine months ended September 30, 2022, the Company recorded a derivative gain totaling $0.7 million and a derivative loss totaling $1.3 million, respectively, which is reflected in derivative gain (loss) and other in the Company’s condensed consolidated statement of operations. As of December 31, 2022, the fair value of the compound embedded derivative within the 2019 Facility Agreement was $0.1 million.

In November 2022, the Company exchanged a portion of the 2019 Facility Agreement into Series A Preferred Stock. In March 2023, the Company refinanced the remaining principal outstanding under the 2019 Facility Agreement with proceeds from the issuance of its 2023 13% Notes. As a result of this activity, the Company wrote off the embedded derivative associated with the 2019 Facility Agreement, which is included in "Loss on extinguishment of debt" on the condensed consolidated statement of operations; therefore, no balance remained as of March 31, 2023. See Note 6: Long-Term Debt and Other Financing Arrangements for further discussion.

8. FAIR VALUE MEASUREMENTS

The Company follows the authoritative guidance for fair value measurements relating to financial and non-financial assets and liabilities, including presentation of required disclosures herein. This guidance establishes a fair value framework requiring the categorization of assets and liabilities into three levels based upon the assumptions (inputs) used to price the assets and liabilities. Level 1 provides the most reliable measure of fair value, whereas Level 3 generally requires significant management judgment. The three levels are defined as follows:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical assets or liabilities.

Level 2: Quoted prices in markets that are not active or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability.

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity).

Recurring Fair Value Measurements

The Company marks-to-market its derivatives at each reporting date, or more frequently as deemed necessary, with the changes in fair value recognized in the Company’s consolidated statements of operations. See Note 7: Derivatives for further discussion.

Embedded Derivative within the 2023 Funding Agreement

The embedded derivative associated within the 2023 Funding Agreement is valued using a discounted cash flow model. The most significant observable input used in the fair value measurement is the discount yield, which was 8.73% at September 30, 2023 and 8.52% at issuance. As the discount yield used in the valuation increases, the fair value of the embedded derivative increases. The significant unobservable input used in the fair value measurement includes estimated timing and amounts of cash flows associated with the prepayment features within the debt agreement. As projected cash flows increase, the fair value of the embedded derivative increases.

As of September 30, 2023, the embedded derivative within the 2023 Funding Agreement was categorized as a Level 3 fair value and was $0.1 million.

Compound Embedded Derivative within the 2019 Facility Agreement

The compound embedded derivative within the 2019 Facility Agreement was valued using a probability weighted discounted cash flow model. The most significant observable input used in the fair value measurement was the discount yield. The unobservable inputs used in the fair value measurement included the probability of change of control and the estimated timing and amounts of cash flows associated with certain mandatory prepayments within the debt agreement.

As of December 31, 2022, the compound embedded derivative within the 2019 Facility Agreement was categorized as a Level 3 fair value and was $0.1 million. In March 2023, the Company refinanced the remaining principal balance outstanding under the 2019 Facility Agreement and wrote off the associated embedded derivative balance; therefore, no balance remained as of March 31, 2023.

Rollforward of Recurring Level 3 Assets and Liabilities

The following table presents a rollforward for all assets and liabilities measured at fair value on a recurring basis using significant unobservable inputs (Level 3) (in thousands):

| | | | | | | | | | | |

| Nine Months Ended September 30, 2023 | | Twelve Months Ended December 31, 2022 |

| Balance at beginning of period, January 1, 2023 and 2022, respectively | $ | (122) | | | $ | (880) | |

| Issuance of embedded derivative within the 2023 Funding Agreement | (341) | | | — | |

| Derivative adjustment related to conversions | — | | | 1,563 | |

| Derivative adjustment related to extinguishment of debt | 122 | | | — | |

| Unrealized gain (loss), included in derivative gain (loss) and other | 243 | | | (805) | |

Balance at end of period, September 30, 2023 and December 31, 2022, respectively | $ | (98) | | | $ | (122) | |

Nonrecurring Fair Value Measurements

2023 Funding Agreement

As previously discussed, the Company entered into the 2023 Funding Agreement in February 2023. Significant quantitative Level 3 inputs were utilized in the valuation model as of the first draw date on April 18, 2023. The Company's first draw under the 2023 Funding Agreement occurred in April 2023 with a total fair value of $76.0 million calculated as the projected future cash flows discounted using the prevailing market rate of interest for a similar transaction. The discount yield used for this calculation was 8.52%.

Amounts payable under the 2023 Funding Agreement, are expected to be guaranteed by Thermo under a guarantee agreement among Thermo, the Company and the Partner. The Company recorded a total fair value of $6.9 million for this embedded feature, which was calculated as the difference in projected cash flows with and without the guarantee agreement discounted using calculated rates of 6.22% and 8.52%, respectively.

2021 Funding Agreement

In connection with the re-characterization of the 2021 Funding Agreement from deferred revenue to debt, the Company recorded the fair value of the debt calculated as the projected cash flows discounted using the prevailing market rate of interest for a similar transaction. The discount yield used for this calculation was 8.52%. The total fair value of the 2021 Funding Agreement was $76.3 million and was recorded on the Company's condensed consolidated balances sheet during the second quarter of 2023 when the amendment was effective.

License Agreement

In connection with the License Agreement discussed in Note 2: License Agreement, the consideration paid was in the form of Globalstar common stock.

Approximately 41.8 million shares were not subject to legal trading restrictions and were valued using the low stock price on the transaction date, which was $1.23 per share. The total fair value of these shares was $51.4 million on the transaction date.

The remaining shares, totaling 18.8 million, were subject to legal trading restrictions and were valued using a Black-Scholes pricing model on the transaction date. The total fair value of these shares was $19.0 million and computed using the following assumptions on the transaction date:

| | | | | | | | | | | | | | | | | | | | | | | |

| Underlying Stock Price and Exercise Price | | Term (Years) | | Volatility | | Risk-Free Interest Rate |

Fair Value of Consideration | $ | 1.13 | | | 0.5 | | 74.5 | % | | 5.52 | % |

Performance Share Units

During the third quarter of 2023, the Company granted 44.5 million restricted stock units ("RSUs") to certain employees which are earned over a four-year performance period. The RSUs vest upon the Company's common stock trading at various price levels throughout the performance period. The RSUs were valued using a Monte Carlo simulation model. As of the grant date, September 25, 2023, the fair value of the RSUs was $39.5 million. This total fair value will be recognized over the derived service period for each tranche within the grant. The Monte Carlo simulation was computed using the following assumptions:

| | | | | | | | | | | | | | | | | |

| Risk-Free Interest Rate | | Stock Price Volatility | | Market Price of Common Stock |

Fair Value of RSUs | 4.73 | % | | 80.00 | % | | $ | 1.29 | |

Fair Value of Debt and Other Financing Arrangements

The Company believes it is not practicable to determine the fair value of its debt agreements on a recurring basis without incurring significant additional costs. Unlike typical long-term debt, certain terms for these instruments are not readily available and generally involve a variety of factors, including due diligence by the debt holders. The Company's vendor financing arrangement was recorded at net carrying value, which approximated fair value.