First Trust Energy Income and Growth Fund (the "Fund") (NYSE

American: FEN) has declared the Fund's regularly scheduled

quarterly distribution of $0.30 per share. The distribution will be

payable on July 31, 2023, to shareholders of record as of July 24,

2023. The ex-dividend date is expected to be July 21, 2023. The

quarterly distribution information for the Fund appears below.

First Trust Energy

Income and Growth Fund (FEN):

Distribution per share:

$0.30

Distribution Rate based on the July 7,

2023 NAV of $15.32:

7.83%

Distribution Rate based on the July 7,

2023 closing market price of $13.56:

8.85%

It is anticipated that, due to the tax treatment of cash

distributions made by the publicly-traded master limited

partnerships ("MLPs") in which the Fund invests, a portion of

distributions the Fund makes to Common Shareholders may consist of

a tax-deferred return of capital. The final determination of the

source and tax status of all distributions paid in 2023 will be

made after the end of 2023 and will be provided on Form

1099-DIV.

The Fund is a non-diversified, closed-end management investment

company that seeks a high level of after-tax total return with an

emphasis on current distributions paid to shareholders. The Fund

focuses on investing in MLPs and related public entities in the

energy sector which the Fund's investment sub-advisor believes

offer opportunities for income and growth. The Fund is treated as a

regular corporation, or a "C" corporation, for United States

federal income tax purposes and, as a result, is subject to

corporate income tax to the extent the Fund recognizes taxable

income.

First Trust Advisors L.P. ("FTA") is a federally registered

investment advisor and serves as the Fund's investment advisor. FTA

and its affiliate First Trust Portfolios L.P. ("FTP"), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $190 billion as of May

31, 2023 through unit investment trusts, exchange-traded funds,

closed-end funds, mutual funds and separate managed accounts. FTA

is the supervisor of the First Trust unit investment trusts, while

FTP is the sponsor. FTP is also a distributor of mutual fund shares

and exchange-traded fund creation units. FTA and FTP are based in

Wheaton, Illinois.

Energy Income Partners, LLC ("EIP") serves as the Fund's

investment sub-advisor and provides advisory services to a number

of investment companies and partnerships for the purpose of

investing in MLPs and other energy infrastructure securities. EIP

is one of the early investment advisors specializing in this area.

As of June 30, 2023, EIP managed or supervised approximately $5.1

billion in client assets.

Principal Risk Factors: Risks are inherent in all investing.

Certain risks applicable to the Fund are identified below, which

includes the risk that you could lose some or all of your

investment in the Fund. The principal risks of investing in the

Fund are spelled out in the Fund's annual shareholder reports. The

order of the below risk factors does not indicate the significance

of any particular risk factor. The Fund also files reports, proxy

statements and other information that is available for

review.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost. There can be no assurance that the Fund's investment

objectives will be achieved. The Fund may not be appropriate for

all investors.

The Fund is subject to risks, including the fact that it is a

non-diversified closed-end management investment company.

Securities held by a fund, as well as shares of a fund itself,

are subject to market fluctuations caused by factors such as

general economic conditions, political events, regulatory or market

developments, changes in interest rates and perceived trends in

securities prices. Shares of a fund could decline in value or

underperform other investments as a result of the risk of loss

associated with these market fluctuations. In addition, local,

regional or global events such as war, acts of terrorism, spread of

infectious diseases or other public health issues, recessions,

natural disasters or other events could have a significant negative

impact on a fund and its investments. Such events may affect

certain geographic regions, countries, sectors and industries more

significantly than others. In February 2022, Russia invaded Ukraine

which has caused and could continue to cause significant market

disruptions and volatility within the markets in Russia, Europe,

and the United States. The hostilities and sanctions resulting from

those hostilities could have a significant impact on certain fund

investments as well as fund performance. The COVID-19 global

pandemic and the ensuing policies enacted by governments and

central banks have caused and may continue to cause significant

volatility and uncertainty in global financial markets. While

vaccines have been developed, there is no guarantee that vaccines

will be effective against future variants of the disease. Recent

and potential future bank failures could result in disruption to

the broader banking industry or markets generally and reduce

confidence in financial institutions and the economy as a whole,

which may also heighten market volatility and reduce liquidity.

Because the Fund is concentrated in securities issued by energy

companies, energy sector MLPs and MLP-related entities, it will be

more susceptible to adverse economic or regulatory occurrences

affecting those industries, including high interest costs, high

leverage costs, the effects of economic slowdown, surplus capacity,

increased competition, uncertainties concerning the availability of

fuel at reasonable prices, the effects of energy conservation

policies and other factors.

The Fund's use of derivatives may result in losses greater than

if they had not been used, may require the fund to sell or purchase

portfolio securities at inopportune times, may limit the amount of

appreciation the Fund can realize on an investment, or may cause

the fund to hold a security that it might otherwise sell.

Investment in non-U.S. securities is subject to the risk of

currency fluctuations and to economic and political risks

associated with such foreign countries.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the fund are spelled out in the

shareholder report and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial professionals are responsible for evaluating investment

risks independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

The Fund’s daily closing NYSE American price and net asset value

per share as well as other information can be found at

https://www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230710543646/en/

Press Inquiries Ryan Issakainen 630-765-8689 Analyst Inquiries

Jeff Margolin 630-915-6784 Broker Inquiries Sales Team

866-848-9727

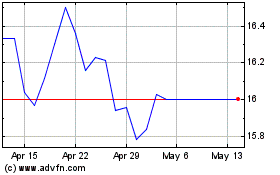

First Trust Energy Incom... (AMEX:FEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

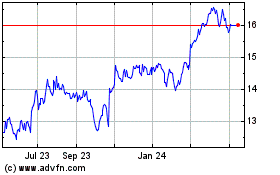

First Trust Energy Incom... (AMEX:FEN)

Historical Stock Chart

From Mar 2024 to Mar 2025