Macquarie/First Trust Global Infrastructure/Utilities Dividend

& Income Fund (NYSE: MFD) First Trust Senior Floating Rate

Income Fund II (NYSE: FCT) First Trust Energy Income and Growth

Fund (NYSE American: FEN) First Trust Enhanced Equity Income Fund

(NYSE: FFA) First Trust/Aberdeen Global Opportunity Income Fund

(NYSE: FAM) First Trust Mortgage Income Fund (NYSE: FMY) First

Trust/Aberdeen Emerging Opportunity Fund (NYSE: FEO) First Trust

Specialty Finance and Financial Opportunities Fund (NYSE: FGB)

First Trust High Income Long/Short Fund (NYSE: FSD) First Trust

Energy Infrastructure Fund (NYSE: FIF) First Trust MLP and Energy

Income Fund (NYSE: FEI) First Trust Intermediate Duration Preferred

& Income Fund (NYSE: FPF) First Trust New Opportunities MLP

& Energy Fund (NYSE: FPL) First Trust Dynamic Europe Equity

Income Fund (NYSE: FDEU) First Trust Senior Floating Rate 2022

Target Term Fund (NYSE: FIV) First Trust High Yield Opportunities

2027 Term Fund (NYSE: FTHY) (each a “Fund” and collectively, the

“Funds”)

After a thorough review, and consistent with the interests of

each Fund, the Board of Trustees of each Fund has adopted Amended

and Restated By-Laws (the “By-Laws”) for the Funds.

Among other changes, the By-Laws contain new timelines for

advance notice of shareholder proposals or nominations to be

brought before a meeting of shareholders. Accordingly, the advance

notice deadlines for certain of the Fund’s 2021 annual meetings of

shareholders will differ from the deadlines previously described in

such Funds’ proxy statements for the 2020 annual meetings of

shareholders. For such Funds, notice of any proposal made outside

of Rule 14a-8 under the Securities Exchange Act of 1934 (the

“Exchange Act”) or shareholder nominee for Trustee must be received

by the Fund at such Fund’s principal executive offices not earlier

than, nor later than, the corresponding dates set forth in the

table below. If a shareholder proposal made outside of Rule 14a-8

or shareholder nominee for trustee is submitted after the period

listed for the particular Fund, it would not be considered “timely”

within the meaning of Rule 14a-4(c) under the Exchange Act, and the

persons named as proxies in the proxies solicited by the Board of

Trustees for the 2021 annual meeting of shareholders may exercise

their discretionary voting power with respect to any such

proposal.

Fund

14a-8 Deadline

Non-14a-8 Deadline

Earliest Date

Latest Date

First Trust/Aberdeen Global Opportunity

Income Fund

October 22, 2020

November 21, 2020

December 6, 2020

Macquarie/First Trust Global

Infrastructure/Utilities Dividend & Income Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Energy Income and Growth

Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Enhanced Equity Income

Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Mortgage Income Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust/Aberdeen Emerging Opportunity

Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Specialty Finance and

Financial Opportunities Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Energy Infrastructure Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Dynamic Europe Equity Income

Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust New Opportunities MLP &

Energy Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Intermediate Duration

Preferred & Income Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust MLP and Energy Income Fund

November 20, 2020

November 20, 2020

December 5, 2020

First Trust Senior Floating Rate 2022

Target Term Fund

April 19, 2021

April 16, 2021

May 1, 2021

First Trust Senior Floating Rate Income

Fund II

April 19, 2021

April 16, 2021

May 1, 2021

With respect to First Trust High Income Long/Short Fund, the

deadline for the advance notice of shareholder proposals or

nominations to be brought before the Fund’s 2021 annual meeting of

shareholders is as described in the proxy statement for the Fund’s

2020 annual meeting of shareholders.

The By-Laws also require compliance with amended procedural and

informational requirements in connection with any such advance

notice of shareholder proposals or nominations. This information

includes, but is not limited to, information about the proponent

and the nominee or shareholder proposal, if applicable. Any

shareholder considering making a nomination or proposal should

carefully review and comply with the provisions of the By-Laws.

Trustee Qualifications and Requirements

In determining whether a particular nominee is qualified to

serve on the Board of Trustees (each, a “Trustee” and collectively,

the “Board”), the Board has an interest in the nominee’s

background, skills, experience and other attributes in light of the

composition of the Board. The Board seeks to assess whether a

nominee has the ability to critically review, evaluate, question

and discuss information provided to the Board, and to interact

effectively with other Trustees, and management of a Fund, among

other parties. The By-Laws, among other things, require a nominee

for Trustee to sit for an interview with the Board, if requested,

include qualifications and requirements for Trustee eligibility,

and require that a nominee agree to comply with the Board’s

Guidelines and Procedures Regarding Governance.

Additionally, the By-Laws have changed the vote required in the

instance in which the number of persons nominated for election as

Trustee exceeds the number of Trustees to be elected. The By-Laws

provide that in such a “contested” election, the affirmative vote

of a majority of shares outstanding and entitled to vote in such an

election is required to elect a Trustee. In all other elections,

the plurality standard pursuant to which Trustees are elected will

remain.

Control Share Provisions

The By-Laws contain provisions (the “Control Share Provisions”)

which, in summary, provide that a shareholder who obtains

beneficial ownership of a Fund’s shares in a “Control Share

Acquisition” may exercise voting rights with respect to such shares

only to the extent the authorization of such voting rights is

approved by other shareholders of the Fund. The Control Share

Provisions are primarily intended to seek to protect the interests

of a Fund and its long-term shareholders by limiting the risk that

the Fund will become subject to undue influence by activist

investors who pursue short-term agendas adverse to the best

interests of the Fund and its long-term shareholders.

The Control Share Provisions do not eliminate voting rights for

shares acquired in Control Share Acquisitions, but rather entrust a

Fund’s non-interested shareholders with determining whether to

approve the authorization of voting rights of such shares.

Subject to various conditions and exceptions, the By-Laws define

a “Control Share Acquisition” to include an acquisition of Fund

shares that, but for the Control Share Provisions, would give the

beneficial owner upon the acquisition of such shares the ability to

exercise voting power in the election of Fund Trustees in any of

the following ranges:

(i) One-tenth or more, but less than

one-fifth of all voting power;

(ii) One-fifth or more, but less than

one-third of all voting power;

(iii) One-third or more, but less than a

majority of all voting power; or

(iv) A majority or more of all voting

power.

Share acquisitions that pre-date the adoption of the By-Laws are

excluded from the definition of Control Share Acquisition. However,

such shares are included in assessing whether any subsequent share

acquisition exceeds one of the above thresholds. A shareholder who

obtains beneficial ownership of shares in a Control Share

Acquisition must deliver to the Trust a “Control Share Acquisition

Statement” as detailed in the By-Laws. When delivering the Control

Share Acquisition Statement, a shareholder generally may

contemporaneously request a special meeting of Fund shareholders to

approve the voting rights for such shares, subject to certain

requirements set forth in the By-Laws. If a shareholder who obtains

or proposes to obtain beneficial ownership of shares in a Control

Share Acquisition does not request a special meeting of Fund

shareholders, consideration of the authorization of voting rights

of such shares shall be presented at the Fund’s next annual or

special meeting of shareholders.

The foregoing discussion is only a summary of certain aspects of

the By-Laws, and is qualified in its entirety by reference to the

By-Laws. Investors should refer to the By-Laws for more

information, which can be found in the Current Report on Form 8-K

filed by each respective Fund with the Securities and Exchange

Commission (available at www.sec.gov). The By-Laws may also be

obtained by writing the Secretary of the Fund at the Fund’s

principal executive office.

This press release is not intended to, and does not, constitute

an offer to purchase or sell shares of any Fund; nor is this press

release intended to solicit a proxy from any shareholder of any

Fund.

Each Fund’s daily closing price and net asset value per share,

as well as other information can be found at www.ftportfolios.com

or by calling 1-800-988-5891.

First Trust Advisors L.P. (“FTA”) is a federally registered

investment advisor and serves as the Funds’ investment advisor. FTA

and its affiliate First Trust Portfolios L.P. (“FTP”), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $149 billion as of

September 30, 2020 through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separately managed

accounts. FTA is the supervisor of the First Trust unit investment

trusts, while FTP is the sponsor. FTP is also a distributor of

mutual fund shares and exchange-traded fund creation units. FTA and

FTP are based in Wheaton, Illinois.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201020005770/en/

Jim Dykas 630-517-7665 Dan Lindquist 630-517-8692

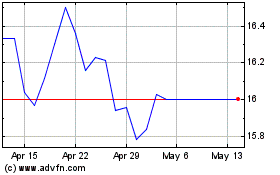

First Trust Energy Incom... (AMEX:FEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

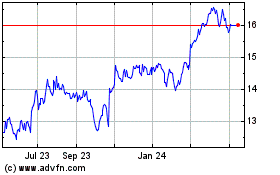

First Trust Energy Incom... (AMEX:FEN)

Historical Stock Chart

From Mar 2024 to Mar 2025