0001880343

false

0001880343

2023-09-07

2023-09-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 7, 2023

FRESH

VINE WINE, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-41147 |

|

87-3905007 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

11500 Wayzata Blvd. #1147

Minnetonka,

MN 55305

(Address of Principal Executive Offices) (Zip Code)

(855)

766-9463

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.001 per share |

|

VINE |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.02 Termination of a Material Definitive

Agreement.

In March 2021, Fresh Vine Wine, Inc.

(the “Company”) entered into five-year license agreements with each of Nina Dobrev and Jaybird Investments, LLC, an entity

managed by Julianne Hough, which were amended in November 2021 in connection with the Company’s initial public offering (as so amended,

the “License Agreements”), pursuant to which Ms. Dobrev and Ms. Hough, respectively, each agreed to use commercially reasonable

efforts to help grow and promote our business and varietals of wine and granted us a license to use her pre-approved name, likeness,

image, and other indicia of identity, as well as certain content published by her on her social media or other channels, on and in conjunction

with the sale and related pre-approved advertising and promotion of our varietals of wine and marketing materials. Ms. Dobrev and

Ms. Hough have the right to terminate their respective License Agreements prior to the scheduled expiration date upon a material breach

by the Company that is not cured within 30 days after receiving notice of such breach.

On August 8, 2023, the Company received written

letters from each of Ms. Dobrev and Jaybird Investments, LLC, notifying the Company that it is in default of their respective License

Agreements based on failure to pay licensee fees contemplated thereby (each, a “Default Notice”). Each Default Notice also

stated that it served as written notice of termination of the respective License Agreements, effective 30 days from the delivery date

of the Default Notice (the “Termination Date”), which shall occur without further action or notice if the Company’s

payment of the applicable license fees is not made prior to the Termination Date. As of September 7, 2023, the Company had not paid the

applicable license fees and each License Agreement terminated.

Pursuant to the License Agreements, upon expiration

or termination of thereof, the rights and licenses granted under thereunder were revoked, and the Company must cease the marketing and

sale of products that feature the licensor’s name, likeness, image, and other indicia of identity, provided that the Company may

continue to use approved marketing materials and sell off the remaining product inventory for a sell-off period of up to 90 days.

Item 3.01 Notice Of Delisting Or Failure

To Satisfy A Continued Listing Rule Or Standard; Transfer Of Listing.

On September 8, 2023,

Fresh Vine Wine, Inc. (the “Company”) received a written notice (the “Notice”) from NYSE American LLC (“NYSE

American”) stating that the Company was not in compliance with NYSE American continued listing standards relating to stockholders’

equity. Specifically, the Notice stated that the Company is not in compliance with the continued listing standard set forth in Section

1003(a)(ii) of the NYSE American Company Guide (the “Company Guide”), which requires that a listed company have stockholders’

equity of at least $4 million if the company has reported losses from continuing operations and/or net losses in three of its four most

recent fiscal years. The Company reported stockholders’ equity of $2.4 million as of June 30, 2023, the end of its second fiscal

quarter of 2023, and has had losses from continuing operations and/or net losses in each of its fiscal years ended December 31, 2020,

2021 and 2022. As a result, the Company has become subject to the procedures and requirements of Section 1009 of the Company Guide and

must submit a plan to NYSE American by October 9, 2023 addressing how the Company intends to regain compliance with Section 1003(a)(ii)

by March 8, 2025.

The Company’s management

is pursuing options to address the deficiency and intends to prepare and timely submit a compliance plan to NYSE American. If the Company

does not submit a plan, or if the plan the Company submits is not accepted by NYSE American, the Company will be subject to delisting

proceedings as specified in the Company Guide. In addition, if the plan is accepted by NYSE American, but the Company is not in compliance

with the continued listing standards by the compliance deadline, or if the Company does not make progress consistent with the plan, the

Company will be subject to delisting proceedings. The Company will have the right to appeal any delisting determination made by NYSE American

staff. If the plan is accepted, the Company will be subject to periodic NYSE American reviews, including quarterly monitoring for compliance

with the plan.

Receipt of the Notice

has no immediate effect on the listing of the Company’s common stock and the common stock will continue to trade on the NYSE American

under the symbol “VINE,” but will be included in the list of NYSE American noncompliant issuers, and the below compliance

(“.BC”) indicator will be disseminated with the Company’s ticker symbol. The website posting and .BC indicator would

be removed when the Company has regained compliance with all applicable continued listing standards. The Company’s receipt of the

notice does not affect the Company’s business, operations or reporting requirements with the U.S. Securities and Exchange Commission

(the “SEC”).

In accordance the rules of

the NYSE American, the Company is issuing a press release announcing that it has received the Notice.

Item 8.01 Other Events.

In light of the Notice received from NYSE American

and the termination of the License Agreements, the Company is supplementing the risk factors previously disclosed in Item 1A of its Annual

Report on Form 10-K for the year ended December 31, 2022 that the Company filed with the SEC on March 31, 2023, and its subsequently-filed

SEC reports to add the following risk factors:

We have relied heavily on celebrities

to endorse our wines and market our brand pursuant to license agreements which have been terminated.

Our brand, and to a large extent our direct-to-consumer

sales outlet, has been heavily dependent on the positive image and public popularity of, and affinity towards, Nina Dobrev and Julianne

Hough. Ms. Dobrev and Ms. Hough have served as celebrity spokespersons and ambassadors of our company, have actively endorsed our wines

on their sizable social media and other outlets, and are considered by many to be the face of our brand. Under our license agreements

with Ms. Dobrev and Jaybird Investments, LLC (an entity managed by Ms. Hough), each of Ms. Dobrev and Ms. Hough granted us a license to

use her pre-approved name, likeness, image, and other indicia of identity, as well as certain content published by her on her social media

and other channels, on and in conjunction with the sale and related pre-approved advertising and promotion of our wine.

On August 8, 2023, the Company received written

letters from each of Ms. Dobrev and Jaybird Investments, LLC, notifying the Company that it was in default of their respective license

agreements based on failure to pay license fees and providing 30 day notice of termination of their respective license agreements.

Effective September 7, 2023, each license

agreement terminated. Upon such termination, the rights and licenses granted to us under such agreements were revoked and were required

to cease the marketing and sale of products that feature their name, likeness, image, and other indicia of identity after a 90 day run-off

period. As a result, we will be required to refocus our marketing and brand promotion efforts, which may adversely affect our business

and results of operations.

We are subject to the continued listing

requirements of the NYSE American. If we are unable to comply with such requirements, our common shares would be delisted from the NYSE

American, which would limit investors’ ability to effect transactions in our common shares and subject us to additional trading

restrictions.

Our common stock is currently

listed on NYSE American. In order to maintain our listing, we must maintain certain share prices, financial and share distribution targets,

including maintaining a minimum amount of stockholders’ equity and a minimum number of public shareholders. In addition to these

objective standards, NYSE American may delist the securities of any issuer for other reasons involving the judgment of NYSE American.

On September 8, 2023, we received written notification from NYSE American that we are not in compliance with the continued listing standard

under Section 1003(a)(ii) of the NYSE American Company Guide (the “Company Guide”), which requires a listed company to have

stockholders’ equity of at least $4 million if it has reported losses from continuing operations and/or net losses in three of its

four most recent fiscal years. As a result, we have become subject to the procedures and requirements of Section 1009 of the Company Guide

and must submit a plan to NYSE American by October 9, 2023 addressing how the Company intends to regain compliance with Section 1003(a)(ii)

by March 8, 2025.

We

intend to prepare and timely submit a compliance plan to NYSE American; however, if we do not submit a plan, or if the plan we submit

is not accepted by NYSE American, we will be subject to delisting proceedings. In addition, if the plan is accepted by NYSE American,

but we are not in compliance with the continued listing standards by the compliance deadline, or if the Company does not make progress

consistent with the plan, we will be subject to delisting proceedings.

If NYSE American delists

our common stock from trading on the exchange and we are not able to list our securities on another national securities exchange, we expect

shares of our common shares would qualify to be quoted on an over-the-counter market. If this were to occur, we could experience a number

of adverse consequences, including:

| ● | limited availability of market quotations for the common

stock; |

| ● | reduced liquidity for our securities; |

| ● | our common shares being categorized as a “penny stock,”

which requires brokers trading in our common shares to adhere to more stringent rules and possibly result in a reduced level of trading

activity in the secondary trading market for our common stock; and |

| ● | decreased ability to issue additional securities or obtain

additional financing in the future. |

In addition, the National

Securities Markets Improvement Act of 1996 generally preempts the states from regulating the sale of “covered securities.”

Our common shares qualify as “covered securities” because they are listed on NYSE American. If our common shares were no longer

listed on NYSE American, our securities would not be “covered securities” and we would be subject to regulation in each state

in which we offer our securities.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FRESH VINE WINE, INC. |

| |

|

|

| Date: September 13, 2023 |

By: |

/s/ Michael Pruitt |

| |

|

Michael Pruitt |

| |

|

Interim Chief Executive Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

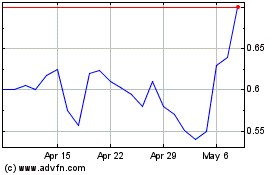

Fresh Vine Wine (AMEX:VINE)

Historical Stock Chart

From Jun 2024 to Jul 2024

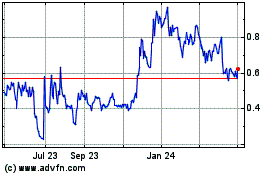

Fresh Vine Wine (AMEX:VINE)

Historical Stock Chart

From Jul 2023 to Jul 2024